The Flaherty & Crumrine Preferred Income Fund (NYSE:PFD) is a fairly well-known closed-end fund, or CEF, that invests in a portfolio of preferred stock and other fixed-income assets in order to provide its shareholders with a very high level of current income. This is evident in the fund’s 6.90% current yield, which is higher than many other things in the market. This yield is unfortunately not nearly as good as some other fixed-income closed-end funds, though, as even some of its sister funds have higher yields:

|

Fund Name |

Current Distribution Yield |

|

Flaherty & Crumrine Preferred Income Fund |

6.90% |

|

Flaherty & Crumrine Preferred Securities Income Fund (FFC) |

7.34% |

|

Flaherty & Crumrine Preferred Income Opportunity Fund (PFO) |

7.17% |

|

Flaherty & Crumrine Dynamic Preferred & Income Fund (DFP) |

7.28% |

The fact that the fund’s yield is lower than its peers is not necessarily a sign that this is a bad fund though, especially because the difference is not very much. However, it does take much more to impress income investors nowadays, considering that the ten-year Treasury is at 4.286% and most money market funds are yielding 5% or higher today.

Unfortunately, as I pointed out in a few recent articles, there could be some headwinds against the fixed-income sector in general right now as the Federal Reserve seems likely to continue to raise interest rates as core inflation is still running at more than double the central bank’s target level. Due to the relationship between fixed-income securities and interest rates, this could push the price of the fund down despite the fact that it has already lost 14.53% year-to-date. With that said, though, the fund is trading at a price that is well below the intrinsic value of its shares, so it might still be worth picking up. Let us investigate and see if this fund could make sense for your portfolio today.

About The Fund

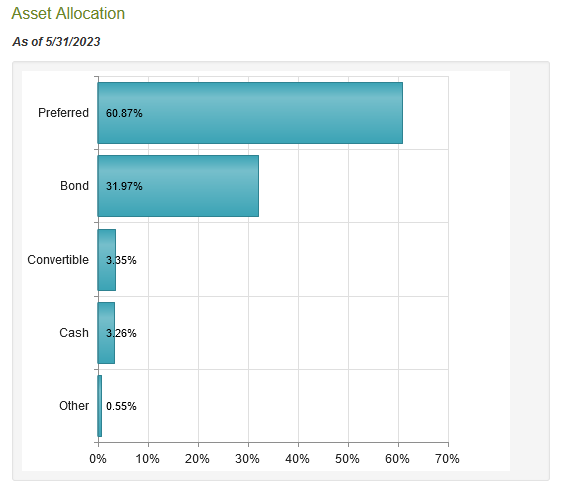

According to the fund’s website, the Flaherty & Crumrine Preferred Income Fund has the objective of providing its investors with as high a level of current income as possible while still preserving the value of its principal. That is not an especially surprising objective considering that the fund’s name suggests that it will be investing primarily in preferred stock. The portfolio itself appears to confirm this, as 60.87% of the fund’s assets consist of preferred equity issues:

CEF Connect

We also see that the fund has considerable exposure to bonds alongside small allocations to convertible securities and cash. Clearly, this is a fixed-income fund and fixed-income funds do generally promote their commitment to maintaining the value of their investment principal. It is not necessarily that difficult for a fixed-income fund to accomplish this, either. After all, as I have pointed out numerous times in the past, any investor who holds a bond for its entire life is guaranteed to not lose money unless the issuer defaults. A bond is purchased at face value, makes regular coupon payments to the bondholder, and then gets redeemed for face value when it matures. Thus, the investor that holds the bond for life will receive the coupons as their investment profit. This is very different from common stock, as there is never a guarantee that you will receive your initial investment back just because you held common stock for a certain period of time. Technically, this is the same with preferred stock as there is no maturity date with preferreds in most cases but usually, there is a face value that the investor will receive back if the security is held for long enough.

Unfortunately, it is not the case that this fund’s share price will remain the same over time. This is partly because the fund’s share price will at least somewhat reflect the current value of the underlying securities. As everyone reading this likely knows, the market price of most fixed-income securities has been declining since the start of 2022. As we can see here, the Bloomberg US Aggregate Bond Index (AGG) is down 15.46% and the ICE Exchange-Traded Preferred & Hybrid Securities Index (PFF) is down 22.22% since the start of 2022:

Seeking Alpha

This is mostly due to the rising interest rate environment. The market prices of these securities have an inverse correlation with interest rates, so when the market interest rate rises, the value of these securities declines.

