Buster Went Long Despite Our Warning And Is Revaluating Being An Income Investor

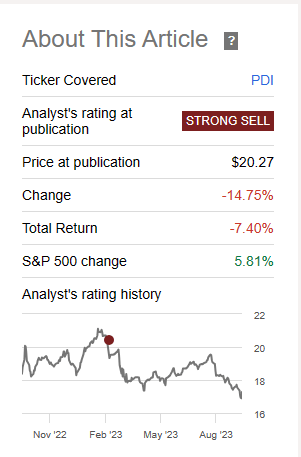

On our last coverage of PIMCO Dynamic Income Fund (NYSE:PDI), we gave you 4 reasons that this fund was a really bad setup. In fact, we called it an Abysmal Setup. Perhaps that was a little hyperbole, but it was hard for us to see it any other way. You rarely get fundamentals and pricing line up so poorly and that was the case for PDI. Those that took the high road out and unloaded to income investors indifferent to returns or pricing, are laughing all the way to the bank.

Seeking Alpha

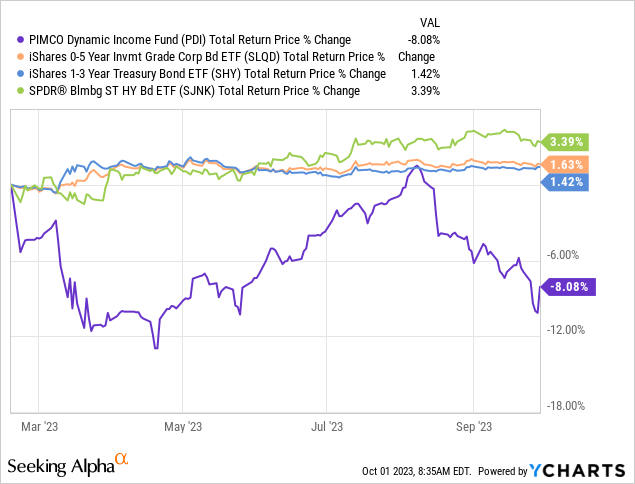

PDI’s total return of negative 7.4% lagged the broader S&P 500 (SPY) by 13.21%. Perhaps SPY is not the best comparative here but even running it against iShares 0-5 year Investment Grade Corporate Bond ETF (SLQD), iShares 1-3 Year Treasury Bond ETF (SHY) and SPDR® Bloomberg Short Term High Yield Bond ETF (SJNK), shows just how poorly PDI has done.

SJNK is the most relevant out of the three and bears out our thesis that you can (but never must) overpay for the PIMCO suite. PDI underperformed SJNK by 11.41%.

What Happened?

While we warned about a bunch of macro headwinds that could throttle back this fund, none of them played out in our timeframe. Sure, we did have some recessionary talk escalate and GDI actually has come in negative for a few quarters, unlike GDP. But junk bond spreads remain remarkable well contained. You don’t even have to pull any information up for that, just look at SJNK’s total return above and you get what is happening.

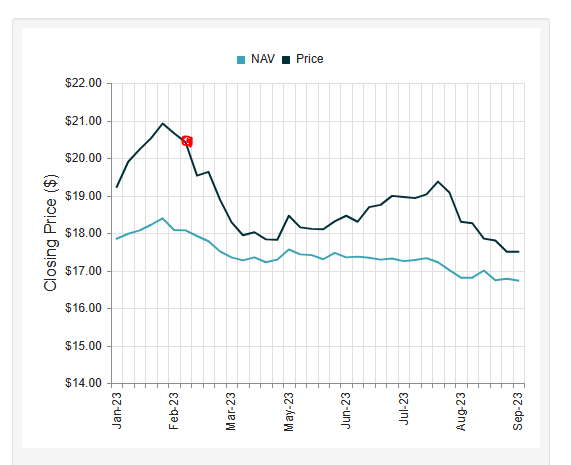

But such is the magic of rejecting extremely poor setups like PDI in February 2023. When everything is lined up against a fund, then every last thing must go right for the fund to actually deliver. Here the macro forces stood aside but pricing knocked it right to the ground. The fund stood at a 13.01% premium to NAV at the time of the last article.

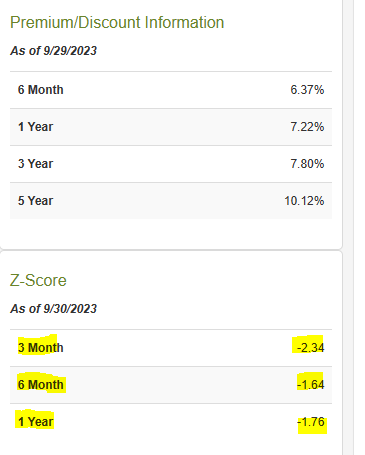

CEF Connect

Our commentary from back then is relevant for assessing where we are today.

PDI trades at a 13% premium to NAV. That is a stunning number when you consider that it results in a Z-score of 1.93.

Such a high Z-score is screaming out that your forward returns are likely to be very poor even ignoring other factors.

…when this is over, we expect some strong negative Z-scores to appear.

Source: Abysmal Setups

That turned out to be an insurmountable force as the price finally went closer to NAV.

