Petróleo Brasileiro S.A. – Petrobras (NYSE:PBR) demonstrated significant growth and efficiency in its operations as per the production and sales report for Q3 2023, with a notable increase in output. This success was primarily driven by improved operations in pre-salt platforms and reduced maintenance-related interruptions. The company is scheduled to disclose its financial results for Q3 2023 on November 9, 2023, projecting a revenue increase relative to Q2 2023. This article offers an in-depth analysis of Petrobras, focusing on the fundamental perspective and a technical examination of the stock price to determine future trends and potential investment opportunities. The analysis concludes that the long-term forecast for Petrobras is decidedly optimistic. Any dips in the stock price should be considered a significant buying opportunity.

Petrobras Significant Growth and Efficiency

Petrobras significantly increased its output, marking a notable period of growth and efficiency in Q3 2023. The company’s total average production, encompassing oil, NGL, and natural gas, climbed to 2.88 MMboed — a 9.1% rise from Q2 2023. This increase was primarily driven by improved operations in the pre-salt platforms, alongside reductions in maintenance-related interruptions. The enhanced performance can also be attributed to the starting of various platforms, such as P-71 in Itapu, FPSO Almirante Barroso in Búzios, and FPSO Anna Nery in Marlim. Additional boosts came from the launch of FPSO Anita Garibaldi in the Marlim and Voador fields and the introduction of new wells in both Campos and Santos Basins. The quarter saw a record-breaking pre-salt production, achieving 2.25 MMboed, 78% of the total output. Overall, Petrobras reached an unprecedented total operated production of 3.98 MMboed, reflecting an increase of 7.8% from the previous quarter. The introduction of FPSO Sepetiba in the Mero field, equipped with innovative technologies for improving efficiency and reducing carbon emissions, underscores Petrobras’s commitment to environmentally responsible energy production.

Regarding refining and sales, Q3 2023 was a significant achievement for Petrobras. The company’s refining facilities operated at a peak efficiency of 96% — the highest rate since 2014, ensuring a reliable supply of oil products totaling 1,829 Mbpd. Within this production, diesel, gasoline, and jet fuel represented 69% of the output, reflecting the company’s strategic focus on key energy products. The quarter marked a milestone with record-breaking sales of S-10 diesel, accounting for 62% of total diesel sales, indicating a shift towards more sustainable fuel varieties. Petrobras’s commitment to the environment and efficiency was further evident in achieving the lowest-ever refinery energy and greenhouse gas emissions intensities. This achievement aligns with initiatives like the RefTOP Program, aimed at enhancing operational efficiency and environmental compliance. Additional environmental efforts included the implementation of the electrostatic precipitator at REFAP, reducing emissions significantly. The company also celebrated a historic achievement in pre-salt gas processing at the Caraguatatuba and Cabiúnas facilities, setting a new record and demonstrating Petrobras’s focus on maximizing resource use while maintaining environmental safeguards.

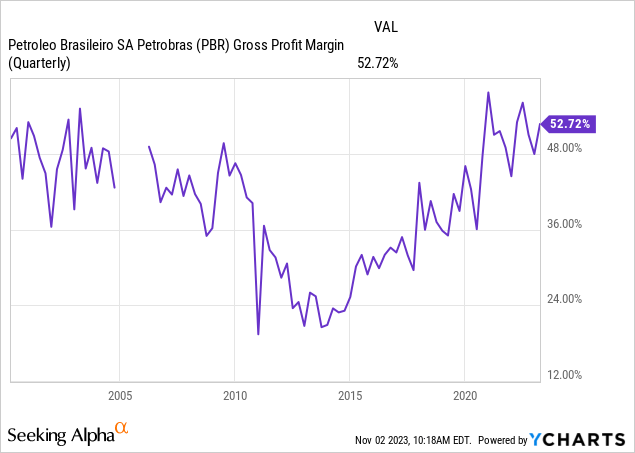

Moreover, Petrobras faced a mixed financial scenario per the Q2 2023 earnings report. The company’s recurring EBITDA showed a significant downturn, reaching $11.7 billion, marking a 19% drop from Q1 2023. This decline was primarily influenced by a steep decrease of over 40% in international diesel crack spreads quarter-over-quarter. Despite these market pressures, Petrobras maintained its cash flow strength, with an Operating Cash Flow of $9.6 billion. The company’s gross debt remained stable at $58 billion, even with an uptick due to the new leases from the recent introduction of the FPSOs Anna Nery and Almirante Barroso. Additionally, the gross profit margin presents an uptick to 52.72%.

Petrobras is expected to release its financial outcomes for Q3 2023 on November 9, 2023. The company forecasts its revenue to reach $25.77 billion, an increase from the $22.86 billion recorded in Q2 2023. However, the expected Normalized EPS is projected to decrease to $0.83.

A Deep Dive into the Dynamics of Bullish Price Structure

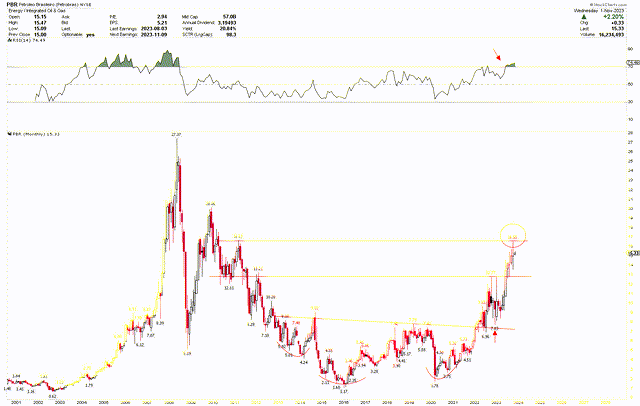

The monthly chart below indicates a bullish long-term perspective for Petrobras. It highlights a solid foundation built from 2014 to 2021, evident through the inverted head and shoulders pattern. The pattern features the head at the 2016 low of $1.17 and the shoulders at $4.24 and $1.78, respectively. The neckline of this formation is around $7, which was surpassed in 2022. Following the breakout, a pullback occurred to $7.83 in 2022, leading to a vigorous market rally that propelled the stock to a high of $16.55 in October 2023.

