Investment Thesis

Company Overview

Palo Alto Networks (NASDAQ:PANW), founded in 2005 with headquarters in Santa Clara, CA, is a global cybersecurity provider that serves enterprises, organizations, service providers, and government entities from cyber threats. The company’s zero trust solutions focus on serving five areas, including Network Security, Secure Access Service Edge, Cloud Security, Security Operations, and Threat Intelligence and Security Consulting.

Strength

Palo Alto has been around for 18 years, during which the cybersecurity industry has gone through transformative changes due to the technological development in the internet and cloud computing. It has scored in 13 categories of industrial services by Gartner, up from 9 in 2020. But what differentiates it from its competitors is its ability to provide all the services in a unified platform. It delivers to clients as product, subscription, and support. While in its most recent quarters, the revenue generated from subscription and support grew much faster than from product alone. The company is strong in providing innovative solutions to enterprise security against cyberattacks. Each categorical service can serve at the granular level, which makes them more effective in serving customers’ demands. As a leader in the cybersecurity industry, it has a strong pull with both its customers and its competitors.

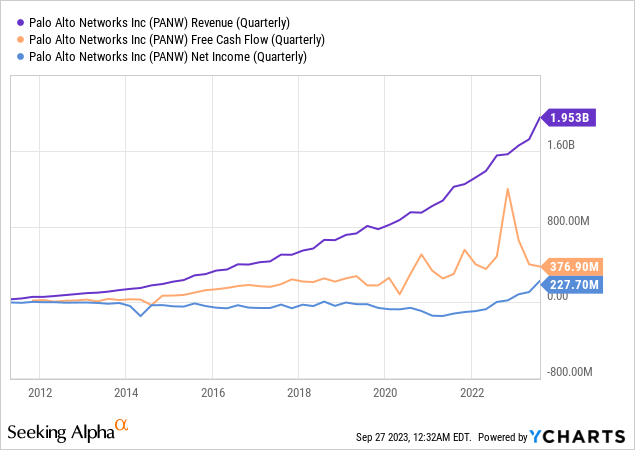

The company’s revenue has almost doubled every three years since it went IPO. The secular growth of its net income, after falling to its lowest level in 2022, is finally looking up. In fact, FY 2023 marked the first time its net income has swung to positive since its IPO. The most noticeable pattern of its free cash flow, on the other hand, is its large fluctuation since 2020. We connect these three in the analysis below to uncover more connections between them.

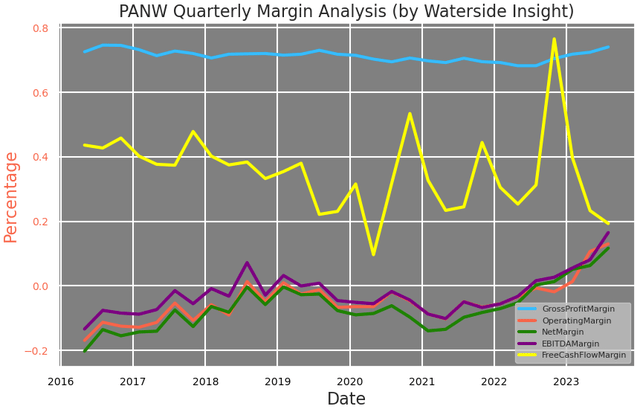

Steady margins since 2015 have had upward momentum, with its net margin and EBITDA margin becoming positive in the past two quarters. And the most noticeable was its free cash flow margin substantially better than its average level in the past three years almost doubling where it was before the pandemic. Its free cash flow started to show pronounced seasonality in 2020.

panw (panw)

