Invesco Preferred ETF (NYSEARCA:PGX) is a fund that holds a large number of preferred stocks and is somewhat popular with income-oriented investors with its 6.5% yield, but it is likely not an ideal place to park cash in the long term.

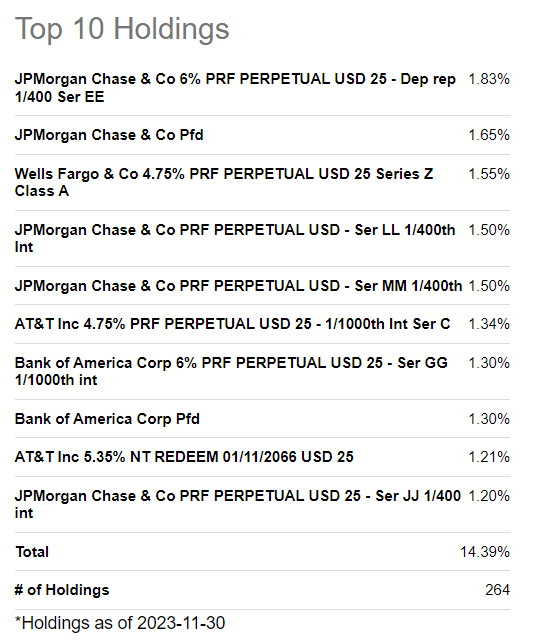

The fund holds a total of 264 positions and its biggest holdings seem to come from big banks such as JPMorgan (JPM), Wells Fargo (WFC), and Bank of America (BAC) along with other popular income-generating names like AT&T (T). These preferred stocks in themselves are not bad, and many of them are trading at a discount to their par value.

Top 10 Holdings (Seeking Alpha)

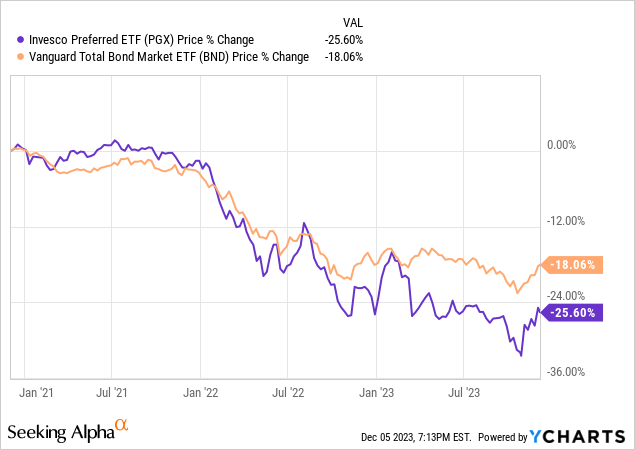

As a matter of fact, preferred stocks got hit almost as bad as long-term bonds did in the last couple of years as the Fed launched one of the most aggressive rate hike campaigns in its history, hiking rates from 0% to 5.5% in a little over one year. In historical rate hikes we’d seen before, it would have taken multiple years for the rates to rise at a similar magnitude. As bonds sold off, so did preferred stocks because investors viewed them as bond substitutes even though they have very little in common with bonds.

This is no surprise, though. Typically, valuations of assets are determined by how they compare to the risk-free government treasuries in terms of risk and reward. If an asset type has better risk-adjusted return potential than treasury bonds, it is considered “cheap” and when it has a lower risk-adjusted return potential, it is considered “expensive”. In some asset types, like stocks, it is incredibly difficult to reach a consensus fair value because we don’t know in advance what the risk-adjusted return potential is. We can look at historical performance to determine a value, but it would be only directionally correct and far from perfect.

Things are a bit simpler with preferred shares because they have a par value and a fixed rate of income. Unless something drastic happens, you know what to expect from your preferred shares with a fairly small margin of error. What this means is that there will be a stronger correlation between bond performance and preferred stock performance than what you’d expect to see when you are correlating bonds and regular stocks. Oftentimes, regular stocks can completely decouple from bonds, but it rarely ever happens with preferred stocks.

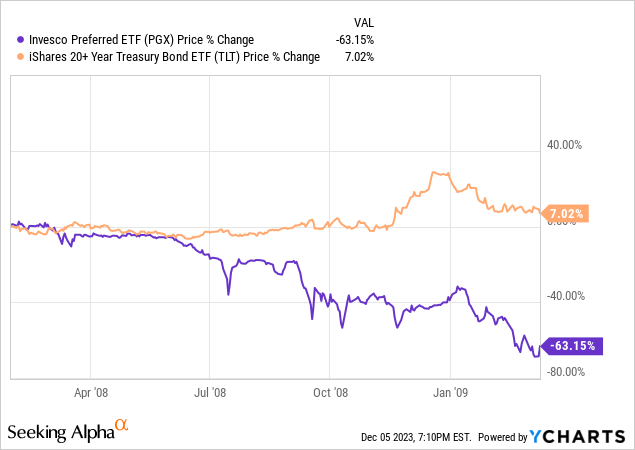

Then there are exceptions. During the last financial crisis, PGX saw its value drop by as much as 63% whereas treasury bonds were actually up 7%. During that time investors were selling off stocks (both regular and preferred) flocking to the safety of bonds. Actually, they weren’t buying all the bonds either. They were specifically buying up treasury bonds and avoiding corporate bonds because no one knew which companies would survive the disaster of the 2008 global financial crisis. If it wasn’t for the government bailout, we might have seen most of the big banks on the chopping block during that time.

