Otis (NYSE:OTIS) emerged as a prominent elevator and escalator manufacturer following its spinoff from United Technologies in 2020. The company’s primary revenue stream comes from its service sector, which accounts for over half of its group revenue. This service division boasts significantly higher margins and exhibits stable organic growth. Otis aims for a modest low-to-mid single-digit organic growth and anticipates an annual margin expansion of 40 basis points over the medium term. However, it’s crucial to note that approximately 18.8% of Otis’s market exposure lies in China, where it faces considerable growth pressure in the immediate future. Based on my analysis, I consider the current valuation of Otis’s stock to be slightly inflated. Therefore, I recommend a “Sell” rating for the time being.

Well Balanced Portfolio

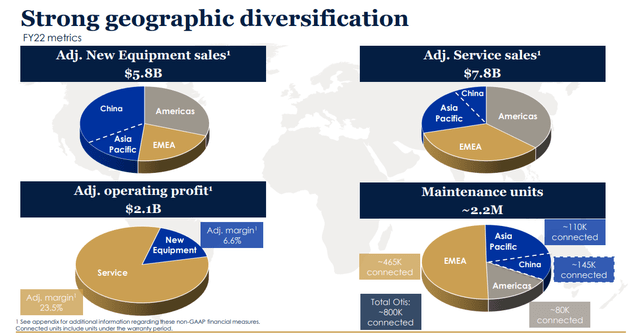

I appreciate Otis’s strategic diversification across various geographic regions and business segments, making it a truly global entity. According to data from KONE (OTCPK:KNYJF), approximately 1 million new elevators and escalators were installed in 2022. China accounted for a significant portion, contributing 60% to the total, while EMEA represented 17% and Other Asia Pacific contributed 10%. Otis has established a robust presence in these high-growth regions, positioning itself well for future opportunities.

Furthermore, Otis’s focus on services is a key strength. More than 57% of the group’s sales come from services, encompassing Maintenance and Repair as well as Modernization. This service-oriented approach provides stability, as services are generally less volatile and more dependable compared to the fluctuations often seen in new equipment sales. This focus on sticky, recurring revenue underscores the company’s resilience in the market.

Otis Investor Presentation

Resilient Service Business

Maintenance and Repair, along with Modernization, are pivotal components of Otis’s group strategy due to their ability to generate stable profits and cash flow. Notably, these services yield significantly higher margins compared to new equipment sales. Otis’s guidance for the FY23 Q2 indicates an operating margin of 24% for the service segment, in stark contrast to the expected 6.8% margin for new equipment sales.

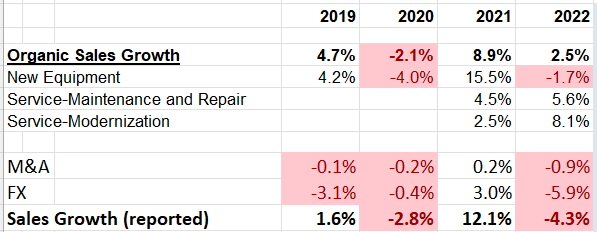

Examining historical data illustrated in the table below, Otis’s service segment has displayed consistent mid-single-digit growth, while new equipment sales have shown greater volatility. This stability in the service business makes it a reliable contributor to Otis’s overall growth. Several factors support this trend.

Firstly, Maintenance and Repair, as well as Modernization, are essential services from the customer’s perspective, not subject to significant discretionary spending. Regular professional maintenance is crucial to prolong the service life and ensure safety for elevators and escalators. Furthermore, modernization plays a pivotal role for property owners in attracting new tenants, whether residential or commercial.

Secondly, these services benefit from price growth over time. Otis, for instance, is guiding mid-single-digit service pricing growth in FY23. This consistent price growth can effectively counterbalance any labor cost inflation, resulting in increased profits for Otis. This pricing strategy aligns with the essential nature of elevator and escalator services, making them less susceptible to market fluctuations and ensuring a steady revenue stream for the company.

Otis 10Ks

Otis Medium-Term Outlook

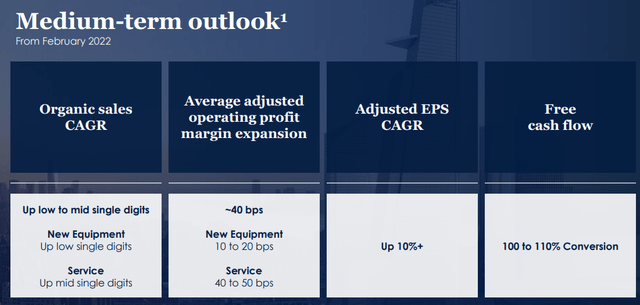

Otis’s strategic plan of targeting low-to-mid-single-digit organic revenue growth with a 40 basis points annual margin expansion appears to be grounded in realistic projections. Firstly, according to Fortune Business Insights, the global elevator and escalator market is expected to experience substantial growth. Projections indicate an increase from $88.59 billion in 2023 to $142.52 billion by 2030, reflecting a Compound Annual Growth Rate of 7.0%. This anticipated market expansion provides a favorable environment for Otis’s growth initiatives.

Secondly, the fact that the service business is growing at a faster pace than new equipment aligns with their strategy. This growth dynamic naturally enhances the revenue mix, creating a conducive environment for margin expansion over time. By focusing on services, which tend to be more stable and recurring, Otis can capitalize on this trend, leveraging their expertise and market presence to sustainably increase both revenue and margins.

