Introduction

With the current state of the economy, there’s so much uncertainty right now about the FED’s decision to keep rates higher for longer. Will they or won’t they? Are they going to cut in 2024 or 2025? Maybe even 2026? We don’t know nor can we control whether they do or not. But what we can control is where we invest our money. And unlike some, I’ve been taking advantage of the uncertainty by buying great stocks at low valuations, especially in the real estate sector (VNQ). I’ve also been searching for opportunities outside the sector. That’s how I came across Old Dominion Freight (NASDAQ:ODFL). The company has been around for a long time and looks to be a great addition to a portfolio focused on dividends. While investors place their money into treasuries, I’ve been on the hunt for future stars in the dividend space.

Business Overview

For those not familiar with ODFL, it operates as a less-than-truckload (LTL) motor carrier in the United States and North America. Less than truckloads, or loads, are small loads of freight. These can accommodate the shipping needs of countless businesses that need to move smaller loads of goods frequently. An advantage of this is more frequent loads shipped to the wholesaler, mitigating the risk of potential loss of sales. So instead of businesses waiting until inventory gets low, companies like ODFL ship loads more frequently so businesses can have a steady influx of inventory to reduce sales losses.

ODFL investor presentation

The company was founded in 1934 in Richmond, Virginia and currently has 256 service centers in 48 states. They’re the second largest LTL behind FedEx (FDX) with 12% market share. Additionally, they have over 11k tractors and more than 46k trailers. The trucking industry has seen a slowdown this year because of supply chain disruptions, uncertainty in the economy, and a shortage of truck drivers. Freight demand has also decreased, contributing to the overall slowdown this year. So, while 2022 & 2023 have been tough for the industry, this is expected to improve by Q2 of 2023.

Why Old Dominion

When investors think of dividend paying stocks, many of us think of businesses like banks, tobacco companies, REITs, tech companies, and BDCs when looking into dividends. So, it’s easy to overlook stable, growing businesses like ODFL when searching for quality businesses to invest in. But most of these businesses have been around for decades and are vital to our everyday life whether we realize it or not.

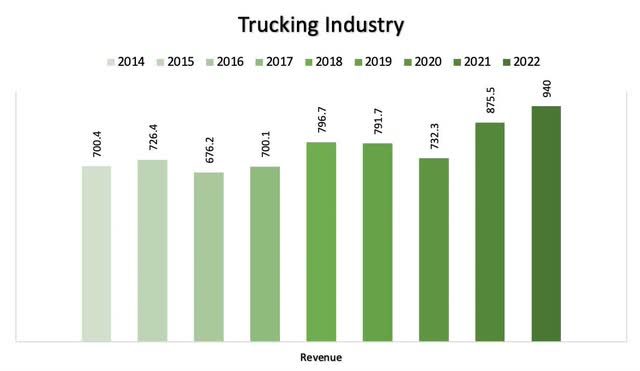

As previously mentioned, the company was founded in 1934 and IPO’d in 1991. Since being founded, the company has continued to expand and acquire competitors along the way. The trucking industry is a huge, billion dollar industry and its revenues have continued to grow over the last decade. Every major industry relies on trucking companies to maintain their supply chain and these businesses move everything from agricultural products, medical devices, pharmaceutical products, and food.

So, it’s safe to say the industry is going to continue growing for the foreseeable future. Below is a look at the revenue growth of the industry in the last decade or so. As you can see, revenue decreased in 2020 & 2022 due to supply chain issues during COVID. As I previously mentioned, the industry has suffered a slowdown this year but is expected to grow at a CAGR of 4.35% over the next seven years.

Author creation via Statista

Growing Financials

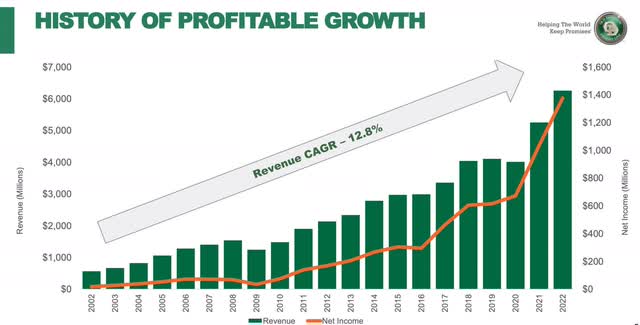

As the industry expands, Old Dominion has also been growing their financials over the time as well. In the two last decade, revenue has grown at a CAGR of 12.8%. As you can see, net income has also trended up and to the right over the same time, specifically after the GFC of 2008-2009 and again after the pandemic. Although the business and industry as a whole witnessed a slowdown in 2020, revenue & net income has since risen exponentially.

