Palantir’s AI potential evaluated by the Peter Lynch method

Peter Lynch is a talented investor on multiple fronts. In his writings (for example, One up on Wall Street and Beating the Street), he divided investable stocks into several types (ranging from fast growers to turnarounds, to stalwarts) and shared his insights on all of them. However, he is probably best known as a growth investor thanks to his extensive success cases with 10 baggers.

For many investors (this author included), our biggest gains often come from fast growers. Identifying one or two of these (assuming you have a reasonably concentrated portfolio) can often decide the long-term performance of an entire account. However, trying to catch these fast growers also entails large inherent risks. Fortunately, Lynch provided comprehensive guidelines for identifying these risks. His own track record (and my own experience of following them) shows me that following these guidelines systematically could dramatically improve our odds.

This leads me to the main thesis of today on Palantir Technologies (NYSE:PLTR). In particular, I will examine its AI’s potential following the Lynch framework. The remainder of this article will show why my final conclusion is a HOLD rating after a Lynch-style evaluation. To summarize, the stock has mixed prospects according to the following criteria Lynch developed:

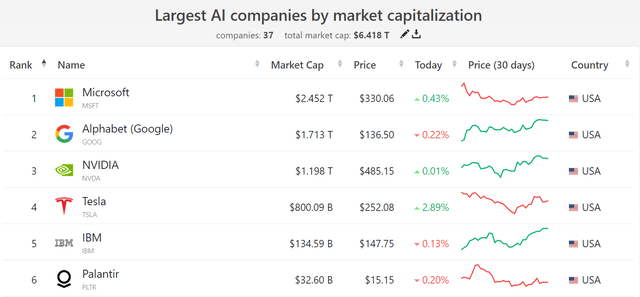

- A scale leader in a fast-growing industry. PLTR is a scale leader in the burgeoning AI sector. Better yet, PLTR is still of a relatively small size compared to other giants in this space, making its growth potential even more attractive.

- And above all else, PLTR is a stock with a good story. Lynch strongly recommends investors stick with companies with a “good story” – a story that they can understand, a story that they can see what is going to happen, and a story that they can see the possible outcomes. As to be detailed in the next section, PLTR certainly has a good story.

- Rapid growth curve ahead. For fast growers, Lynch prefers to see annual earnings growth at 20% or above. This is the first place where the stock sends a mixed signal as to be detailed in the next section.

- Finally, a reasonable valuation. Ultimately, I view Lynch as a GARP (growth at a reasonable price) investor. I never recall him advocating the “purse-growth-at-any-price” strategy, a motto for many growth investors (a very dangerous motto in my view). Instead, each of his major investments was guided by a firm valuation principle. The Lynch PEG ratio (P/E multiple divided by growth rate) has become a routine vocabulary now. The essence is that, instead of looking at P/E (which can be very high for fast growers), we should also look at PEG. A PEG ratio of 1x signals reasonable valuation even if the P/E is higher. This is the second place where PLTR sends out a mixed signal.

An AI leader with a good story

The stock is a leader in the AI space and very likely a big winner too in my view. As seen in the first chart below, PLTR is ranked as the 6th largest AI company by market cap, right after IBM. Better yet, PLTR is not too big either (compared to giants like Microsoft and Google), adding more appeal for growth investors trying to catch 10 baggers at an early stage.

The company has a good story to tell (at least for investors with a working knowledge of IT technology, like myself). Full disclosure, I am not an AI expert (my specialty is in high-tech R&D related to new energy and large-scale computation). Yet, I find its story easy to follow and makes good sense. I have firsthand experience of how cumbersome and “labor-intensive” it can be to gather, organize, and analyze large amounts of data. The ever-increasing amount of “inhomogeneous data” further compounds these challenges – data consisting of numbers, tables, texts, and images (this article itself is a good example). Palantir’s Artificial Intelligence Platform (“AIP”) is designed precisely to address these issues. AIP aims to integrate outside large language models (“LLMs”), like OpenAI’s GPT-4 and Google’s BERT, so that customers can process their data more efficiently and cheaply. The addressable market is huge. Both commercial and government organizations can benefit from training LLMs in their private data without having to share their private data.

Source: companiesmarketcap.com

AI growth potential uncertain

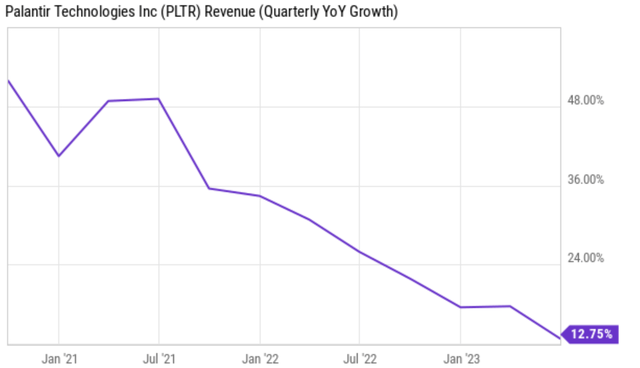

As aforementioned, for fast growers, Lynch prefers annual growth of 20% or above. This is the first place where I see mixed signals.

