Palo Alto Networks, Inc. (NASDAQ:PANW) showcased a commendable financial performance in Fiscal Year 2023, registering impressive revenue growth year-over-year. The company witnessed a notable surge in its operating margin and recorded a significant rise in its non-GAAP EPS, outperforming its initial guidance targets for the fiscal year. The company will disclose Q1 2024 earnings on November 16, 2023, which might influence the subsequent price trajectory. This piece offers a technical perspective on PANW’s stock value to discern its future direction and uncover investment possibilities. Notably, while the stock demonstrates a prolonged bullish inclination, it faces notable resistance.

Financial Outlook

PANW showcased a stellar financial performance in fiscal year 2023. The company registered a commendable total revenue of $1.95 billion, reflecting a 26% growth compared to the previous year. The operating margin, on a non-GAAP basis, stood at 28.4%, experiencing a significant boost of 760 basis points year-over-year. Total billings amounted to $3.16 billion, an 18% increase over the previous year. The adjusted free cash flow, on the same non-GAAP basis, was reported at $388 million, up by 46% on a trailing 12-month basis. In addition, the company’s remaining performance obligation rose by 30% to $10.6 million year-over-year. Moreover, non-GAAP EPS reached $1.44, indicating an exceptional 80% surge from the previous year.

In terms of customer expansion, PANW has seen significant growth. From a base of around 9,000 enterprise customers at the end of fiscal 2012, the number has skyrocketed to over 80,000. This growth in the customer base coincides with the company turning consistently profitable on a GAAP basis for the past five consecutive quarters, primarily attributed to the containment of stock-based compensation expenses.

Originating from a next-generation firewall (NGFW) product, the company expanded its horizons, creating the Strata suite focusing on on-premise network security tools. As part of its growth strategy, it introduced Prisma for cloud-based security services and Cortex for AI-driven threat detection. Competing against newer entrants like CrowdStrike and SentinelOne, PANW managed to stay ahead with significant investments and acquisitions. As a testament to their expansion efforts, the company’s next-generation security services, encompassing Prisma and Cortex, contributed 43% to its annual recurring revenue (ARR) by the close of fiscal 2023, a leap from 34% the previous fiscal year.

Moreover, PANW unveiled its Prisma® Cloud Darwin release, introducing the industry’s premier integrated Code to Cloud™ intelligence. This innovative feature aims to streamline cloud security and enhance collaboration among developers, operations, and security teams by providing a unified source for risk assessment related to application development. This integration facilitates easy risk detection and mitigation across code, infrastructure, and runtime environments. Addressing the current challenge, where 80% of security exposures are found in cloud environments, Prisma Cloud’s solution seeks to counteract the mounting threats in cloud application development, which have been accelerating faster than security teams can manage. This release addresses the increasing need for comprehensive security solutions in a rapidly evolving cloud-focused landscape, potentially enhancing the company’s profitability.

For Q1 2024, PANW projects a robust financial outlook, with total billings anticipated to remain between $2.05 billion and $2.08 billion, signifying a significant year-over-year growth ranging from 17% to 19%. The total revenue for the quarter is estimated to be between $1.82 billion and $1.85 billion, marking a year-over-year increase of 16% to 18%. Furthermore, the diluted non-GAAP net income per share is projected to land within the bracket of $1.15 to $1.17, showcasing a remarkable year-over-year surge of 39% to 41%.

Moreover, for fiscal year 2024, the company’s expectations are equally optimistic. Total billings are forecasted to span from $10.9 billion to $11.0 billion, reflecting a year-over-year augmentation of 19% to 20%. The revenue projection stands at a range of $8.15 billion to $8.20 billion, indicating an 18% to 19% growth compared to the previous year. Diluted non-GAAP net income per share is estimated to range from $5.27 to $5.40, translating to a year-over-year growth of 19% to 22%. Finally, the adjusted free cash flow margin is expected to be between 37% and 38%.

Technical Outlook

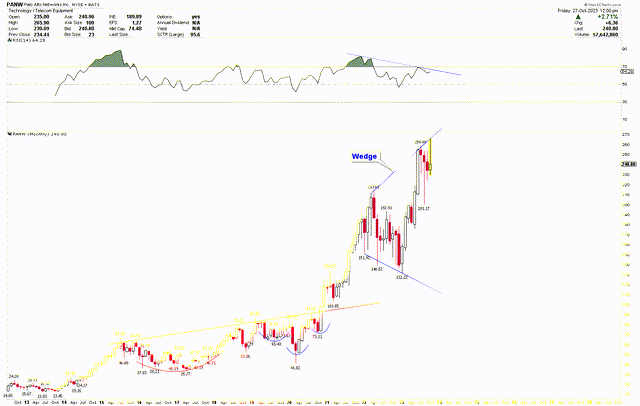

The technical outlook for PANW over the long run appears strongly bullish, as illustrated by the monthly chart below. This optimism is underscored by a pronounced bullish foundation established between 2016 and 2020, comprised of a rounding bottom and an inverted head and shoulders pattern. A red arc delineates the rounding bottom, while blue arcs outline the inverted head and shoulders. The trend line from 2015 to 2020, breached in 2020 at around $91, represents the neckline of these patterns. This foundational setup prompted a significant rally in PANW’s stock. The inverted head and shoulders pattern has the head at $41.82 and shoulders at $65.43 and $73.11.

