Approaching the close of 2023, the healthcare sector continues to be hammered with nearly countless tickers hitting fresh 52-week lows despite making significant progress over the course of the year. As some investors decide to stay on the sidelines, I am making an effort to make some of the small-cap tickers a focal point of my market research in order to find opportunities in specialized niches that offer great risk-reward prospects. Among the plethora of potential healthcare tickers, PepGen (NASDAQ:PEPG) stands out as a trailblazer in developing therapies for genetic disorders. Specifically, their groundbreaking work in Duchenne muscular dystrophy (DMD) and their innovative Enhanced Delivery Oligonucleotide platform have garnered significant attention. Unlike the approved gene therapies for DMD, PepGen is taking a different approach that could create profound potential for long-term value creation, and the intricate science that underpins their promising advancements.

Unfortunately, the FDA put a clinical hold on PepGen’s PGN-EDODM1 for Myotonic Dystrophy Type 1 (MD1), which delayed their estimated start date for their clinical trial, and devastated the share price. At that time PEPG was trading around $16 per share but has since fallen to under $5 per share despite the company still moving their pipeline forward and the ticker trading with a negative enterprise value. I believe PEPG is offering a great risk-reward for speculative investors looking to take advantage of oversold healthcare tickers that still have immense upside.

I intend to provide a brief background on PepGen and their technology. In addition, I will discuss the company’s recent performance and updates. Furthermore, I will point out a few downside risks that investors need to consider when managing a PEPG position. Finally, I go over why I think PEPG is a prime candidate for the Compounding Healthcare “Bio Boom” portfolio.

PepGen’s EDO Platform

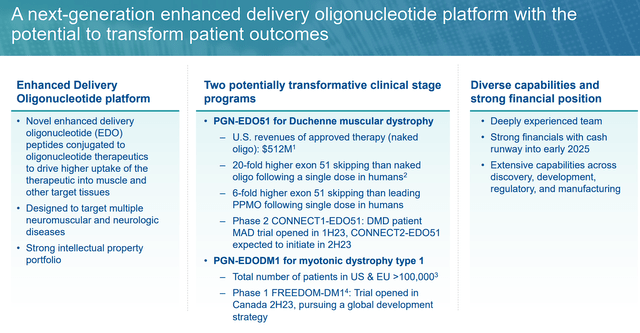

At the heart of PepGen’s remarkable journey lies the Enhanced Delivery Oligonucleotide (EDO) platform, a technological marvel designed to revolutionize the delivery of therapeutic agents in tissues affected by neuromuscular and neurologic diseases. This platform marries specialized peptides with oligonucleotide therapeutics, presenting an avenue to vastly enhance their uptake and efficacy. PepGen’s formidable intellectual property portfolio bolsters the transformative potential of their EDO technology, offering a glimpse into the future of genetic disorder treatments.

PepGen’s EDO platform has showcased a remarkable 25-fold increase in oligonucleotide delivery to myotube nuclei in vitro when compared to conventional “naked” oligonucleotides. This advancement holds significant promise for the treatment of neuromuscular diseases, where precise delivery of therapeutic agents is critical.

PepGen Overview (PepGen)

In vivo studies on non-human primates further demonstrated the EDO technology’s efficacy. Following two doses at 30mg/kg, an impressive 72% of skeletal muscle nuclei exhibited positive oligonucleotide presence. This achievement is poised to reshape the landscape of oligonucleotide therapies.

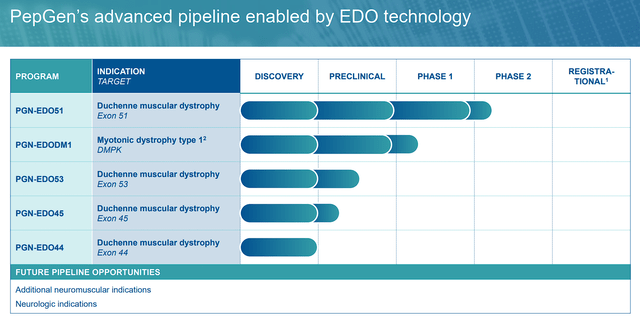

PepGen’s Pipeline

Within PepGen’s expansive repertoire, two clinical-stage programs shine as beacons of hope: PGN-EDO51 for DMD and PGN-EDODM1 for DM1. While both programs hold immense promise, our focus will primarily be on PGN-EDO51, given its exceptional progress and potential to redefine the treatment landscape for DMD.

PepGen Pipeline (PepGen)

PGN-EDO51

Duchenne muscular dystrophy, a rare genetic disorder, is characterized by progressive muscle weakness and wasting due to the deficiency of dystrophin, a pivotal protein in muscle health. PGN-EDO51 represents a beacon of hope in the quest to combat this devastating condition. By targeting the genetic cause of DMD through the skipping of exon 51 in the dystrophin gene, this investigational compound holds the potential to unlock the production of a functional, truncated dystrophin protein.

The transition from animal models to human subjects is a critical phase in drug development. PepGen’s EDO platform demonstrated its effectiveness by achieving substantial muscle concentrations of PGN-EDO51 at 5 mg/kg and 10 mg/kg in healthy volunteers. At 28 days post-dosing, concentrations of 3.8 nM and 11 nM were observed, respectively. Importantly, treatment-emergent adverse events were mild, transient, and reversible, underscoring the platform’s safety profile.

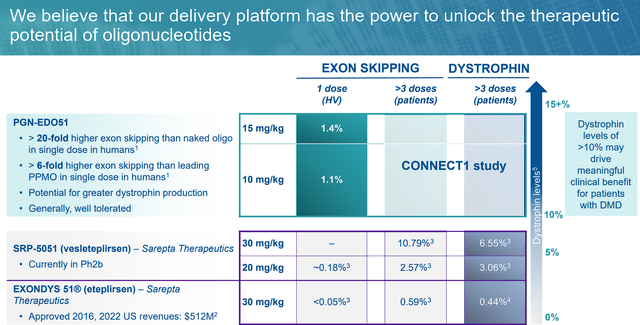

The breakthrough lies in the significant exon-skipping levels observed in clinical trials. After a single dose, PGN-EDO51 demonstrated a greater 20x higher exon-51 skipping than “naked” oligopeptides in a single dose in humans, which is 6x higher than Sarepta Therapeutics (SRPT) gene therapies that address exon-51.

PepGen PGN-EDO51 vs. Sarepta Therapeutics Products (PepGen)

This points to great dystrophin production with the potential of improved clinical benefits for the patients. What is more, the therapy was generally well-tolerated.

If approved, PGN-EDO51 could mark a paradigm shift in how we treat DMD.

PGN-EDODM1

The PGN-EDODM1 program, a cornerstone of PepGen’s research, exhibited extraordinary promise in preclinical trials. In a murine model of DM1, a single dose of 30 mg/kg of PGN-EDODM1 reversed an astounding 76% of myotonia and corrected 68% of mis-splicing. These results are an encouraging sign of the potential therapeutic impact on DM1 patients.

Additionally, the lasting presence of PGN-EDODM1 in muscle tissue 28 days post-administration highlights the persistence of the treatment effect. This is favorable for the development of extended treatment regimens.

The Market Opportunity

Beyond scientific advancements, the market potential for DMD treatments is compelling. Projections indicate the global DMD treatment market will experience robust growth with a CAGR of 11% for the remainder of the decade and will hit nearly $2B by 2030.

Although we are seeing DMD gene therapies being approved and having some commercial success, we still need to see some of these therapies report the results of their confirmatory trials. So, it is possible that the DMD therapeutics market is still largely unclaimed outside steroids. So, we can still see that there is an unmet medical need in DMD treatment underscoring the importance of innovative solutions like PGN-EDO51.

As for DM1, the global DM market is expected to grow at a CAGR of roughly 12% and hit $2.8B by 2033.

If approved, PepGen would be still considered one of the early movers in these spaces and would have the potential to reap significant rewards.

How Much?

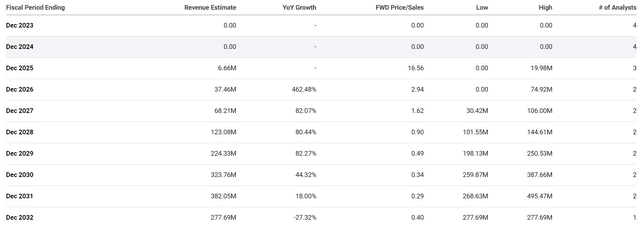

Some Street analysts believe PepGen is only a few years from potentially getting a product on the market and starting to record significant revenue growth through the end of the decade.

PEPG Annual Revenue Estimates (Seeking Alpha)

The Street believes that PepGen could hit ~$324M in 2030, which would be a forward price-to-sales of 0.34x. Considering the industry’s average price-to-sales is about 4x, we can say PEPG is trading at a discount for their revenue estimates. At those levels, PEPG would be valued at around $1.3B or roughly $54 per share. Yes, these are just estimates, and the company will most likely have to use dilutive financing at least once between now and 2030. So, those estimates and targets will change dramatically. However, these numbers do provide investors with some perspective about the company’s potential growth and valuation if all goes well.

Clinical Progress

PepGen is making progress in their clinical trials as their Phase II open-label CONNECT1-EDO51 study is underway in Canada, targeting improved treatments for neuromuscular conditions. The company anticipates initial data on dystrophin production, exon skipping, and safety from this study in mid-2024, marking a potential breakthrough in the field.

PepGen is also anticipating their upcoming Phase II CONNECT2-EDO51 multinational study, expected to commence in the near term. This randomized, double-blind, placebo-controlled trial will be a major milestone for the company and aims to further validate the efficacy of PepGen’s therapies and potentially pave the way for accelerated regulatory approval.

Furthermore, PepGen is actively pursuing a “global” strategy, focusing on initiating the FREEDOM-EDODM1 clinical study, which will be performed outside the United States. This strategic move demonstrates the company’s commitment to broadening access to their groundbreaking therapies on a global scale. This will be key to establishing a global presence, while also helping validate that their technology can be operative in other populations.

Clinical Hold

The FDA’s clinical hold on PGN-EDODM1 for DM1 is a setback. The withdrawal of Phase I trial initiation guidance adds to the complexity. In the world of clinical-stage biotech, stock value is largely driven by significant events like trial updates and market transitions. Any alteration in the outcome of these events significantly influences the investment landscape. Consequently, this clinical hold had a huge impact on PEPG’s share price.

Fortunately, PepGen mentioned that they are working with the FDA to address concerns regarding their IND for PGN-EDODM1. It is critical that they work with the FDA for a swift resolution of these matters in order to expedite the clinical trial process in the United States. Although it is great that the company is making progress in other countries, however, the U.S. is typically the larger opportunity and is often the make or break for a product’s commercial success. In fact, 90% of DMD therapeutics sales were in the U.S. in 2020.

Financial Overview

As with all clinical-stage companies, PepGen is burning through cash in order to keep their pipeline moving and maintain operations. R&D expenses for Q2 2023 amounted to $16.9M, while their G&A expenses came in at $4.2M for the quarter. As a result, PepGen reported a net loss for Q2 of $19.5M, reflective of the company’s resolution to advance cutting-edge therapies.

Thankfully, the company is well funded at the moment to absorb the losses. At the end of the first half, PepGen boasted a robust financial position with $147M in cash and cash equivalents. PepGen believes this cash position could sustain the company’s operations well into early 2025, providing a solid foundation for continued R&D efforts.

Navigating Risks

While the promise of the company’s platform technology is undeniable, it is crucial for investors to understand and manage the inherent risks associated with biotechnology investments.

First and foremost is regulatory risks that can derail a biotechnology company for years. PepGen is subject to the regulations of the FDA and other government agencies. Clearly, PepGen is already dealing with the FDA regarding their IND for PGN-EDODM1. Any additional setbacks in clinical trial updates pose a significant downside risk for the ticker.

Another major concern for PepGen is competition, which includes larger, more established players. Sarepta Therapeutics is probably considered the leader in DMD and other gene therapies. So, PepGen is going to need a solid commercial strategy if they are going to claim a foothold.

Last but not least, the lingering risk of small-cap volatility can generate anguish among investors. PepGen is categorized as a small-cap equity, making it susceptible to high volatility. Small catalysts can lead to significant fluctuations in share prices, which can be great for positive updates… but negative news can crater the share price for a prolonged period of time.

Considering these risks, I gave PEPG a conviction level of 2 out of 5 and it will be a watch list ticker for the Compounding Healthcare “Bio Boom” speculative portfolio.