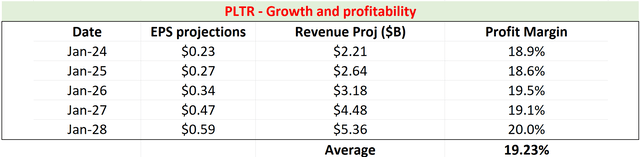

Looking ahead, consensus estimates are projecting such a growth rate ahead. Revenues are projected to grow from $2.21B in 2024 to about $5.3bB in 2028 (as seen in the first table below). Such forecasts translate into an annual growth rate of 19.2%, exactly the type of growth Lynch describes. Furthermore, the consensus estimates of its profit growth (i.e., EPS growth) is also about 20% for the next 5 years.

Source: Author based on Seeking Alpha data

The mixed signal came to me in two ways. First, the company’s past growth rates do not support such a projection. As seen in the second chart below, the company experienced superb growth in its earlier days with ~50% YoY revenue growth. However, the growth rates have been decreasing as it grows. The current growth rate based on its most recent quarterly results is only 12.7%, a far cry from the 20% forecast.

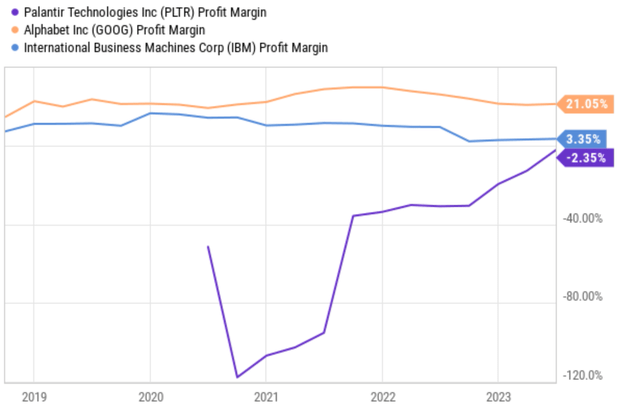

Secondly and more importantly, I view the consensus estimates as an overestimate of its profitability. Based on the consensus estimates of EPS and revenue cited above, the 4th column of my above table shows the implied profit margin for the next 5 years. As seen, consensus implies a stable profit margin of around 19% starting next year. I view such a projection as overly optimistic. For one, the business has not made a profit yet and its margin has been negative so far (see the second chart below). And secondly and more fundamentally, I think the consensus estimates are overestimating its profitability and pricing power. The company (and the industry too) have been reporting substantial increases in personnel salaries and operation costs lately. And I won’t be surprised to see such high costs persist given the elevated inflation and tight job market. In the meantime, competition will only get more intensified in this space with all the heavyweights (such as Microsoft, Google, et al) aggressively cranking up their investment in this area.

Source: Seeking Alpha data

Source: Seeking Alpha data

Valuation risks and final thoughts

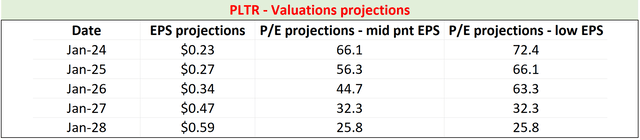

Even if the business manages to grow at 20% per year and achieve a 19% net profit margin, its PEG valuation would still be substantially higher than the 1x threshold for an ideal Lynch pick. As seen in the chart below, at its current price, its FY5 P/E would be still about 26x even assuming 5 years of continuous growth at the projected rates, implying a PEG ratio of ~1.3x.

Source: Author based on Seeking Alpha data

To recap, I am seeing mixed signals in PLTR, especially regarding its AI potential. The stock has some obvious positives as a potential 10 bagger. It is a strong contender in the fast-growing AI industry. Better yet, its relatively small size ($32B market cap compared to Microsoft’s $2.4T) adds more to its growth potential. PLTR tells a good story that can address real pain points in a huge potential market. However, the negatives are also substantial in my view. The growth projection from the consensus estimate is overly optimistic in my view. And more fundamentally, the consensus projection implies even more optimistic expectations of its profit margin and pricing power. These expectations severely underestimate the risks of competition and cost escalation, in my view.

Read the full article here

Leave a Reply