PLDT, Inc. (NYSE:PHI), traded as TEL in the Philippine Stock Exchange, is the oldest telecommunications company in the Philippines. It revolutionized communication after merging four telephone companies under GTE in 1928. With the Philippine Government Act 3436, it obtained a 50-year charter and the license to form a Philippine telephone network that would link major places globally.

PLDT has remained at the top spot for almost a century amidst the evolving market environment. It almost monopolized the market for a short period after winning the cut-throat competition with BayanTel. It kept expanding and capturing more customers with its prudent capitalization on M&As.

Now, it keeps up with the fiercer competition amidst the fast-paced digital transformation. Macroeconomic volatility remains a concern, but decreasing inflation can help PLDT and the whole industry. Other opportunities are evident, which we will discuss thoroughly in the succeeding parts. These make PLDT a secure company with sound financial positioning. Most importantly, the stock price appears undervalued, making it ideal for a buy or long position.

Q2 2023 Performance

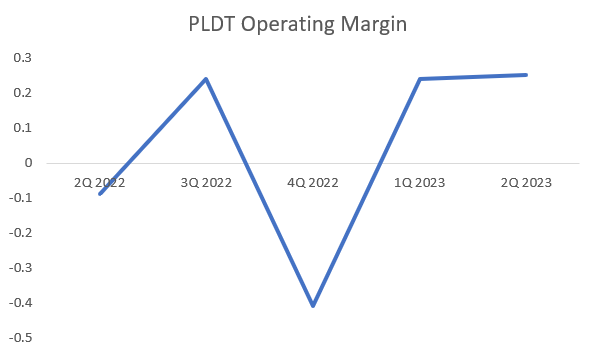

PLDT, Inc. still operates in a highly challenging market amidst elevated prices and interest rates. As a capital-intensive company, it must ensure adequate capital and well-covered borrowings. In Q4 2022, it faced more disruptions as cost pressures squeezed its margins. Despite this, PLDT regained its footing in Q1 2023. Revenues may have contracted, but costs and expenses became more stable. Hence, its margins rebounded.

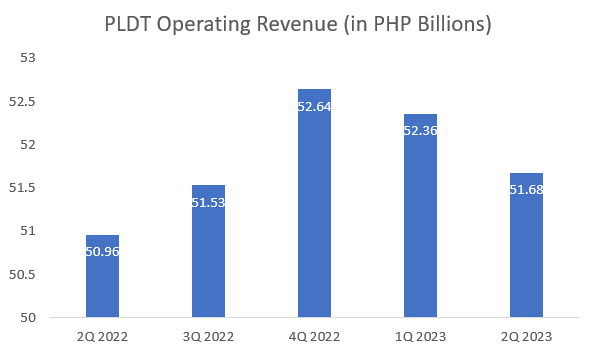

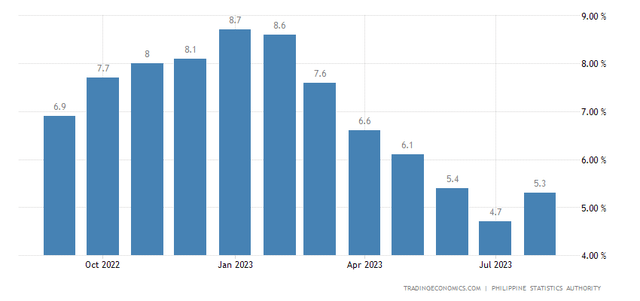

During the second quarter, PLDT became more at ease in the current market environment. The operating revenue reached PhP 51.68 billion, 1.2% lower than in Q1 2023, with PhP 52.36 billion. Seasonality could be a primary factor since the historical Q2 and Q3 values were relatively lower. Also, inflation was more intense in the quarter, so PLDT had to adapt to cope with cost pressures. Meanwhile, it was 1.4% higher than the same quarter in 2022. Various factors contributed to its stable revenues. First, its home segment remained its primary growth driver. It was most evident in its Home Fiber segment, with an 11% YoY growth. Second, inflation has consistently decreased since February 2023. At the end of the quarter, it landed at 5.4%, 38% lower than the 8.7% peak last January. The manageable unemployment rate also helped increase consumer confidence. Both macroeconomic indicators allowed the company to set more strategic pricing. Other driving forces were the hybrid and remote work setups and the boom in online stores. All these led to higher demand for internet connections as more business activities go online. We will delve into these external forces in the succeeding parts.

Operating Revenue (Company Financials)

Meanwhile, the operating costs and expenses dropped by 31%. Indeed, the favorable impact of decreasing inflation was more visible in PLDT’s production. More interestingly, its operating leverage remained below 10%. It means that its variable costs comprised a small portion of the total costs. This aspect made it easier for the company to adjust to cost pressures and improve viability. Unsurprisingly, its operating margin had a sharp rebound to 25%. It was also the highest in the past five quarters.

Operating Margin (Company Financials)

For the second half of FY 2023, I expect PLDT to maintain its revenue momentum as PH inflation becomes more manageable despite the uptick in August. The prevalence of hybrid work setup and the fact that income levels in PH still outpace inflation improves the purchasing power of its customers. Its adaptation to the fintech revolution will also be another potential growth driver.

Risks

PLDT must watch out for risks that may disrupt its growth potential.

Higher Interest Rates

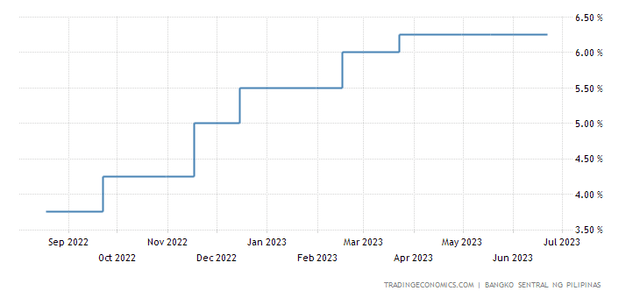

The reopening of the PH economy stimulated growth across industries. Yet, it caused massive shortages and coincided with the goods movement across the region. The inflation level skyrocketed and reached its ten-year high.

PH Interest Rates (Trading Economics)

To that end, the BSP had to contract its monetary policy by increasing interest rates. It proved effective as it softened borrowing and investment levels in the PH economy. However, it has already exceeded expectations. Interest rates are now 6.25%, the highest since the aftermath of the Global Financial Crisis. The US Fed just reported its inflation at 3.7%. As such, the possibility of another interest rate hike is high. The Central Bank of the Philippines may also raise its interest rate to match the US rates and prevent peso devaluation.

PLDT must be concerned about its borrowings of Php 310 billion. The total amount is equivalent to 49% of the total assets. So, higher interest rates can squeeze PLDT’s liquidity. Also, its high reliance on borrowings may raise interest expenses and reduce net income. Thankfully, its Net Debt/EBITDA Ratio of 2.48x is acceptable for a capital-intensive company. Most importantly, the percentage of borrowings maturing this year is only 10% of the total value. It still has enough earnings to cover borrowings and sustain its core operations.

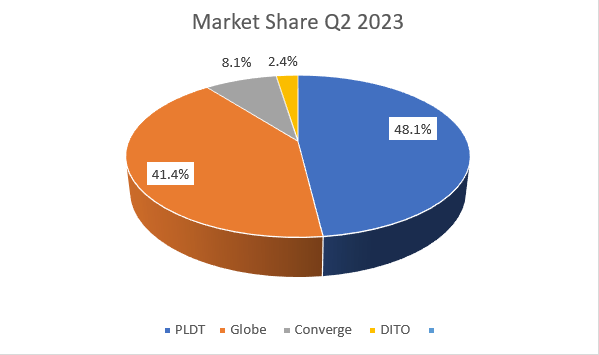

Tight Competition

PLDT saw fiercer competition when Converge (PSE:CNVRG) and DITO (PSE:DITO) entered the market. For many years, its closest competitor was Globe (PSE:GLO). PLDT matched it by acquiring Smart to capture cellular phone users.

PLDT holds a 48.1% market share compared to 48.7% in 2022. Globe ranks second with 41.4% from 41.8% in the previous year. Converge comes in far third with 8.1%, but the increase from 7.1% in 2022 must be noted. Lastly, DITO’s market share doubled to 2.4%.

Market Share (PSE EDGE)

It must beware of Globe as it also tries to match PLDT’s capabilities. Aside from BayanTel, Globe-at-Home also penetrates the fixed-line segment.

But Converge appears to be posing a bigger threat. It has started to expand as it continues the construction of Bifrost, a cable landing station. This will extend its internet capacity from the Philippines to other countries in APAC and even in North America. In turn, it will increase its coverage and match the international capabilities of PLDT.

Potential Risk Mitigants and Opportunities

PLDT may capitalize on these potential risk mitigants and opportunities.

