Introduction

One of the key features and notes from the last report by PRA Group, Inc. (NASDAQ:PRAA) has to be the rapid increase it has had in the investments of the portfolio. The last quarter alone has resulted in an additional $328 million in investments where most of it is for Americas and Australia core at $171 million.

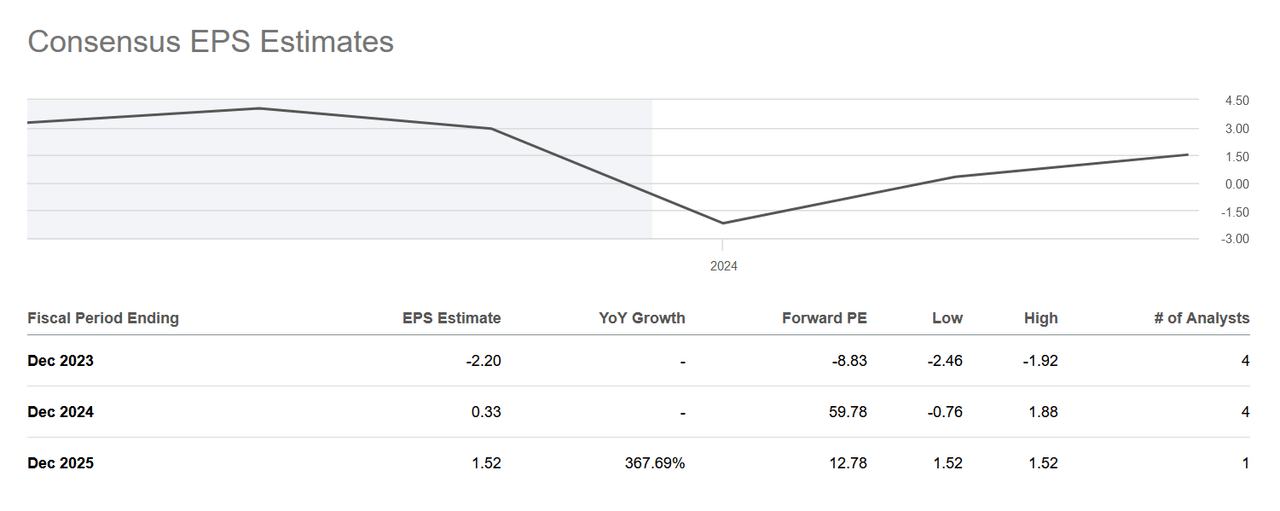

Earlier this year the company saw its share price drop rapidly as the expectations for the report were not met. In early May the share price dropped from $34 to under $20 in the span of a few days. The bottom line is expected to bounce back eventually and in 2024 estimates suggest an EPS of $0.33, putting PRAA at an FWD p/e of 59. I think the current situation does brood some worries and investors are better off holding shares now rather than adding or entering a new position in the company. We need to see how the bottom-line expansion plays out before any higher rating could be suggested.

Company Structure

PRAA is a globally recognized business and financial services company, boasting a strong international presence with operational facilities spanning across Australia, Europe, and the Americas. The company’s core focus revolves around the comprehensive management, cataloging, and strategic acquisition of loans, particularly those characterized by minimal or negative yields. This unique specialization positions PRAA as a key player in the financial industry, operating on a global scale.

Q2 Results (Investor Presentation)

