The Oshkosh Corporation (NYSE:OSK) is an Oshkosh, Wisconsin-based multinational industrial company with operations and subsidiaries across specialty trucks, truck chassis, military vehicles, firefighting equipment, aerial lifts, etc.

Oshkosh Q3 Presentation

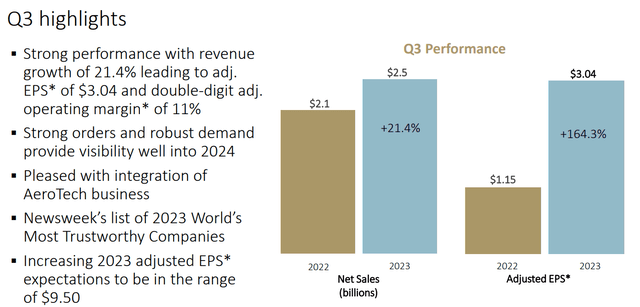

Through these activities, Oshkosh has seen strong Q3’23 earnings figures, reporting a revenue of $2.51bn- a 21.44% increase YoY- alongside a net income of $183.70mn- a 209.78% increase- and a free cash flow of $68.40mn- a 37.99% decline largely attributable to declining cash from investing activities.

Introduction

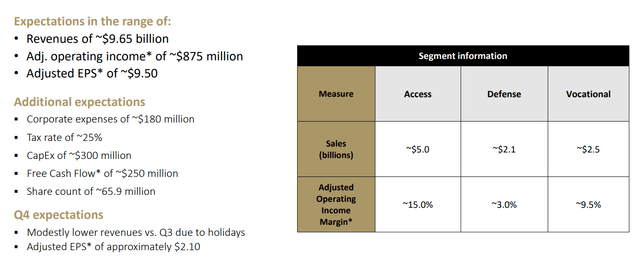

In light of scale and margin growth in the past quarter, Oshkosh has upgraded earnings expectations for the year, with a majority of segmented earnings growth driven by Oshkosh’s ‘Access’ business, which encompasses products such as tractors and telehandlers.

Oshkosh Q3 Presentation

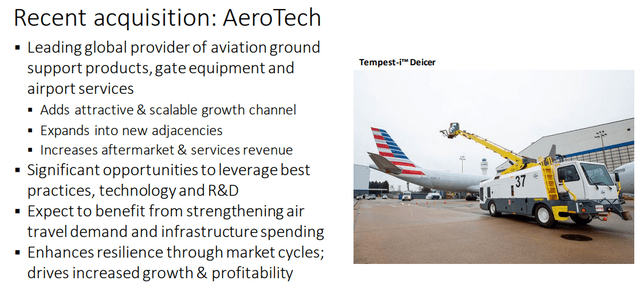

Core to Oshkosh’s continued growth remains its programmatic M&A strategy, aiming for inorganic growth driven by undervalued, synergy-producing companies with an established revenue base. Most recently, this strategy has manifested through the acquisition of Aerotech, which handles on-the-ground aviation operations- an inelastic and low-competition niche.

Oshkosh Jefferies Presentation

The combined accretive effects of Oshkosh’s strategic disposition and presence across diversified revenue streams, alongside a well-advised capital allocation strategy and a general undervaluation led me to rate the company a ‘buy’.

Valuation & Financials

Trailing Performance

In the TTM period, Oshkosh’s stock- up 0.05%- has experienced middling price action between TradingView’s Industrial Companies Index- down 2.05%- and the broader market, as represented by the S&P500 (SPY)- up 7.61% in the same time period.

Oshkosh (Dark Blue) vs Industry & Market (TradingView)

The price dynamics of Oshkosh can largely be explained through the price action of the general industrial sector, with Oshkosh and the like manufacturing products used in inelastic sectors- such as defence and agriculture- but demand being compressed by sticky interest rates and inflationary pressures.

