Dear readers/followers,

While small, my investment in Portland General Electric (NYSE:POR) has not seen great or acceptable returns. It’s down double digits so far – so I’m glad I did not overexpose my portfolio to this name. The likely logic for the underperformance is sound here. The simple fact is that even a BBB+ rated company in utilities is being discounted in a world where you can throw cash and hit an 8%+ yielding debt instrument from a company with an investment-grade credit rating.

This makes the typical case for a utility, meaning a good yield, and safety, somewhat hollow – because there are many options out there on the market that offer the same or similar sort of trends and upside.

However, I believe POR has an upside here – and I’m not changing my “BUY” rating here. I’m doubling down on my thesis. As of this latest period, we’re looking at a 10-year low for the company in terms of valuation.

The company rarely trades at anything that approaches 15x P/E -and now it’s at 15.65x normalized P/E.

In this article, I’m revisiting the long-term upside for POR – and I see many positives, despite the numerous risks to the company.

Portland General Electric – the upside at 15x P/E is significant

My investing in this sort of companies in NA and the USA specifically, has been a very small thing for this year, for a number of reasons. It’s FX, which has been very unfavorable for over a year, but it’s also that there are so many better investments in the utility sector in Europe at this time. But I’m always going to highlight undervalued opportunities when I find them – and this company, at this valuation is undervalued for what it is.

I’m also very careful about west-coast investing, given the multitude of challenges I see in this geography in the USA. The company is hip-deep in these, being found in these operating geographies.

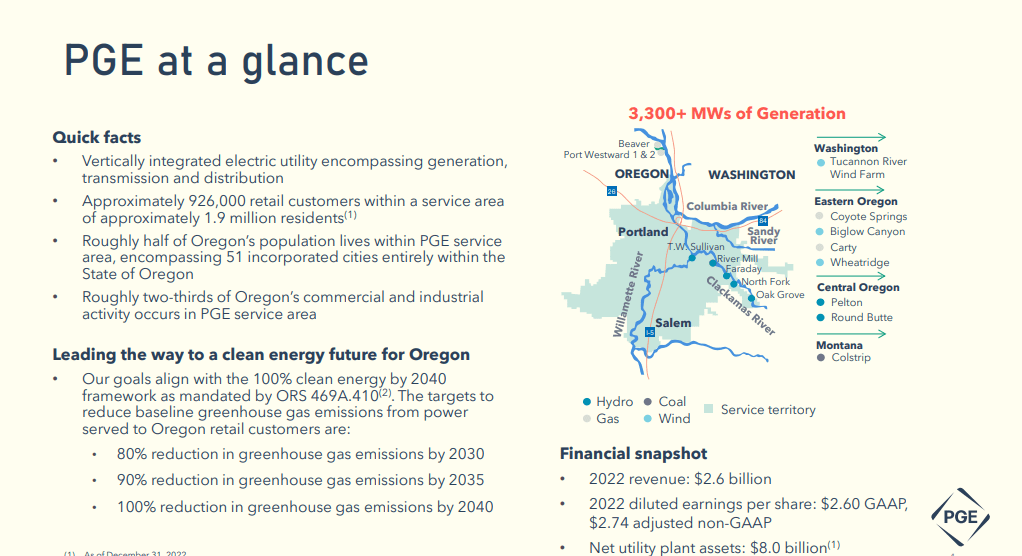

POR IR (POR IR)

Clean energy investment is not something unique any longer – but POR has come a long way. The reason for me for investing in POR in the first place was a set of attractive assets even compared to some of my other, larger investments, such as Danish Ørsted A/S (OTCPK:DNNGY) as well as similar companies with a far larger tilt to renewables than POR has.

There are problems with how POR has been doing their own shift. I go through these in my earlier article for the company, which you can find here.

Essentially, the company has been shifting to renewables without considering what’s replacing their legacy assets, and putting faith, among other things, in consumers and buying electricity on the market. Probably the worst solution to this problem that there is.

However, even with this risk where the company needs to invest to both harden existing infrastructure and prepare for the coming decades, there are plenty of upsides to like for POR here.

