Intel Corporation (NASDAQ:INTC) was announced as our top investment recommendation for 2023 at the start of the year. Since that article was written, the company has had a total return of more than 70%, versus the S&P 500 (SP500), which returned just over 20%. As we’ll see throughout this article, despite tripling the market, we expect Intel to continue performing.

Intel Executive Overview

Intel has a strong Q3, beating on revenue and margins, as the company’s recovery continues.

Intel Investor Presentation

However, more important than that strong quarter is the company’s continued progression on its technology leadership. The company is continuing to target its 5 nodes in 4 years target, with innovation in both packaging technology and EUV production. The company’s next goal is to progress on its Intel18A, a node where it hopes to be competitive with Taiwan Semiconductor aka TSMC (TSM).

Intel Financial Performance

Financially, the company earned $14.2 billion in revenue, down 8% YoY.

Intel Investor Presentation

However, it’s still $0.8 billion above the company’s July outlook. The company has been impacted by growing demand from the impact of artificial intelligence. Its higher revenue came with a 45.8% gross margin, flat YoY, and a massive 2.8% above the company’s July outlook. Lastly, the company’s EPS was more than double its July outlook.

In fact, the company’s $0.41 EPS, was up a massive 11% YoY. The company’s annualized EPS puts the company at a P/E of around 25. That financial performance, will enable the company to return to long-term shareholder returns.

Intel Guidance

The company’s guidance for the last quarter of the year shows its continued strength.

Intel Investor Presentation

The company is expecting roughly $15 billion in revenue, showing the worst is over, with a 8% YoY increase. Additionally, the company is expecting a 46.5% gross margin (up 2.7% YoY). Putting that all together, and the worst seems behind it for the company, with $0.44 EPS, almost tripling YoY. That’s incredibly strong recovery.

The company’s EPS, despite its strong share price performance, gives it a P/E of 25, a relatively low valuation, that shows continued potential.