Comparable Companies

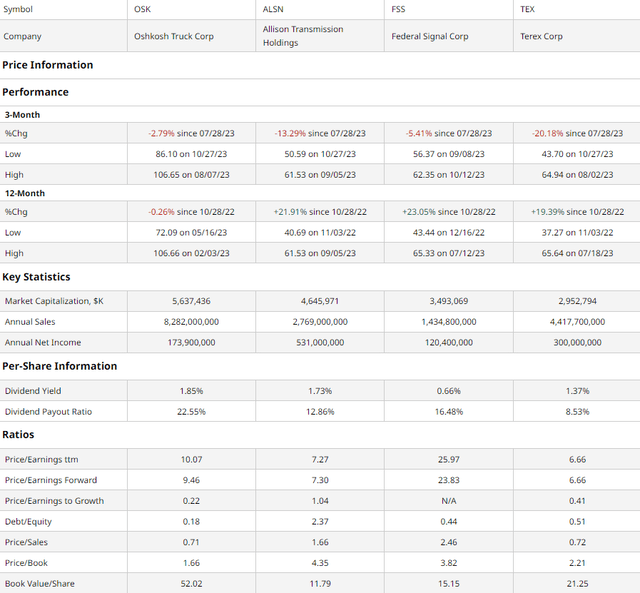

As a highly versatile industrial company, Oshkosh generally does not have any similarly sized direct competitors. As such, I sought to compare Oshkosh to similarly sized industrial companies, as recommended on the ‘Peers’ tab on Oshkosh’s Seeking Alpha page. This group includes the Indianapolis, Indiana-based commercial auto-transmission and hybrid propulsion system producer, Allison Transmission (ALSN), the Oak Brook, Illinois-based emergency vehicle equipment and municipal vehicle manufacturer, Federal Signal Corporation (FSS), and lifting and material-handling manufacturer, Terex (TEX).

barchart.com

As demonstrated above, Oshkosh has experienced superior trailing quarter returns, declining only 2.79%, though this does follow the worst yearly performance among the peer group. Despite this, owing to Oshkosh’s superior ability to return cash flows to shareholders and superior multiples-based value, I believe Oshkosh maintains continued growth capabilities.

For instance, although Oshkosh’s P/E ratios are not as competitive among peers, the company maintains lower P/E ratios than historic levels. Additionally, the company retains the lowest PEG ratio, lowest P/S ratio, and lowest price/book ratio among the group.

Moreover, assessing the company’s balance sheet strength, Oshkosh maintains the lowest debt/equity among the peer group in addition to the highest book value per share, demonstrating fiscal resilience and lower long-run cost of capital.

Furthermore, investors can expect solid income alongside general share price appreciation, with Oshkosh maintaining the highest dividend yield among peers with a modest payout ratio.

Valuation

According to my discounted cash flow valuation, at its base case, the net present value of Oshkosh is $96.54, meaning, that at its current price of $88.04, the stock is undervalued by 9%.

My model, calculated over 5 years without perpetual growth built-in, assumes a discount rate of 9%, balancing Oshkosh’s debt-light capital structure with its higher equity risk premium. Additionally, to remain conservative and due to rising interest rates compressing M&A, I estimated an organic revenue growth rate of 10%, contrary to Oshkosh’s highly volatile trailing 5Y growth rate of ~50%.

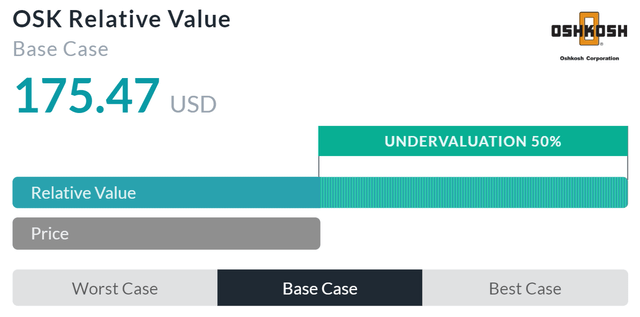

Alpha Spread

Alpha Spread’s multiples-based relative valuation model more than corroborates my thesis on undervaluation, estimating a relative value of $175.47, representing a 50% undervaluation.

