Oracle Corporation (NYSE:ORCL) investors have outperformed the S&P 500 (SPX) (SPY) since my previous update, as the AI hype continues to drive investor enthusiasm. Despite that, my assessment suggests ORCL investors are hanging on a thin thread, as its relative overvaluation met with recent selling pressure after it topped out in early February.

The company can still benefit from a broader multi-cloud shift, capitalizing on Oracle’s relational database advantage. However, it might not be sufficient to overcome its less efficient IaaS scale compared to its larger hyperscaler peers. As a result, its legacy on-premise baggage could hinder a further valuation re-rating.

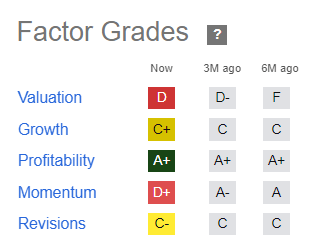

Despite that, it’s crucial to consider ORCL’s best-in-class profitability, assigned an “A+” profitability grade by Seeking Alpha Quant. However, the company is still expected to face growth impediments “as customers increasingly migrate their workloads to the cloud.” Given that its narrow economic moat is predicated on its core on-premise technologies, investors must be cautious about assigning high valuation multiples similar to its cloud-native SaaS peers.

Accordingly, ORCL is valued at a forward EBITDA multiple of 13.7x, well above its 10Y high of 10.7x. However, it remains well below its SaaS peers’ median of 23.5x, reflecting my caution. As a result, I believe the market is cognizant of Oracle’s legacy headwinds, potentially losing market share as customers “bypass its solutions” while migrating to the cloud.

However, Cleveland Research articulated in a recent note that ORCL is expected to see bullish momentum driven by “new business signings in AI and OCI.” As a result, the company could see an improvement from its fiscal second quarter, as Oracle experienced capacity constraints in OCI. In addition, Oracle’s partnership with Microsoft Azure (MSFT) has been beneficial, “driving strong growth in migrations to Oracle cloud from on-premise versions.” Therefore, I assessed that the recent recovery in ORCL has likely reflected such optimism as AI stocks continued their march higher.

Investors must be cautious as I don’t see Oracle as a pure-play cloud-native SaaS exposure. Hence, execution risks relating to its on-premise license revenue must still be accounted for when assessing its cloud growth opportunities.

ORCL Quant Grades (Seeking Alpha Quant)

Furthermore, ORCL’s “C+” growth grade should highlight caution, behooving investors to ask tough questions on whether it can justify its “D” growth grade. Analysts’ estimates suggest Oracle’s adjusted EBIT growth is expected to slow down through FQ4, indicating tougher YoY comps over the next two quarters.

As a result, I urge investors to consider ORCL’s “D+” momentum grade carefully, indicating a lower market enthusiasm in taking its premium valuation higher. The market likely needs a more robust cloud migration from the FQ3 earnings scorecard onwards before ORCL can break decisively above its $127 resistance zone.

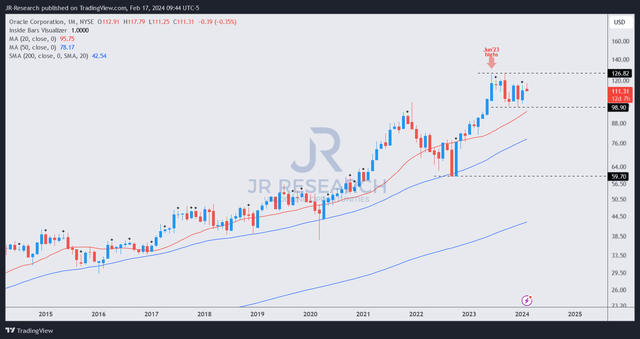

ORCL price chart (monthly, long-term) (TradingView)

As seen above, ORCL buyers have struggled to break above its $127 resistance zone since June 2023. I assessed that ORCL’s relative overvaluation is reflected in its “D+” momentum grade, indicating that ORCL is likely in a distribution zone. Morningstar’s fair value estimates indicate an overvaluation of more than 30%, which is significant.

Oracle remains a fundamentally sound stock with a robust profitability grade and competitive on-prem advantages. While its OCI growth drivers have rejuvenated its recent growth momentum, the market seems not keen to take its valuation re-rating much higher.

Consequently, I view the risk/reward as unattractive at the current levels, urging investors to consider rotating out and reallocating their exposure.

Rating: Downgrade to Sell.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here

Leave a Reply