I first recommended purchasing Old Republic International (NYSE:ORI) in early 2021 for its solid business model, its exceptionally generous dividends and its cheap valuation. Since then, the stock has outperformed the S&P 500 by an impressive margin, as it has offered a total return of 66% while the index has gained 17%. Even since my latest bullish article, just five months ago, the stock has outperformed the S&P 500 by a wide margin (+19% vs. +5%).

After such a vast outperformance and a rally to a new all-time high, many investors will be tempted to take their profits, fearing that a reversion to the mean may cause the stock to underperform in the upcoming years. However, Old Republic International remains attractively valued, as it is trading at a forward price-to-earnings ratio of 10.8x. Given its reliable business model and its outstanding dividend record, the stock remains attractive for income-oriented investors.

Business overview

Old Republic International is an insurance company with operations in the U.S. and Canada. It offers various general insurance products to numerous corporations and organizations as well as title insurance products to buyers of real estate and investors.

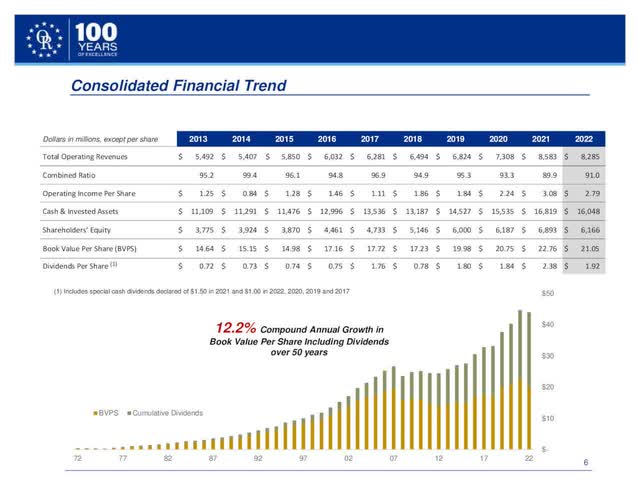

The key characteristic of Old Republic International is its disciplined underwriting policy, which generates reliable earnings growth in the long run. As shown in the slide below, the company has consistently achieved solid combined ratios throughout the last decade.

Old Republic International Growth Record (Investor Presentation)

Source: Investor Presentation

Combined ratios below 100% indicate that the insurance business is profitable. As shown in the above slide, the insurer has posted combined ratios below 100% every single year over the last decade. It has also managed to grow its operating earnings per share at a 9.3% average annual rate, from $1.25 in 2013 to $2.79 in 2022. A consistent growth record is one of the most important features investors should look for in stocks, particularly in insurance stocks, most of which are characterized by highly volatile results.

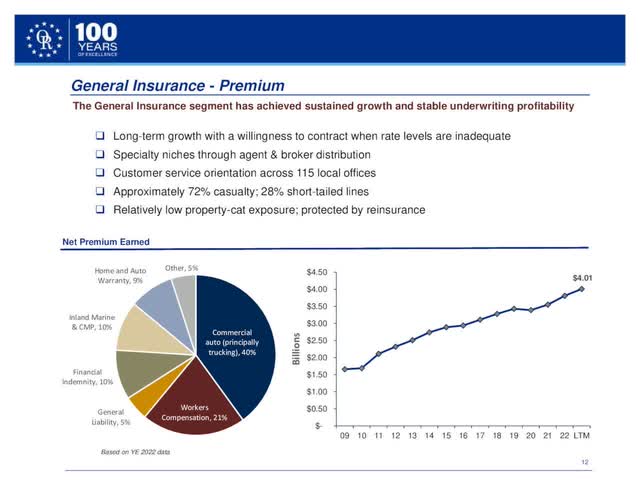

Old Republic International generates 65% of its underwriting profit from its general insurance segment. The company has more than 70 years of expertise in risk management, and thus, it prices its insurance products with discipline, in order to secure adequate profit margins. It has also posted remarkably high customer retention rates, in excess of 90%, and thus it has achieved markedly consistent premium growth over the long run, from $1.6 billion in 2009 to $4.01 billion in the last 12 months.

Old Republic International General Insurance Segment (Investor Presentation)

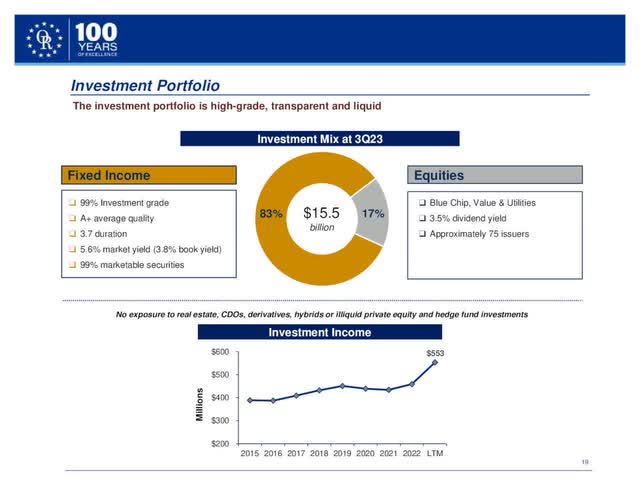

Old Republic International also has another key characteristic, namely a high-quality investment portfolio. Most investors do not pay attention to the investment portfolio of insurers, but this is a great mistake, as the quality of the investment portfolio will determine the returns of the earned premiums and the behavior of the stock during recessions and bear markets.