However, due to Alpha Spread’s inability to incorporate recessionary risks and outlier companies Alpha Spread uses their model to skew the valuation skyward.

As such, taking a weighted average of my NPV and Alpha Spread’s relative valuation- with more weight given to my NPV- the fair value of Oshkosh is $107.01, an 18% undervaluation.

Oshkosh Continues to Invest- and Lead- in Speculative Growth Vectors

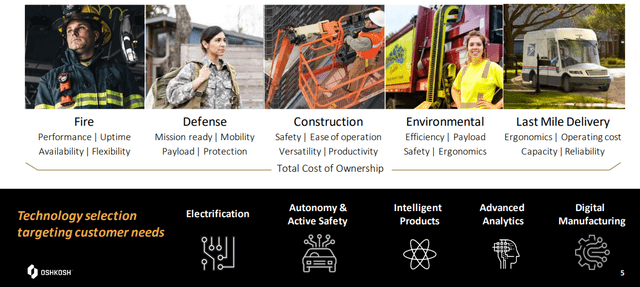

Central to Oshkosh’s value proposition remains its multisided growth platforms across a variety of secular growth streams. For example, Oshkosh is able to effectively leverage long-term megatrends across electrification, autonomous vehicles, digital manufacturing, etc. through its positioning in fire products, defence, construction, environmental, and last-mile delivery. Moreover, with the latter-described versatile range of sector participation, Oshkosh is able to remain resilient in recessionary times and enable magnified growth during inflationary periods, as demonstrated by their strong Q3 results.

Oshkosh Jefferies Presentation

This strategic theory is best exemplified by Oshkosh’s $800mn acquisition of aviation and airport equipment manufacturer, Aerotech, which enables stability through market cycles, is expected to support ~$20mn in run-rate synergies by 2026, and ultimately supports additional margin-enhancing opportunities.

Oshkosh Jefferies Presentation

Oshkosh’s present value generation is then recycled into an efficient and effective capital deployment strategy, which combines Oshkosh’s commitment to an affordable and flexible cap structure, continued investment in core businesses, the growth of its 1.86% dividend, opportunistic share repurchases, and, of course, inorganic growth through its aggressive M&A strategy. As such, investors can expect a balance of returns and long-run, sustainable growth from Oshkosh.

Oshkosh Jefferies Presentation

Wall Street Consensus

Analysts generally agree with my positive view of the company, projecting a 1Y price target of $107.92- a 22.58% increase.

TradingView

Even at the minimum projected price target, analysts estimate a price of $89.00- a 1.09% return enhanced by the company’s dividend program.

I believe this reflects Wall Street’s opinion that the market has generally underpriced Oshkosh’s operational capabilities and resilience.

Risks & Challenges

Sticky Interest Rates May Inhibit Growth

Although, as demonstrated by the company’s Q3 earnings, Oshkosh has successfully navigated many of the headwinds associated with rising interest rates and continues to maintain low debt, Oshkosh may see reduced growth if rates remain high. Principally, this idea concerns Oshkosh’s M&A orientation, with debt-financed deals increasingly costly. Moreover, although Oshkosh operates in relatively inelastic sectors, many of Oshkosh’s consumers may downsize or opt for repairing existing equipment over purchasing newer products from Oshkosh.

Involvement Across an Array of Industries May Increase Compliance Costs

A key strength of Oshkosh derives from its sheer revenue diversity, and ability to balance growth and resilience efficaciously. However, with operations across such a wide variety of industries, Oshkosh may be forced to contend with ever-evolving regulatory circumstances, thus increasing compliance costs and the potential for litigation. Oshkosh currently adjusts to these risks by operating different sectors wholly through its more specialized subsidiaries with experience in the field but nonetheless exposes itself to a greater number of regulatory risks.

Conclusion

Looking forward, Oshkosh maintains a strong operational structure, well-supported by fundamental financials and potential for investor returns.

Read the full article here

Leave a Reply