Bio Boom Prospect

PepGen’s pioneering work in genetic disorders, fueled by their EDO platform, holds immense promise in muscle and other affected areas in neuromuscular and neurologic diseases. The EDO platform addresses the challenge of efficiently delivering oligonucleotide therapeutics, resulting in significantly higher levels of nuclear delivery compared to unconjugated oligonucleotides.

PepGen has two promising clinical-stage programs: PGN-EDO51 for DMD and PGN-EDODM1 for myotonic dystrophy type 1. PGN-EDO51 has shown remarkable results, including a 20-fold increase in exon 51 skipping compared to the standard therapy after a single dose. PGN-EDODM1 targets a substantial patient population and a Phase I trial has been initiated.

The company boasts a proficient team, solid financial standing with funds available until early 2025, and extensive capabilities across the development process. What is more, the company holds a strong intellectual property portfolio.

Considering these points, I see PEPG to be a prime “Bio Boom” candidate. Not only does the ticker provide a great risk-reward, but they are well-funded to allow the company to hit some upcoming catalysts to provide some trading opportunities.

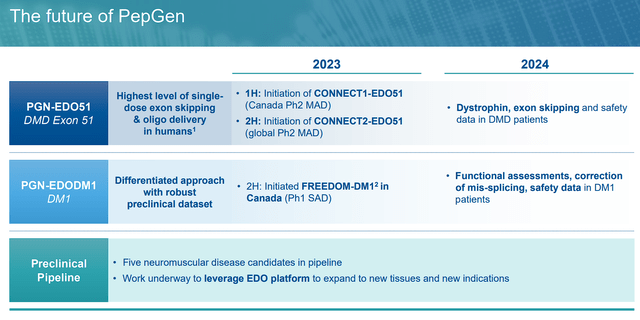

PepGen Upcoming Milestones (PepGen)

Thankfully, both PGN-EDO51 and PGN-EDODM1 are expected to report data in 2024, which could indicate if these programs are still capable of being approved and outperforming contemporary treatments. In addition, the company might announce some additional pipeline candidates derived from their EDO platform to add additional catalysts.

These catalysts might be great trading opportunities for PEPG because the share price has not been immune to the small-cap and healthcare sell-off over the course of 2023. In addition, the ticker is still dealing with the consequences of the FDA’s clinical hold. So, any positive pipeline update might entice apprehensive bulls to stop the bleeding and potentially reverse course.

How Big Of Trading Opportunity?

Well, I would point to the company’s discounted valuation and the ticker’s technical oversold condition. At the moment, PepGen has a $147M cash position with only $21.36 in debt and a ~$110M market cap, so the ticker currently has a -$15.18 enterprise value. In addition, the company has roughly two years of cash runway remaining, which could allow them to progress their pipeline enough to justify a richer valuation. Considering the company has already reported superior data to their FDA-approved competition in DMD, I would anticipate assenting data might be a strong enough catalyst to bring PEPG back to its former trading range before the FDA clinical hold, which was roughly $16 per share.

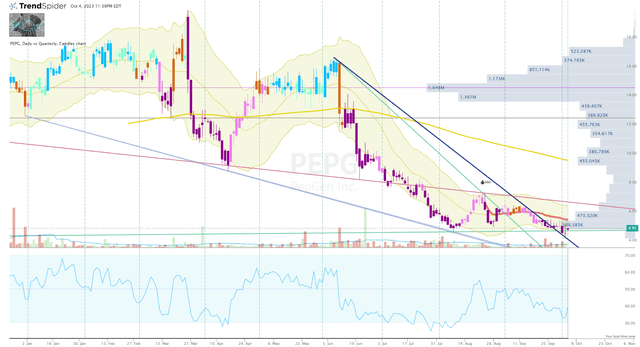

PEPG Daily Chart (Trendspider)

PEPG is currently trading under $5 per share and is fighting to construct a reversal out of its oversold state. The ticker has not posted a bullish signal on the Go-No-Go indicator since June of this year, so the share price has deteriorated quickly under relatively low trading volume. So, a positive update could prompt a bullish reversal and inject some momentum to fuel the share price up to the volume shelf at just under $16 per share.

Certainly, I am not claiming that this is going to happen, however, the setup is there and risk-reward favors the bulls here.

Read the full article here

Leave a Reply