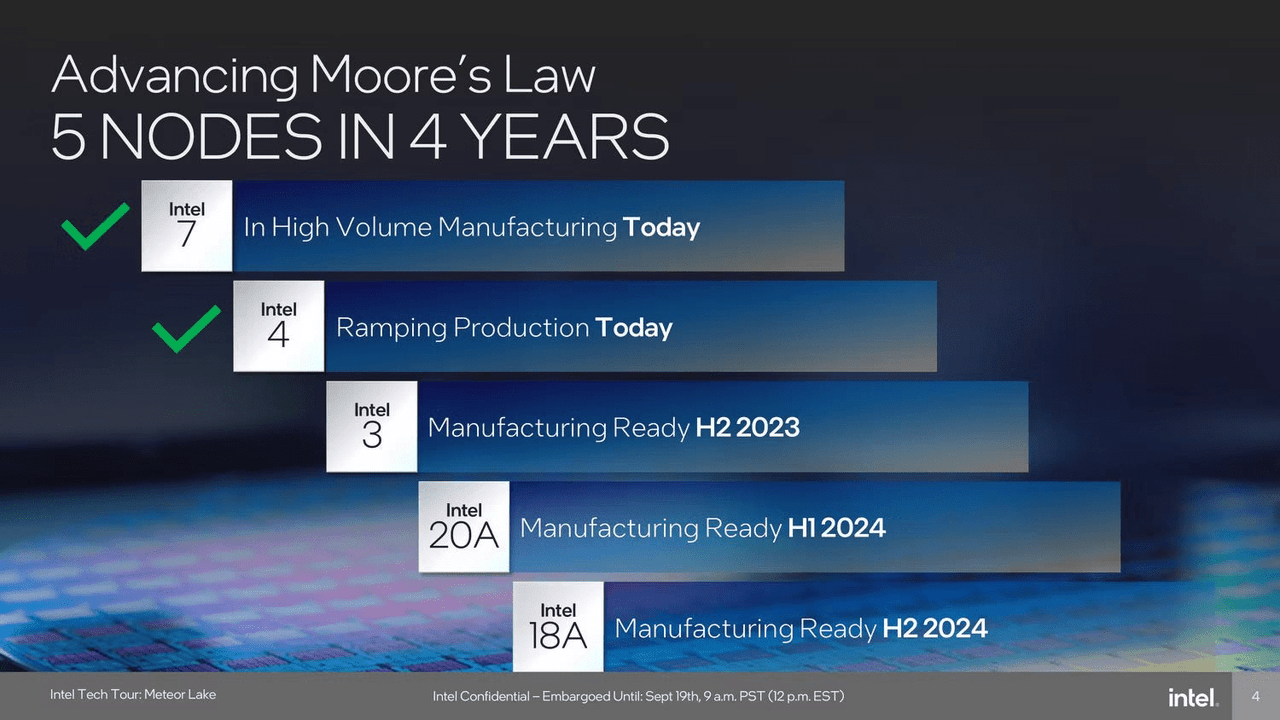

Intel 5 Nodes In 4 Years

The largest announcement by the company is its goal for 5 nodes in 4 years.

Intel Investor Presentation

The company’s goal for 4 nodes in 5 years was a rapid target, based on its prior learnings, that would enable the company to catch up with TSMC. The company has adjusted its naming to roughly match TSMC, and TSMC’s 2 nm is expected to launch approximately 2H 2025. That means if Intel accomplishes its goals, it should manage to defeat the company.

Intel has begun high volume Intel 4 production, and the Meteor Lake CPUs are out.

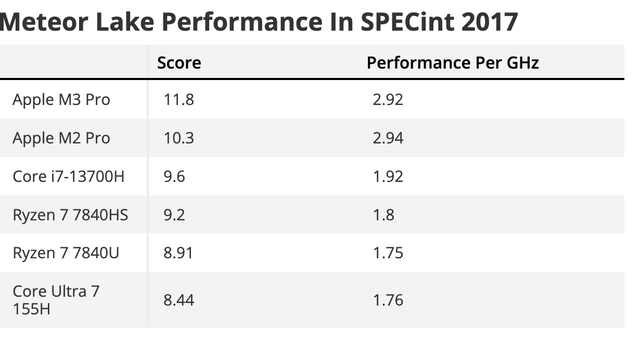

Meteor Lake

However, the CPU still has some performance gaps. It’s key that Intel makes sure that simply hitting its next node and naming it as such doesn’t cause the company to miss out on performance gains and make prior mistakes. The company is also using TSMC for manufacturing some tiles on these processors, and only using Intel 4 partially indicating the process isn’t fully there.

The real question is whether the company can hit is Arrow Lake CPUs on 20A node, the node that will move the company to parity with TSMC. The company has allegedly started shipping CPUs to customers, and it has big improvements, such as the company’s movement to RibbonFETs. This will be combined with backside power delivery (PowerVia).

Two major technologies at once with a node size shrink is incredibly complex, and it will be key to the company’s success whether it can roll this out.

Thesis Risk

The largest risk to our thesis is whether or not the company can hit its shipping targets. That 20A node we discussed above is incredibly complex, a node jump with complex technologies. The company will need to pull this off in 2024, which is the culmination of several years of hard work. Should it fail, its share price might drop back down.

Conclusion

Should it succeed, its foundry and other services could come roaring back. Intel has worked to dramatically improve its financials and had a strong recent quarter. The company’s expertise also came into demand as the growth of artificial intelligence has increased the demand for all sorts of servers. Going into the end of the 2023, the company expects that performances and financials recovered.

Chip making is incredibly expensive financially. It requires massive investment. As a result, Intel Corporation profits are heavily dependent on revenues, which will support its margins. A small drop in revenue can lead to a much faster drop in profits. If the company can manage to succeed into 2024, it is a long-term valuable investment. We expect it’ll deliver.

Read the full article here

Leave a Reply