Look at appropriate payout ratios for CAPEX-heavy industries and real estate income trusts (REITs). If you don’t, you could be surprised by dividend cuts or miss out on great companies!

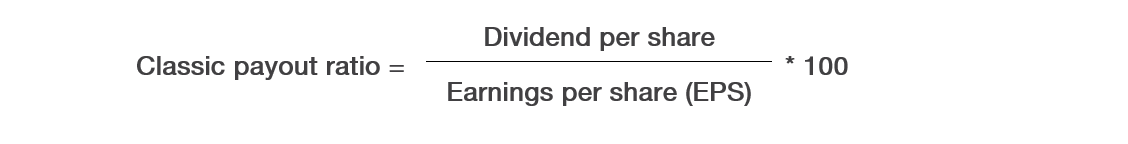

The classic payout ratio is calculated like this:

For some industries, this metric is completely misleading. Why? Because their EPS is not an accurate reflection of their ability to keep paying dividends.

CAPEX-Heavy Industries

Capital-intensive companies require large investments in capital assets – machinery, equipment, infrastructure, and technology – to operate and generate revenue. Examples include pipelines, utilities, and telecommunications.

While they do spend a lot of money in capital expenditures (CAPEX), often borrowing to do so, these are investments they expect will pay off. They invest in new projects and asset maintenance to generate more revenue and profit in the future.

These capital assets depreciate over time. Depreciation is a non-cash charge deducted when calculating profit and affects earnings per share (EPS).

Such companies’ earnings are often depressed by their capital-intensive business model. Since the classic payout ratio calculation uses EPS, it can falsely make it seem like a company is paying more in dividends than it can afford to, and that the dividend is at risk.

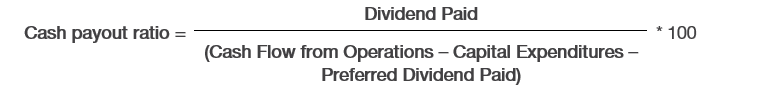

Cash Payout Ratio

Is the Cash Payout Ratio a better metric for these companies?

Well, it’s more precise because 1) it uses Cash Flow from Operations, itself derived from actual cash in and out of the company, and 2) it removes CAPEX from the ratio calculation.

However, CAPEX is often financed, wholly or in part, through debt or issuing shares. The cash payout ratio doesn’t account for debt and share issuance, so it might give the impression that it’s the dividend that is financed through debt, not a good look.

A company should be able to pay dividends with its cash flow from operations and finance projects with debt. Borrowing money at 5% and investing it expecting a 10% return is a smart choice and it enables the payment of dividends in the meantime!

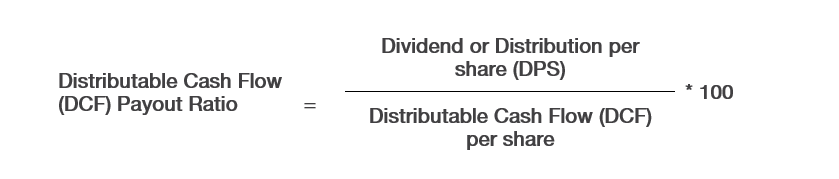

Distributable Cash Flow Payout Ratio

Pipelines and utilities often use the Distributable Cash Flow Payout Ratio, calculated as follows:

It’s similar to the cash payout ratio in that you get a clear picture of how much cash the company has to pay dividends. Companies that use this ratio often provide a detailed calculation in their quarterly earnings report.

For example, look at the payout ratio of CAPEX-intensive company Enbridge (ENB). For the last five years, its payout ratio is always over 100%, making its dividend look unsustainable. Over the same period, the Distributable Cash Flow (DCF) payout ratio remained in the 60% to 70% range: the dividend was quite safe!

REITs

REITs own and manage real estate and receive rental income from properties like apartment complexes, hospitals, office buildings, warehouses, hotels, etc.

Most REITs must invest at least 75% of their assets in real estate or cash equivalents. In other words, they can’t produce goods or provide services with their assets.

By law, REITs must distribute at least 90% of their income in dividends. As a result, the classic dividend payout ratio for REITs is often near or even exceeds 100%, making it appear as if they are paying out more than they earn.

This is because REITs have sizeable depreciation and other non-cash charges that reduce their income but not their cash flow. These unique characteristics make the classic dividend payout ratio misleading for REITs.

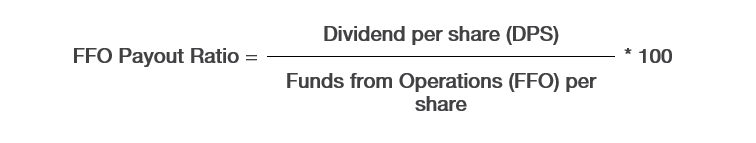

FFO Payout Ratio

REITs often report a metric called Funds from Operations (FFO) to measure their operating performance. FFO adds non-cash charges back to net income and subtracts gains from property sales.

FFO = Earnings + Depreciation (Amortization) – Proceeds from Property Sales

The FFO payout ratio, which uses FFO rather than EPS, reflects the cash flow generated by the REIT’s operations. Therefore, it’s more appropriate for evaluating the sustainability of REIT dividends.

Since earnings include proceeds from selling property, but the FFO does not, a REIT whose income comes disproportionately from selling properties could have a 90% payout ratio, usual for REITs.

However, its FFO payout ratio could be well over 100%, indicating that too much of the money is from selling off assets versus rental income; this isn’t sustainable for the long term.

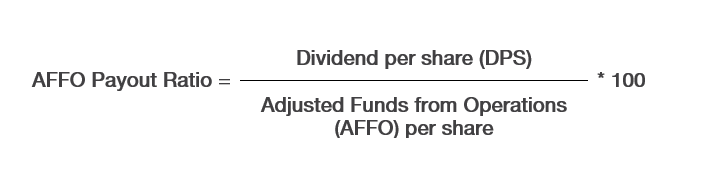

AFFO Payout Ratio

REITs often invest in property maintenance, improvements, and acquisitions to maintain and grow their portfolios. This means substantial CAPEX that can significantly affect the ability to sustain or grow dividends.

We’ve seen already that CAPEX aren’t adequately captured in the classic dividend payout ratio, nor are they in the FFO used in the FFO payout ratio.

That’s when the Adjusted Funds from Operations (AFFO) metric can help. Basically, it’s the FFO minus the CAPEX.

AFFO = Earnings + Depreciation (Amortization) – Proceeds from Property Sales – Capital Expenditures

Investors like the AFFO payout ratio; it provides a clearer picture of the funds available for dividends after essential property-related expenses.

REITs performance and dividend sustainability

The FFO and AFFO are probably the most useful metrics to analyze a REIT’s financial performance; they are akin to earnings and adjusted earnings for regular stocks.

The associated FFO/AFFO payout ratios provide a clearer picture of the dividend sustainability than the classic payout ratio. Fortunately, we can find both FFO and AFFO metrics inside each REIT’s quarterly report and press release.

Don’t follow only the total FFO/AFFO, but also the FFO/AFFO per unit (per share). REITs usually issue additional units to finance projects and acquisitions.

Even if FFO grows year over year, there might not be more money to distribute to shareholders if the REIT issues more units along the way. When a REIT grows its FFO but fails to improve its FFO per unit, you likely won’t get a distribution increase.

Final Thoughts

Now you know why some payout ratios are not appropriate for CAPEX-intensive industries and REITs, and which ratios are more precise. Remember that you shouldn’t use the payout ratio, even the correct payout ratio, as the sole or first criteria for analyzing stocks. See Using Payout Ratios Wisely.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here

Leave a Reply