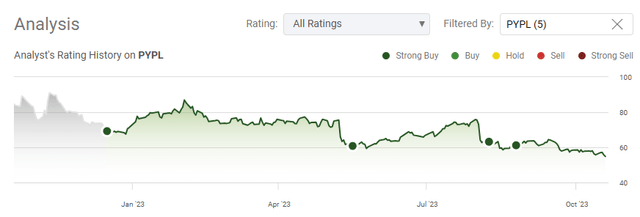

I have been absolutely incorrect, as PayPal (NASDAQ:PYPL) shares have fallen through their short-term resistance level. I have been following PYPL closely and still feel it’s one of the most mispriced equities in the market today. Since my previous article on PYPL, which was published on 8/25/23, shares have declined by 12.46% compared to the S&P 500, which declined by 3.76%. Since starting my position this summer, I have added shares six additional times, purchasing shares as high as $62.78 and as low as $57.82. My current price per share is $60.92, as I am down -12.36% on my overall investment into PYPL. Seeking Alpha is running a contest where contributors discuss their best value ideas, and I selected Citigroup (C) (can be read here) over PYPL for two specific reasons. PYPL had broken through its short-term resistance, and there is no telling how low shares will go prior to entering a bottoming process and establishing new support levels because I am not getting paid to wait. Now that PYPL has declined -14.29% in the past month and -4.77% this week, I am gearing up to make another purchase before earnings on 11/1/23. My goal is to knock -4.02% off of my price per share and go into earnings with a cost basis of $58.47. While Citigroup was my top value idea, I consider PYPL my 2nd best value idea and plan to discuss why the declining share price doesn’t worry me.

Seeking Alpha

Following up on my previous article

In my previous article about PYPL (can be read here), I discussed the bear case, why I invested in PYPL, how PYPL utilizes its capital, and how PYPL was valued compared to other companies. A lot has changed since August as inflation is ticking higher, the Fed is signaling for a higher for longer rate environment, the bear case has evolved a bit, and PYPL has fallen right through critical support levels. I wanted to follow up with an update before earnings and discuss how the bear case has intensified due to a changing macroeconomic environment, why I am allocating more capital toward PYPL as it sinks, and why I consider PYPL my 2nd best value idea.

The bear case for PayPal is evolving as the macroeconomic environment has changed

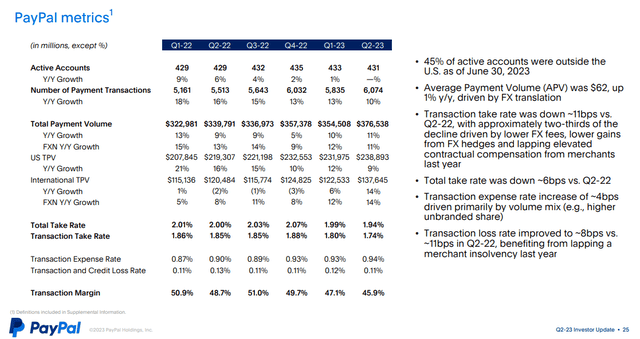

While PYPL has strong underlying fundamentals. one of the largest impacts of the declining share price has been its transactional data. While revenue growth has slowed and competition expanded internally, PYPL has faced declining transaction take rates and transaction margins. For those unfamiliar with these terms, the take rate is the fee a processor or merchant charges for online transactions. For example, if someone purchases a product for $100, they won’t see the take rate, but on the backend, the seller of the product will have to pay a take rate for the fees paid to PYPL, or any other company processing the transaction. If the seller ends up with $97 after processing fees, they pay a 3% take rate to the backend entities to facilitate the transfer of capital from the buyer to the seller. Part of the bull case was that PYPL and PYPL, through Venmo, would grow its ability to raise prices incrementally, which would increase revenue, but PYPL’s total take rate, transaction take rate, and transaction margin are all slowing. This correlates to less revenue generated per transaction, and if transactions start declining while margins are negatively impacted, we could see revenue go from slowing to decreasing.