Old Republic International has an investment portfolio that has two major advantages; a high yield and great resilience to recessions. It consists of 83% bonds and 17% defensive stocks. The bond portfolio has an A+ average quality and a 5.6% average yield.

Old Republic International Investment Income (Investor Presentation)

As a result, the company earns a high return on its insurance premiums while it is also resilient to economic downturns. This is clearly reflected in the above-depicted long-term growth of its investment income.

It is also important to note that Old Republic International greatly benefits from the surge of interest rates to a 16-year-high, in contrast to many financial institutions, such as banks. Most banks have seen their net interest margin contract in the last two quarters due to rising deposit costs. On the contrary, Old Republic International has greatly benefited from high interest rates, as its investment income has pronouncedly increased.

In the third quarter, its total operating revenue dipped 7% over the prior year’s quarter, but its investment income grew 27%, as the company invested its float at high yields. As a result, the insurer grew its earnings per share by 6%, from $0.68 to $0.72, and thus exceeded the analysts’ consensus by $0.11. Notably, Old Republic International has exceeded the analysts’ estimates in 15 of the last 16 quarters. This impressive record is a testament to the sustained business momentum of the insurer and its reliable business model.

Analysts expect Old Republic International to post flat earnings per share of $2.72 in 2024 and grow its earnings per share by 5% in 2025, to $2.85. The modest growth prospects should probably be attributed to the expected impact of 16-year high interest rates on the housing market. As mortgage rates have surged in the last two years, they are likely to take their toll on the sales of new houses at some point. In fact, this is the goal of the Fed, which is trying to cool the economy and thus restore inflation to its long-term target of 2.0%-2.5%. Therefore, it is prudent to expect high interest rates to weigh on the title insurance profits of Old Republic International next year.

On the other hand, as mentioned above, the elevated interest rates have enabled the company to invest its float at far higher yields than it did until two years ago. Therefore, the insurer is likely to continue growing its investment income at a fast pace until interest rates deflate. Therefore, while it is prudent to rely on the analysts’ estimates, investors should be aware that Old Republic International may keep beating the analysts’ estimates in the upcoming years.

Valuation

Old Republic International is currently trading at a forward price-to-earnings ratio of 10.8x, which is much lower than the 10-year average of 13.0 of the stock. The stock is also trading at only 10.3 times its expected earnings in 2025. Given the outstanding record of the company in beating the analysts’ estimates, it is evident that the stock is cheaply valued right now.

The cheap valuation may be attributed to the modest growth prospects in the short run due to the effect of high interest rates on the title insurance segment. However, as soon as this headwind subsides, the stock is likely to revert towards its average valuation level. In such a case, it will have significant upside potential. If it reverts to its 10-year average valuation level by 2025, it will enjoy a 26% rally (= 13.0/10.3 – 1) merely thanks to the normalization of its valuation.

Dividend

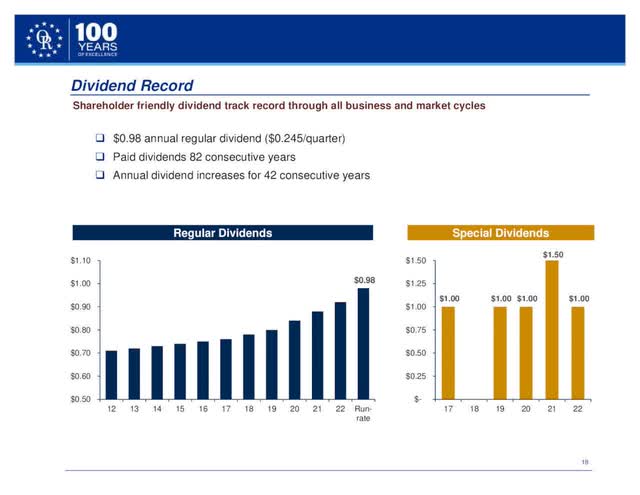

Old Republic International has an exceptional dividend growth record. To be sure, it has paid uninterrupted dividends for 82 consecutive years and has raised its dividend for 42 years in a row.

Old Republic International Dividend Growth (Investor Presentation)

Moreover, the insurer has a solid payout ratio of 35%. Given its robust business model, it is likely to continue raising its dividend for many more years.

On the other hand, investors should be aware that the insurer has grown its dividend by 4.5% per year on average over the last three years. This growth rate is decent but not spectacular. In addition, due to its rally to an all-time high, the stock is currently offering a nearly 10-year low yield of 3.4%. However, this is just the regular dividend yield of the stock. As shown in the above chart, Old Republic International has offered a remarkably generous special dividend in 5 of the last 6 years. If it offers a special dividend of $1.00 per share, its total dividend yield will double, from 3.4% to 6.8%. Overall, the stock remains attractive for income-oriented investors.

Risk

The primary risk for Old Republic International is the unfavorable scenario of sticky inflation for years. In such a scenario, the Fed will probably keep interest rates elevated, and hence, it may continue to weigh on the title insurance business of the company. Nevertheless, even in this case, the insurer is likely to continue growing its net investment income at a fast pace and hence it will probably offset, partly or fully, the effect of high interest rates on its title insurance division.

Final thoughts

Old Republic has outperformed the broad market by an impressive margin in recent years, and thus, it has climbed to new all-time highs. It is thus natural that many investors will be tempted to take their profits. However, the stock has not become overvalued. While it may take a breather in the short run, it remains attractively valued from a long-term perspective.

Read the full article here

Leave a Reply