Summary

OTIS Worldwide Corporation (NYSE:OTIS) stands as a global titan in the elevator and escalator industry. With a legacy spanning over a century, OTIS specializes in designing, manufacturing, and servicing a wide range of vertical transportation solutions. Its presence extends to over 200 countries, underscoring its commitment to innovation, safety, and top-tier customer service. As urban landscapes evolve, OTIS continues to be an essential player, powering mobility in cities worldwide and reinforcing its position at the pinnacle of its sector.

In the latest quarter, OTIS showcased robust organic growth in new equipment [NE] sales, although there was a notable decrease in NE orders compared to the previous year. This prompted the management to lower expectations for most key markets, particularly China, which now has a more pessimistic outlook. However, the Asia Pacific region remains an exception, continuing to show potential for growth. Encouragingly, the global pricing for new equipment orders is on the rise, and there’s a general sense of optimism regarding future growth from the management. The service and repair sectors have also demonstrated significant growth, though a slowdown is anticipated in the latter half of the year. Regardless of these mixed signals, management remains bullish about growth in 2023, indicating an uptick in revenue compared to the decline observed in the prior year. However, due to a lack of margin of safety given that my target share price is close to its fair value which derived from management’s guidance, I recommend a hold rating.

Financials / Valuation

OTIS’s revenue from 2017 to 2022 has grown at a compounded annual rate of approximately 2%. The 4% revenue dip in 2022 can be attributed to challenging comparisons with 2021’s figures, which were bolstered by the reopening of major economies post-COVID lockdowns, leading to a surge in demand for vertical transportation. In the coming years, I anticipate that the year-over-year revenue growth will closely mirror its historical CAGR. This aligns with management’s guidance, which projects full-year 2023 revenue to be between 14 and 14.3 billion, signifying a growth of 3-5.5%. Factors influencing this projection include the normalization of the anomalous impacts of COVID, which has mitigated the challenges of tough year-over-year comparisons, and the strong organic growth in NE sales, underpinned by strong pricing growth. In terms of EBITDA margins, OTIS has consistently held it at 18%, showcasing its proficiency in cost management regardless of sales volatility. In their most recent announcement, OTIS introduced the UpLift program aimed at enhancing their operating efficiency and generating cost savings. Given these factors, I anticipate that they will sustain these margins in the future. This outlook aligns with management’s projections, forecasting operating margins of 15.9%, up from the current quarter’s 15.6%.

Valuation

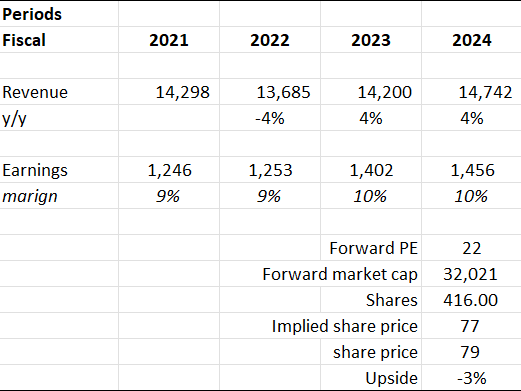

Based on my view on the business, I anticipate a 4% growth in its revenue for the next 2 years, which aligns with the management guidance for 2023. This projection is influenced by its rising global prices for new equipment orders. Management is hopeful, expecting some growth in the Americas and EMEA and a small increase in Asia. Even though NE sales have grown, orders are down. However, the strong growth in services and repairs helps balance things out. Given these dynamics, management remains optimistic about 2023 net sales, even in the face of waning orders.

Based on author’s own math

Given the competitive nature of the elevator and escalator industry, net profitability might be crucial as both companies have net margins lower than 10%. P/E, focusing on net earnings, could provide clearer insights into which company manages to retain more profit from its operations.

