Dr. Ing. h.c. F. Porsche AG, or P911, just released its quarterly figures (OTCPK:DRPRF, OTCPK:DRPRY). Here at the Lab, we closely follow the company given our investment in Volkswagen (we recently double-down) and its macro upside positive. Following last year’s IPO, Volkswagen owns 75% minus one share equity stake in P911.

Q3 Results

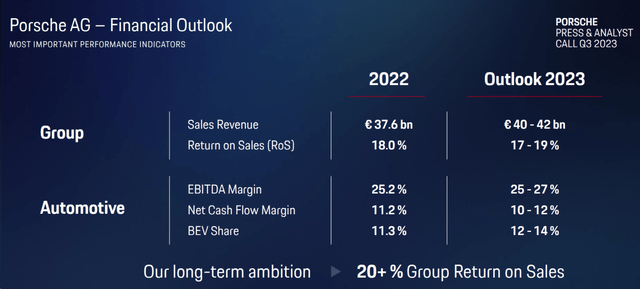

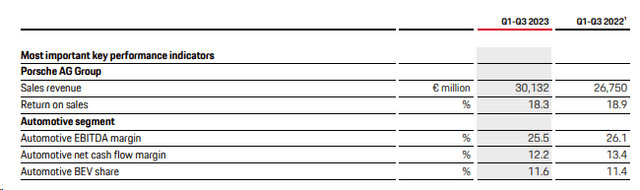

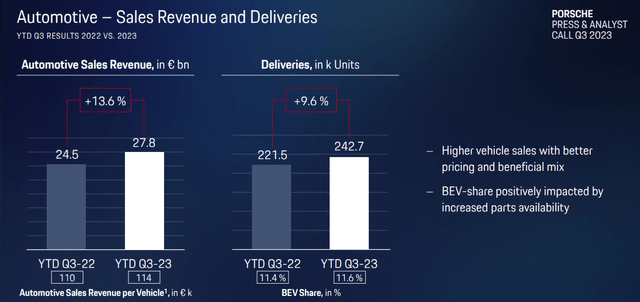

After reporting higher revenue and operating profit with a lower return on sales in the first nine months, the company confirmed its 2023 outlook (Fig 1). In detail, deliveries were up by 9.6%, with 242,722 vehicles (Fig 2). On the top-line sales, the German sports car manufacturer recorded a 12% increase, reaching €30.13 billion. The company recorded a good demand momentum in Europe, the United States, and emerging markets; however, in China, deliveries fell by 12%. Despite that, product MIX contribution and growing demand for customization had a positive P&L impact. Indeed, going down to the P&L, the company’s operating profit reached a plus 9% to €5.5 billion with a margin of 18.3%. This is a good result in the upper half of the guidance range for 2023, but it is lower than the 18.9% achieved last year. Looking at the details, higher investments in technology and motorsport with the new launch preparations negatively impacted the P&L.

Porsche AG 2023 guidance

Source: Porsche AG Q3 results presentation – Fig 1

Porsche AG Q3 Financials in a Snap

Source: Porsche AG Q3 press release – Fig 2

Looking at the cash flow evolution, it is essential to emphasize that net cash flow increased to €3.39 billion from €3.27 billion, with a net liquidity that fell mainly for the dividend payment. Another critical point is the financial services division, which saw revenue grow with lower margins due to higher interest rates and refinancing activity.

Why is Porsche AG a buy?

- There is a positive trajectory in pricing MIX. Despite a potential consumer slowdown, the company increased deliveries by 9.6% compared to last year’s Q3 results, and more expensive models drove the greater demand (Fig 3). In particular, on a year-to-date basis, P911 and Taycan units were up by 26% and 11%, respectively;

-

Here at the Lab, we have reason to believe that the company is ramping up with investments. This is due to the EV fleet coming online; consequently, Porsche AG increased start-up costs. In 9M, the company spent €2 billion in R&D compared to €1.8 billion last year. In detail, capitalized development costs reached €1.6 billion. In addition, there is a higher OPEX expenditure in marketing activities and strategy digitalization. We should also recall more investment in motorsports. Though the short-term impact might lead to a consensus downside, the medium-longer-term benefits could be more relevant. For this reason, our internal team is forecasting sales of €43.5 and €45.5 billion in 2024 and 2025;

- Our better sales projections are supported by Porsche’s aim to introduce several new electric models in the upcoming years. The fully electric Macan sports SUV is expected in 2024 and will be followed by the 718 Roadster and the Cayenne. By 2030, Porsche aims for more than 80 percent of new vehicles delivered to be fully electric;

- Despite lower Chinese sales, Porsche confirmed its forecasts for 2023 (Fig 1), expecting an operating return on sales of between 17% and 19%. This forecast is based on a turnover target between €40 and €42 billion. In our estimates, we are at the low-range guidance with a top-line sales projection of €40.5 billion;

- We are not forecasting M&A activities and believe the company might be debt-free in early 2025. For this year, considering a Q2 weaker FCF due to higher cash tax payments and employee bonuses, Porsche will have €2.5 billion in debt. Assuming lower CAPEX investments due to 2023 rump-up costs and also a higher dividend per share (+5% on the three-year visible period), the company has an FCF potential of at least €2 billion per year equal to an average deleverage of €500 million per quarter.

Porsche AG sales and deliveries detail

Fig 3

Conclusion and Valuation

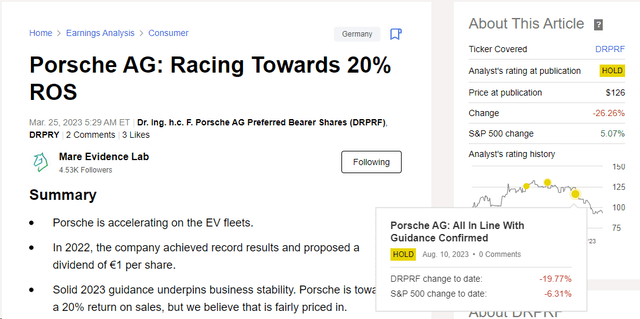

Since our neutral initiation of coverage called Racing Towards 20% ROS, Porsche AG’s stock price has declined by more than 26.26%. Here at the Lab, we believe this is not justified. Deliveries are increasing, and the company achieved double-digit sales growth and confirmed a solid operating profit margin. In addition, considering the current FCF, Porsche AG will be able to fully deleverage while investing for growth and increasing shareholders’ remuneration.

Mare Past Analysis

Regarding the company’s valuation, here at the Lab, we have opted for a blended P/E. We cannot fully consider Porsche AG a luxury company such as Hermes or Ferrari; however, we cannot recognize Porsche AG as an OEM mass producer. Therefore, we average OEM and luxury peers’ P/E deriving a 19x price-earning multiple. Following our 12-month visible estimates, with top-line sales at €43.5 billion and a core operating profit of €6.5 billion, we arrive at an EPS of 5.67. Applying a 19x P/E multiple, we arrive at a price of €107 per share ($11.6 in ADR). The company is subject to several risks. These include clients’ demand volatility, FX development, execution in the EV race, and higher interest rates affecting the financial services division.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply