Is there even going to be a market?

I wrote about Platinum Group Metals (NYSE:PLG) here at Seeking Alpha back a couple of years. My base contention was that the market for the intended production had a problem. Therefore I was unsure about whether the mine would, in fact, go into production. My concerns have only grown over the period since. I now think it is going to be very difficult for PLG to finance its mine. And I think they’re going to have significant problems if they can manage that.

I’d also suggest that they themselves have realized this problem – for they’re doing something to try and solve that market demand problem. Something I don’t think will work but that’s not quite my point. That they are doing this thing tells me that they understand the problem they’re facing.

Detailed finances

Aitezaz Khan has done a detailed walk through the finances and balance sheet. I don’t see any great purpose in rewriting all of that so go read that piece for that section of the information. Yes, they’ve got money, they’ve got an ore body, I’ve little doubt they’ll be able to be fully licensed and so on.

My question is all about whether it’s worth in fact mining their ore body. I think perhaps not. Now, whether the rest of the market agrees with me will be the determinant of whether they gain the necessary financing to go into production. Who reality agrees with will be the determinant of whether a profit is made by doing so.

The platinum group metals

The intention – obviously enough – is to go mining for the platinum group metals. Palladium, platinum and rhodium are the ones that concern us here with reference to the Waterburg Development. One of my contentions is that it is Waterburg that matters for PGL. Without that going into production there’s really nothing here.

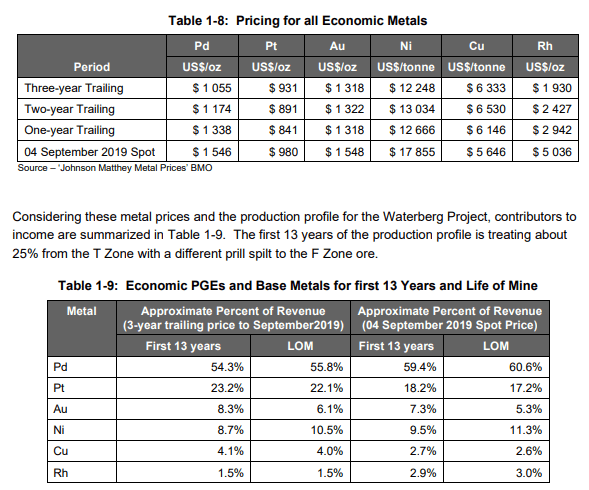

OK – rhodium we can leave to one side, it’s a couple of percent or so of predicted revenue. Why not their own chart?

Price assumptions from PGL (Platinum Group Ltd)

We can take palladium to be our bellweather. Other than platinum – whose price we’d expect to move closely with Pd – the others are nice to have revenue streams but they don’t make or break the project. If Waterburg’s not worth mining for the palladium then it’s not worth mining at all.

So, is it worth mining for palladium?

At current prices sure it is. People make a profit doing so from current sources, so sure. But that’s not quite the right question. For it takes time to get a mine into production, and build a pgm refining plant, so we need to be looking at prices some years out to get a grip on the likely revenues.

And, well, I’ve been a really big downer on the pgm prices. I might be wrong about this but follow along with the logic here and see what you think.

Electric vehicles and catalytic converters

Now, this is not wholly and exactly true but as a modelling assumption it’s fine. The use of palladium is in catalytic convertors for gasoline powered cars. Diesel uses platinum – at least, is more likely to. As I say, there are other uses for Pd but as a modelling assumption this is going to work just fine for us.

From the USGS we also get something useful for our analysis here: “World resources of PGMs are estimated to total more than 100 million kilograms. The largest reserves are in the Bushveld Complex in South Africa.” Waterberg’s in the Bushveld (actually, seems to be the Northern end of it) so the proposed digging is in the right place.

But from the same source we also get: Pd consumption of 90 tonnes a year (or Pd and Pt of 130 tonnes perhaps, they’re often substitutable so sometimes the joint number is more relevant). Note this is US only. Of which the catalytic converters are the leading use. I would also say the majority use. For, we also have this: “About 115,000 kilograms of palladium and platinum was recovered globally from new and old scrap in 2021, including about 53,000 kilograms recovered from automobile catalytic converters in the United States.”

Now, we don’t in fact get all of the Pt and Pd back from recycling those convertors. As one researcher found, they get damaged, the honeycomb breaks up and gets, well, exhausted from the exhaust pipe. This means that dust swept up off the road contains Pd and Pt. To the point that someone’s (it’s a part of Veolia) trying to make road sweepings a recyclable. It’s not working yet – but for us it tells us that the return from recycling converters is less than annual demand for material to go into converters.

OK, that then tells us that demand/usage for converters in the US is at least half the Pt and Pd demand in the US. 53 tonnes of 130, we know that recycling’s not 100% efficient? Sure, the demand must be 50% and more.

But EVs again

That market could be about to disappear. Sure, it’s wholly possible to think that EVs aren’t going to take the entire market by 2030. Or 2035 – despite varied governments insisting it must happen by then. But EVs are going to take a very large portion of the market in that sort of time scale. Which, obviously, means that Pd demand is most likely going to fall greatly.

But there’s more – recycling

OK, so Pd demand is going to drop by half or so – again, modelling, not necessarily accurate numbers. But recycling’s not going to stop just yet. And as we can see we’ve got near half of supply coming from that recycling. The recycling’s going to continue until the current crop of ICE vehicles is off the road – around 20 years is the usual thumbnail for the lifetime of the fleet as a whole.

At which point recycling alone is going to be able to supply all, or near all, of demand once the need for new catalytic converters is gone.

Again, not quite accurate – there’s the replacement parts market for example. But again, useful as a modelling exercise.

We’re thus just about to enter a phase where Pd demand halves, all of that can be supplied by recycling the current stock and that will likely last for a couple of decades. The only thing that stops this is the Pd price falling so far that it’s not worth recycling the converters.

But – converters are richer ore than primary mines are. So, preferentially, we’ll process the converters rather than mine for virgin or primary material. We can test this too. Is a catalytic converter worth more, per kg, than pgm ore if we measure that value by the pgm content? The converter scrap is worth many times what the ore is – therefore the converter scrap is a much richer ore than the pgm ore. We can go look up contents if we want to but we don’t need to – prices tell us all we need to know. No one’s going to steal 5 kg of ore from a mine, people might steal a converter from your car – QED.

That is, I think the Pd (and Pt, Rh and so on) business is about to enter a valley of death scenario. Sure, things get better 20 years out but that’s rather a long valley of death to have to finance. Therefore I think it’s unlikely that it will be financed.

My initial view

So, I think that pgm mining is not a good place to be. Further, I think that opening a new pgm mine is a truly bad place to be. This means I’m doubtful that a new pgm mine will gain full financing. And, that if it does, it’s not going to be a joyous outcome for the shareholders in that pgm mine.

The reason for this is that I believe we’re about, as a result of technological change, to enter a period of a substantial fall in pgm prices, Pd and Pt especially (rhodium I’d expect to be even harder hit, but that’s a trivial part of the cashflow here).

We’re about to have demand for new catalytic converters collapse, while we’ve still got 20 years worth of recycling from the current fleet to come. That material from recycling will be more than adequate to supply all of the non-catalytic converter demand in my view. Finally, the only reason the converters will not be recycled is because demand and thus prices collapse – which does not bode well for a primary mine. Which, recall, we expect to have lower grade ore – thus higher production costs – than recycling converters.

There’s one more thing here

It looks like PGL realizes this problem. For, along with other pgm producers, they’ve set up a new company:

Platinum Group Metals Ltd. founded Lion Battery Technologies Inc. in partnership with Anglo American Platinum Limited to support the use of palladium and platinum in lithium battery applications. The possibility of creating additional demand for platinum and palladium in the battery technology space is an exciting development and of strategic importance to both parties.

Lion Battery has entered into an agreement with Florida International University to further advance a research programme that uses platinum and palladium to unlock the potential of Lithium Air and Lithium Sulfur battery chemistries to increase their discharge capacities and cyclability.

OK, that’s very fun and I wish them all the luck in the world etc. But now think about what they’re doing. They’re trying to find new uses for the metals they want to mine. Which could be taken as an admission that the current uses of the metals they want to mine aren’t going to last – as above.

We’re, well, we could call it Dr. Seuss. If we had some eggs we could have ham and eggs for breakfast if we had some ham. We’ve a great pgm mine here if we can find a use for the pgms from our mine. And, well, it’s possibly true but it’s not a story I’d like to put my money into.

There are other problems

It’s possible to look at the economic background in South Africa and wonder whether it’s a good place to go mining anyway. The unions are strong, wage demands are high. It’s not wholly obvious that Eskom is going to continue to be able to supply power to industrial organizations. Other mining companies have had significant problems with both.

But leave those aside.

My view

Given the looming cliff facing pgm demand I am deeply unsure that pgm mining is a good thing to be in. Further, given that recycling will remain a cheaper source of pgms than primary mining it’ll be the primary mines that suffer first from a fall in demand – and prices – and recycling will continue. The volumes of either and both are such that, for a couple of decades at least, I think it’s entirely possible to see recycling alone supplying all demand.

It’s even possible to be very cynical indeed and suggest that the whole Lion Battery idea is an acknowledgement of this. Sure, we know that the current market is going to disappear so let’s try to invent a new one! I think that’s less than convincing.

Why might I be wrong

There is another technological path possible. Toyota, for one, has been looking at it. And it’s not an impossible one (I did some work a couple of decades back on a variation of it). Which is that while we do move away from ICE – I think that’s inevitable now – we don’t move to EVs. Rather to fuel cells and hydrogen as the fuel. Yes, I know, that has its own problems. But it’s still a possible technological path. And the most likely form of fuel cells would be PEM, which use pgms.

In fact, a usual complaint from the environmental side is that there aren’t enough pgms to be had to supply such a technological change. Which isn’t true but even so, think what that would do to prices and the prospects for previously marginal mines.

No, I don’t know and nor do you or anyone else. We’re going to have to wait and find out. But that is the technological bet for pgms. That fuel cells will take over from the converter demand. And if they don’t then prices are likely going to crater in my opinion.

The investor view

In terms of what PGL is doing in detail there’s nothing wrong at all. They’ve definitely got a deposit, it’s known how to mine it. At current prices they’ll do OK – it passes the feasibility study which is how we can judge that. On most of the conventional measures it is, if a bit unexciting, just fine.

What worries me is that I don’t think the market – nor the prices – for pgms is going to be there by the time they’re able to come to market. And further, I think that there’s enough uneasiness about this in the market more generally that it’s not obvious to me that they’ll be financed into production. Finally, if they are I don’t expect it to work out well.

My answer here is therefore pretty boring. Do something else. No, it’s not so obviously immediately bad that shorting is an appropriate technique. There might well be wobbles either way in the price. But I simply cannot see the long term outcome as being beneficial to shareholders. Thus the advice is to be elsewhere in the market.

Read the full article here

Leave a Reply