As of now, OTIS forward P/E stands at 22x, surpassing its peers like Kone (OTCPK:KNYJF) which have a forward P/E of 19.5x. This higher multiple can be attributed to OTIS higher margins in comparison to its peers. OTIS boasts an net margin of 9.6%, higher than the peer of 7.4%. Moreover, OTIS generates a higher Last Twelve Months [LTM] revenue of 13.8 billion vs peer of 11.8 billion. Therefore, I believe its higher valuation is fair.

Based on OTIS’s current forward P/E, my target price is $77. Given that there’s no margin of safety and the company is facing challenges in NE orders, leading the management to adjust the market forecast downwards, I recommend a hold rating on the stock.

Comments

NE sales performed well this quarter, seeing a 9.5% organic growth across all regions. However, NE orders took a hit this quarter, dropping by 12%. This decline contrasts sharply with the 16.5% rise from the same time last year. Management has revised its market outlook downwards for EMEA, the Americas, and China. Only the Asia Pacific region, primarily due to India’s contribution, is expected to continue its mid-single-digit growth. EMEA’s market is now predicted to decline at a high-single-digit rate in 2023, with Northern Europe’s customer weak spending decision being a significant factor. The situation in the Americas has deteriorated over recent months, anticipating a similar high-single-digit decrease, predominantly due to the multifamily residential sector’s decline. China’s market expectations have also been adjusted, now anticipating a 10% decline, a pessimistic shift from the previous 5-10% drop prediction. On the pricing front, global price for new equipment orders have slightly increased, except for China, which saw a minor decrease due to deflationary pressure. Nevertheless, the company remains optimistic about its organic sales growth outlook, expecting mid-single-digit growth in the Americas and EMEA and a slight increase in Asia.

The growth in services remains robust, but there’s anticipation of a decline as repair activities return to normal. The quarter witnessed an impressive 9.4% increase in organic service sales with growth recorded across all regions. Maintenance and repair surged due to an unexpected volume of repairs. Meanwhile, the number of portfolio units in the company’s roster expanded by 4.2%, and the company achieved a 4% increase in like-for-like pricing. Modernization activities also had a significant uptick, registering a 10.9% growth this quarter. China consistently showcased growth, with its portfolio increasing in the double digits for the eighth consecutive quarter. The repair segment has been performing notably well for the past six to eight quarters, with a noticeable surge in the first half of 2023.

For the upcoming quarters, I am optimistic about its sales growth. Amidst these challenges, its robust service segment and global pricing keeps them positioned for the future. Management guidance is in line with my expectation as they guided 2023 net sales to be 14.0 to $14.3 billion. It represents a grow of ~3% vs 2022’s negative 4.3%. This shows that management is confident in its outlook.

Risk & conclusion

A key downside risk for the company is the declining trend in NE orders, particularly the sharp drop this quarter. Coupled with downward revisions in market outlook for key regions, there’s potential for a greater impact on revenue and profitability. Specifically, the anticipated high-single-digit market decline in EMEA and the Americas, along with China’s adjusted market contraction, could have material consequences. While the services sector’s resilience offers a buffer, the expected slowdown in organic growth in the latter half of 2023 does not help in these challenges. Moreover, the reliance on the Asia Pacific, primarily India, for continued growth can be precarious if that market faces unforeseen disruptions. The adjustments in China’s pricing due to market difficulties further highlight the potential vulnerabilities.

In summary, this quarter saw a commendable rise in NE sales, contrasting sharply with a decline in NE orders compared to the same period last year. This shift has led management to adjust their market expectations downwards for most major regions, with the exception being the Asia Pacific, buoyed primarily by India’s performance. The EMEA market, especially Northern Europe, is facing challenges, as is the Americas, largely due to shifts in the multifamily residential sector. Furthermore, China’s market expectations have been revised to a more pessimistic outlook. On the brighter side, the robust growth in services, along with modernization efforts and increasing global pricing, offer a counterpoint to these concerns. While there are challenges, the company remains generally optimistic about future organic sales growth. Management’s guidance for the coming year reflects a degree of confidence, suggesting resilience amidst evolving market dynamics. With a lack of margin of safety and the difficult challenges in NE orders, I recommend a hold rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply