Pioneer Resources (NYSE:PXD) is rumored to be acquired by Exxon Mobil (XOM). But this ignores the long history of Exxon Mobil in making acquisitions. I had previously mentioned that Exxon Mobil tends to sell high-cost production into a market like this, while others like Chevron (CVX) write off properties and dump them at market bottoms. That procedure is unlikely to change just because rumors have started, unless there is a reason not currently known for the deal.

Pioneer has some of the best acreage in the industry and has long produced excellent results because of that acreage location. But this is not a surprise that would cause a decision to purchase the company at a time when oil prices are relatively high. This has been known for some time. So an offer could have been made back in 2020 or 2021 by a financially strong company like Exxon Mobil.

In the current fiscal year, you have several purchases that were made already. Chevron acquired PDC Energy back in May 2023, when the discussion for the acquisition was done at considerably lower oil prices. Furthermore, if you check back at the stock price at the time, the acquisition was done for a relatively small premium.

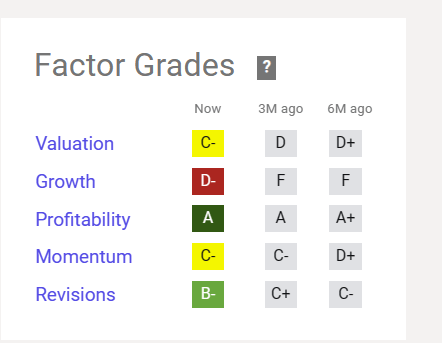

Pioneer Natural Resources Quant System Valuation Measures October 6, 2023 (Seeking Alpha Website October 6, 2023)

Pioneer Natural Resources already has a fair valuation. One would normally think an acquisition would take place when the Valuation is an A or maybe a B. Someone who would purchase an oil and gas company with the valuation shown above is far more likely to be from outside the industry without the experience to purchase a bargain. Instead, they just “want in on the action”. That kind of merger often comes back to haunt the company later.

Other Bargains

The industry is loaded with bargains right now. Diamondback Energy (FANG) has a lower price-earnings ratio. The acreage is every bit as good.

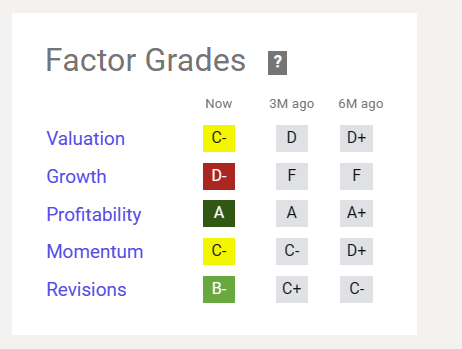

Diamondback Energy Quant System Valuation (Seeking Alpha Website October 6, 2023)

Despite the lower price earnings ratio, the Quant System on the website does not give this company a superior grade. That should tell investors that things were cheaper earlier, and indeed there were a lot of purchases and acquisitions made throughout the industry when prices were cheaper.

Industry insider will buy when the valuation grade is higher. Speculative money without industry experience will often buy during market tops or frankly anytime insiders as a group do not see a bargain.

Baytex Energy

Baytex Energy (BTE) for example announced the purchase of Ranger Oil (ROCC) back in March 2023 when oil prices were significantly lower than they were now. That means that negotiations and independent evaluations occurred at a time when the market was far less optimistic about the industry outlook than now.

The controlling entity was Juniper Capital advisors as the major shareholder of Ranger Oil. So why would Juniper (someone with considerable experience) sell? The answer is that the company purchased its interest near the market bottom for about $10 per share. When the company sold to Baytex, the deal was worth about $44 per share. Therefore, Juniper made a good profit over about 3 years, while Baytex purchased a far improved situation at a good time in the oil and gas industry cycle for a relative bargain.

This was a win-win for both companies, and Baytex will likely build on that win.

Current Industry Conditions

Oil prices are not in a favorable position for industry insiders to make large purchases without some unknown reason that insiders would likely know but would not be apparent to the public. Furthermore, when Exxon Mobil made the offer to purchase Denbury (DEN) that offer came “out of the blue” as is typical for Exxon Mobil.

