On Thursday morning, we received second quarter results from Polestar (NASDAQ:PSNY). The electric vehicle company has seen its shares hit hard after going public through a SPAC last year, thanks to multiple cuts to its vehicle delivery guidance and large losses leading to major cash burn. Unfortunately for investors, the latest report showed many of the same recent negative trends, sending the stock quite a bit lower for the day.

For Q2, the company reported total revenues of $685 million. While this was up more than 16% over the prior year period, the figure missed analyst estimates by more than $70 million. As I mentioned in my previous article on the name, Polestar has been involved in a lot of discounting recently, which hurt the top line a little. The Q2 delivery number initially reported was also rounded up to the nearest hundred, so actual units sold were a little lower than previously thought.

Due to the discounts and some other one-time charges, the company actually swung to a gross loss in the quarter. As mentioned on the conference call, last year’s period was also helped by some non-recurring items. This year’s period had some extra contract manufacturing costs, supplier charges for batteries and semiconductors, as well as an inventory impairment charge. These charges added up to $68 million, after subtracting out a positive currency benefit of $12 million. Overall, the operating loss of $274 million increased by $20 million over Q2 2023 when excluding last year’s listing expense.

For the year, management reiterated guidance for gross margins of 4% and deliveries of 60,000 to 70,000 units. However, it is important to note that this year’s vehicle guidance has already been reduced twice, partially due to the pushback of the Polestar 3 launch to 2024. There should be some nice improvement in gross margins later this year, primarily as unit volumes ramp up, and the company has less older inventory to clear out.

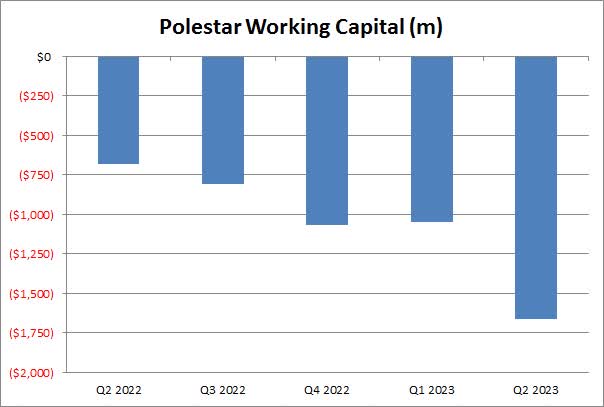

One of the main issues for the company is its financial position. As the chart below shows, working capital continues to be significantly negative. The large losses being racked up have resulted in a lot of cash burn, and the company is looking at further ways to raise capital. The large net debt position only hurts the future profitability picture, as interest expenses are soaring over prior year periods. The need to raise funds, potentially diluting investors quite a bit, is likely why the stock continues to trade near its public trading lows.

Polestar Working Capital (Company Earnings Reports)

The company has been at a major disadvantage over a number of its key EV competitors for a while, since the current Polestar 2 is not currently eligible for the US federal EV credit. Polestar 2 models are already a few thousand dollars more expensive in the US than their closest Tesla (TSLA) counterparts, and that’s before including the significant credits that comparable Tesla models are eligible for. Tesla also recently introduced lower priced variants of its luxury Model S and X vehicles, which will add further competition to Polestar’s upcoming higher end vehicles set to launch.

When you throw in the rest of the major ICE players boosting their EV offerings as well as all the local brands in China looking to make major strides, this is a very crowded field. The discounts certainly hurt Q2 results, and I’ve already seen price reductions for some of Polestar’s 2024 lineup, including the Polestar 3 that’s not even out just yet. With the company not trying to be a mass market brand given its guidance for only a couple of hundred thousand units a few years from now, it’s hard to see major economies of scale from large unit volumes.

Analysts continue to be fairly positive on the stock, with the average price target going into this report over $5 a share. While that does represent quite a bit of upside from current levels, that average valuation has been more than cut in half from its summer 2022 high of $11.50. Anyone that bought right after the SPAC combination was completed is down significantly at this point. At Thursday’s close, the stock was only about 20 cents from hitting a new low.

My personal rating on this stock remains a sell after this report. While the company should have some decent growth ahead of it, there is not yet a clear path to profitability or positive free cash flow. Management has admitted it needs to raise more capital, and with a market cap of about $7 billion currently, plugging the working capital shortfall could be extremely dilutive to shareholders. Management has taken down delivery guidance two years in a row as well, so I need to see better execution here. I would consider moving to a hold if the company can get its balance sheet in order a bit as well as show that some of the previous growth guidance shortfall can be overcome.

In the end, shares of Polestar lost more than 13% on Thursday after the company reported Q2 results. The top line number badly missed street estimates, and weaker margins led to losses being more than expected. While management keeps talking about a bright future, it has yet to deliver on its original SPAC presentation guidance for delivery volumes. The balance sheet also remains in terrible shape and a major capital raise is needed here. Unless execution improves a bit and the company can get its financial situation in order rather quickly, it wouldn’t surprise me if shares hit a new low.

Read the full article here

Leave a Reply