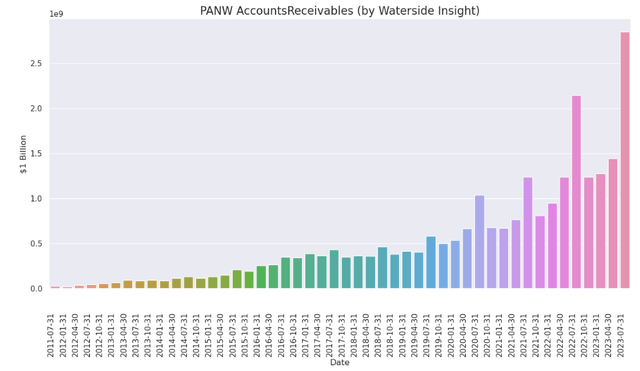

The provision to is operating cash flow has a strong factor from its more pronounced seasonality from its accounts receivables. The quarter ending in July of each calendar year, which is the last month of its fiscal year has the highest value for the FY. That particular quarter used to not be that distinguished from the rest of the quarters in the same FY, but since 2018, the difference has noticeably increased. In the FY that just ended, FY Q4 is almost doubling the previous three quarters’ average. The company explained that it is mostly due to end-customers’ December 31 fiscal year-end or year-beginning budget planning, August being the seasonally light month in sales, and due to the internal sales compensation plan.

panw (panw)

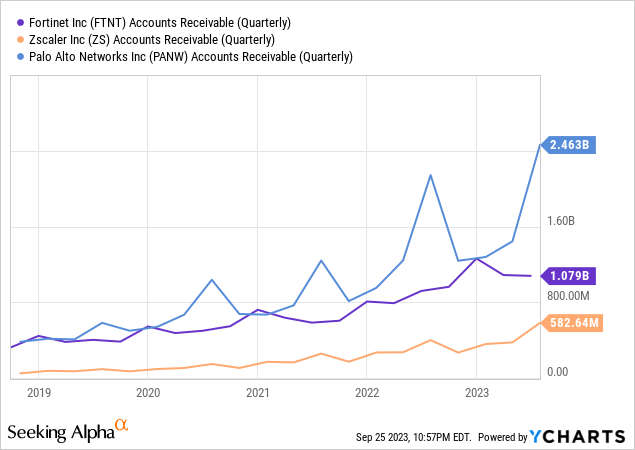

If it is due to its customers’ business planning and management, there should be a general trend occurring within the industry, at least to some degree. But when we compare Palo Alto Networks accounts receivables with its competitors such as Torinet and Zscaler, we didn’t find such significant seasonality. We believe it is mostly due to PANW’s own sales compensation plan that includes annual quotas and commission rate accelerators for obtaining the sales contracts at the end of the FY.

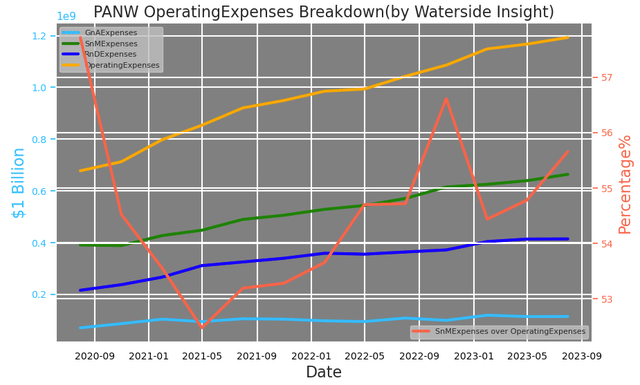

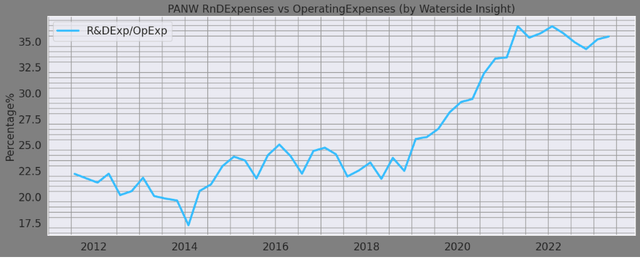

These contract costs that are recoverable and incremental to obtaining customer sales contracts are systematically deferred on the basis of how the contractual goods or services are being delivered to the customers. Such deferred contract costs are included in the sales and marketing expenses. Indeed, a breakdown of its operating expenses shows that Palo Alto Networks spends the least in administration, and maintains strong spending on R&D, while having sales and marketing expenses as the largest component, accounting for more than half of it. And this ratio has been increasing in 2021. up from 52% to around 56%, after falling in 2020. Although it is not a large increase, it shows that the increasingly stronger seasonality is also associated with contract acquisition costs.

panw (panw)

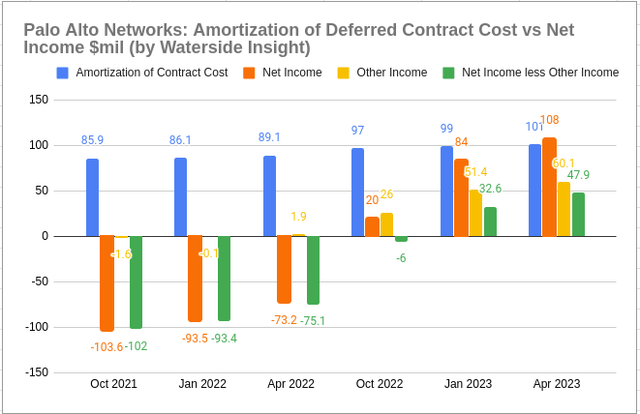

The sales commissions are mostly related to initial contracts more than renewals. The amortization of these contract costs is spread over a period of five years, taking into consideration contract length, technology life, and other quantitative and qualitative factors. By comparing the deferred contract costs and its net income, which has just turned positive this year sustainably, it appears that Palo Alto Networks’ commission incentivization dollars have gone far in boosting the net income as it has turned from negative $103 million in the quarter ending in October 2021 to positive $108 million in the quarter ending in April 2023. This is a huge turnaround. But as we look a little further, its net income has been a notable contribution from other income, which is mostly comprised of interest income from its investment portfolio. Other income used to be not material five quarters ago, but now it is almost half of its net income. Without other income, this turnaround is still strong but is much less in value.

panw (panw)

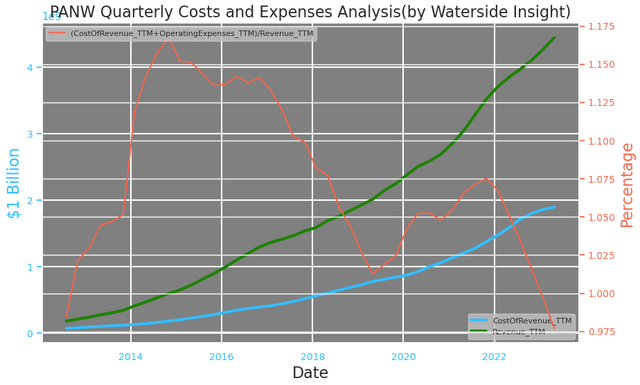

We believe another deciding factor to its positive net income is better control of its costs of revenue and operating expenses. Given the fact that its cost of revenue and operating expenses as a whole are lower than its revenue for the first time in the past eight years, there are reasons to believe this positive turnaround could be sustainable if such a trend continues. But given the way contract costs are deferred, could there be a rebound of expenses going forward to drive this up? After all, this level is the lowest it’s been since its IPO.

panw (panw)

To summarize, there is an organic growth momentum in Palo Alto Networks’ sales growth, even though it is greatly stimulated by the sale commission plans. However, the magnitude of such growth is not as strong as it appears if simply judging by its net income and earnings numbers alone. And we will look further into the investment portfolio that gives rise to its Other Income below.

Weakness/Risks

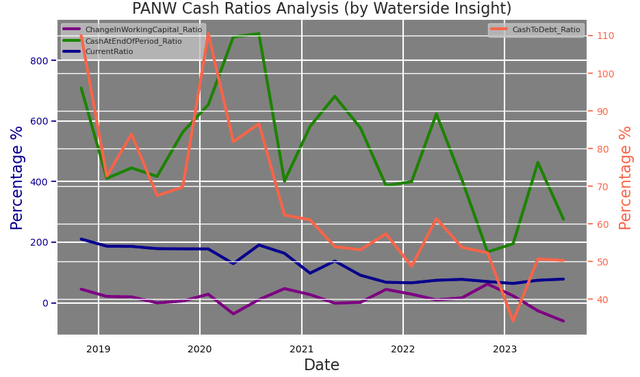

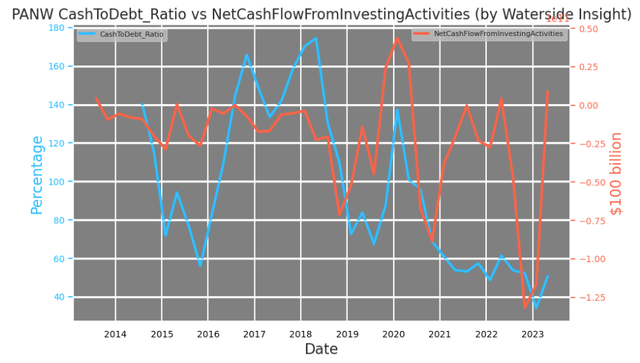

With such a strong operational cash flow, one would be surprised to see Palo Alto Networks’ 0.78x current ratio, around 50% cash-to-debt ratio, and what’s more, a narrative change-in-working-capital ratio.

panw (panw)

With its quadruple free cash flow on a TTM basis, where did its cash go? While its cash ratio was declining, its cash flow from investing activities has gone up almost by 3x in a year.

panw (panw)

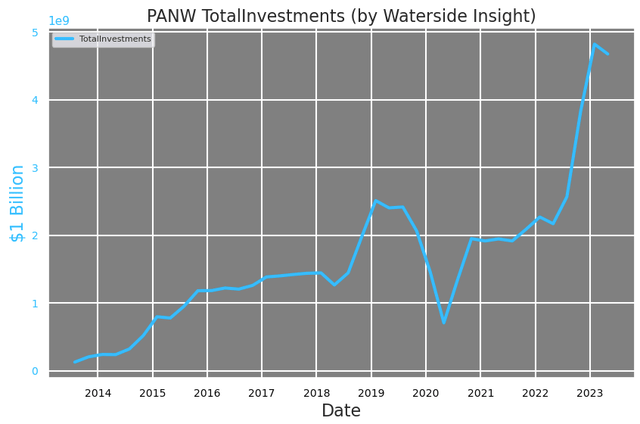

And indeed, its total investment has shot up to double where it was in mid-2022.

panw (panw)

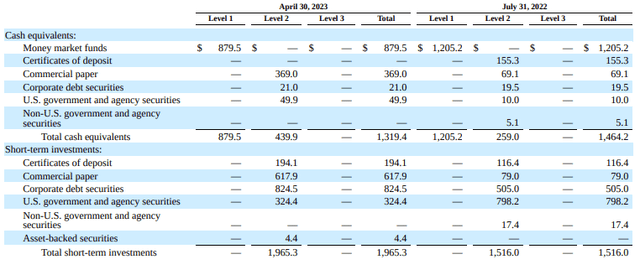

If we look at the composition of its investment, its short-term investment has a concentration in corporate bonds and US agency debt.

panw (panw)

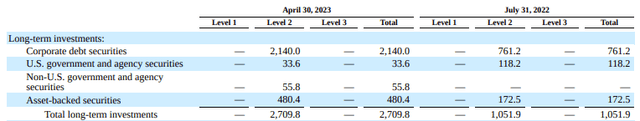

While its long-term investments are mostly tied up in US corporate bonds. The company is undoubtedly bullish on US corporate bond markets. It even mentioned higher interest rate was a factor in achieving higher investment income in its latest 10Q.

panw (panw)

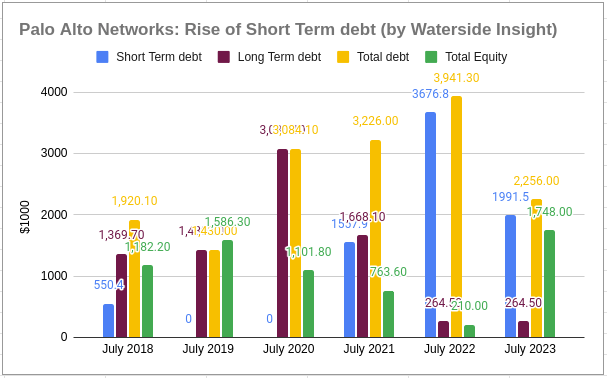

In the meantime, its debt utilization has switched to be dominated by short-term debt. It lowered its long-term debt while increasing almost the exact amount of short-term debt. Its debt-to-equity at 3.2x and debt-to-EBITDA ratio at 4.67x are very high compared to other software companies. Certainly, this is a dramatic improvement compared to the debt-to-equity ratio of 18.84x in Q4 FY2022. But it is mostly due to higher total equity rather than crushing down the debt. Although this ratio is in the ballpark with what it was in 2021 and 2020, the difference is back in ’20 and ’21, it had a higher long-term debt with minuscule short-term debt. This ratio is probably higher than about 98% of the companies in the software industry. With more of the obligations being pulled forward, this is not helpful for its future cash flow, which is likely to underperform as a result.

panw (panw)

It almost feels like Palo Alto Networks is leveraging its recent strong operating cash flow to fund its investment portfolio. It could be a bullish bet on the corporate bond market or it is a measure to shore up its ability to fulfill the short-term debt obligations without impacting its free cash flow as much. The corporate bonds market could provide a higher yield as a fixed-income portfolio.