PayPal

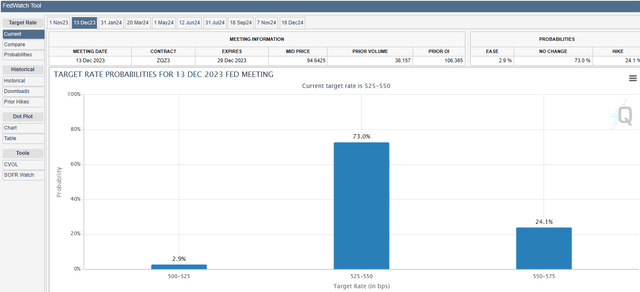

Over the past two months, the macroeconomic landscape has changed, adding additional pressure to PYPL’s take rate and transaction margin fears. In September, inflation remained steady at 3.7%, which went against market expectations of falling CPI. This caused Jerome Powell to take an overly hawkish stance, and the investment community finally realized that rate cuts in 2023 would not occur and that the Fed really does mean higher for longer. On 10/19, Jerome Powell delivered prepared remarks and doubled down on the Fed’s message, indicating that inflation was still too high and the door was open for an additional hike before 2023 ends. There are two more Fed meetings this year, with the next meeting coming on 11/1. The CME Group is projecting a 96.1% chance that rates will stay where they are at the November meeting, but their projection indicates that a 25 bps hike has a 24.1% chance of occurring at the December meeting. CME sees a 15.4% chance that rates will come down 25 bps from where they are now at the March 2024 meeting, and this increases to a 26% chance at the May meeting and a 42.7% chance at the June meeting. By the end of 2024, CME Group is forecasting that there is a 60.8% chance that rates will be somewhere between 400-500 bps, with the highest probabilities being a 32.4% chance of a 475-500 range and a 20.9% chance of a 450-475 range.

CME Group

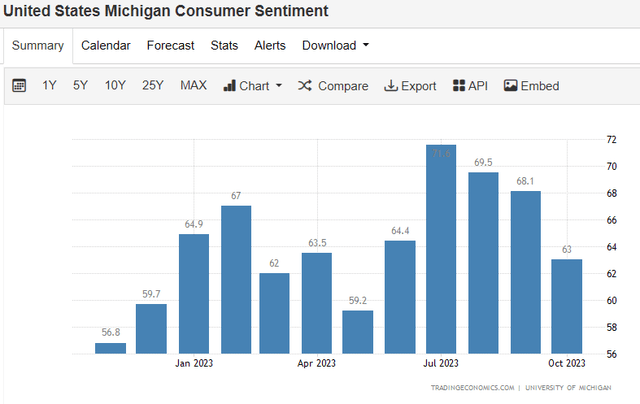

Higher for longer creates an economy that works against PYPL, especially with student loans coming back. The cost of capital is excessive for many, the mortgage market is frozen, and carrying costs on credit cards are increasing. Consumer confidence is declining as the University of Michigan consumer sentiment for the US fell to 63 in October 2023 from 68.1 in September, the lowest in five months, which missed the consensus estimates of 67.2. The combination of sticky inflation, rates at the highest point since the early 1980s, and student loans starting back up are putting additional strain on consumers, and it’s showing in the consumer confidence numbers. If this migrates over to actual consumer spending during the holiday season, PYPL could see additional pressure. The risks for PYPL have exceeded business metrics, and with the consumer at risk, there are economic factors outside of PYPL’s control that are intensifying the bear case. So far, the Fed has avoided a recession, but if they hike again and cause unemployment to increase and a recession occurs, I think that the risks to PYPL that I outlined will look mild as spending will become much tighter than it already is. Anyone investing in PYPL should pay attention to rates and the Fed’s message at the next two meetings, as PYPL should do better in a declining rate environment rather than rates staying higher for longer.

Trading Economics

Despite macroeconomic headwinds, I am still allocating capital toward PayPal as I see PayPal as my 2nd best value idea

You would need to go back to June 26th of, 2017 to see the last time shares of PYPL traded at these levels. Over six years later, PYPL is trading at the same valuation despite more than doubling its annualized revenue and more than doubling its profitability. The aspect that is worrisome is that we’re well below the pandemic lows, and short-term support has been obliterated. Back in May, shares of PYPL dipped below $60 and then ran to around $75. PYPL then declined to $58.60 in August and increased to around $65 in September, only to break the $60 level and never look back around September 21st. In the past week, shares have declined from $57.16 to $53.39 without the slightest increase, and there is no telling where the next support level is. While PYPL can continue much lower, I think it’s unlikely, and I am willing to buy shares at prices that I think are beyond discounted. PYPL is a technology company that is widely profitable, and it’s not even being treated as a consumer staple.

Seeking Alpha

Seeking Alpha

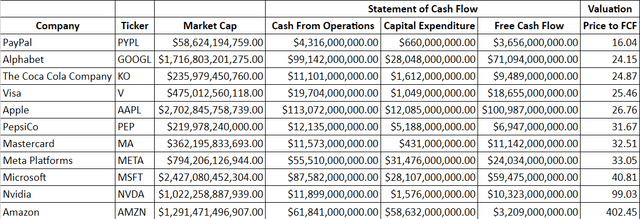

We’re headed into earnings season, and PYPL is trading at a deep discount to payment companies, tech companies, and consumer staples based on the amount of free cash flow (FCF) they generated on a trailing twelve-month (TTM) basis. Today, you can pay 16.04x for PYPL’s FCF, and PYPL was adamant that they would generate $5 billion of FCF in 2023, and if I lug $5 billion into this table, their price to FCF drops to 11.72x. At a minimum, I feel that PYPL should trade at 25x its FCF, especially when they have more growth on the horizon than several of these companies. If PYPL does produce $5 billion in FCF this year, that would put my fair value at a market cap of $125 billion, which means shares would need to increase by 113.22% to get there. If PYPL misses their internal guidance and maintains a $3.66 billion FCF level for 2023, I would still consider fair value a $91.4 billion market cap, which would mean that shares would need to increase by 55.91%.