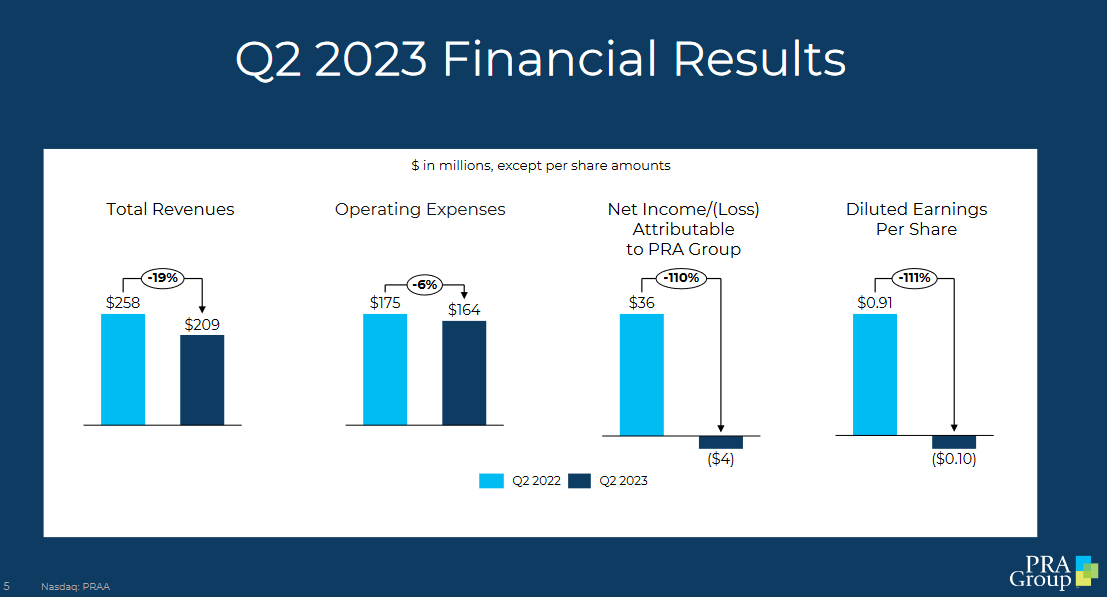

One of the key things to watch out for with PRAA has been the expenses for the business. The last report did bring some positive news as the operating expenses decreased by 6% YoY, which was largely driven by compensation for staff being left out, saving PRAA $8.3 million. Another $9.2 million was saved by a decrease in outside fees and services. PRAA still has a long way to go, in my opinion, but improvements like these are certainly a step in the right direction I think.

Earnings Transcript

On August 7 PRAA had its latest earnings call for investors and getting some insight into the company’s performance and outlook I think has been very necessary. PRAA has had some difficulties lately as the company saw its bottom line heavily decrease as revenues dropped and expenses remained high. The new CEO Vikram Atal had the following to say.

Europe now represents over 50% of our ERC. And while the UK remains our largest market presence in the region, we have established broad diversification across the continent. Over the years, we have invested considerable effort to build relationships with sellers and other stakeholders, along with a focus on enhancing core capabilities such as digital”.

The significant concentration the company used to have before seems to be coming to an end right now. Seeing PRAA divert and introduce a more international portfolio of investments seems like the right direction to head. It should hopefully help them hedge somewhat in tougher periods of economic growth.

Valuation & Comparison

EPS Estimates (Seeking Alpha)

I think that valuing PRAA right now is necessary to base it on that it can recover to its previous levels. Estimates suggest that EPS in 2025 will be $1.52 which is lower than what they had back in 2019. At that earnings results the FWD p/e sits at 12, a near 25% premium to the rest of the sector, which doesn’t offer any incentive right now to be buying I think. Until the share price drops further I won’t be a buyer, unfortunately. A p/e of 8 – 9 might be necessary, which indicates a drop of around 30% from current levels. It’s a volatile stock and allocating a smaller portion of a portfolio to it seems like the best route to go down.

Risk Associated

The company’s stability hinges on its ability to effectively acquire assets and achieve a substantial return on investment to sustain and enhance its ongoing operations. If the acquired loans fail to meet performance expectations, I assert that both FCF and net income will experience a downturn. This, in turn, could result in a reduction in the company’s stock valuations, potentially undermining investor confidence and affecting its overall financial health.