Opportunities, Challenges, and Competitions

Palo Alto Networks’ willingness to use acquisitions to strengthen its ability has been as strong as ever. It has used 17 acquisitions totaling about $4 billion spending to form its Cortex and Prisma Cloud business. The company shows its focus on delivering integrated organic growth through M&As and partnerships with several legendary start-ups Over and again, the company has shown its ability to integrate these acquisitions to enhance or complement its own product capability.

Underneath the surface, there are bubbling activities through incoming acquisitions through M&As and partnerships and ongoing spun-offs from former employees. The graph below shows some of its notable alumni-founded start-ups.

Palo Alto Networks Alumni Spin-offs (rakgarg@substack)

Therefore, to stay ahead of the curve, the company is savvy in using both home-grown and acquisitions to make technological advances and stay competitive.

panw (panw)

and with this much investment sitting on bonds as we alluded to earlier, the company is likely bidding time to scoop up valuable companies when stocks sell off. It is likely to liquidate some of its fixed-income investments to make another acquisition. The areas in which it will try to acquire a technological edge most likely involve AI and deep learning, which currently have applications in network security and advanced threat prevention. The latter is where Palo Alto Networks constantly needs to defend by iterating and improving, given increasingly sophisticated cyberattacks from at home and overseas. Should a bargaining deal emerge, it won’t miss the chance. However, we don’t think the company will be able to pull a large deal without first bringing down its short-term debt profile first.

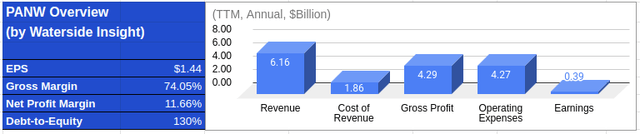

Financial Overview

panw (panw)

Valuation

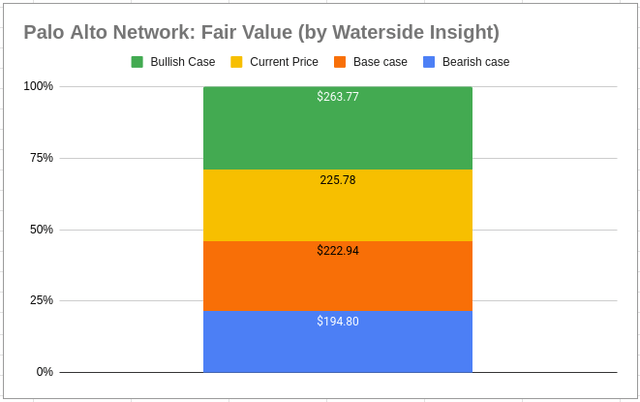

In summary, Palo Alto Network’s business has a profile of high growth, strong cash flow, lower earnings, and mixed with high debt/leverage. Based on all our analysis above, we use our proprietary models to assess its fair value with a ten-year projection ahead. In our base case, the company has strong growth in FY2023 but is followed by a dip in the next, with its long-term growth steady; it is priced at $220.66. In the bullish case, it continues to generate substantially high cash flow even accounting for the debt obligation, so its near-term growth becomes stronger than the base case; it is valued at $243.26. In the bearish case, debt payment erosion to the cash flow compounded by slower sales pace, its near-term growth reverting back to the historical norm; it was priced at $189.75. The current market price is almost right at the base case scenario.

panw (panw)

Conclusion

In summary, we give full credit to Palo Alto Networks’ organic topline growth under active acquisition efforts. However, its debt profile will prove to be a constraint for its near-term growth acceleration while its investment portfolio could be a vulnerability during financial market swings. The sales acquisition costs are currently sustainable but it is a cost that is hard to cut down. We see its price to be fair at the moment and recommend a hold.

Read the full article here

Leave a Reply