Focused on the Fundamentals

In a recent Management Meeting, PayPal (NASDAQ:PYPL) executives went into details on some key business initiatives that they are rolling out. I want to highlight a few of these as they look promising for future earnings growth. Before I get started on this, I want to provide some helpful background on the business.

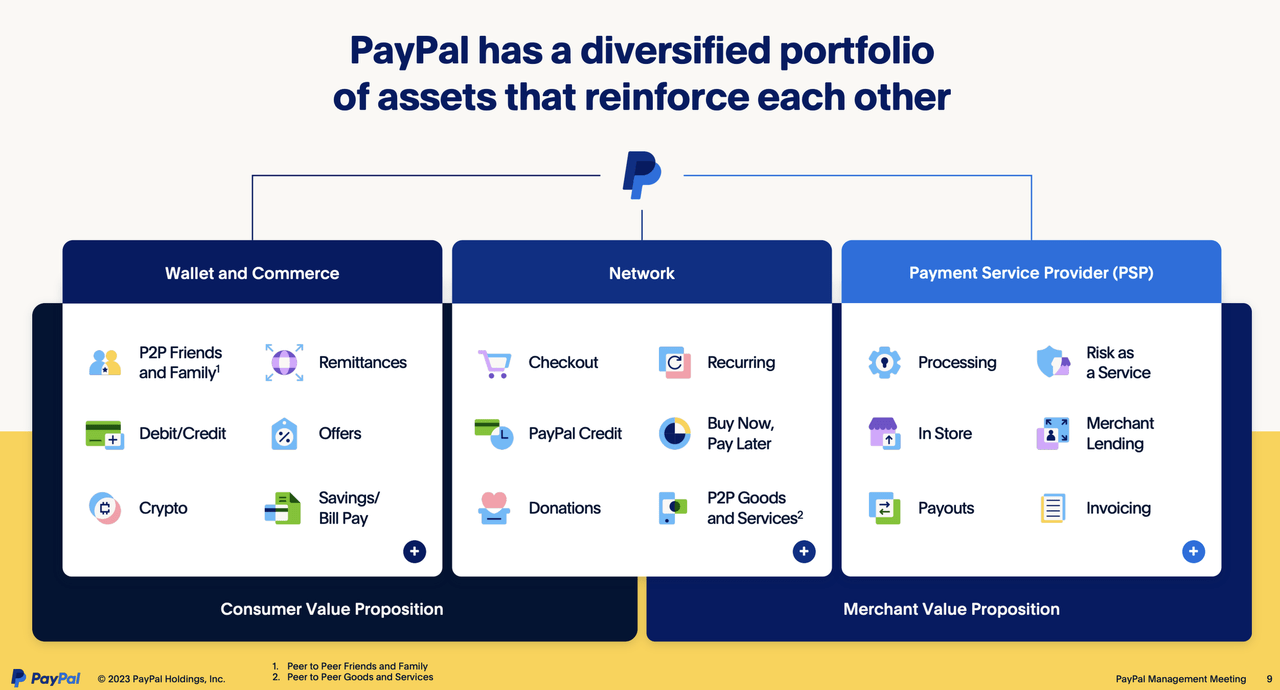

The following slide outlines PayPal’s 3 core business segments and how they overlap as it services both sides of the customer/merchant relationship as well as the network that connects them:

PayPal June 2023 Management Meeting Presentation

Wallet and Commerce includes the PayPal and Venmo apps and all the services contained within them.

Payment Service Provider includes Braintree, PayPal Complete Payments [PCP], and Zettle. Braintree provides payment processing and related services to large enterprises, such as Uber. PCP is a standardized payment processing service for small and medium sized businesses (SMBs). It is a relatively new offering and will be a focus of this Letter. Zettle was acquired by PayPal in 2021. It is in-store payment processing platform that competes with Square.

Network is where consumers pay for products or services. PayPal’s strategy is to drive its branded checkout where consumers checkout with Pay with PayPal or Pay with Venmo (now an option on Amazon). These transactions are higher margin. The company is focused on making branded checkout as frictionless as possible and adding value added services.

Roughly 1/4 of all e-commerce transactions go through PayPal and 25% of all payment cards (credit, debit, etc.) in the Western world are held in a PayPal vault. Given its existing market share, the PayPal opportunity lies not so much with payment volume growth, although that will continue to grow, especially with higher inflation, but with potentially growing its take rate by driving more higher margin branded checkout. PayPal’s take rate is currently 2%. If it was able to grow this to 2.5% on its current expense base, then free cash flow would double and the stock price would triple or quadruple, all else being equal.

PayPal Complete Payments

PayPal Complete Payments, or PCP, is a standardized payment processing platform for SMBs. It will accept any payment method and, notably, always provides merchants with the most up-to-date, optimized checkout experience (which is primed to enable branded checkout). This is a serious competitive threat for the likes of Block and Stripe. One of the issues that PayPal has with its merchant customer base is that they are using a string of older legacy platforms. By converting SMBs to PCP, it will ensure they are always on the current platform which PayPal can continually optimize for better customer experiences.

90% of PayPal’s Braintree business comes from large enterprises. Management is focused on leveraging PCP within its Braintree business to sell its payment process capabilities to higher margin SMBs. In a recent conference, Acting CFO Gabrielle Rabinovitch, described this opportunity as follows:

In addition, we talked about PPCP [PCP], which really is bringing a full stack processing capabilities in a full-stack platform to SMBs. We’ve never been in this market. We’ve never had a product to compete in this market, and this is amazing white space for us when we think about what we can do for SMBs.

SMBs – the PayPal brand to Checkout button is sort of an essential need for most SMBs. And so we bring real conversion and real lift to their business. The ability now to offer sort of the stack that can give them everything they need with one partner, we think, will be very, very compelling. And that, of course, has a much higher margin profile than what we would have on the LE side.

PayPal’s success or lack thereof with this move will be an important area of focus as we get more incoming data in the upcoming quarterly results.

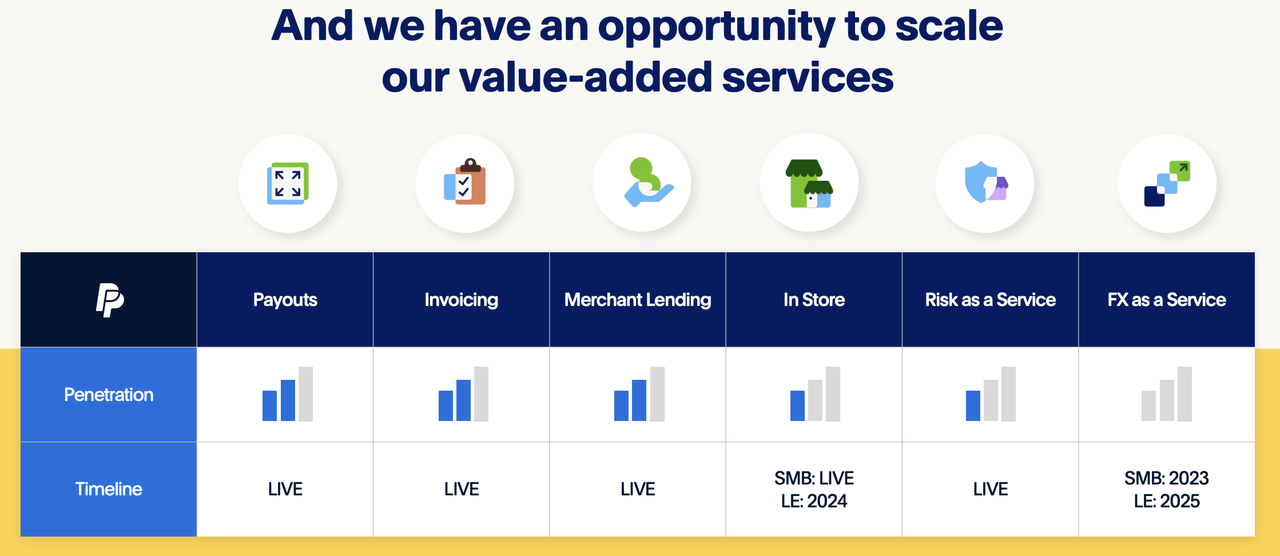

In both PCP and Braintree, PayPal is looking to expand internationally, where margins are higher, and offer value-added services such as those depicted on the following slide:

PayPal June 2023 Management Meeting Presentation

In some of these categories, such as In Store, Risk as a Service, and FX as a Service, PayPal has minimal market share penetration. The cross-selling of these additional services enables the sale of deeper, end-to-end solutions which are higher margin.