This has had a significant impact on the Flaherty & Crumrine Preferred Income Fund as well. As we can see here, this fund is down a whopping 44.42% since the start of 2022:

Seeking Alpha

That is clearly much worse than either the preferred stock or the traditional bond indices over the same period. It is not exactly unexpected though, as most fixed-income closed-end funds have significantly underperformed the indices in the market. This is partly due to their use of leverage that amplifies the fund’s losses. We will discuss this in more detail later in this article. In addition to this, the market price of closed-end funds does not always perfectly correlate with the performance of the portfolio itself. As a result, it is certainly possible that investors rushing to sell the shares in response to a weakening fixed-income market pushed the shares down more than was justified by the falling prices of the securities in the fund’s portfolio.

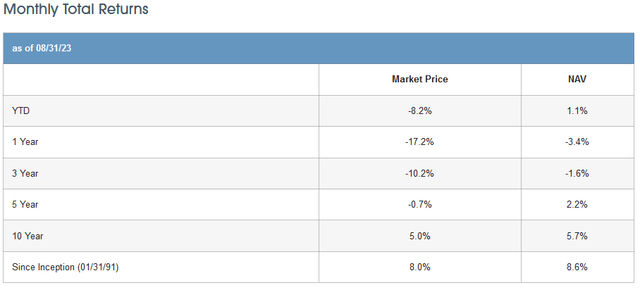

There may be some reasons to believe this latter explanation. For example, as we can see here, the portfolio itself has performed much better than the market price of the fund’s shares over both the year-to-date and the trailing one-year periods:

Flaherty & Crumrine

The column marked “Market Price” shows the total return delivered by the fund’s shares in the market over the specified period. The column marked “NAV” shows the total return that the fund’s portfolio actually managed to earn. As we can clearly see, for the past three years, the portfolio has delivered a much better performance than the fund’s shares would indicate. This could represent an opportunity for investors to obtain the shares for much less than they are actually worth.

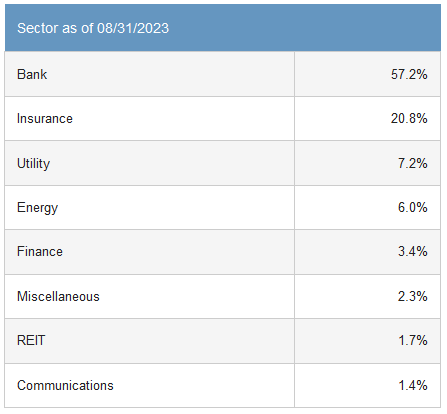

As I pointed out in a recent article on one of Flaherty & Crumrine’s other preferred stock funds, these funds tend to have a very high weighting to securities issued by commercial banks. The Flaherty & Crumrine Preferred Income Fund is no exception to this, as can be seen here:

Flaherty & Crumrine

As we can clearly see, the fund currently has 57.2% of its assets invested in bank stocks. This is something that may be concerning to more risk-averse investors considering that 2023 has been the worst year for bank failures in more than fifteen years. However, it is very common for preferred stock funds to be heavily invested in bank securities. I discussed the reason for this in a previous article:

“The banking sector is by far the largest issuer of preferred stock in the market. One reason for this is international banking regulations. As a result of Basel III, banks are required to maintain a certain percentage of their assets in the form of Tier One capital. This is defined as that portion of a bank’s capital that is not simultaneously a liability to somebody else, such as a depositor. This is essentially the bank’s ‘own money.’ Whenever regulations require a bank to increase its Tier One capital, it has to issue either common stock or preferred stock. Most bank managers will opt to issue preferred stock in these situations in order to avoid diluting the common stockholders. In other industries, there are no regulations such as this and so most companies will opt to issue debt instead of preferred stock because debt is quite a bit cheaper to service. Thus, by default banks are the largest issuers of preferred stock and any preferred stock fund will be heavily invested in the banking sector.”

