Overview

PayPal (NASDAQ:PYPL) shares faced a tumultuous ride over the past two years, marked by an over 80% drop from its all-time high. PayPal is an undisputed payments giant that has significantly shaped the digital payment landscape. Born as an online payment system, PayPal quickly evolved, providing a comprehensive platform for online money transfers, standing tall as a modern electronic counterpart to age-old paper methods like checks and money orders.

Yet, recent times have spilled some turbulence in PayPal’s stock performance. This downturn is primarily anchored in a trio of challenges. Firstly, there’s the decelerating revenue growth. After a consistent upward trajectory for many years, PayPal’s growth pace has somewhat slackened, sparking investor concerns regarding the company’s future growth potential.

Secondly, the realm of digital payments is no longer the exclusive playground it once was for PayPal. There’s a growing swarm of competitors, with companies like Block (SQ), Stripe, and even tech behemoths like Apple (AAPL) and Google (GOOGL), through Apple Pay and Google Wallet respectively, making assertive inroads. These entities are not only introducing innovative solutions but are aggressively courting PayPal’s user base. Lastly, the platform has seen a slowing influx of new users while facing challenges in holding onto its existing ones, further compounding investor apprehensions.

This an all-too-familiar story for those who’ve invested in growth stocks over the pandemic.

Nevertheless, the company’s current predicament increasingly reminds me of the narratives surrounding Meta (META), Netflix (NFLX), and Adobe (ADBE) just last year. Each of these tech giants confronted their share of market skepticism, facing declines that stirred doubts about their futures. Yet, each rebounded, demonstrating resilience in the face of widespread uncertainty. After all, PayPal continues to grow and innovate in a quickly growing fintech market, while still generating impressive cash flows.

Still Relevant

PayPal caters to both consumers and merchants, offering a range of services that cater to different needs. One of PayPal’s primary segments is the high-margin branded checkout button, which contributed to 30% of PayPal’s total payment volume (TPV) in 2022. PayPal has established itself as a prominent global fintech giant, with a 40.52% share of the global payment service segment. Since its inception, PayPal has garnered worldwide recognition and currently serves an impressive 431 million active users. While it has a strong presence globally, the United States remains its largest market by number of users.

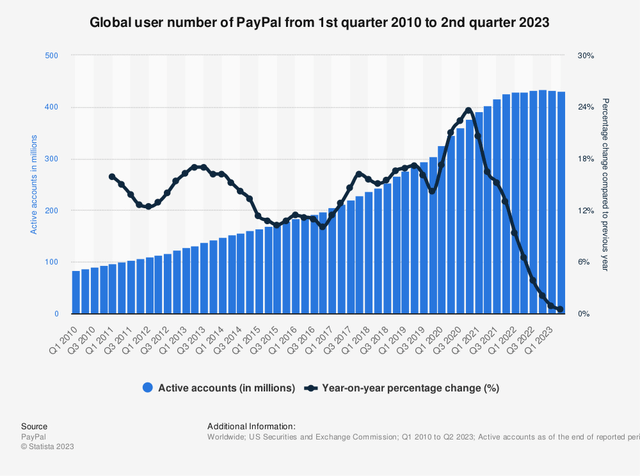

Statista

During the pandemic, PayPal’s number of users surged as a result of increased online transactions. However, in recent quarters, PayPal’s user numbers have stalled and even declined slightly to 431 million active accounts. PayPal’s main app is crucial as it caters to both consumers and merchants. One of PayPal’s primary segments is the high-margin branded checkout button, which contributed to 30% of PayPal’s total payment volume (TPV) in 2022. If PayPal loses users, it is less likely that users will continue utilizing the branded checkout option, which accounts for the majority of PayPal’s high-margin revenue.

E-commerce to the Rescue?

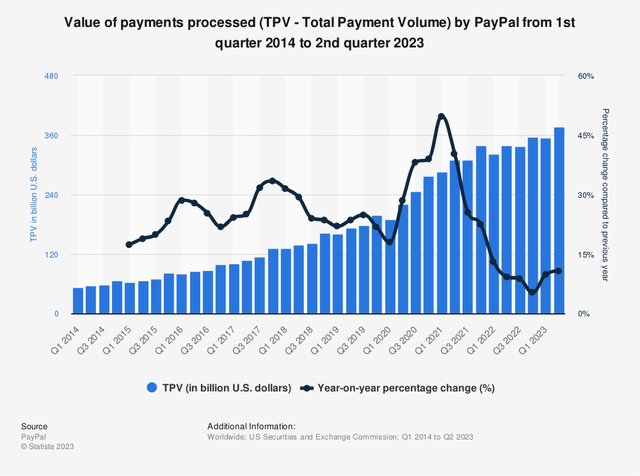

Statista

A significant point of discussion surrounding the stock has been the effectiveness of PayPal’s Branded Checkout button, known for its high profitability. In September 2022, PDD Holdings (PDD) unveiled its U.S.-focused online marketplace called Temu, emphasizing heavily discounted products predominantly shipped from China to U.S. buyers. One of the payment alternatives available during Temu’s checkout process includes PayPal.

Temu is bearing similarities to Amazon.com (AMZN) in terms of its marketplace model and is swiftly gaining traction among consumers. Data from SimilarWeb reveals a staggering increase in Temu’s website visits, starting from about 7 million in September 2022, skyrocketing to 75 million by January 2023, and reaching nearly 300 million by August 2023.

In August, Temu accounted for approximately 2% of the total incoming traffic to PayPal, marking a 2.5x rise from January and a twelvefold increase from the previous year. With Temu’s escalating popularity, its contribution to PYPL’s Branded segment could become increasingly significant. At this point, it is crucial to note PayPal’s buyer protection, which is becoming more and more important as transactions, purchases, and payments are being digitalized across the economy. While Mastercard and Visa also offer purchase protection, I believe that PayPal’s user-friendly application offers a key advantage in terms of simply viewing and managing claims as well as recurring payments such as current subscriptions.