In summary, Otis’s growth playbook appears to be well-founded, drawing strength from the anticipated market growth and the strategic emphasis on the service sector. These factors position Otis favorably to achieve its targeted organic growth and margin expansion goals.

Otis Investor Presentation

Sluggish Chinese Market

In Q2 FY23, Otis is anticipating a 10% decline in the Chinese market, a more significant contraction than their earlier guidance of a 5-10% decrease. Given that China contributes over 18% of Otis’s total revenue, this downturn represents a substantial challenge for the company. The management has noted a mixed performance in China, with strong momentum in April followed by a weak May. They do not anticipate a swift recovery or acceleration in the Chinese market. Consequently, Otis has factored in this weak Chinese growth into their full-year guidance.

This decline in the Chinese property market appears to be more than a momentary setback. Reports from the Financial Times indicate a continuous drop in Chinese property prices, with no direct government bailout in sight. Several major property developers, including Evergrande, one of the largest in the industry, are grappling with financial distress. The chairman of Evergrande has even been taken into custody on suspicion of alleged “illegal crimes.” This situation suggests a prolonged period of weakness in the Chinese property market, posing a significant headwind for Otis’s growth in FY24 and beyond.

However, amidst this challenging scenario, Otis’s service revenue could provide a cushion for their earnings volatility. Service businesses tend to be more resilient during economic downturns due to their essential nature, offering a stable revenue stream even in challenging market conditions. This stability in service revenue could mitigate some of the adverse effects of the sluggish Chinese market on Otis’s overall earnings. Nonetheless, it’s crucial for Otis to closely monitor the situation and adapt their strategies to navigate the evolving landscape effectively.

Recent Results

In Q2 FY23, Otis demonstrated robust performance with a 9.5% increase in organic sales year over year, accompanied by a 7% growth in adjusted EPS. Notably, new equipment orders experienced a 12% decline, indicating a challenging market for new equipment sales growth. However, there were positive aspects, such as a 4.2% rise in maintenance units and a 14% increase in modernization backlog in constant currency. These factors highlight a shift where new equipment revenue faces pressure in the near term, while the service sector continues to grow steadily.

Looking ahead to FY23, Otis has provided guidance of a 3.5%-5.5% sales growth in constant currency and reaffirmed their free cash flow projection of $1.5 to $1.55 billion. During the earnings call, Otis noted an increase in both product and commodity prices, although supply chain challenges were improving. The significant downturn in the Chinese market poses a notable concern, especially in the context of FY24 growth. If the Chinese market fails to rebound promptly, it could raise substantial apprehensions among investors.

Despite these challenges, Otis remains proactive in returning value to investors. They plan to repurchase $800 million of their own shares this year and pay dividends totaling $465 million in FY22. With a solid balance sheet and a gross debt leverage estimated at 2.1x in FY23, liquidity concerns do not appear to be an issue for Otis.

In summary, while Otis faces headwinds in the new equipment segment, the company’s strong performance in services, prudent financial management, and focus on investor returns provide a measure of stability in an uncertain market environment. However, close attention to the evolving situation in the Chinese market will be crucial for both the company and its investors in the coming fiscal year.

Key Risk

Indeed, the challenges for Otis extend beyond the Chinese market. The United States, accounting for 28% of the group revenue, presents another area of concern. In Q2 FY23, Otis’s management noted a weakening in the Americas market, projecting a high-single-digit decline in units. This decline is indicative of a broader trend where economic factors, including high interest rates, are impacting the property market.

The current high-interest rate environment in the US is unfavorable for both newly built and modernization projects. Property owners may be inclined to postpone these projects if they anticipate a potential recession or are experiencing financial difficulties. The uncertainty surrounding the economy often leads to cautious spending, affecting investments in elevator and escalator installations and upgrades.

Valuation

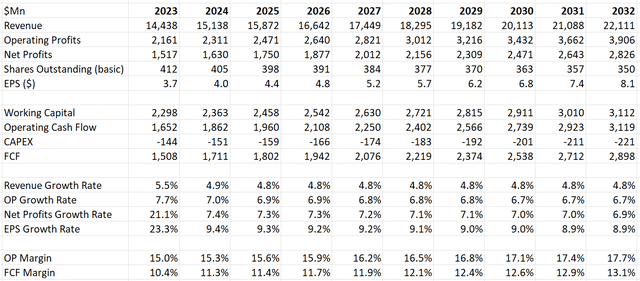

In the DCF model, I assume a 5.5% revenue growth in FY23, which is in line with their guidance and has already considered the slowdown in the Chinese market. I expect a 4.5% normalized organic revenue growth with a 30bps growth from acquisitions. These growth assumptions align with their medium-term playbook. As their service business is growing faster than their new equipment, and services carry higher margins, I anticipate their operating margin to expand by around 30bps per year, reaching 17.7% by FY32.

Otis DCF – Author’s Calculation

The model employs a 10% discount rate, a 4% terminal growth rate, and a 25% tax rate. After discounting all the free cash flow from the firm and adjusting for net debt and cash, the fair value of their stock price is calculated to be $72 per share in my model. Consequently, the stock price is slightly overvalued in this scenario.

Wrap-Up

Overall, I believe Otis is a well-managed and globally diversified business. Their strong service business adds solidity and resilience to their operations across economic cycles. However, considering the slight overvaluation of the stock price and the significant growth challenges faced in the Chinese market, I am assigning a “Sell” rating to Otis.

Read the full article here

Leave a Reply