One-click Buying

PayPal is gradually rolling out one-click buying for its 35 million merchants. The idea is that consumers will be able to check out with one-click when shopping with any one of these 35 million merchants. The way it works is your payment information is saved to a network vault so that the next time you go to pay you don’t have to set up or edit anything. This eliminates the issue of stale payment information stored with each individual site. The selling point for merchants is that there is a 90% conversion rate when consumers select PayPal versus only 50% to 60% for guest checkout.

There are about 1 billion users of guest checkout today. PayPal is looking to drive more of these consumers to create PayPal accounts by making value-added services available to them through their merchants if they do so. Here is how Chief Product Officer, John Kim, described some of these:

Let me show you some examples of things that we would do to drive users into becoming PayPal users. One example is package tracking. The value from the consumer is they get to track their packages from order all the way through delivery.

For the merchant, it does 2 things. One is that we’ve reduced the number of contacts for where is my package; and number 2 is we actually decreased the chargebacks related to non-delivered items. So whether they are a PayPal customer or a non-PayPal customer, we get to offer value added features and make it all available through the PayPal app.

A second example is smart receipts. With smart receipts, we’re going to detail the items that are purchased, and then consumers can save these receipts to their PayPal Wallet for easy discovery, to track their history, to manage all of their finances. And within the wallet, what we’ll do is we’ll provide a surface. So it’s very easy for merchants to cross-sell and upsell, giving merchants an ability to double the value of every given transaction, again changing the economics of using PayPal.

Given the scale at play here, it will be interesting to see how this change affects user adoption.

These additional service offerings are important to consumers because they increase convenience and peace of mind, especially when it comes to Buy Now Pay Later.

Buy Now Pay Later

PayPal is a leader in Buy Now Pay Later (BNPL), has an 81.6 Net Promoter Score (which is apparently very high and the highest in the industry), and was ranked #1 by Consumer Reports. This article details some of the issues that consumers have with this new service that competes with credit cards. Consumers will stop using these services if they run into major hassles. PayPal is not squeaky clean here but its focus on frictionless, security transactions should enable it to continue to stand out.

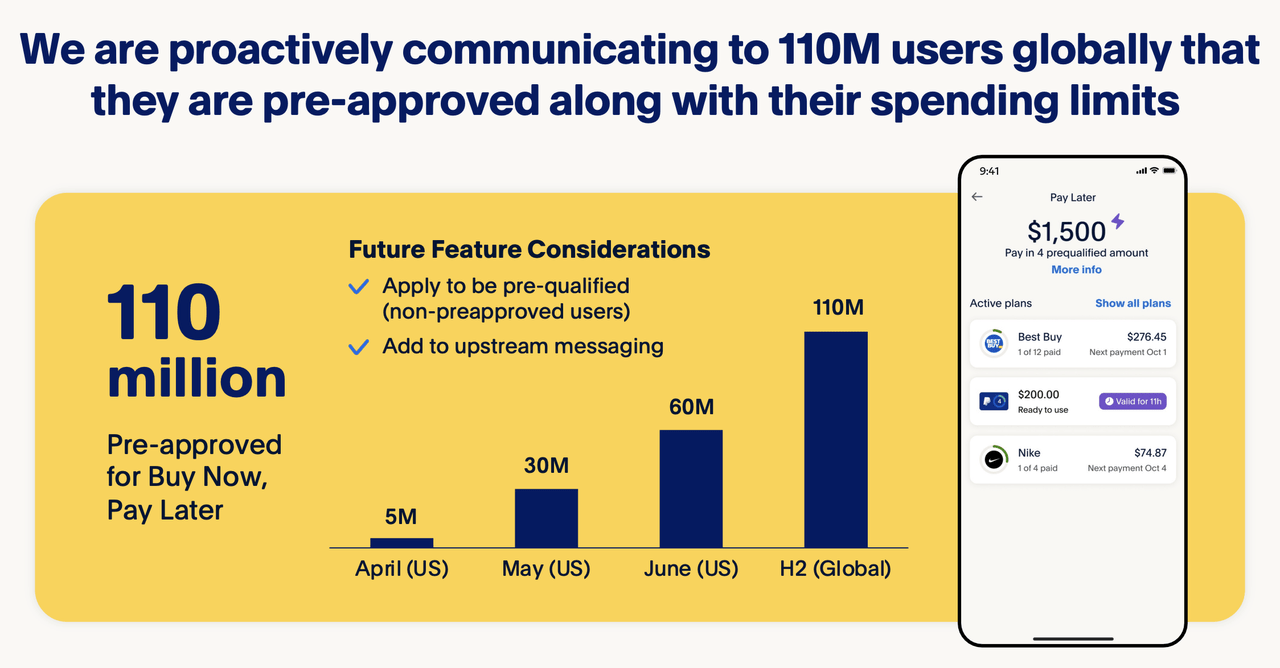

Management understands this so they are introducing enhancements. Notably, when it comes to BNPL, they are proactively communicating to 110 million users over the coming months what their pre-approved spending limits are, as the following slide outlines:

PayPal June 2023 Management Meeting Presentation

This will not only make millions of users aware that this service is even available, but it may encourage increased use of Pay with PayPal in general. [Note: I recently used this service myself after PayPal made it clear what my pre-approved amount was. It worked great and I will likely use this again in the future.]

This rollout is part of a greater effort by the company to deal with customer pain points when it comes to using BNPL services.

What I like about the direction of PayPal’s BNPL strategy is that it is not looking to take on the credit risk. It is looking to earn a fee on the transaction (merchants pay when customers use it) and then sell the short-term loan book to investment firms such as KKR.

Valuation

Over the long-term, I’m making the following key assumptions in my financial model for PayPal:

- 12% Total Payment Volume (TPV) growth

- A gradual decline in the take rate by roughly 3 basis points per year

- 7% annual growth in costs and expenses

This would lead to operating margins climbing into the high-teens/low 20% range. Assuming the company devotes 80% of free cash flow to share repurchases going forward, this trajectory could have the company generating $10 of free cash flow per share in 3 years.

These assumptions could be conservative considering that TPV growth has averaged almost 24% annually over the last 8 years. Moreover, the fundamentals highlighted in this article could stabilize or even grow the take rate.

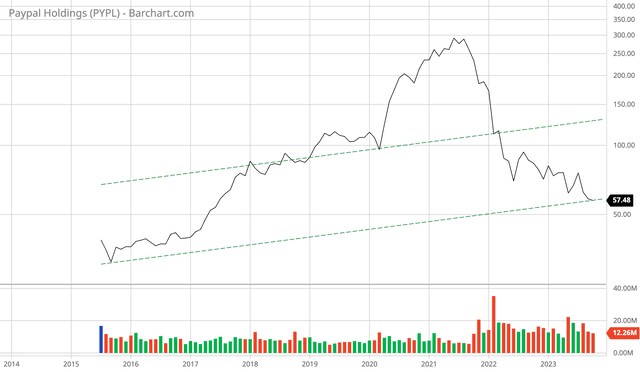

Here is the monthly log chart:

Courtesy of Barchart

My 12-month target price is $84 which 14 times the $6 of FCF per share that I think the company can generate in 2024. This is roughly the middle of this monthly trend channel.

The Key Risk

The key and immediate risk to the short-term performance of the stock is a faster decline in the transaction take rate due to lower margin large enterprises continuing to dominate its Payment Service Provider (PSP) business. This is why management’s strategic focus on selling PayPal Complete Payments (PCP) to small businesses, international expansion, and valued-added services is so critical here. These are all higher margin transactions.

Strategic Conclusion

I like the “focus on fundamentals” direction that management has been steering the business in. PayPal continues to be one of my largest positions. The stock is trading for less than 10 times my 2024 free cash flow per share estimate and I see 45% upside over the next 12 months.

The stock looks like it is potentially putting in a significant long-term bottom and the details of this article have me suspecting that this will lead to earnings results that outperform over the coming quarters.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here

Leave a Reply