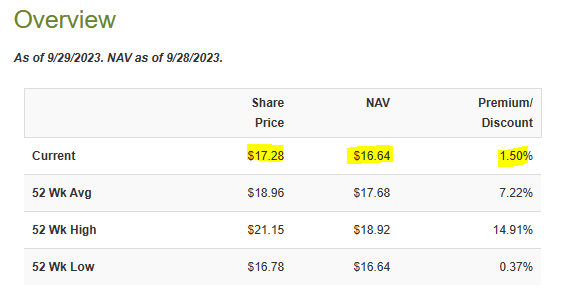

CEF Connect

So the bulk of the headwind came from the repricing to a normal level. But now we have got those deeply negative Z-scores we warned about.

CEF Connect

Do we buy?

Outlook

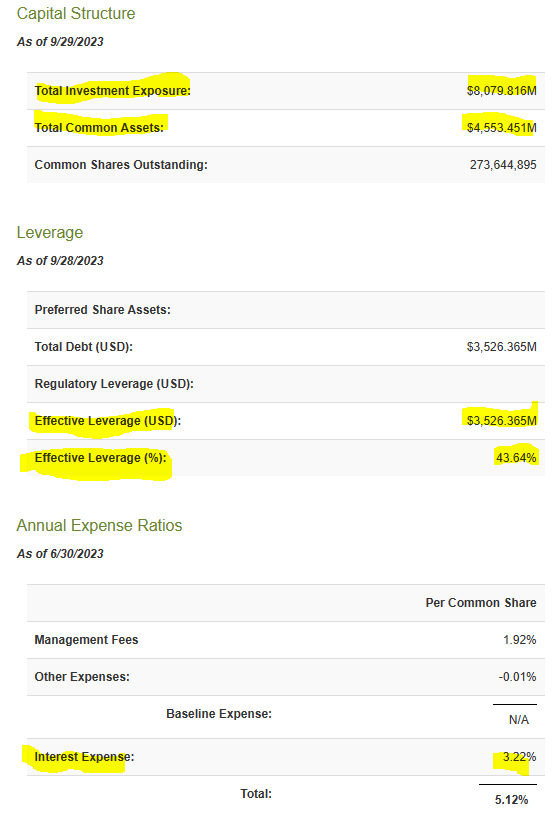

What bothers us even after this drop is just how the fund is setup. With $8.079 billion of assets, the fund is still using $3.526 billion of leverage.

CEF Connect

This is calculated as 43.64% as CEF Connect and every other site just divides the $3.526 billion by total assets of $8.079 billion. More accurately from our point of view, this is close to a 1.77X leveraged fund where total assets are 77% higher than total common assets. We just don’t think this is the kind of investment exposure one should take when interest rates are rising so rapidly. The tails are fat and skewed to the downside. You can break things really badly and these funds have an upper limit of investment exposure. So they have to sell on the way down. The picture above also shows that that total expense ratio is now running at over 5%. That is unfortunately bad and what is even more unfortunate is that that number is lagging and in no way shows the expense ratio today. Remember that is an annual number and the weighted average interest rate between July 2022 and June 2023 was far lower than what it is today. So we would use a modicum of caution and keep in mind that all those macro headwinds we mentioned in our last article are still likely to be in play at some point.

Verdict

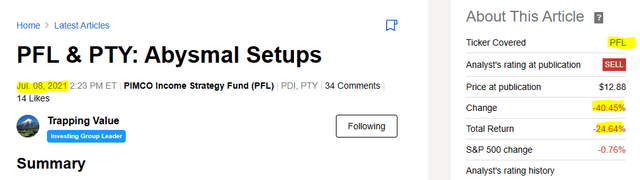

It is easy to get seduced by returns during the ZIRP (zero interest rate policy) era. Whether it is for REITs, or Closed End Funds that went out on a limb with leverage, the returns were so good. But as we have been warning for some time, the future will look radically different. Just look at the return profile for PIMCO Income Strategy Fund (PFL) from the 22% premium to NAV setup.

Seeking Alpha

You could have kept your money in Treasury bills for two years, funded the corresponding distribution of PFL, paid far less tax, and come back and bought it today. You would be far better off. Of course some of the riskier funds we warn about, don’t land up blowing up in such an epic manner. But the math there is that if we warn about 5 and even 1 turns out to be such a poor performer, then it would make sense to avoid all 5. The rest never produce enough alpha to justify going for such funds. You can see this even the current example. PDI lagged SJNK by 11.41%. So you if you had 4 other CEFs, they would each have to outperform SJNK by 3% to just make up the shortfall. In reality, the majority of our warnings (though never all) pan out. So collectively, our risk management improves returns drastically.

Getting back to PDI, the leverage looks incredibly risky for us and we would need some serious discounts to NAV to even start thinking about this on the long side. There are closed end funds that have outperformed PDI and use almost no leverage. Those are the ones we gravitate towards for some limited capital allocation. But we are upgrading this to a “Hold” from a “Strong Sell”. The caveat is that you could not pay us to “Hold” this in our account. We are just acknowledging the fact that the Z-score tells us that we need to declare a victory for a while and dial back the immediate pessimism.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here

Leave a Reply