Decelerating Inflation

Inflation decreased considerably in the second quarter. Now, it rests at 5.3%, a 40% reduction from the January 2023 peak. Indeed, the efforts of the BSP helped slow down inflation. Prices stay elevated, and the relaxing inflation can make other macroeconomic indicators more manageable. If it decreases further, the BSP may keep interest rates at their current level or reduce them. The near-term market condition may be challenging, but the current trend shows some sprinkles of hope. Lower inflation also means more stable costs and expenses. PLDT may also set more favorable pricing to optimize sales and volume and maintain top-line growth.

PH Inflation (Trading Economics)

Regarding recession, we must remember that inflation was driven by pent-up demand. It was a natural response for prices to increase to maintain market equilibrium. And as other countries also reopen their economies, importing raw materials may become faster and less expensive. Hence, the cost of production inputs may start to stabilize.

Sky Acquisition and Sustainable Innovation

PLDT still capitalizes on prudent expansion through M&As. One of its most recent transactions was its acquisition of Sky for nearly Php 7 billion in Q1 2023. This move will allow PLDT to deepen its penetration in other niches, especially in remote areas. It can cater to more customers and increase revenues and market share. The M&A also cements its position as the largest telecom company in the Philippines.

Given this, the company remains the most valuable telecom brand in the Philippines. The recognition extends to other regions. The independent study of Brand Finance confirmed it. The London-based business valuation firm looked into several aspects to assess company value. Aside from the sustained expansion, PLDT used innovation to enhance user experience. Sustainability initiatives like its carbon fiber technology for cell towers were also appreciated. For Brand Finance, PLDT’s milestones may inspire more telecom brands in the European region. It is more essential today amidst the digital revolution. The need for a reliable internet connection and IT support in London is evident today.

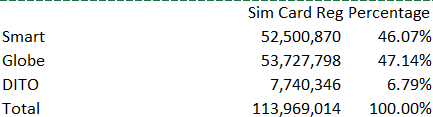

SIM Card Registration – Increased Mobile Market Share

After the three-month extension, sim card registration in the Philippines has been wrapped up. Smart had 52.5 million registrations or 80% of the total network subscribers. Meanwhile, Globe secures the top spot with 53.7 million registrations or 64% of the total network subscribers. Despite this, the gap between the two leading mobile networks narrowed from 22 million to 1.2 million. It shows a more solid customer base due to higher subscriber retention rates. It also increases the chance of PLDT doing well in the mobile segment competition since it is the most robust niche of Globe.

Sim Card Registration (ABS-CBN News)

Digital Revolution

PLDT remains at the forefront of the digital revolution. First, the e-commerce boom and hybrid work setups prevalence persist. In a recent survey, Southeast Asians consider working conditions as one of their top priorities. More specifically, 46% of Filipinos prefer a hybrid work setup. The fully remote work setup was chosen by 28% of the respondents. It coincides with the revenge travel in the Philippines. It requires more business owners and employees to secure stable internet connection while working away from the office. This can increase the demand for PLDT’s products and services.