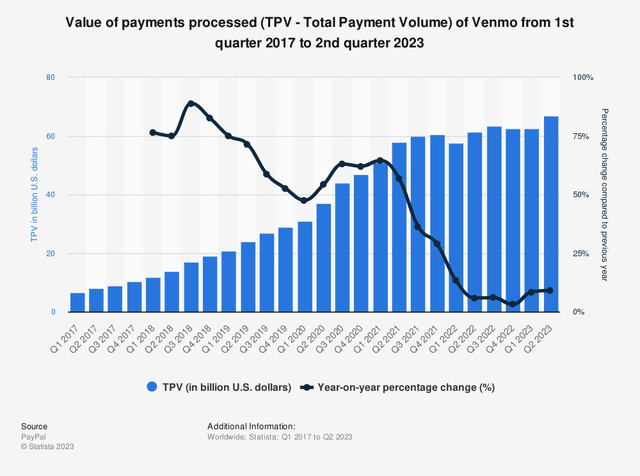

Statista

Moreover, Venmo, a popular peer-to-peer payment app, has become a growth driver for PayPal, contributing approximately 16% of its total revenue. Venmo was created in 2009 and acquired by Braintree and later by PayPal. Venmo processed over $244 billion in total payment volume in 2022 and has over 78 million users. Its annual revenue growth has slowed to 10% in 2022. Recently, Venmo launched its own debit card, which can be added to users’ accounts. PayPal sees Venmo’s social network as a potential source of revenue. Venmo’s growth has been impressive, with its payment volume rising 97% in 2017 to $35 billion and to over $200 billion in 2022.

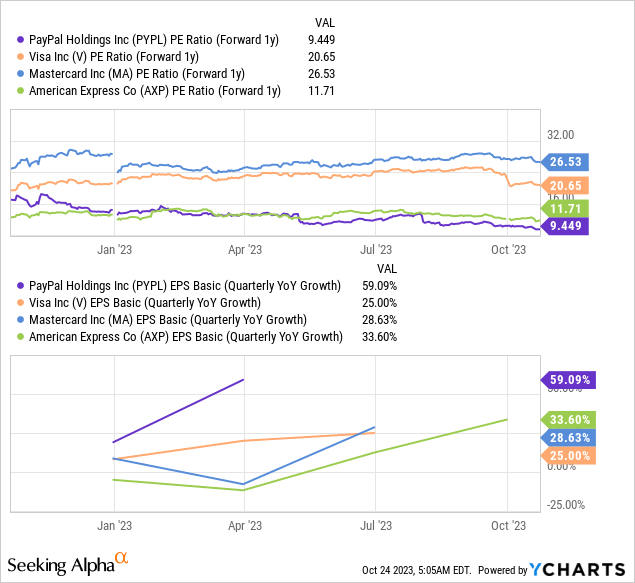

Compressed Valuation

PayPal has never been particularly cheap, and in my opinion, only became attractively priced after its ~30% slump in 2023. This is in part because, in comparison to Payment peers such as Mastercard (MA) and Visa (V), PayPal’s margins are significantly lower. Here, PayPal holds gross margins of 41%, compared to Visa and Mastercard, which both boast gross margins of 100%. Moreover, PayPal’s EBITDA margins hover at ‘just’ 20%, while Visa and Mastercard operate at EBITDA margins of 67% and 65%, respectively. Thus, in my opinion, it is best to value PayPal on a Gross Profit basis, as it is not as capital-light as Visa or Mastercard.

| Company | Price to Gross Profit (TTM) | Price to Sales Ratio |

| PayPal (PYPL) | 4.97x | 2.2x |

| Block (SQ) | 3.9x | 1.33x |

| Nu Holdings (NU) | 8.6x | 6.2x |

| Adyen (OTCPK:ADYEY) | 16.8x | 3.8x |

| Mastercard (MA) | 15.3x | 15.6x |

| Visa (V) | 13.7x | 17.1x |

| American Express (AXP) | 1.77x | 1.7x |

Thus, considering PayPal is currently generating $11.8 billion in TTM Gross Profit, it trades at just under 5 times its annual gross profit, only one-third of Visa and Mastercard’s Price to Gross Profit valuation. While Block (SQ) trades at a similar discount, at 3.9 times Gross Profit and 1.3 times Price to Sales, Block is much less profitable and is generating less consistent cash flows. Thus, Block’s operating margin currently stands at roughly -2%, compared to PayPal’s 16% operating margin.

Despite PayPal’s slowing growth and increased competition, PayPal’s financial health remains robust. The company has consistently generated positive cash flow, with a total levered free cash flow of over $5 billion. PayPal’s balance sheet is also reassuring, with $14.4 billion in cash, cash equivalents, and investments, and a manageable debt load of $10.5 billion.

PayPal’s next earnings report is scheduled to be published on November 1, 2023 after market close. The estimated earnings per share (EPS) for PayPal’s next earnings release is $1.22. According to current estimates, analysts expect PayPal’s revenue to grow by 8.8% to $30.69 billion in fiscal 2024. If PayPal is able to beat the current estimates, especially with regard to user numbers, shares will likely surge.

The Bottom Line

PayPal is a great buy ahead of its Q3 earnings. After selling off over 80% from its all-time highs, PayPal is now much more attractively valued. At just 10 times forward earnings, PayPal’s current valuation offers a significant margin of safety. With PayPal’s total payment volume still on the rise, sentiment is overly negative, in my opinion.

Investors may remember how Meta bounced back last year. PayPal could very well pull off a similar move in 2024.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!”

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply