Peyto Exploration & Development Corp. (OTCPK:PEYUF) (this is a Canadian producer that reports in Canadian dollars) rarely makes any kind of acquisitions, let alone large ones, while taking on considerable debt. The key to this one (acquisition) is a belief that the year 2025 will mark a material change in the ability of North America to export oil and gas. Management is therefore willing to make a large bolt-on acquisition to be in a position to take advantage of this future. The financing raises the risk of this strategy somewhat. But the rewards appear to far outweigh the presumed risk.

Bolt-On Acquisition

Peyto announced the acquisition of Repsol Canada Energy Partnership, a subsidiary of Repsol (OTCQX:REPYY), for C$636 million. This is the value of proved producing reserves at a 5% discount on the reserve report.

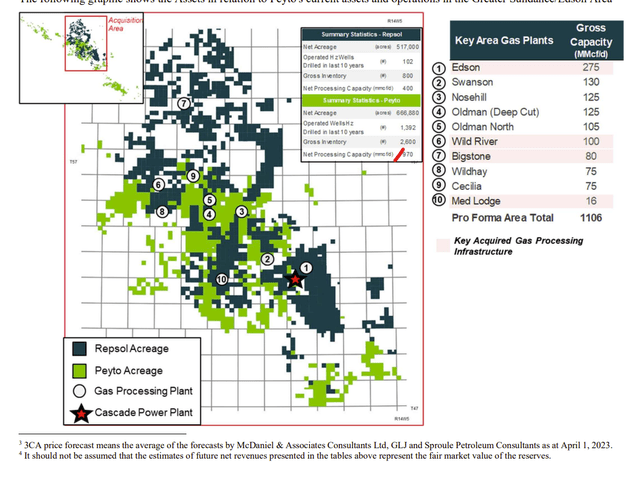

Peyto Map Of Acquired Lands And Already Owned Land (Peyto Acquisition Announcement September 6, 2023)

This large acquisition sharply deviates from the history of Peyto where acquisitions are rare and a few that are made tend to be small and “bolt-on”. This one is largely “bolt-on” as shown above. But it is materially larger, and it is largely financed with debt, even though there is a “bought deal” for the sale of roughly 10.5 million shares (before any extra sales to handle overallotments and other activities allowed). That original proposal was raised to nearly 17 million shares and closed yesterday. This indicates significant progress towards the acquisition.

The stock jumping yesterday about 8% is a very rare occurrence. Usually, stocks swoon after an offering for a few months. Evidently Mr. Market likes this deal early on.

There is a new debt commitment of roughly C$1.3 billion. This will be a sizable debt increase from the recently reported nearly C$870 million of net debt. Meanwhile, production will only increase about 23,000 BOED per day.

The good news is that production is 75% natural gas, which is a considerably lower ratio than the company reports regularly. Remember that Peyto has long been a dry gas producer that was slowly “dipping its toe” into rich gas production. So, there is more value-added products produced from the acquisition. The other good news is the properties proposed to be acquired have not been drilled on for some years. Therefore, the rapid decline that often occurs with newly producing wells is not an issue here. This is older production that will decline far more slowly.

Management has plans to get the debt levels back to 1 or below by sometime in 2025. There is some risk that 2024 would not turn out to be as helpful for deleveraging as management has planned. That would mean more financial risk of higher debt levels for a longer period than originally planned. Any company that expands the leverage ratio generally needs to deleverage as fast as possible in this industry. Oil and gas prices are so volatile, that a long-term strategy of high leverage does not appear to work too well.

Antero Resources

In conjunction with Peyto management going “all in” by leveraging the company, there appears to be considerable confirmation from elsewhere in the industry.

The management of Antero Resources (AR) has monetized the hedge position even though it cost more than $200 million. This is a management that has made billions of dollars long-term by opportunistic hedging. Their success makes this a reliable indicator that they want exposure to what they believe will be increasing natural gas prices in fiscal year 2024.

This management has long noted that the Haynesville is the “swing producer” for natural gas, as that is a dry gas basin. The declining activity that management has demonstrated in several presentations will eventually lead to lower natural gas production.

Management has noted that dry gas producers elsewhere have also responded to lower natural gas prices that were evident this year by idling rigs.

All of this lends considerable credence to the strategy selected by Peyto. Industry experience is something that is nearly impossible to teach and can be very valuable when it comes to making money. Peyto management has been at this a very long time and evidently are not afraid to use that experience to the advantage of shareholders.

Upside Potential

Peyto management negotiated this acquisition during a period of relatively weak prices. As I demonstrated briefly above, there is a fairly common belief that prices will increase. But the evaluation of reserves may well not reflect the expected pricing strengthening in the future because most of these evaluations use some form of future strip pricing. That can vary widely from what actually happens, and in this case is likely on the cheap side.

Clearly, management got involved for a big gain. A typical result would be a triple over a five-to-seven-year period as a result of something like this, which sharply departs from the company’s past.

Some things that appear to be certain is that management purchased the acquisition for the reserve value at a 5% discount. Therefore, additional drilling sites came for free.

In the United States, I follow many managements that paid up to $60K an acre for drilling sites. That sometimes added as much as US$3 million to the cost of any well drilled on such an acquisition. Peyto management has a huge cost advantage over a lot of United States companies by getting the additional drilling sites for free.

In addition, there is considerable midstream capacity with the acquisition. This is typical for Canadian producers. The important part here is all the excess capacity is likewise for free and saves considerable future midstream capital costs.

Main ideas

Management is betting that they acquired these lands at a good price. The reserve report would appear to back up that assertion. Now, not all the reserve report assumptions are in the press release. However, negotiations have taken place during a time of weak natural gas prices, which should give Peyto an advantage as the buyer.

The acreage appears to have a lot of upside potential before all the operational advantages of a “bolt-on” acquisition are considered. However, this is a relatively large acquisition for a company the size of Peyto. Generally, smaller acquisitions have a far higher chance of success. The chances are failure are minimized by the “bolt-on” nature of the acquisition and management’s familiarity with the basin acreage.

Furthermore, the expectations of better natural gas prices in fiscal year 2024 appear to be backed up by the actions of dry gas producers. Many of them are reducing drilling rigs in action. Several companies I cover are following this action. Therefore, lower production seems certain to lead to higher natural gas prices.

Probably the long-term idea here is that by fiscal year 2025, North American export capacity will increase materially. That eventually should lead to the North American market joining the much stronger world natural gas market. That would make this quite a bargain deal in the long term.

Peyto management appears to have taken a well-judged risk during a time of weak commodity prices. For those investors that can handle this type of risk, there may be an appreciation of the stock price that far exceeds the downside risk.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply