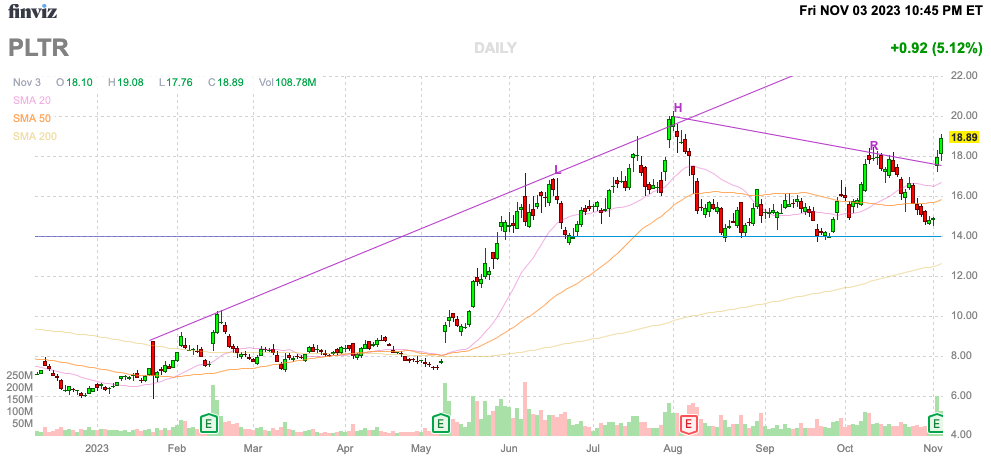

Palantir Technologies (NYSE:PLTR) clearly has a strong future in enterprise AI software. The major question is why investors are so eager to overpay for the hype and not the actual business model. My investment thesis turns more Bearish on the stock preferring to only acquire shares at a much lower price.

Source: Finviz

Not Messi Impressive

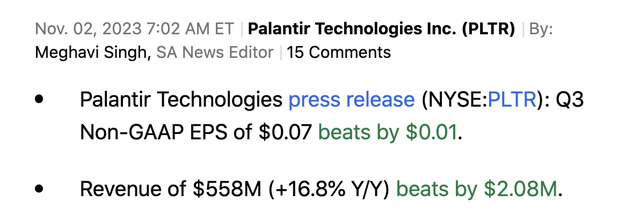

Back on November 2, Palantir reported a solid quarter where the company beat consensus estimates:

Source: Seeking Alpha

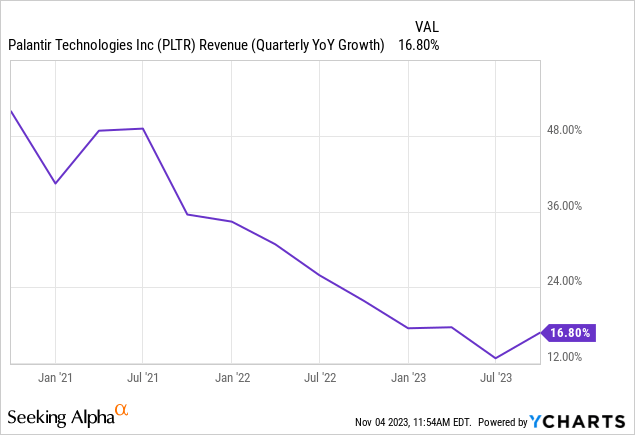

Most importantly, the enterprise software company reversed a downtrend in the growth rate. Palantir had seen revenue growth decelerate to only 12.8% in Q2 and the growth rate jumped back up to 16.8% in the September quarter.

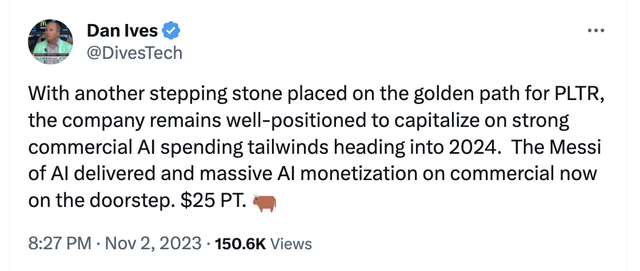

While Palantir is a great company, investors aren’t helped when the stock is hyped up due to AI. Wedbush analyst called the enterprise software company the Messi of AI, alluding to the business that only grew 12% in the prior quarter as equal to one of the greatest soccer players of all time.

Source: Dan Ives Twitter/X account

For such a great company, Dan Ives only slapped a $25 target on the stock. Palantir rallied to nearly $19 to close the week implying ~32% upside in the stock.

Not only did Palantir just report 16% growth, but also only guided to Q4’23 for revenues of $599 to $603 million, implying just 18% growth. These growth rates are hardly software industry leading.

If any AI company is the Messi of AI that would be Nvidia (NVDA) with revenues soaring. The AI chip company reported FQ2’24 revenues soared over 100% to $13.5 billion and guided to FQ3 revenues of $16.0 billion for massive 170% growth.

The Palantir growth rates appear rather pedestrian compared to the numbers of Nvidia.

Focus On A Reasonable Price

Palantir jumped following the solid quarter, but the stock is already ahead of the actual numbers. Investors need to focus on paying a reasonable price for the stock in order to generate strong returns over the long term.

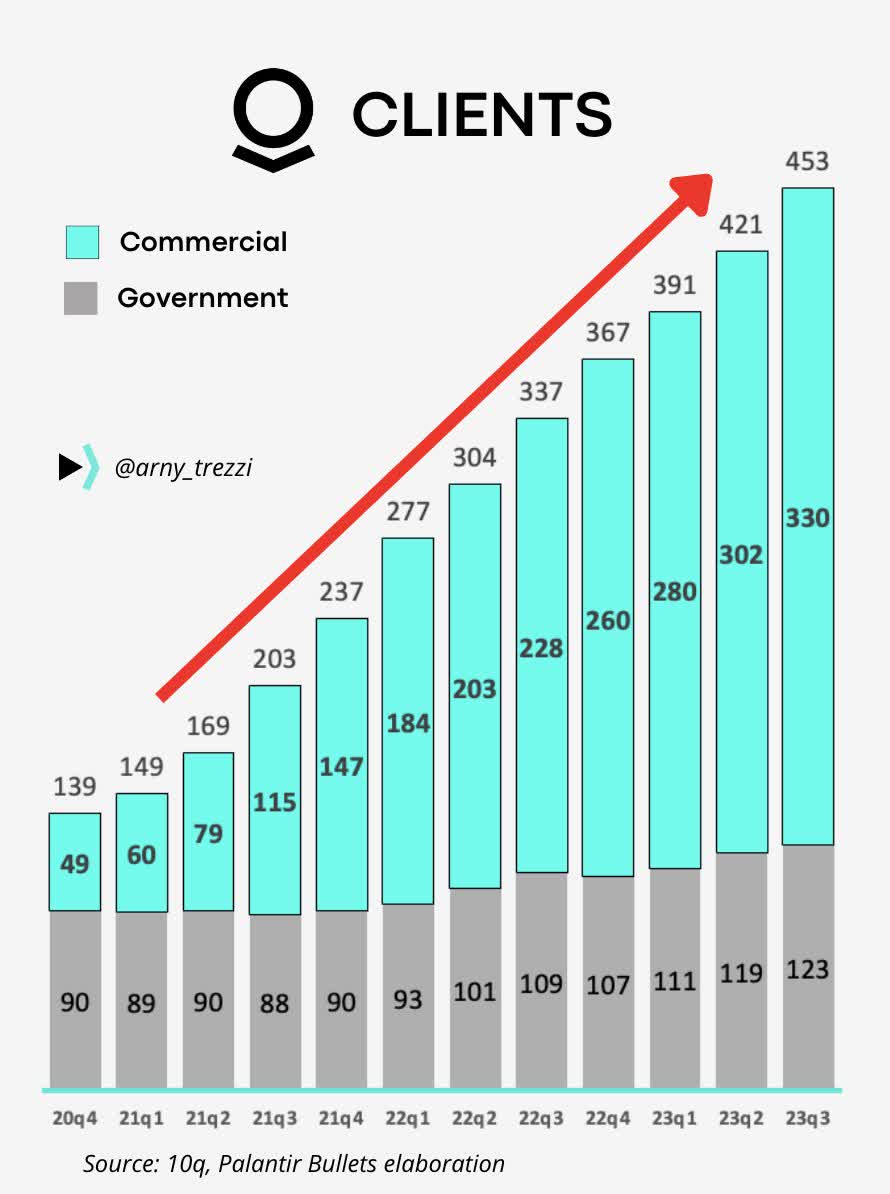

The enterprise AI software company is seeing huge demand from commercial customers while the government side of the business isn’t moving as fast. Palantir claims 330 commercial customers for 45% growth YoY while the government business only added 14 new customers in the year.

Source: @arny_trezzi on Twitter/X

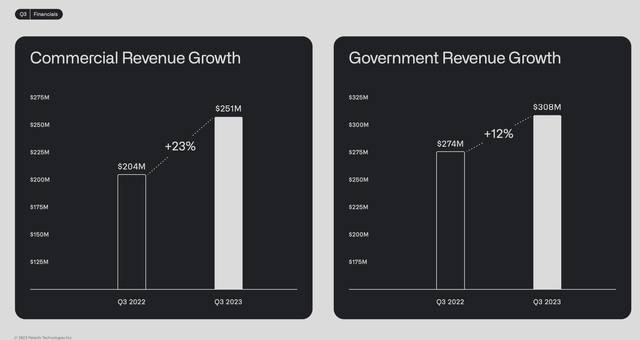

The company is still tilted towards the government segment with Q32’3 revenues of $308 million for only 12% growth. The commercial segment has much more impressive growth at 23%, but the segment is still $57 million per quarter smaller.