This strong rally was initiated in 2020 primarily due to a convergence of global and local factors. Globally, the gradual rebound from the COVID-19 pandemic led to a resurgence in demand for oil and gas. This resurgence was fueled by economies reopening and increased travel and industrial activity. As one of the leading oil producers in the world, Petrobras was well-positioned to benefit from this uptick in global demand. Additionally, the rising international oil prices, driven by constrained supply and geopolitical tensions in various parts of the world, significantly boosted Petrobras’s revenue and profit margins. High oil prices meant higher earnings per barrel for Petrobras, directly translating to increased investor confidence and a rise in stock prices.

Domestically, several initiatives and changes within Petrobras also played a crucial role in enhancing investor sentiment. The company’s management, during this period, focused on reducing debt and improving operational efficiency, which resonated positively with the market. Petrobras’s strategic shift towards more profitable core operations, primarily in deep-water and ultra-deep-water oil exploration and production, and divestment from non-core businesses helped in improving its financials and streamlining operations. Furthermore, there was a noticeable push from the Brazilian government for regulatory reforms and a more market-friendly approach in the energy sector, which encouraged foreign investment and market confidence.

The monthly chart indicates that the price reached $16.55 in October 2023, meeting significant resistance as depicted by the horizontal line. Additionally, RSI suggests an overbought condition, pointing towards a likely correction from these levels. Conversely, the appearance of an inverted head and shoulders pattern underscores a solid market bottom, suggesting that any subsequent correction from this resistance point should be considered a robust buying opportunity.

Petrobras Monthly Chart (stockcharts.com)

Identification of Key Levels

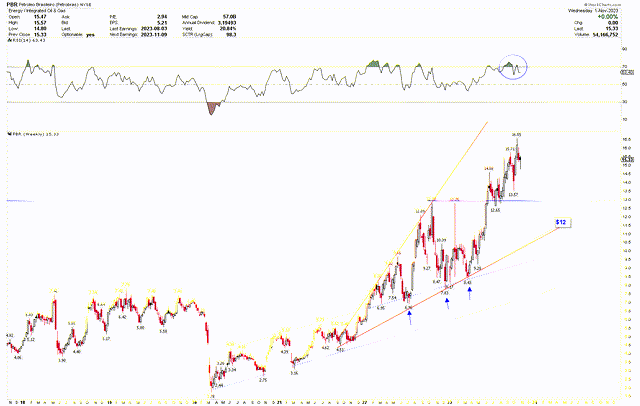

Additionally, the weekly chart clarifies the bullish situation with the blue-dotted long-term trendlines. These lines have repeatedly offered support to the price, as indicated by the blue arrows, signaling excellent opportunities for investors. Additionally, this positive trend is underscored by the ascending broadening wedge from a low of $4.51, which points out the heightened market volatility. However, similar to observations in the monthly chart, the weekly chart also shows that the price has entered an overbought territory.

The combination of high volatility and overbought conditions suggests that a market correction may be imminent. Such a correction will likely find robust support in the $10 to $12 range, presenting an attractive entry point for long-term investors. Investors might view this range as a potential buying opportunity in Petrobras, with room to increase their positions should prices continue to fall, in line with the solid bullish momentum in the monthly chart. However, a monthly closing below $6 would invalidate this optimistic scenario.

Petrobras Weekly Chart (stockcharts.com)

Market Risk

Petrobras’ achievements come amidst fluctuating global oil prices, technological and operational risks, and stringent environmental regulations. The company’s financial health, impacted by variations in EBITDA and increasing lease-related debts, combined with the overarching economic conditions and political stability in Brazil, further contribute to its market risk profile. This scenario is complicated by the inherent volatility of the energy sector and the potential impacts of global and local economic shifts on energy demand and pricing.

Technical indicators present a mixed outlook for Petrobras. Despite a bullish long-term perspective, current technical analysis suggests that Petrobras’ stock is overbought, indicating an imminent market correction. This overbought situation, as per the RSI, raises concerns about short-term stock price volatility. Moreover, the potential correction anticipated by the technical analysis suggests significant support in the $10 to $12 range. However, a descent below this could signify a more significant negative trend, requiring investors to remain cautious and monitor these levels closely.

Bottom Line

In conclusion, the company’s operational and financial performance paints a picture of a robust entity striving to adapt and grow amidst a challenging and dynamic global energy market. Petrobras has achieved significant milestones in production efficiency, particularly in its pre-salt operations, and has made commendable strides in refining and environmental initiatives. Its focus on sustainable fuel options and efficiency in operations highlights its commitment to evolving with the times and meeting global energy demands responsibly.

However, this period of operational success and strategic growth has been tempered by financial constraints. The decline in EBITDA, impacted by factors such as lower international diesel crack spreads and increased lease-related debts, presents a challenge that the company must navigate carefully. Moreover, the stock market analysis indicates that while Petrobras’s shares have shown a bullish trend, there’s a looming possibility of a market correction, as suggested by the overbought conditions on the technical charts. The company’s impending announcement of its financial results for Q3 2023 may trigger volatility in its stock price. Nonetheless, this market adjustment should be viewed as an attractive opportunity for long-term investors to enter. Investors may consider buying Petrobras in the $10 to $12 range.

Read the full article here

Leave a Reply