The “leaking” of information that a deal is supposedly about to occur has led to this:

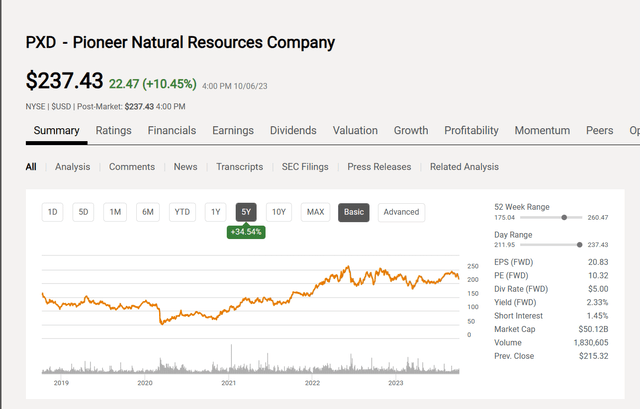

Pioneer Resources Stock Price History And Key Valuation Measures (Seeking Alpha Website October 6, 2023)

The Pioneer common stock price shown above is already up 10% in an era when the market has long demanded no or very little premium in a takeover bid for the industry for quite some time. That price appreciation alone could kill the deal (for all intents and purposes) unless an acquirer wants to pay cash. But Exxon Mobil has long acquired companies for stock (see the details of the Denbury acquisition).

When Exxon Mobil Did Pay A Premium

There was a time when Exxon Mobil Paid a premium (XOM). The Interoil acquisition comes to mind.

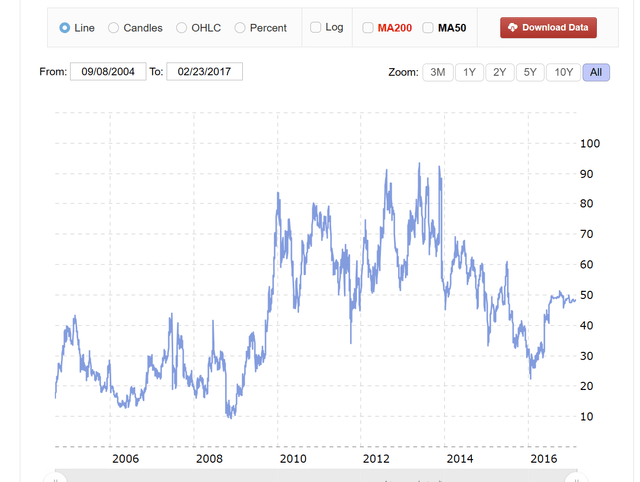

Interoil Common Stock Price History (www.macrotrends. net October 6, 2023)

As shown above, Exxon Mobil did pay a premium when it offered $45 a share. But the stock was down considerably from its highs close to $90 a share when the offer was made. Exxon Mobil paid quite a bit less for the company just by waiting.

Conclusion

What is shown above is far more typical of successful and experienced insiders. They will pay what the market considers top dollar if they see no other reasonable strategy at the time and the acquisition reasons are compelling enough. That remains to be seen.

But in this case, Exxon Mobil is a known bargain hunter. For shareholders, that is also known as good management. Denbury was acquired after it came out of bankruptcy and had shed a whole lot of debt. The company was likely a lot cheaper just because of that.

The Permian has a lot of bargains that I follow, with price-earnings ratios as cheap as 2. Even so, the quant system clearly shows that for the industry, there were better times than the current time to purchase bargains. For those two reasons alone, Pioneer is unlikely to be acquired now.

That is not the same as stating it will not happen. What it is saying is that if it does happen, it is not a typical transaction. Therefore, I would stay on the sidelines.

There are a lot of good companies selling historically cheaply in the oil and gas business. But there is no reason to just rush in at a time like this. Investors can do well at current prices if they are willing to wait for that return to historically normal pricing. However, industry insiders are capable of taking advantage of bargains that can vanish quickly. There is every indication that the bargains that existed since 2020 are becoming scarce.

Much of the buyers’ market that I cover exists among unnatural sellers and speculators that hoped to make a killing in the 2015-2020 period but were disappointed. They now want to “dump and run” which usually provides far better opportunities than acquiring public companies. Hence, I have a lot of articles of these private entities selling for 3 times EBITDA or less.

All of these considerations make Pioneer a relatively expensive acquisition proposal. The result weighs against the rumors now floating around. If it does happen, it would be because an inside buyer like Exxon Mobil sees a far better future ahead for the acquisition that the company did not see in the past, for reasons the market will not know. That, to me, sounds like a tall order because insiders usually do not act that way.

Read the full article here

Leave a Reply