Investment Overview

I last covered Organon (NYSE:OGN), a company whose stock I own, back in mid-February, reviewing a positive set of full-year 2023 earnings that sent shares rising in value from ~$16, to ~$19, adding fresh momentum to a bull run that began in December 2023.

Until late-December, Organon stock had experienced a torrid 2023, sinking in value from $32 per share in January, to ~$11.5 at the end of November, for an overall loss of nearly 65%.

The company missed analysts’ consensus target on earnings in Q1 2023, while revenues declined, and in Q3, missed on both revenues and earnings, while full year revenue guidance was adjusted downward, to $6.15 – $6.25bn, below consensus, and adjusted EBITDA margin also reduced, to 30.5%, from 31%.

As a reminder, Organon’s business is described as follows in its Q1 2024 quarterly report / 10Q submission:

We develop and deliver innovative health solutions through a portfolio of prescription therapies and medical devices within women’s health, biosimilars and established brands. We have a portfolio of more than 60 medicines and products across a range of therapeutic areas.

In 2023, the Women’s Health division delivered $1.7bn of revenues, the biosimilars division $593m, and Established Brands $3.85bn, respectively up by 1.7%, up by 23%, and flat year-on-year. In the final reckoning, full year 2023 revenues came in at $6.3bn, adjusted EBITDA was $1.9bn, and earnings per share $3.99 on a diluted basis, and $4.14 on an adjusted diluted basis.

In Q1 2024, Organon’s earnings beat (analyst’s consensus estimates) on revenues of $1.62bn, and non-GAAP EPS of $1.22. The Women’s Health division earned $422m, up 11% year-on-year, biosimilars $170m, up 46%, and Established Brands $1bn, once again flat year-on-year.

Meanwhile guidance for 2024 was provided for $6.2bn – $6.5bn of revenues, adjusted gross margin of 61% – 63%, SG&A expense of $1.5bn – $1.7bn, R&D expense of $400 – $500m, adjusted EBITDA margin of 31% – 33%, and a tax rate of 18.5% – 20.5%.

Adding interest and depreciation, and doing the maths, I estimate that Organon will deliver full-year 2024 EPS in the region of ~$4.6, providing a forward price to earnings ratio of ~4.7x – low enough to suggest there is a buy opportunity in play – and let’s not forget that Organon also pays a dividend, which was hiked to $0.28 per share per quarter in May, giving an annual yield of >5%.

By several measures then Organon looks to represent an attractive investment opportunity, but there are other angles from which the picture is not so attractive. Organon was spun out of parent company Merck & Co (MRK) in 2021, and as a parting gift, Merck realised an $8bn tax free windfall, whilst saddling Organon with net debt of >$8bn.

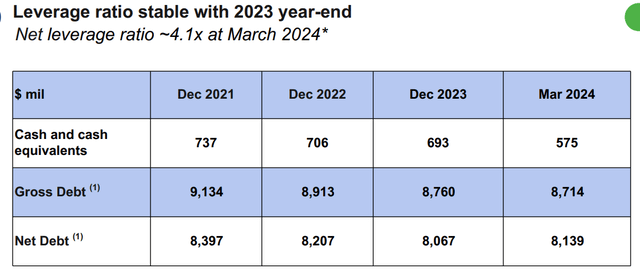

As we can see below (source: Q1 2024 earnings presentation) in two and a half years, Organon’s net debt has barely shrunk, and the net debt leverage ratio is 4.1x – interest expense in 2023 amounted to >$500m.

Organon net debt leverage (presentation)

Furthermore, Organon’s Established Brands division consists of >50 drugs whose patents are expiring, or have long since expired, and although the company has done a good job maintaining the division’s revenue contribution up until now, it is generally acknowledged that it will shrink over time, as sales volumes, prices, and number of prescriptions fall in the face of newer drugs with a better safety and efficacy profile, or due to a rising level of generic competition.

In common with other companies recently spun out from “Big Pharma” parents – e.g. Viatris (VTRS), spun out of Pfizer and merged with Mylan, the generics giant, Haleon (HLN), a spin out of GSK’s consumer brands division, and Kenvue (KVUE), a spinout of Johnson & Johnson’s (JNJ) consumer health division, Organon’s challenge is to try to offset falling revenues from the established brands division with new and innovative products from its new areas of focus – Women’s Health and Biosimilars in Organon’s case – while attempting to shrink its net leverage.

This helps to explain why spun-out companies often look undervalued based on metrics such as price to sales (“P/S”) and Price to Earnings (“P/E”), and why dividend payouts tend to be generous – the market is sceptical that the companies are genuinely capable of delivering top line growth, while pricing in the risk that revenues will shrink.

As mentioned, however, a spin-off that can successfully overcome its debt and revenue growth issues is likely to pay off handsomely as an investment opportunity, and therefore in this post, with Organon set to announce its Q2 2024 earnings on August 6th – next Tuesday – I’ll attempt to preview the issues I believe will set the agenda – and the company valuation and share price as we head into the second half of 2024, and beyond.

Organon Ahead Of Q2 Earnings – State Of Play

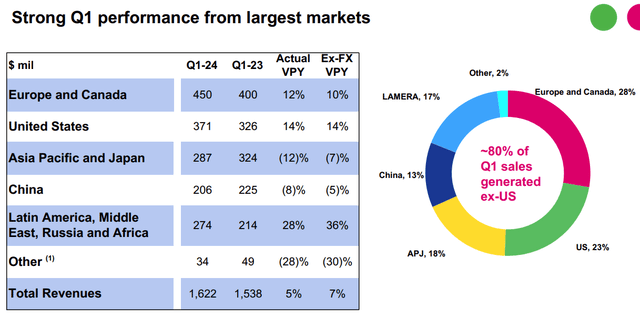

As we can see in the diagram below, from Organon’s Q1 2024 earnings presentation, Organon is a truly global company, making >80% of its sales outside of the US.

Organon Q1 2024 sales breakdown (presentation)

While patent expiries, volume based procurement, and price competition contributed to falling revenues in Q124, this was more than offset by sales volumes, which contributed $130m to the top line last quarter, enabling Organon to grow revenues slightly.

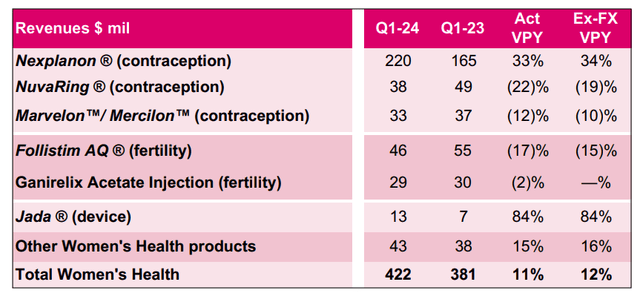

Nexplanon – “a small, thin and flexible arm implant” that acts as a form of birth control, was Organon’s best-selling product in Q1, earning $220m of revenues, up 34% year-on-year. Management’ believes Nexplanon will soon surpass $1bn in annual revenues. The product’s patents are due to expire in 2027, however management is confident that these can be extended beyond 2030 owing to label expansions opportunities. On the Q1 earnings call, Organon CEO Kevin Ali told analysts:

First, our five-year studies on track to close this year and pending FDA review and approval, our planning assumption is that we will be able to market with a five-year label in 2026. A differentiated label will give us three years of data exclusivity on that five-year duration of use claim, which we know from our market research is preferred by women and providers.

This important, because several other assets within the Women’s Health division are not showing revenue growth, as shown below:

Women’s Health division by product revenues in Q1 (presentation)

I have mentioned before in articles on Organon that Women’s Health is a tricky industry that has traditionally underperformed – AbbVie (ABBV), for example, the Pharma giant, recently disposed of its Women’s Health division altogether.

On the last earnings call, CEO Ali discussed “offering solutions in women’s health beyond the narrow definition of reproductive health”, raising the prospect of more varied M&A deals in this division, although the jury is arguably still out on previous Women’s Health M&A deals.

For example, Organon paid $240m to acquire Alydia Health and its JADA system, which is designed to stop excessive bleeding after childbirth, in 2021, and the device delivered $13m of revenues in Q1, up 84% year-on-year. While the growth is impressive, Organon needs bigger selling products that can match the performance of its Established Brands products – in Q1 2024, at least eight Established Brands products contributed >$50m revenues.

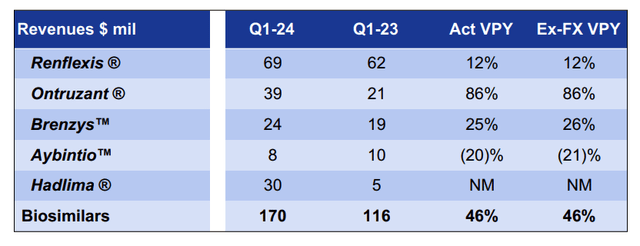

The story is broadly similar within the biosimilars division – as we can see below, products are showing promise, without reaching the levels set by Established Brands.

Biosimilars revenues (presentation)

Renflexis, Ontruzant and Brenzys are biosimilars for autoimmune conditions, breast cancer therapy trastuzumab, and plaque psoriasis respectively, while Aybintio is a biosimilar for Bevacizumab – marketed and sold by Roche (OTCQX:RHHBY) as Avastin, and indicated for solid tumor cancers and certain Ophthalmic conditions. Hadlima is a biosimilar for AbbVie’s Humira, a one-time >$20bn per annum selling asset.

In Q1, management sounded a slightly downbeat note on Biosimilar performance across the rest of 2024 – Chief Financial Officer Matt Walsh told analysts:

I would note that Ontruzant growth would have been down this quarter if not for the incremental upside we had from these additional volumes in Brazil. In fact, on a global basis we expect Ontruzant will be declining this year due to competition in other markets.

And on U.S. Hadlima we had a strong first quarter, but given that this market has been difficult to predict and continues to evolve we’ll only say that it is our objective to grow that product sequentially each quarter this year.

On the plus side, management says its “aim in biosimilars is to launch a new asset every couple of years”, and in late May, Organon announced that:

the European Medicines Agency (EMA) has validated the marketing authorization applications (MAAs) for HLX14, an investigational Prolia® and Xgeva® (denosumab) biosimilar.

In 2022, Shanghai Henlius Biotech entered into a license and supply agreement with Organon granting Organon the exclusive commercialization rights to two biosimilar candidates, including HLX14. The agreement covers markets such as the European Union, the United States, and Canada. An exception to the agreement is China.

Prolia, marketed and sold by Amgen (AMGN), earned >$4bn of revenues last year, while Xgeva earned >$2bn, and both lose patent protection in 2025. In some ways, it is the same story within the biosimilar division as it is in Women’s Health – promising, but more assets capable of commanding higher annual revenues are required for Organon to convince the market it is genuinely headed for growth, not simply treading water.

Finally, established brands continue to provide the revenue “ballast” that prevents Organon from shrinking, while driving the margins that make the company profitable. Established brands is a blessing in that regard, but a curse in terms of long-term sustainability – their revenue contribution will not hold up forever.

In fact, performance may have looked worse in Q1 had it not been for Organon adding two more assets to the division – Eli Lilly’s migraine therapies Emgality and Rayvow, in exchange for a $50m upfront payment to Lilly, and sales based milestone payments.

Organon has attempted to frame this deal as part of its Women’s Health business, with CEO Ali suggesting it “further bolsters our offerings to women, who are disproportionately impacted by migraine”, and unlike the rest of Established Brands, Emgality’s patents are not due to expire until 2030.

Perhaps a way for Organon to grow faster long term is by investing in more hybrid Women’s Health / Established Brands products, or simply to look to bring in established brands of any kind that have some kind of patent protection, but, for whatever reason, are no longer wanted by their original owner.

Concluding Thoughts Ahead Of Q2 Earnings – Signs Of Promise Support Bull Thesis, But Setbacks Cannot Be Ruled Out

Ultimately, in recent quarters, the sums have begun to add up for Organon. Management is forecasting for a third consecutive year of revenues growth. The company pays a substantial amount of interest on its debt – ~$520m in 2024, it is forecast, but notwithstanding, can afford a generous dividend payout and its credit rating is solid.

According to S&P Global update from early May, around the time Organon revealed plans to complete a $1bn debt offering of “$500 million of 6.750% senior secured notes due 2034 (the “Secured Notes”) and $500 million of 7.875% senior unsecured notes due 2034”, which will be used to pay off other borrowings on less favourable terms:

Our ‘BB’ issuer credit rating and stable outlook on Organon are unchanged and continue to reflect our expectation for low-single-digit percent revenue growth over the next several years, as gains in Women’s Health and Biosimilars segments more than offset moderation in the Established Brands business.

As mentioned previously, key to the bull thesis for Organon is that the company maintains the impressive performance of Established Brands, while bringing through new assets in Women’s Health and Biosimilars, but I sense from recent deals i.e. the deal with Lilly for emgality, that going forward, management may not restrict itself rigidly to pure biosimilars and women’s health M&A deals, and instead be more guided by the value opportunity than the target market.

I don’t see this as a bad thing – Organon is already a global company, so why not leverage that advantage as much as possible across as many products as possible?

With a forward price to sales ratio of <1x, and forward PE of <5x, the fundamental value proposition for Organon is still very much in play, and although progress has been more incremental than exponential, Organon’s play book is beginning to take shape, which seems to be allaying the market’s fears that a shrinking company deserves a valuation downgrade, as has happened in the past.

As such, I believe investors in Organon can look forward to next week’s earnings with optimism, however it should be emphasised that, as in 2023, a failure to meet analysts expectations – for $1.08bn of revenues in Q2, and normalised EPS of $1.08 – will lead to share price losses, without a cast iron guarantee those losses may be recovered.

Based on my calculations, shared above, however, I’d expect Organon to easily exceed these targets, and I look forward to hearing more positive updates during next week’s earnings call with analysts.

Confirmation of an anticipated recovery in China and the US for certain Women’s Health brands would be welcome, as would updates on the Prolia / Xgeva biosimilar, and perhaps, a better performance from Humira biosimilar Hadlima, recently added to the formulary list of the Mark Cuban Cost Plus Drug Company, are some of the updates – along with positive progress on net debt leverage (dropping >4x), and ongoing sustainability of Established Brands revenues – that ought to result in the company valuation expanding to at least match FY24 revenues guidance, hence I believe there is ~11.5% upside potential post Q2-earnings – provided there are no unexpected surprises.

Read the full article here

Leave a Reply