ODFL investor presentation

One reason for this improvement is that their on-time service has increased from 94% in 2002 to 99% in 2022. They also managed to improve their cargo claims ratio from 1.5% to just 0.1% over the same time frame. During Q2 ODFL reported EPS of $2.65, an increase from $2.58 in Q1. Although EPS was up, revenue was down from $1.44 billion in Q1 to $1.41 billion in Q2. The decrease in revenue was primarily due to the 14.1% decrease in LTL tons per day and 1.1% decrease in LTL revenue per hundred weight. Additionally, the company was coming off all-time highs in revenue & profits in 2022, so this shouldn’t have been a surprise to some. Management expects this to improve over the coming quarters.

Stellar Dividend Compounder

Although the company has been around over 8 decades and IPO’d over 30 years ago, the company only recently started paying a dividend in 2017. Since then, they have grown the dividend at an astronomical rate from $0.10 to $0.40 currently. ODFL has a short, but impressive dividend growth record. Their 3-yr dividend growth rate is 38.33% while their 5-yr growth rate is 35.64%. To put this into context, peer J.B. Hunt (JBHT) has a 3 & 5-year growth rate of 15.76% and 11.81% respectively. The company last raised the dividend earlier this year when they announced a 33% raise from $0.30 to $0.40, a huge reward to shareholders. This is a testament to the strength of the business, considering the current macro environment. Seeking Alpha gives ODFL a dividend safety & growth score of A+ which I agree with. This is most likely due to their conservative payout ratio of just 12%, which is very low for any company or sector.

Very Low Debt

The company has kept its debt under control, allowing their finances to steadily grow over the last decade. They currently have a very low Net debt to EBITDA of just 0.1. To put this into perspective, this is lower than peer JBHT, who also has a very low Net debt to EBITDA of 0.78. One reason ODFL is able to achieve this is by retaining a lot of their cash flow. Since 2019, free cash flow has averaged almost $700 million while paying out an average of $87 million in dividends over the same period. Furthermore, their debt has decreased in the last six months from $100 million to $80 million. With $55 million in cash & cash equivalents, the company could literally pay its debt off in no time.

CAPEX has averaged roughly $500 million since then. This is also a reason the company has been able to buy back a substantial amount of its shares over the years as well. ODFL repurchased $141 million worth of shares in the 1st quarter, and $302 million in the 1H of this year. I know because of high interest rates many investors are worried about companies debt loads, but there’s nothing to worry about with ODFL.

Risks

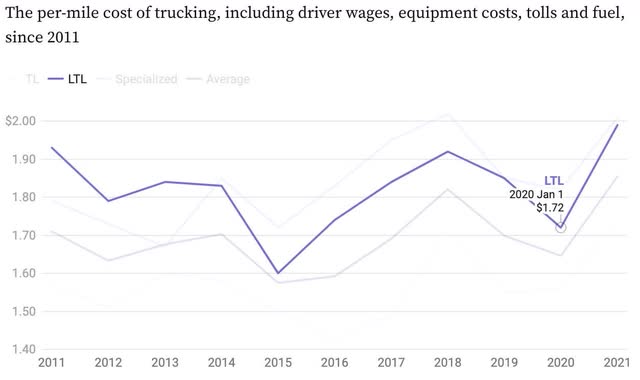

One risk investors in ODFL should be aware of is the rise in fuel costs. Oil prices have been surging lately and this could continue to affect ODFL in the near-term. Fuel remains the largest expense for trucking companies. As you can see below, costs for LTL companies declined in 2020, but since has spiked. With oil prices over $90 per barrel currently, companies like ODFL may see this continue to push operating costs upwards, possibly affecting the company’s earnings. Another well-known risk for the industry is rising labor costs due to high interest rates.

truckingdive

Valuation

While many companies are down in the last year, ODFL has seen its price appreciate over the same period. This has risen over 62% in the last 12 months, and almost 25% in the last 6 months. In May of this year the price was trading below $300 but is now trading closer to its 52-week high of $438. ODFL’s forward P/E is currently higher than its 5-year average of 28 and industry average of 18.2, which means it may be overvalued. Analysts’ currently have a hold rating for the stock and I agree as it doesn’t offer very much upside. Current shareholders should hold here, and investors looking to start a position should add on any signs of share price weakness. Me personally, I wouldn’t consider adding unless the price drops well-below $400, which is a possibility if we do enter a recession.

Tipranks

Investor takeaway

ODFL is a great company that has been firing on all cylinders this year. They’ve been doing everything right and rewarding shareholders with stellar dividend increases and share buybacks. This has cause the stock to become overvalued and investors looking to add should wait for a pullback. It’s also possible investors can miss out as the stock price could continue trending higher as well. This would be less likely if we do enter a recession, in my opinion. There isn’t anything negative I can say about this company and with the trucking industry expected to post positive growth over the next several years. Investors may also want to consider adding here, but for now, I rate them a hold.

Read the full article here

Leave a Reply