Source: Palantir Q3’23 presentation

At the current growth rates, Palantir won’t reach a point where commercial revenues top government until 2025. The company even expects the US government business to reaccelerate reducing the ability of the commercial segment to top the government business and ditch the anchor on total growth rates.

The stock now has a market cap of nearly $39 billion while Palantir is only targeting revenues of $2.2 billion this year. The company has a $3.3 billion cash balance and generates positive cash flow, but the stock still has an EV topping $35 billion.

The consensus analyst estimates only predict Palantir reaches 2024 revenues of $2.6 billion or a rather pedestrian growth rate of below 19%. As great as the quarter sounded with the AI boot camps, the AI software company only slightly topped analyst estimates and the guidance for Q4 was mostly in line with expectations suggesting the targets for 2024 are solid.

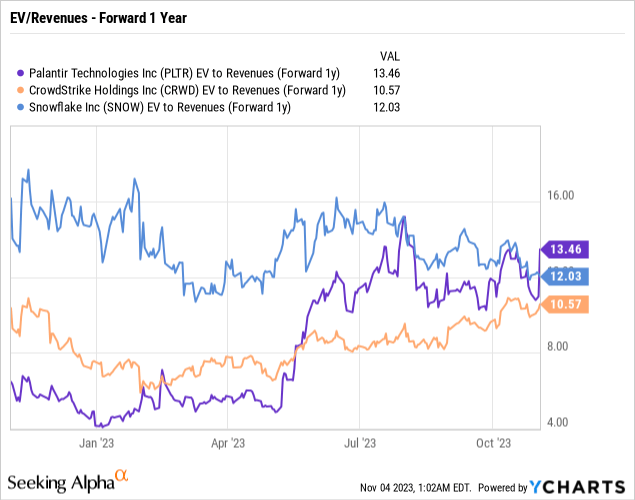

The stock is flat out expensive at over 13.5x EV/revenue targets for 2024. Both Snowflake (SNOW) and CrowdStrike Holdings (CRWD) in the enterprise software sector already have higher growth rates toping 30%, yet both stocks trade at lower forward EV/S multiples than Palantir and neither of those stocks are being compared to GOATs.

The problem is that the market is assigning a Messi type valuation to the stock while the company doesn’t actually generate the growth to warrant such a lofty multiple. Palantir would need 30%+ growth to warrant the multiples of Snowflake and CrowdStrike, much less a premium.

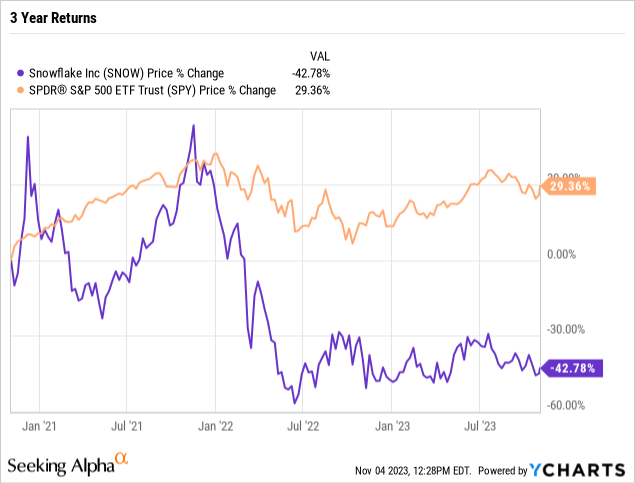

Snowflake is a prime example of what happens when investors overpay for the growth rates of a stock. The enterprise software stock has generated a nearly 43% loss over the last 3 years while printing a 35.5% sales growth rate in the July quarter. The S&P 500 is up nearly 30% during this period.

Our view that Palantir gets interesting around $10 hasn’t changed. The stock would have a market cap of $23 billion, or 10x the 2023 sales target.

The company is now GAAP profitable likely allowing an entry into the S&P 500. The stock will likely get another boost and a rally to $20+ is the opportunity to sell Palantir for an unsustainable premium.

Takeaway

The key investor takeaway is that Palantir has an impressive business opportunity in the enterprise AI market. Unfortunately though, due to the original focus on the government sector, the company doesn’t have the massive growth rates warranting a higher stock price. Even worse, Palantir continues to be hyped with Messi claims which aren’t really accurate.

Investors should use the Messi hype and the likely inclusion into the S&P 500 as an opportunity to unload Palantir at an excessive premium. Long term investors will ultimately be able to acquire shares at a lower price or at similar prices far into the future to improve annualized returns.

Read the full article here

Leave a Reply