“Energy is an eternal delight, and he who desires, but acts not, breeds pestilence.” – William Blake.

Whether you believe in green energy or not, the reality is that there is a ton of money going into the space from multiple governments worldwide. We can debate the merits from here until tomorrow and narratives, but the game of investing is about tracking flows and making money over time. To that end, let’s talk about the Invesco WilderHill Clean Energy ETF (NYSEARCA:PBW).

PBW, established on March 3, 2005, is an exchange-traded fund (“ETF”) that primarily invests in U.S public companies that are heavily involved in the advancement of cleaner energy and conservation. It tracks the WilderHill Clean Energy Index, comprising stocks that promote the development of renewable energy technologies and services.

The ETF’s investment strategy is to invest at least 90% of its total assets in the common stocks that make up the index. The fund and the index are rebalanced and reconstituted quarterly, providing a dynamic investment proposition that continually adapts to changes in the market.

Valuation and Momentum

PBW has in total 76 holdings, and its management fee is pegged at 0.50% with a total expense ratio of 0.62%. The fund’s price-to-book ratio (P/B) is 2.20, while its price-to-earnings ratio (P/E) is 14.41. This is not an expensive area of the marketplace, and has only gotten cheaper.

Cheap, of course, can get cheaper as negative momentum asserts. When we look at the chart of PBW, it’s clear there’s a major downtrend in place, and the Oil surge has done nothing to help it. I think given the current macro backdrop this becomes really challenging to allocate here. Yes it might make sense for some small allocations, but I maintain my view that we are in a very high-risk juncture overall for risk assets.

tradingview.com

ETF Holdings and Components

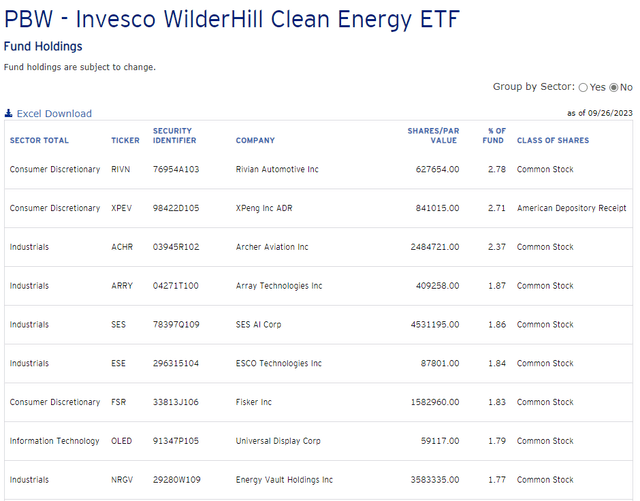

The ETF’s portfolio comprises stocks of companies actively engaged in advancing cleaner energy and conservation. The holdings are fairly well spread out, with only 3 stocks making up more than 2% of the fund. This makes it a good diversified proxy of the alternative energy space.

invesco.com

Sector and Geographic Allocation

The ETF’s assets are spread across various sectors and geographies, providing a diverse investment portfolio. As of June 30, 2023, the sector allocation was as follows:

- Industrials (46.80%)

- Consumer Discretionary (17.29%)

- Information Technology (16.42%)

- Materials (11.52%)

- Utilities (6.90%)

- Energy (1.08%).

The fund’s geographic allocation is heavily skewed towards the United States, accounting for 72.21% of the total assets. Other significant allocations include Canada (8.09%), China (6.96%), and Norway (1.78%).

Risks Involved in Investing in PBW

Investing in PBW, like any other investment, comes with its fair share of risks. The fund’s performance may not match that of the underlying index due to factors such as management fees and operating expenses. Moreover, market volatility can significantly impact the fund’s performance.

The fund’s focus on the clean energy sector exposes it to specific risks associated with that industry. Stocks of small and mid-sized companies, which form a significant part of the fund’s portfolio, often face heightened risks and can be more volatile compared to large-cap stocks.

Investors should also be aware of the potential risks associated with the fund’s reliance on the index provider to identify the securities that provide exposure to the clean energy sector. If the index provider fails to accurately identify these securities, the fund’s performance could suffer.

Current Market Scenario: A Strong Avoid?

Given the current market conditions and the fund’s recent underperformance, is PBW a strong avoid for investors? The answer might be “yes” for the short term. The ETF has been on a downward trend, sparked by the broader market volatility and the rising interest rates environment. This has resulted in a high-risk juncture for all stocks, including those in the clean energy sector.

Moreover, the momentum looks unfavorable for the Invesco WilderHill Clean Energy ETF. However, for long-term investors, the outlook may be different. The shift towards renewable energy is a trend that is here to stay, and companies in this sector are likely to see significant growth over the long term. Therefore, while the current market scenario may not be favorable, the long-term potential of PBW cannot be disregarded.

Personally I’d hold off on this one now, but keep it on the watch list for lower levels.

Read the full article here

Leave a Reply