PayPal Holdings, Inc. (NASDAQ:PYPL) investors are likely assessing whether they should capitalize on the recent pullback and add more exposure as we head into PayPal’s fourth-quarter earnings call on February 7. I believe it will be a pivotal earnings conference for management to follow up on its recent showcase as PayPal looks toward a transformation in 2024 and beyond.

In PayPal’s recent “First Look” event, new CEO Alex Chriss previewed six “new innovations.” However, the market wasn’t impressed, notwithstanding Chriss’s belief that PayPal would “shock the world.” PYPL’s recent price action suggests that selling pressure hasn’t intensified, although the early optimism that led to the surge pre-event has deflated somewhat. Despite that, if management provides a more convincing earnings Q&A session suggesting that PayPal could show more near-term improvement in its operating leverage, it could lead to a post-earnings surge.

As a result, I assessed it’s opportune for me to reconsider whether it’s timely for me to turn more constructive on PayPal’s thesis pre-earnings, particularly as PayPal followed up with a decision to reduce 9% of its headcount. It’s proportionally higher than the previous cut under ex-CEO Dan Schulman in early 2023. Consequently, the “well-timed” announcement post-First Look event suggests that management could have wanted to assess Wall Street’s reaction first to PayPal’s innovations preview.

Unfortunately, Wall Street generally didn’t seem convinced by Chriss’s highlights, assessing these as longer-term growth initiatives. Wall Street is looking for more near-term growth catalysts, aligning with the recent announcement to cut headcount.

Investors shouldn’t understate the marked impact such cost-cutting initiatives could have over the next year, as we observed in the improvement in operating performances for Meta Platforms, Inc. (META) and Amazon.com, Inc. (AMZN). Chriss has also indicated that he remains focused on right-sizing PayPal’s organization to bolster its operating efficiencies. While we might not see an immediate improvement in PayPal’s earnings growth profile in the near term, forward-looking investors could be accumulating PYPL at the current levels, anticipating a more substantial growth inflection subsequently. Therefore, management will likely need to impress upon the market and analysts at its upcoming earnings conference by lifting its earnings guidance in response to the recent initiatives and headcount reduction.

My belief that PYPL could be bottoming out also stems from the lack of significant selling intensity, notwithstanding the slew of recent analysts’ downgrades on PYPL. In other words, with PYPL valued at just 11.5x forward earnings, has the selling pessimism dissipated? Morningstar’s fair value estimate of PYPL suggests it’s in deeply undervalued territory.

I assessed that PayPal’s challenges aren’t expected to be resolved in the near term. With big tech such as Apple Inc. (AAPL) and Alphabet Inc. (GOOG), (GOOGL) gaining clout in financial services and extending their dominance, PayPal lacks a sustainable and defensible consumer ecosystem to safeguard its moat. However, the company does have a substantial scale (400M consumers and 35M merchants) that should offer it some space to execute its initiatives to revive its growth and operating efficiencies.

Notwithstanding the less enthusiastic analysts’ outlook, PayPal is still expected to post an adjusted EPS growth of 11% in FY25 and FY26, respectively. While it’s anticipated to be much lower than FY23’s 21% growth, tough comps from its initial cost improvement initiatives in 2023 need to be considered. In other words, management might have a lower bar to cross as the market and analysts likely head into the upcoming earnings scorecard with relatively tepid expectations.

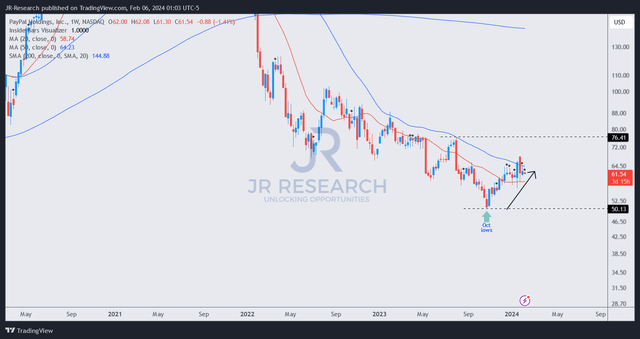

PYPL price chart (weekly, medium-term) (TradingView)

I assessed PYPL to have bottomed out in October 2023. That thesis remains intact. Also, the recent selloff hasn’t gained traction, suggesting investors have likely moved past the competitive headwinds and earnings growth challenges. While these aren’t expected to disappear overnight, it seems like the market has reflected them in its well-battered valuation, as discussed earlier.

PYPL’s price action is also increasingly constructive. Although it’s still in a medium-term downtrend, there’s a support zone at the $55 level, underpinning its recovery. As a result, I see the risk/reward of recovering toward the $75 zone before a consolidation as more likely.

Consequently, it’s timely for me to turn more constructively on PYPL’s thesis as the company looks to turn around its three-year losing streak since it topped out in 2021.

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here

Leave a Reply