Dear readers/followers,

Orange (NYSE:ORAN) is a telco stock I have written about and invested in, mostly successfully, for years at this point. In the context of European telcos, it’s interesting because it front-loaded much of its major investments which has enabled it to see declining ratios of CapEx/sales when other telcos are still ratcheting up to 16-17% on an annual basis.

Orange as an investment is backed up by the infrastructure and customers of not one country, but several countries – though its core area is France. Despite a decline in RoR since my last article, which came out in July, the overall RoR since I bought the lion’s share of my position is still market-beating, much as I expected, and once again showcasing what works when you focus on investing at the right valuation.

Going into this, I’ll be updating this telco. I remain convinced that the company will deliver superb yield and safety, though as we’ve seen in the past, we’re likely to continue to see volatility going forward.

Let’s see what we have going for us going into 2H23 for Orange.

Orange – The latest results confirm the upside.

First off, I recommend that you read my previous articles on the company to get a bit of a “feel” for the business. Having this sort of feel is, I believe, crucial when you go into an investment. Far too many investors go into a play simply because “others” say so, and the investment may not match their upsides or expectations or their timeframe.

Orange, to me, is essentially a bond- or pref-type investment with a potential upside from valuation. That’s how I see most of my telcos. I want a competitive yield, but I also want a valuation-related upside, and I’m always looking for a conservative 15% or above.

Do I always get it?

No, I do make mistakes as anyone.

However, Orange has very good safety scores and profitability. Despite being a volatile telco with content, it has never seen its ROIC drop negatively, even net of WACC. Even during the worst of the telco drop, the company remained firmly profitable, and this is one of the core requirements for any investments I make long-term.

The company’s profitability KPIs aren’t class-leading, which can be excused in this context. The reason it can be excused is fundamentals and dividend coverage. Furthermore, Orange has attractive exposure. 41.1% to France, 24.6% to the rest of Europe, and 17.3% to enterprise. Even though the company does have its growth regions in Africa/Middle East that currently make up around 15% of revenues, the company is really a play on central Europe and France.

I like companies that mix this sort of geographical appeal and essentially end up with African/middle-eastern growth regions, as long as they don’t make up too much of the mix. The future potential in these areas is absolutely massive – but I don’t want to “play” too much capital, especially in a single company, in it.

On a high level, the issues the company has had in previous quarters are now abating.

The company is on track to deliver its annual guidance.

Why?

Because of strong retail trends in core areas. Spain, which has been a bit of a problem, is back to growth with almost 5% retail growth YoY. France is up 3.6% as well. The company has delivered strict cost discipline, realizing €175M worth of savings out of the planned €600M until 2025, and this is from a base of €11.8B, so this is not an insignificant amount of savings, neither planned nor realized.

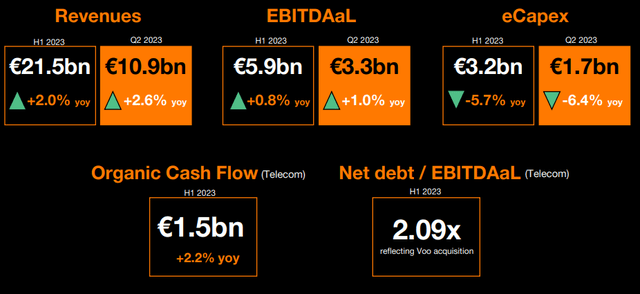

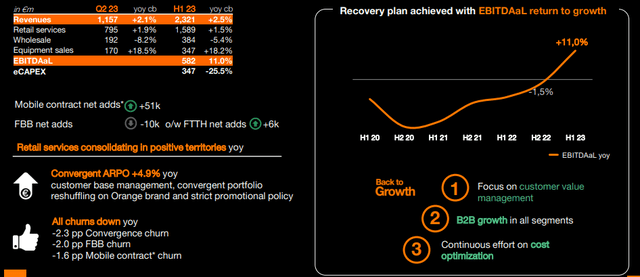

Here are the fundamental numbers for the 2Q23 and 1H23.

Orange IR (Orange IR)

The numbers speak for themselves. Everything that “matters” is up. These results are due to the aforementioned retail growth, not just in Europe, but in the Middle Eastern/African geographies, as well as better trends in the company’s TowerCo, totem.

France is seeing pressure in terms of EBITDAaL, but the company expects full pricing power benefits to be realized during the 2H23 period, which should weigh up results and trends towards the end of the fiscal.

