Investment Thesis

Patrick Industries (NASDAQ:PATK) was one of the major beneficiaries of the COVID-19 pandemic, as the demand for recreational vehicles surged. The stock price more than doubled between 2019 and 2021, but in 2022, PATK’s investors faced a lot of pain. Over the last twelve months, the stock price demonstrated a stellar comeback with a 72% rally, significantly outpacing the broader stock market. My valuation analysis suggests that the stock is still massively undervalued. The business is of a high quality, and the company demonstrates strong profitability compared to the sector median. I like the management’s commitment to improving cost efficiency and diversifying the revenue mix. Capital allocation has not been optimal in recent years, but I am optimistic about the future since the management appears focused on decreasing the outstanding debt. All in all, I assign the stock a “Buy” rating.

Company Information

Patrick Industries is a component solutions provider for recreational vehicles (RV), marine, manufactured housing (MH), and various industrial markets. PATK operates through a nationwide network that included, as of the latest fiscal year-end, 185 manufacturing plants and 67 warehouse and distribution facilities located in 23 states.

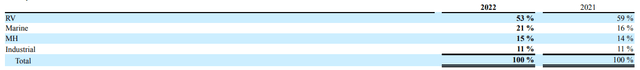

The company’s fiscal year ends on December 31. PATK operates within two reportable segments: Manufacturing and Distribution. According to the latest 10-K report, the Manufacturing and Distribution segments accounted for 74% and 26% of sales, respectively, in FY 2022. RVs accounted for over half of the company’s net sales in the last two fiscal years.

PATK’s latest 10-K report

Financials

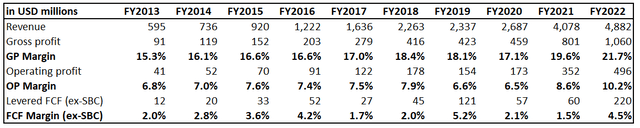

The company’s financial performance over the past decade has been strong. Revenue compounded at a staggering 26.3% CAGR, and the operating margin improved notably, from 6.8% to 10.2%. I like it when companies can deliver profitability ratio expansion as the business scales up because it suggests that the business model is sound. As a result, the free cash flow (FCF) margin ex-stock-based compensation (ex-SBC) more than doubled over the decade. However, the FCF has been very volatile in recent years but consistently positive.

Author’s calculations

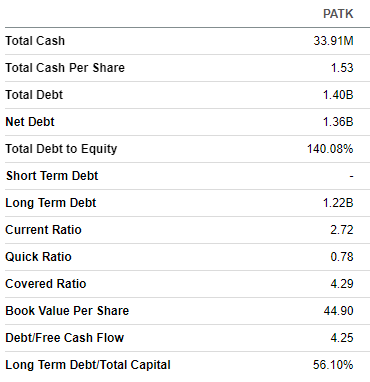

Despite having a consistently positive FCF margin, PATK’s balance sheet is highly leveraged. The company is in a substantial net debt position, and its D/E ratio is far above a hundred percent. On the other hand, the major part of the debt is long-term, and current liquidity metrics are in excellent shape. Overall, I cannot praise the capital allocation approach in the past because having a high amount of debt, while paying out dividends and conducting stock buybacks, does not look optimal to me. At the same time, I have to underline that the net debt dynamic is positive and decreasing from last year’s peak.

Seeking Alpha

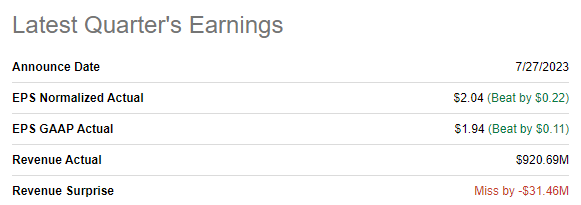

The latest quarterly earnings were released on July 27, when the company missed consensus revenue estimates but outperformed from the bottom line perspective. Revenue demonstrated a dramatic YoY 38% decrease, and the adjusted EPS more than halved. The weakness in revenue almost did not affect the gross margin, but the operating margin shrank by more than three percentage points.

Seeking Alpha

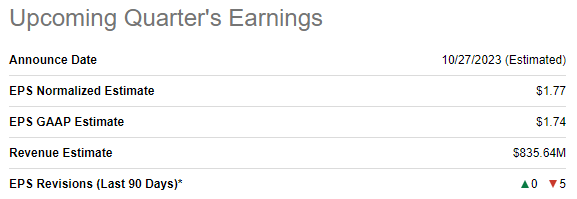

The upcoming quarter’s earnings are expected to be released on October 27. Quarterly revenue is forecasted by consensus at $836 million, which suggests about a 25% YoY decline and a 9% sequential decline. The adjusted EPS is expected to follow the trajectory of the top line and drop from $2.43 to $1.77.