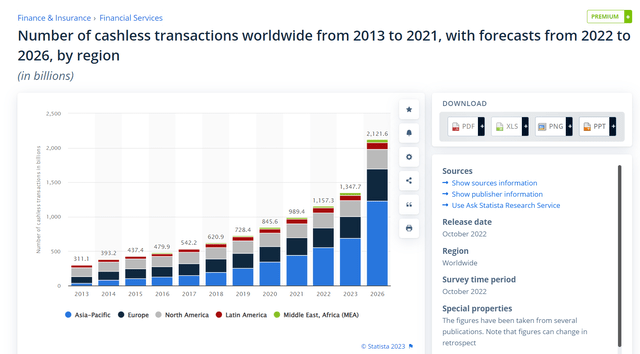

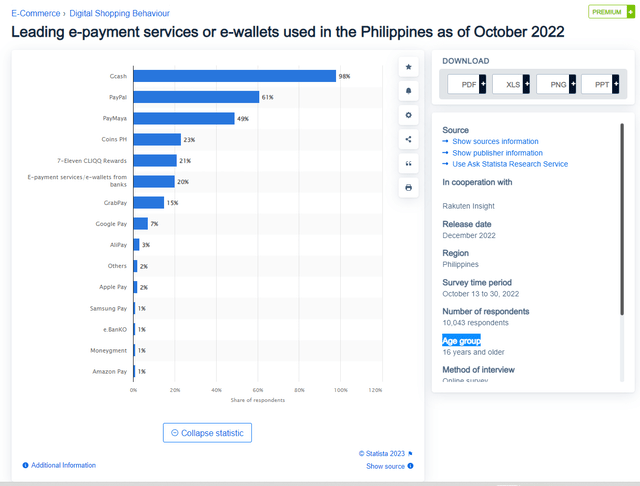

Another factor to consider is the fintech revolution. It became more prominent at the height of the pandemic. Now, it is highly correlated with e-commerce and hybrid work setups. In a 2021 survey, over 70% of Filipino respondents favored cashless payment methods. Asia-Pacific had the highest volume of transactions. But, the actual penetration rate remained low. There are still many untapped potentials that mobile wallet apps and banks can utilize. By 2026, cashless transactions may exceed $2 trillion globally, with the Asia-Pacific region contributing 58%. In the Philippines, PLDT also leads the fintech revolution with Maya. As of October 2022, almost half of Filipinos used Maya for their transactions.

Cashless Transactions (Statista)

Leading E-Wallets (Statista)

Company Sustainability

PLDT remains a market giant through its continued expansion, innovation, and acquisition. It is no surprise its borrowing levels continue to increase. It remains a challenge for the company amidst interest rate hikes. Despite this, its efforts continue to pay off as returns remain decent. Cash levels may be too low relative to borrowings. But, the high EBITDA levels ensure decent financial positioning. In the past three years, the Net Debt/EBITDA Ratio has remained below 3x, meaning the company has enough earnings to pay off borrowings and dividends. We can also see its continued expansion using the Cash Flow from Operations and CapEx. The company maintains adequate cash inflows to sustain its CapEx.

PLDT Debt Profile (PLDT Investor Presentation)

PLDT (PHI) – Valuation

The stock price of PLDT has decreased in the past year. At PhP 1,100, its value from the same day in 2022 has already been cut by 32%. It was a massive reduction in only a year. Yet, it opens an opportunity to buy shares at a discount.

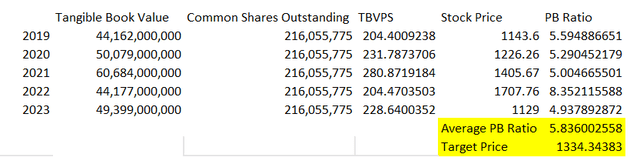

We must assess the stock price relative to its fundamentals. As a capital-intensive company, the Price-to-Tangible Book Value Ratio may give more precise findings than the PE Ratio and the PB Ratio. We can find the target price by comparing the company’s historical tangible book value and stock price. We can use the weekly stock prices and find their simple moving averages. The method gives a target price of PhP 1,334.34, or an 18% upside from the current stock price.

Tangible Book Value (Author Estimation)

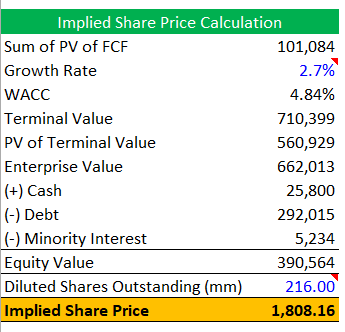

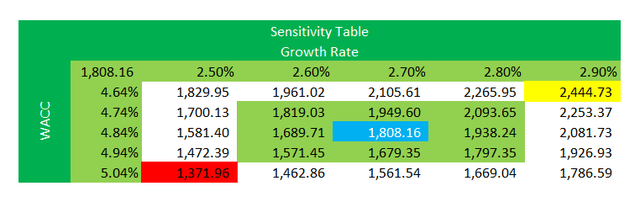

The DCF Model is a better method to assess the stock price. The target price using the model also shows stock price undervaluation. The average upside potential of 60% proves the stock is a very good bargain. The stock is recommended for a solid buy position. See the screenshot of my actual stock price computation. I derived the perpetual growth rate using the historical average growth of 3.2%, but I reduced it to 2.7% for a more conservative estimation. I also included the screenshot of my sensitivity analysis table to show how the stock price will vary with perpetual growth and WACC.

DCF Model (Author’s Calculation)

Stock Price Sensitivity Table (Author’s Calculation)

Bottomline

PLDT, Inc. is a telco trailblazer that kept its starpower. Despite the tight competition and macroeconomic volatility, its growth prospects are not lackluster as one may think. It continues to expand its niches, even expanding to fintech and digital banking. Even better, it has adequate liquidity levels to suffice its expansion and dividends. The stock price is also very cheap now, and the target price is reasonable for its fundamentals and growth potential in 2024.

Read the full article here

Leave a Reply