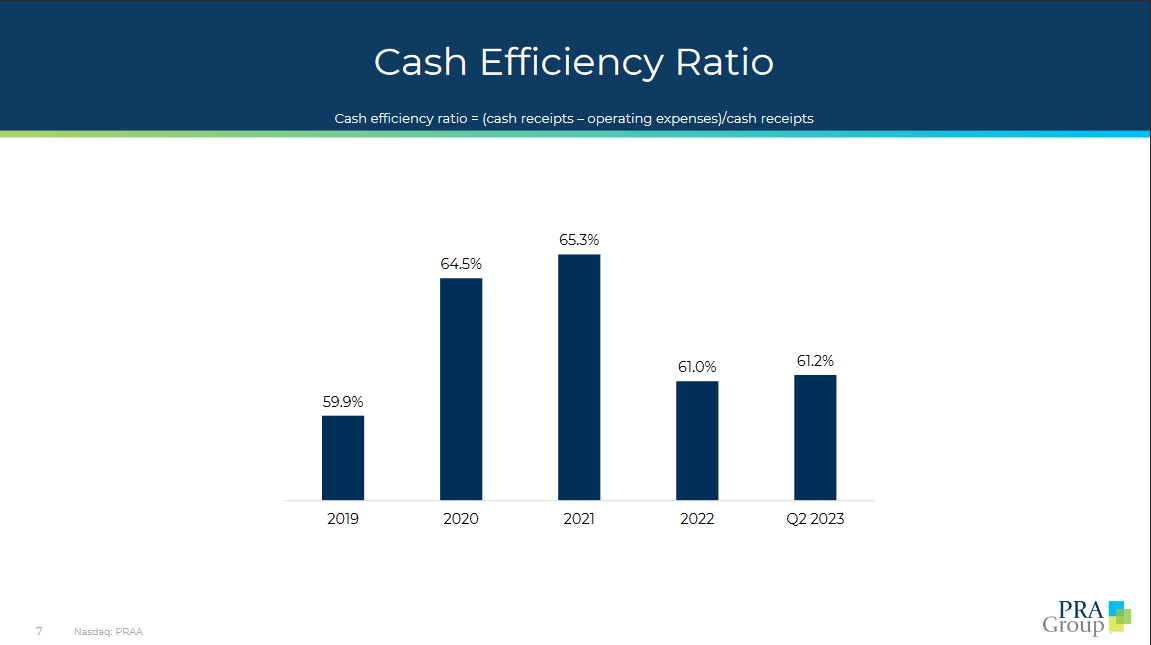

Cash Ratio (Investor Presentation)

Furthermore, I hold the viewpoint that PRAA could face significant challenges if there are shifts in the lending industry or alterations in credit origination strategies. Should the credit origination process evolve into a more sophisticated and robust system, the availability of nonperforming loans, which the company relies on for acquisitions, could diminish substantially. This could in turn hamper the company’s ability to capitalize on lucrative purchase opportunities, potentially impacting its growth and profitability.

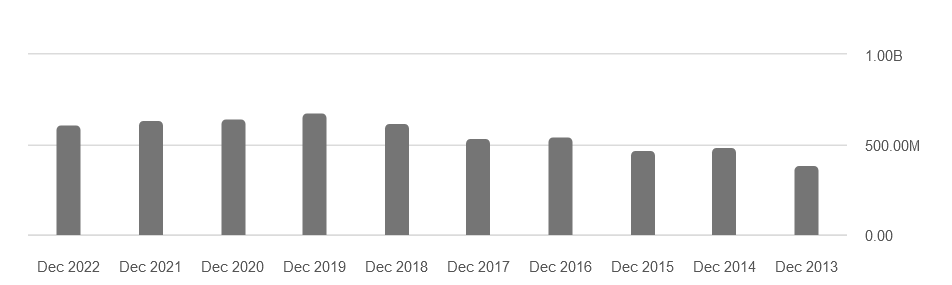

Operating Expense (Seeking Alpha)

The drop the company had earlier on this year for the share price has not been recoverable and it still trades far below where it was in January for example. The company was facing large amounts of increased expenses whilst the revenues were declining. For PRAA there seems to be some wage inflation as well as the selling general & admin expense have been climbing, indicating that perhaps the company needs to trim some staff and expenses if they want to recover the bottom line to a positive level.

Investor Takeaway

PRAA has continued to invest heavily into its portfolio but right now I do not see enough of an incentive to be a buyer in the company as the price remains expensive and the operating expenses are still far higher than they should be. The management of PRAA has been taking some strong steps towards reducing the expenses, but there is still a lot more progress necessary to make I think. Until there are better bottom-line results posted or a further decrease in the share price I won’t be a buyer. Until then I will have a hold rating for PRAA instead.

Read the full article here

Leave a Reply