PANW Monthly Chart (stockcharts.com)

Throughout 2020 and 2021, PANW saw its stock price skyrocket, primarily driven by a heightened demand for cybersecurity tools. The COVID-19 pandemic magnified this surge as businesses worldwide transitioned to remote work, emphasizing the necessity for resilient cybersecurity measures. As a frontrunner in the cybersecurity domain, PANW swiftly responded by launching state-of-the-art solutions in alignment with evolving cyber threats. Moreover, strategic takeovers and the expansion of cloud services strengthened the market stance, leading to heightened investor trust and a subsequent rise in stock price.

This strong rally has carved out distinct bullish price patterns, notably the wedge formation. This wedge became discernible on the monthly chart from 2020, signaling a bullish sentiment. As of October 2023, the stock price is being corrected after confronting the wedge’s resistance. The RSI is correcting from overbought scenarios, indicating potential price adjustments. Yet, the overarching technical scenario remains strong, grounded in the rounding bottom, inverted head and shoulders, and the emerging symmetrical broadening wedge. A breakout from this wedge is necessary to reach higher levels.

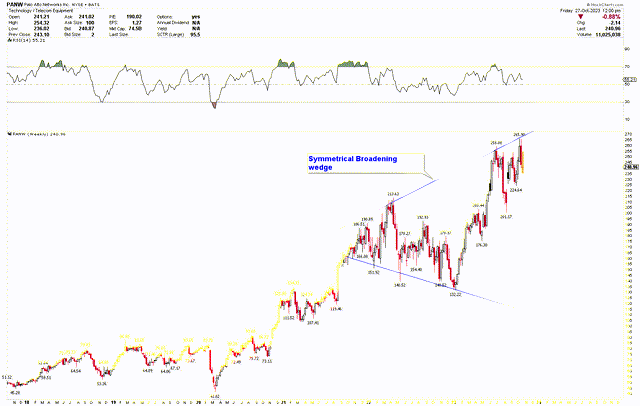

Delving deeper into the weekly chart, a detailed view of the symmetrical broadening wedge emerges. When observed against a rising trend background, this pattern indicates a possible upward momentum. However, if there’s a correction from the resistance level, it could present a golden opportunity for investors. For investing, it’s recommended to wait for this downward adjustment. If the price drops further, it might present an opportune time to acquire more PANW shares. The stock has a substantial support range between $180-$200, which could be an ideal zone for those looking to expand their holdings in PANW.

PANW Weekly Chart (stockcharts.com)

From the above discussion, it’s evident that the long-term trajectory is positive. However, the price is now facing significant resistance and may be due for a correction. Should the stock price surpass $260, it’s likely to drive further upward momentum, potentially triggering the subsequent notable increase in value.

Market Risk

PANW has witnessed rapid appreciation in its stock price over the past few years, driven by its commendable financial performance and a positive technical outlook. However, such a meteoric rise often invites scrutiny regarding overvaluation. If the market begins to perceive PANW’s stock as overbought, even minor setbacks in its quarterly results or future guidance could trigger a substantial correction in the stock price. Furthermore, the technical analysis points towards a correction as the stock recently confronted the resistance of a wedge. Any deeper pullback than expected could lead to a prolonged period of price consolidation or even a downturn.

The cybersecurity sector is characterized by intense competition, with giants like Cisco Systems, Inc. (CSCO), Fortinet, Inc. (FTNT), and Check Point Software Technologies Ltd. (CHKP) battling for market dominance. Any innovation or strategic alliances by these competitors could undermine PANW’s market position. Moreover, PANW’s growth trajectory and the lofty expectations associated with it make flawless execution imperative. Any misstep or deviation from its strategic roadmap could lead to growth deceleration, possibly affecting investor sentiment. The rapid evolution of technology also demands that PANW remain vigilant and adaptive; any inability to keep pace with emerging threats and provide practical solutions can erode its customer base and market share.

Economic downturns present a significant threat, as businesses, to manage costs, might curtail IT and cybersecurity expenditures, thereby impacting PANW’s revenue streams. With aggressive growth projections, PANW’s success hinges on the sustained demand for cybersecurity solutions. A dip in this demand or an inability to penetrate new markets could jeopardize its revenue prospects.

Bottom Line

In Fiscal Year 2023, PANW delivered a stellar financial performance, surpassing many of its initial guidance targets and showcasing robust revenue growth. With an impressive record, PANW capitalized on the increasing global demand for cybersecurity tools, particularly as businesses adapted to the remote work environment due to the pandemic. Technically, the company’s stock has established a bullish, solid foundation over the years and exhibits an encouraging long-term outlook, supported by prominent patterns of rounding bottom and inverted head and shoulders. The robust foundational patterns, followed by significant price surges, have maintained a consistent long-term bullish trend. Nevertheless, the current price has entered overbought territory and is now facing the formidable resistance of the wedge. This pronounced resistance suggests a potential price correction before its next upward move. Investors can join the market during the upcoming dip, estimated between $180 to $200. Should the price breach $260, it would counteract the expectation of a pullback, propelling a solid rally.

Read the full article here

Leave a Reply