Apart from unique times like those, preferred stocks tend to see their performance more or less correlate with bond markets as we’ve seen in the last couple of years.

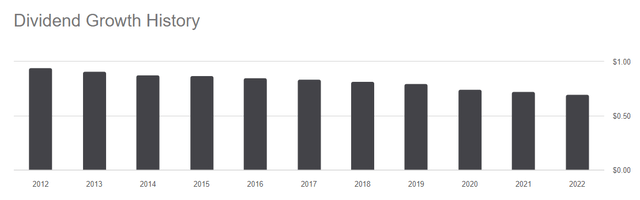

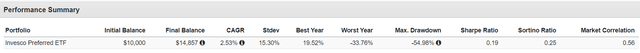

So what’s wrong with PGX, and why am I not recommending it? The biggest problem I have with this ETF is that its high expense ratio seems to eat into its dividend payments in such a meaningful way that it has to cut dividends every year in order to keep its NAV constant. When you buy a stock fund that charges you 0.50% per year, it may not be a big deal since stocks tend to rise about 10% per year on average, and you probably won’t notice that fee. But what if you have an asset type that has no price appreciation and all returns come from dividends? Then that fee will slowly but surely eat into your dividends over time. In the last 10 years, this fund’s dividend distributions dropped from $0.95 to $0.70, a drop of almost 20%. If you add inflation to the mix, the drop becomes even more dramatic.

Dividend History (Seeking Alpha)

How does this happen if preferred shares pay a fixed dividend? Let’s say you have a fund that generates 7.0% from its holdings but pays 6.5% in dividends, but it charges a fee of 0.5% per year. Let’s say this fund starts at an NAV of $100. The first year’s dividend will come at $6.50. The next year the fund’s NAV is at $99.5 so it generates $6.96 in dividends and distributes $6.48. If this continues on for enough years, you will notice a significant drop in your income.

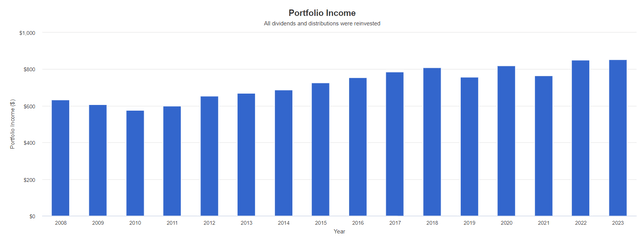

Of course, you can overcome some of it by reinvesting your dividends. If you had bought $10k of PGX at inception and reinvested all dividends since then, your annual income would have grown from $632 to $850, a yield of 8.5% against your original cost but this is far from impressive since we are talking about compounding and reinvestment happening over 15 years.

Income Growth With Reinvestments (Portfolio Visualizer)

As a matter of fact, your total annual compounded return would have been 2.53% which is hardly worth the investment.

Total Return Metrics (Portfolio Visualizer)

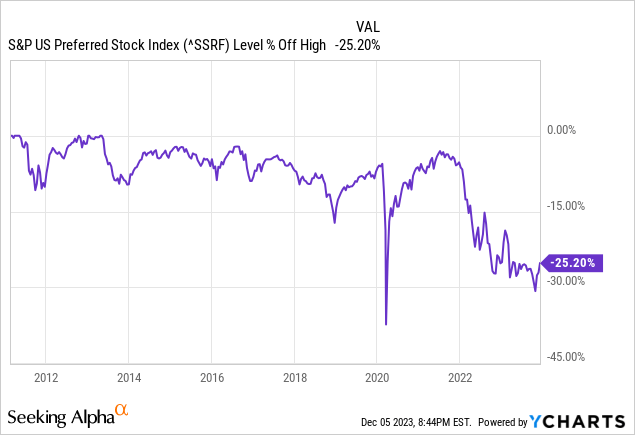

If I were to play the devil’s advocate, I must also say that many of this fund’s holdings are trading at a deep discount to par because preferred stocks have been in a bear market. S&P US Preferred Stock Index is down about 25% from its recent highs and these things tend to bounce back to the par price sooner or later (unless the underlying company is in deep trouble or goes bankrupt) because they are fixed-income vehicles that can be recalled at a specific price, many times with maturity dates attached to them like bonds. One could say that if you buy PGX and wait long enough, you will eventually get a decent return when prices return to par values whenever that may be. So if you are bullish on preferred stocks, this could be a good time to buy this fund as this is one of those rare moments where we could be looking at an upside potential in the share price.

Still, it would be more of a trade than a long-term investment. If you are looking for a place to generate reliable income that rises from year to year (or at least stays steady over the years), this is probably not a good place to be.

Read the full article here

Leave a Reply