This fund is certainly taking precautions to avoid having too much risk from losses due to a bank failure or similar event. While the Federal Reserve has taken some steps that are intended to reduce the risk of failures, banks still have enormous mark-to-market losses on their balance sheets due to the decline in bond prices over the last year. Thus, such precautions are certainly warranted and should be appreciated by investors. One of these precautions is that the fund is limiting its exposure to any individual issuer. As of the time of writing, the Flaherty & Crumrine Preferred Income Fund has 221 issuers represented in its portfolio and no single issuer accounts for more than 2.32% of the fund. As such, even a worst-case scenario involving a single issuer should not have a significant or even noticeable impact on the fund as a whole.

Leverage

As mentioned earlier in this article, the Flaherty & Crumrine Preferred Income Fund employs leverage as a way to boost the effective yield of its portfolio. I discussed how this works in a recent article on another closed-end fund:

“In short, this fund is borrowing money and then using these borrowed funds to purchase preferred securities, bonds, and other income-producing assets. As long as the interest rate that the fund pays on the borrowed money is less than the yield that it receives from the purchased assets, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing at institutional rates, which are considerably lower than retail rates, this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an excessive amount of risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of assets for this reason.”

The fact that this fund employs leverage could have contributed to the underperformance of the fund’s shares relative to the two relevant comparison indices. This is because the fund’s leverage would have amplified the losses that it took as a result of falling fixed-income security prices over the past nineteen months or so. However, this was not the sole contributor to the decline that investors experienced, as was already discussed.

The Flaherty & Crumrine Preferred Income Fund’s leveraged assets comprise 39.47% of the portfolio as of the time of writing. Clearly, that is quite a bit more than we really want to see as it does exceed my one-third level. This could be a bigger risk today than it was in the past. As I discussed in a recent article, we are starting to see funds suffer performance declines because of their rising costs to service their leverage. As such, it would generally be a good idea for a fund to maintain a lower level of leverage right now to reduce the risks that it poses to investors.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Flaherty & Crumrine Preferred Income Fund is to provide its investors with a very high level of current income. In order to achieve this objective, the fund invests in a combination of preferred stock and bonds. Each of these security types delivers the bulk of its investment return in the form of direct payments to security holders and so each of them tends to have a respectable yield. The ICE Exchange-Listed Preferred & Hybrid Securities Index, for example, currently yields 6.95%. The Flaherty & Crumrine Preferred Income Fund collects the dividends and coupon payments made by the securities in its portfolio and employs leverage to allow it to collect payments from more securities than its equity would ordinarily allow, which results in the effective yield of the portfolio being boosted. The fund then pays out the majority of its investment profits to the shareholders in the form of distributions.

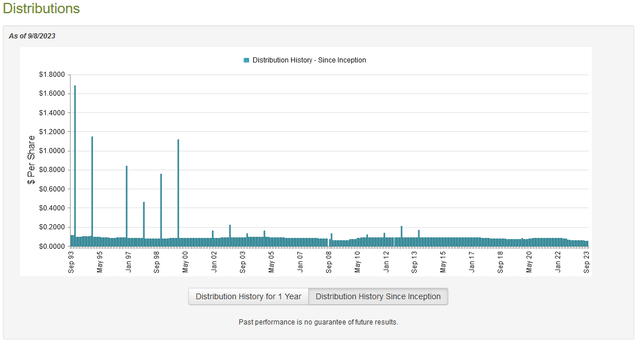

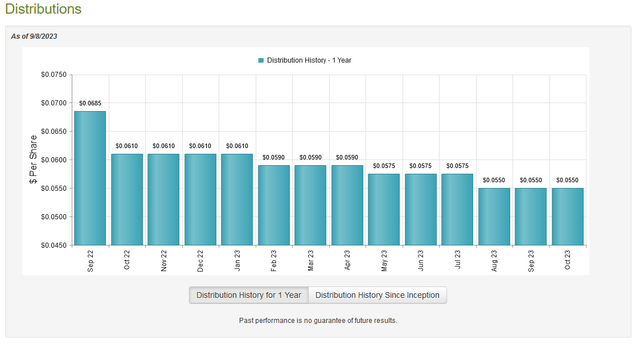

As such, we can expect that the fund will have a fairly impressive yield itself. This is indeed the case, as the fund currently pays out a monthly distribution of $0.0550 per share ($0.66 per share annually), which gives it a 6.90% yield at the current price. When we think about it, perhaps that yield is not really that impressive because it is lower than the index. In addition, the fund has not been particularly consistent with its payout over the years. As we can see here, the fund has raised or lowered its distribution fairly often over its lifetime:

CEF Connect

This long-term distribution variability could be a bit of a turn-off for those investors who are seeking a safe and secure source of income with which to pay their bills or finance their lifestyles. The fact that the fund reduced its distribution four times in the past twelve months, in particular, will be something of a turn-off:

CEF Connect

However, there have been a number of fixed-income funds that have reduced their distributions over the past several months. This is due to the fact that the rising interest rates have reduced the market price of the securities held in their portfolios even as the amount of income that they would receive from any new security purchase went up. As such, some of these funds have reduced their distributions in order to bring the distribution in line with net investment income as opposed to depending heavily on capital gains to drive returns.

As I have pointed out numerous times in the past, the fund’s past is not necessarily the most important thing for anyone buying today. This is because anybody buying today will receive the current distribution at the current yield and will not actually be affected by the actions that the fund has taken in the past. The most important thing is how well the fund can sustain the current distribution. Let us investigate this.

Fortunately, we do have a relatively current document that we can use for the purposes of our analysis. The fund’s most recent financial report corresponds to the six-month period that ended on May 31, 2023. As such, it should be able to give us a good idea of how well the fund was able to take advantage of the strength in fixed-income securities that we saw during the early months of this year. It will also provide us with some insight into the causes behind the fund’s recent distribution cuts.

During the six-month period, the Flaherty & Crumrine Preferred Income Fund received $2,898,363 in dividends and $4,965,866 in interest. When we combine this with a small amount of income from other sources, the fund had a total investment income of $7,886,588 during the period. It paid its expenses out of this amount, which left it with $4,394,436 available for shareholders. That was not enough to cover the $4,570,657 that the fund paid out in distributions during the period, but it did get very close. This certainly confirms the earlier statement that the fund’s management appears to be trying to bring the distribution in line with net investment income. It is still somewhat concerning that the fund did not manage to fully cover it though, since we do generally like a fixed-income fund to be able to fully cover its distribution out of net investment income.

This fund does have other methods through which it can obtain the money that is needed to cover its distributions. For example, it might have been able to take advantage of price fluctuations and earn some capital gains that can be paid out. Unfortunately, the fund failed miserably at this task during the period. It reported net realized losses of $3,927,882 and had another $7,139,812 net unrealized losses during the period. Overall, the fund’s net assets declined by $10,083,454 after accounting for all inflows and outflows over the six-month period. This comes on the heels of a $29,932,230 decline in net assets over the preceding full-year period. This certainly explains why the fund’s management thought it necessary to reduce the distributions. It appears that it is an attempt to stop the bleeding.

We will have to wait until the next financial report is released to know for certain, but given how close the net investment income was to the distribution and the fact that the distributions were cut during the period, there could be reason to believe that the fund probably can sustain the distribution going forward. At least, that is probably the case unless it has more losses due to further increases in interest rates.

Valuation

As of September 8, 2023 (the most recent date for which data is available as of the time of writing), the Flaherty & Crumrine Preferred Income Fund has a net asset value of $10.87 per share but the shares only trade for $9.50 each. This gives the fund’s shares a 12.60% discount on net asset value at the current price. This is quite a bit better than the 10.62% discount that the shares have had on average over the past month. As such, the price certainly looks right today.

This also confirms the earlier conclusion that the market has been selling off this fund’s shares to a much greater degree than is really justified by the performance of its portfolio. The fact that we can pick up shares today for less than they are actually worth could be an opportunity to earn some money.

Conclusion

In conclusion, the Flaherty & Crumrine Preferred Income Fund has seen its share price devastated over the past several months as rising interest rates have decreased the value of the assets in its portfolio and forced it to cut its distribution. However, it appears that the market sold it off to an unwarranted degree, as the fund’s portfolio has been performing quite a bit better than the share price would imply. This has resulted in a situation where the fund’s shares are selling for substantially less than their intrinsic value. When we combine this with the probability that the fund probably can sustain its current distribution, we can see that there might be an opportunity here.

Read the full article here

Leave a Reply