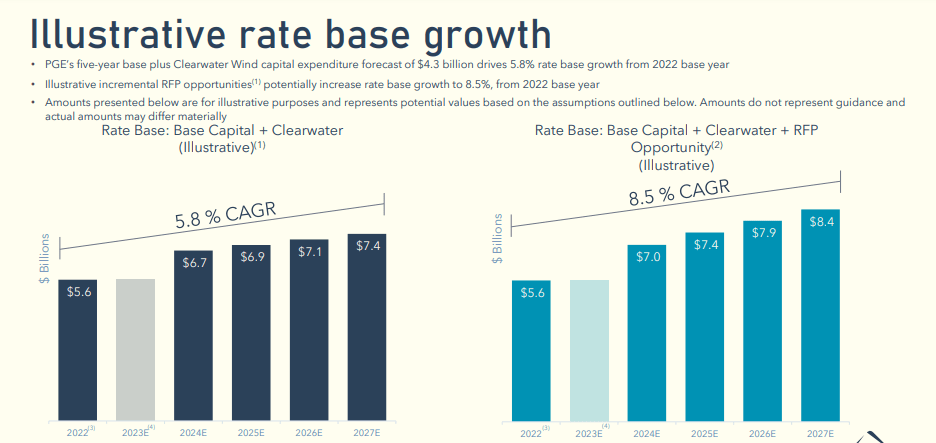

And POR is a company that “easily” delivers according to guidance. The company does not forecast as great a rate of growth as NJR does but still calls for solid annualized growth until 2027E.

POR IR (POR IR)

We can take advantage of the current rate case uncertainty that’s coming in 2024E and that’s also likely weighing things down at this time. The current company proposal/case is a base of $6.3B, applying for an increase of 16% marking a RoE of 9.8% at a cap structure of 50/50 with a cost of debt at 4.32% and a CoC of 7.06%. As I said in earlier pieces, these are very optimistic numbers, and I do not believe that POR will get it – or in fact anything close to a 16% increase. For that reason, I choose to forecast the company at a significantly lower rate case result, discounting to a RoE closer to 9% than the 10% mark.

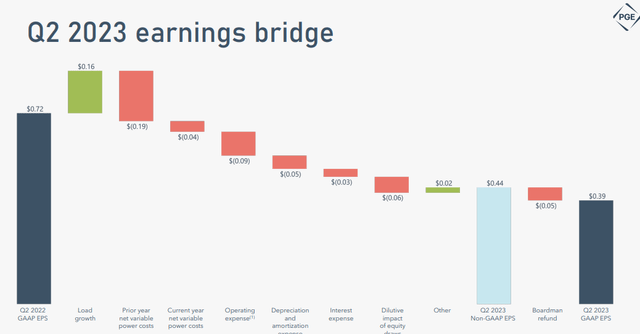

2Q23 is the latest set of results that we have here, and we’ll soon go into 3Q23. The current load growth, however, is under a whole myriad of non-recurring and recurring impacts.

POR IR (POR IR)

However, there are many arguments why we’re at “peak weakness” here, and why this valuation is not one that will hold for the long term.

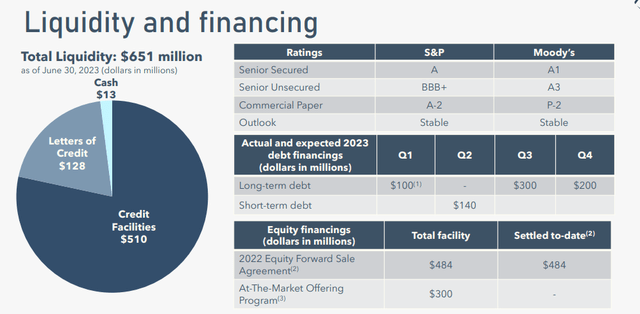

One of those arguments is the company’s current CapEx forecasts. For 2023E, we’re at peak CapEx for the next 5 years, due to significant battery, and general/technological investments that are almost 4-5x the amount we’re forecasting for the next few years. To be clear, the CapEx projected for 2026, is only ~60% of the CapEx for this year – and the company still has ample of financing and plenty of safety, given some of these really superb credit ratings.’

POR IR (POR IR)

POR has a lot of things going for it – as many great utilities do in this current environment. It has good reliability, it can brag about having the #1 renewable energy program in the nation (although, as I said, comes at a price and this price is high in terms of the safety and flexibility of the company), and it’s had a good performance overall, even if 2022 was somewhat flat, and it calls for the long-term growth of 5-7% unlike most utilities, which call closer to 7-9%. Given the current 2023E CapEx, we’re very unlikely to see a significant improvement in this year either, but as I see it, this is actually a positive for those of us who are long-term investors.

POR is a very end-loaded sort of utility in terms of CapEx. That means we have the potential for future outperformance and growth, rather than current growth, which means that I see the potential for longer-term reversal and earnings growth.

This means that despite being BBB+, the company is currently being punished, and if you’re patient, you can actually see some significant outperformance here.

Just how high?

Let me show you.

Portland General Electric – 15%+ annualized upside even at a conservative forward valuation

I made it clear in my last article, that I consider the company a good buy below $50/share, with a PT of $52. I’m discounting it slightly, reducing it to $50.5/share to account for the impacts of rates and higher risk-free rates. The fact that you can get 8% easily needs to be considered, and many of you might go for this instead – or just “BUY” Enel (OTCPK:ENLAY), which I have been doing for over a year at this point.

However, here is where POR may shine.

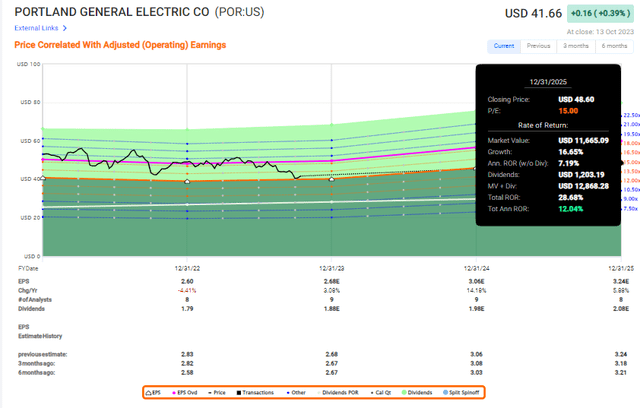

Even at only a 15x P/E, this company is now over 12% per year due to the 10-year low of 15.6x P/E, or $41/share.

Portland General Electric Upside (F.A.s.T graphs)

Again, this is at a 15x P/E. the company typically goes for 20.5x, which makes sense due to a 9.25% annualized EPS growth rate in the next few years, as of current forecasts.

If 20.5x P/E is the valuation we look at, then the upside is far higher than 12% per year – we’re talking 27.5%, or 71.5% in 3 years.

The truth is likely between 12-27% per year, which means that I consider the company to have a high likelihood of giving us a 15%+ annualized RoR.

Risks and considerations?

Grid stability due to the company’s “path”, as I’ve said before. This grid instability and asset shortage has led to expense increases, so some of these growth rates may not materialize as high as this. But I have been covering this risk since I started covering the business, and this earnings drag needs to be accounted for. That’s why I consider the company worth closer to 16-17x P/E, as opposed to over 20x despite its BBB+.

Secondly, the risk is that the population of Oregon, much like other west-coast areas, is actually declining. This is not a good thing for POR, as less population means a smaller rate base/customers, which in turn does not enable the company to generate the income it may need.

While POR is impressively valued at this time, and while I do consider it a “BUY” here, I also want to make clear to you that I believe there are good investments in the sector available elsewhere. It’s without a doubt to me, that Enel is a better investment at this particular time given the relative upside, safety, and yield – but not everyone is interested in “going Italy”.

For those focusing on US utilities, being okay with west-coast, and wanting a 4%+ yield, and a 15% annualized upside, I believe that POR delivers here. That’s also why I maintain my small position and may slightly increase it.

It’s not a bad investment in any way – just one that requires context and consideration.

Here is my updated thesis for POR.

Thesis

- At a lower price of below $50/share, this becomes an interesting utility play in a potentially strong state. However, the lack of asset flexibility and company-stated plans for its future still do not encourage me to invest further here.

- It’s my view that the company’s plans lack proper context and forecastability, allowing us to easily account for potential provisions for extra costs or income effects, influencing margins and income.

- Because of this and despite good fundamentals, heavy discounting is needed. Energy trading losses continue to impact the company’s bottom-line, and this is likely to continue. Due to this, I’m actually lowering my PT to $50.5 here, as of October of 2023.

- This makes POR a “BUY” here, despite some of the headwinds and risk – and I now also consider the company to be cheap.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized):

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansions/reversions.

Now cheap at 15-16x normalized P/E, the upside here is good enough to where I consider it a “BUY”.

Read the full article here

Leave a Reply