Seeking Alpha

Overall, the company is in a strong position in its niche, given a broad network of manufacturing and warehousing facilities, which allows it to drive logistics efficiency. The revenue growth is impressive, and Seeking Alpha Quant suggests that PATK’s profitability metrics are mostly higher than the sector median, meaning the management is efficient in driving growth. But there are still plenty of jobs to be done to improve the balance sheet, especially in the current environment of sharply softening demand for RVs. I like that the management recognizes the need to improve cost-efficiency by streamlining and automating internal processes. The ultimate goal is to improve the balance sheet, and it is a positive sign that in the latest quarter, out of the $179 million operating cash flow, $117 million was used to reduce the outstanding debt balance.

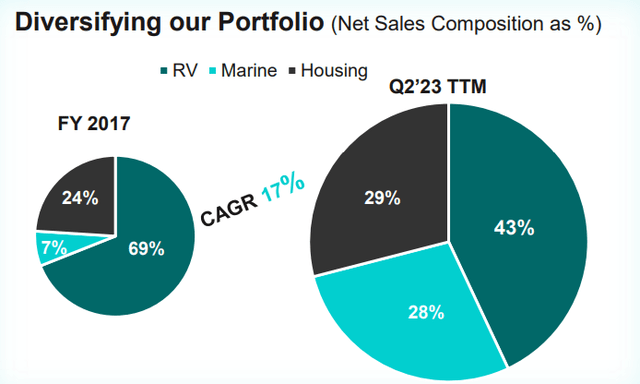

The company’s efforts to improve and diversify the end market mix are also impressive. RVs represented almost 70% of the total sales in FY 2017, while this market’s Q2 2023 TTM share decreased to 43%. The company is focusing on expanding its offerings in the Marine and Housing markets, which is strategically correct in my opinion.

PATK’s latest investor presentation

Valuation

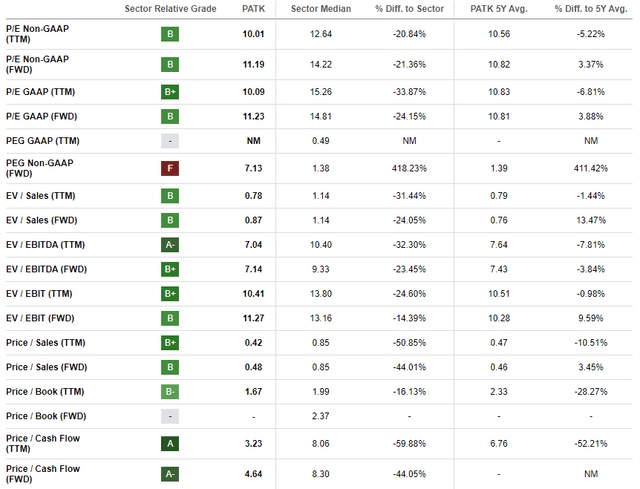

The stock rallied 23% year-to-date, significantly outperforming the broader U.S. market. Seeking Alpha Quant assigns PATK an average “C+” valuation grade, meaning the stock is approximately fairly valued. Most of the multiples are significantly lower than the sector median. On the other hand, the current valuation ratios are close to historical averages. That said, I believe the stock’s current market price is close to its fair price based on the multiples analysis.

Seeking Alpha

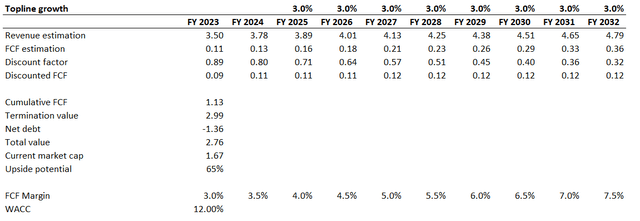

I want to simulate the discounted cash flow (DCF) model to get more evidence about the valuation. I use an elevated 12% WACC for discounting due to the notable volatility in the FCF margin over the past decade. Revenue consensus estimates are available only for the next two years. For the years beyond, I incorporate a modest 3% CAGR. I use the last decade’s FCF ex-SBC margin of 3% and expect it to expand yearly by 50 basis points over the next decade.

Author’s calculations

According to my DCF simulation, the business fair value is $2.8 billion. This indicates a substantial undervaluation with an upside potential of 65%. That said, I think the stock’s fair price is $124.

Risks to Consider

The business is vulnerable to swings in the broader economic cycles. Periods of economic downturns will weigh on revenue growth, and profitability metrics are likely to shrink amid macroeconomic turbulence. Apart from affecting the revenue side, the cost also significantly depends on the cyclicality of raw materials prices.

Such a massive portfolio of manufacturing and warehousing facilities poses multiple operational risks for the company. It is crucial to sustain an efficient supply chain resistant to disruptions like geopolitical events or temporary harsh weather conditions. PATK should also ensure strict product quality control is in place to mitigate reputational and financial risks. While having an extensive network of facilities is an asset allowing it to maximize logistics efficiency, it is also a burden to a company because physical facilities require substantial resources to be invested in maintenance and modernization. The company’s facilities should improve in accordance with the evolving technological environment, and failure to do so might make these expensive assets obsolete.

Bottom Line

To conclude, PATK is a “Buy.” The valuation looks very attractive to me, and the upside potential outweighs the risks and uncertainties. I see a lot of positive trends indicating that PATK is a high-quality business, and I like the management’s initiatives and long-term approach to creating value for shareholders.

Read the full article here

Leave a Reply