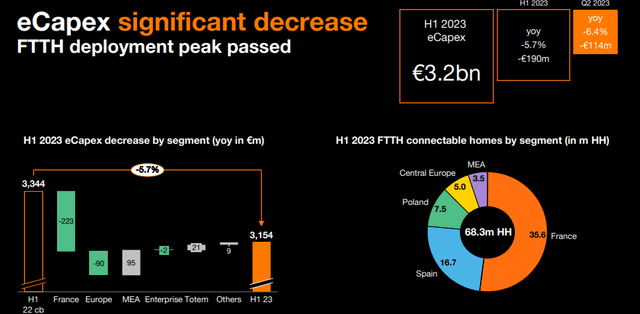

As I mentioned, one of the more interesting things with Orange, and why it’s been so cheap for so long, is that it front-loaded its eCapEx far more than other companies in the same sector.

This is now paying off.

Orange IR (Orange IR)

I expect the company to drop below €3B in eCapEx within the next two years, if everything moves along in accordance with this, but even now, the trends are absolutely solid.

On a net income basis, the company had some non-recurring items for the Half-year that really impacted things. These provisions are related to pension reforms, and drove the net income down, to where it’s negative on a YoY basis, “only” at €1.1B compared to €1.5B YoY.

However, the company’s liquidity position is second to almost none. We have over €15.5B worth if needed, and not many telcos can boast a sub-2.1x net debt/EBITDAaL.

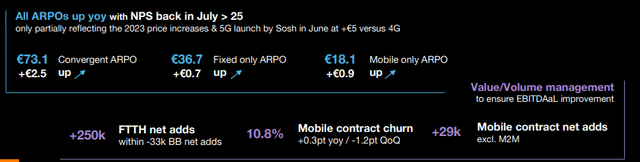

The trends we want to look at for this type of telco are growth in ARPO, broadband/mobile ads, churn, and similar trends. Orange is, like most, increasing its prices, so it’s a good period to look at how many are canceling or shifting providers. So far, trends are very good. Just look at some of the numbers coming out of the core area, France.

Orange IR (Orange IR)

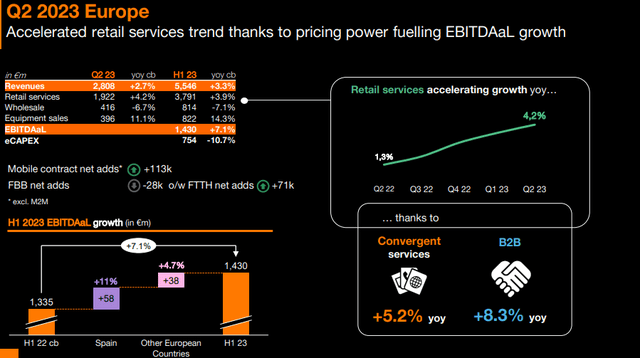

As mentioned, the retail services trends are pushing EBITDAaL growth upward – and this is thanks to very strong pricing power in its European geographies.

Orange IR (Orange IR)

Essentially, the company is making more money with less CapEx. This is an enviable position to be in, but this is what I have been guiding with Orange for several years.

And when it comes to Spain, I really want to highlight the power of a reversal that can happen, when a company executes well – which Orange is doing.

Orange IR (Orange IR)

This is even before going into the AME region, which saw EBITDAaL margin increases despite inflation and cost increases, of 50 bps to 36.3%. I’ve mentioned before how a 40%+ EBITDA margin for a company like this is usually possible only in its “home market”, such as France in this case. A 36.3% margin on EBITDAaL level, is extremely attractive given we’re talking about a growth area, and we’re seeing a 12% EBITDAaL increase YoY. The one negative part about AME, is that CapEx is far from over there – naturally. So CapEx is actually up more than EBITDAaL

Enterprise is something we need to keep an eye on. The sector’s EBITDAaL is down, and Orange is pruning products. Some parts of the portfolio are superb – we’re seeing 11% revenue increases and order intakes in Cyber defense and Digital & Data, but the company isn’t seeing that FCF upside. Plans for now are reducing headcount and optimizing its lineup of services.

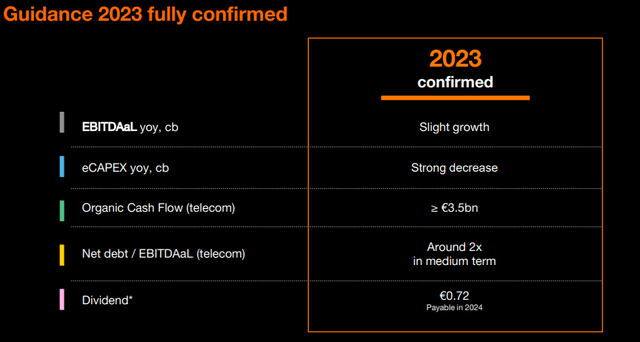

The overall trend and results for Orange here are absolutely stellar, in the sense that 2023E Guidance is now confirmed, and fully. The company can already guide for a 2024E dividend, which means that the forward yield for orange here is 6.55%. This is not market-beating in a world where Verizon (VZ) and AT&T (T) are trading at discounts, so I’m not necessarily saying that Orange is the best telco in terms of valuation here.

But it’s damn solid, and nay-sayers have definitely (as I see it), been proven wrong here.

Orange is not just doing fine, it’s flourishing.

Orange IR (Orange IR)

Orange – The valuation remains compelling, but far from as good as below €9/share.

In my latest article, I told you that Orange is no longer “cheap”. This is still a position I hold at this time. I’m actually lowering my price target for Orange as of this article. My last target was €14/share. I’m lowering it to €13/share.

Why am I lowering it?

Contextual attraction of other companies in the sector, interest rates, and the risk-free rates available out there. A 7% BBB+/similar-rated yield is no longer hard to find. I have several investments, common and debt investments, which are offering exactly a 7%+ yield with that sort of safety. So a 6.55%-yielding French Telco might have a 15% upside to my price target, but it no longer is as great as it once was.

However, the upside is potentially compelling here.

Why do I say this?

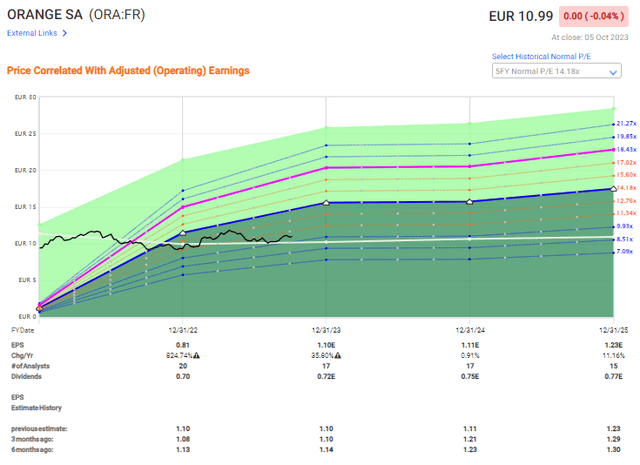

Because Orange is one of the few Telcos that’s being forecasted to grow at double-digit forward rates.

Orange Upside (Orange Upside)

Of course, the reason why I don’t give this 100% credence is because of a 70%+ miss ratio from analysts for the past 10 years. So I would be careful with this type of growth in a telco. I will be keeping a close eye on it though.

But the thing I want to emphasize here is that even if the company only trades at 9-11x P/E of this estimate, you’ll be getting an 11-15%+ per year inclusive of that dividend (account for taxes based on your domicile). If we see anything close to the historical valuation, which I do not believe, that annual RoR would be above 25% per year.

My €13/share PT comes to around 10.5x on a forward 2025E basis. This is a target I consider to be “comfortable” for me from a risk/reward perspective.

Orange is no longer a priority investment for me when it comes to telco investing, but it nonetheless offers us a very good upside.

Add more? You’ll have to decide on your portfolio and goals. I’m saying “BUY” here, but I’m also saying that you have a plethora of other alternatives available on the market at 6-8% yield with equal BBB+ safety.

S&P Global analysts give the company a range starting at €8/share (love to see those calculations) and €16/share (love to see those as well), averaging at around €12.95/share, close to my own target of €13/share. Analysts, 19 of them, are mostly at “BUY”. 16 have either “BUY” or “Outperform” as a target here.

I say the company still has enough upside to interest me, but I also say to look at other things available in the market today.

The following thesis is relevant for Orange as of this update in October of 2023.

Thesis

My thesis on Orange is as follows:

- Orange is one of the more appealing Telcos in terms of valuation, in all of Europe. It’s no longer as good in an international context given what else is available on the market today, but it’s still with a good upside.

- That upside is 11-20%, which is well above the overall market here, depending on where you forecast the company.

- Orange is a “BUY” here. A price target that I would consider attractive for investment based on my goals would be around €13/share – though every investor of course needs to look at their own targets, goals, and strategies. I would also always consult with a finance professional before making investment decisions such as this.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I can no longer call Orange a “cheap” stock. It’s now attractive, but not cheap. Cheap would be below €9.5/share.

Read the full article here

Leave a Reply