Steven Fiorillo, Seeking Alpha

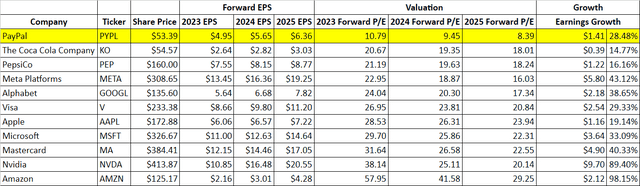

When I look at the earnings estimates for PYPL compared to the Magnificent Seven, other processing companies, and consumer staples, shares look cheap. PYPL is expected to generate $4.95 in EPS for 2023, placing their forward 2023 P/E at 10.79x. PYPL is expected to grow its EPS by 28.48% over the next 2-years and generate $6.36 of EPS in 2025. This places their 2025 forward EPS at 8.39x. No other company in this group trades at under 20x 2023 earnings or 18x 2025 earnings, yet PYPL is trading at roughly half of The Coca-Cola Company’s (KO) 2023 forward P/E and less than half of their forward 2025 P/E. These metrics validate my price to FCF methodology and support the bull case that there is alpha to be generated in an investment into PYPL.

Steven Fiorillo, Seeking Alpha

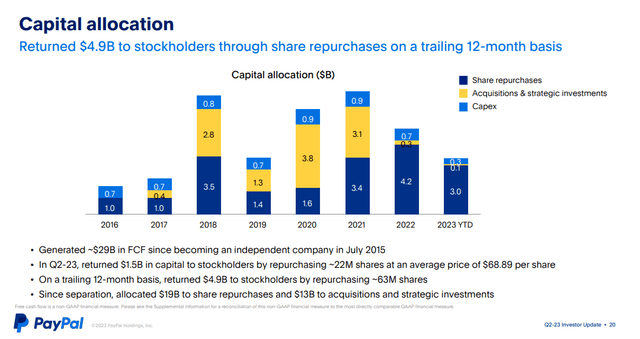

Since 2016, PYPL has continuously returned capital to shareholders in the most tax-efficient way, through buybacks. PYPL has generated $29 billion in FCF since becoming an independent company in July 2015 and utilized $13 billion for acquisitions and $19 billion to repurchase shares. In Q2 of 2023, while the share price was falling, PYPL repurchased 22 million shares at an average price of $68.89, and they are on the record saying that they were planning on allocating an additional $2 billion toward buybacks for the remainder of 2023. I think that this is something that many investors are overlooking, as PYPL has likely been buying shares aggressively on the way down. PYPL has $9.9 billion in cash on hand, with $4.54 billion in long-term investments on its balance sheet with only $10.55 billion in total debt. The high-interest rate environment is not impacting them from an operational cost standpoint, and if PYPL wanted to, they could quickly eliminate all their interest-bearing debt. As PYPL continues repurchasing shares, the valuation case will become more compelling, and they could even take themselves private.

PayPal

What I am looking for in the Q3 earnings report and what I want to hear on the earnings call

I am looking for several things next week when earnings are released. I want to see that earnings are on track to meet their $4.95 EPS goal for 2023, I want to see at least $1 billion of buybacks, and I would like to see some top-line growth. Outside of the financial metrics, I want to see PYPL’s transactional volume increase and its take rate and transaction margin either stabilize or increase. On the conference call, I want to hear their new CEO establish his position and outline a plan to change the market’s perception of PYPL. He only gets one chance at a first impression, and I am banking on the fact that he is going to grab the bull by the horns and deliver a vision that the analyst and investment community buy into.

Conclusion

I had several internal debates about my top value idea for the Seeking Alpha contest, and PYPL is my runner-up. There are many attractive companies for long-term investors to consider, and Citigroup had an edge due to the discount to book value and the dividend that exceeded 5%. I think the market is incorrectly valuing shares of PYPL, but the pain may not be over, as shares need to establish a new bottom before they can recover. There are external risks that investors also need to consider, but as I said in my Citigroup article, from the companies I considered, I feel that PYPL has the most potential for appreciation. I think fair value is somewhere between $100-$120 for shares of PYPL, and as it trades as a value stock rather than a technology company, PYPL is my 2nd top idea for a value play in today’s market.

Read the full article here

Leave a Reply