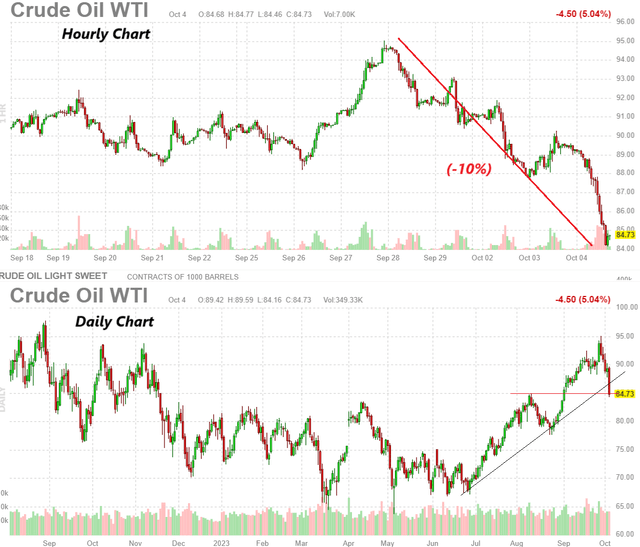

With the market fixated on bond yields with the 30-year and 10-year Treasury Rate approaching 5.0%, the bigger story right now is likely the mini-crash in crude oil prices few expected. Indeed, WTI crude oil (USO) is down more than 10% since reaching a high of $95 bbl and nearly reversing the entire rally since September.

The selloff here likely reflects the combination of some softer economic indicators along with a building gasoline inventory. The sense is that a rush by producers worldwide, including Russia, to take advantage of elevated prices on the supply side is coming up against some softer demand.

The setup here has some major implications not only for inflation expectations and the direction of interest rates but also represents a positive development for the stock market. Our article here reaffirms a bullish view of the S&P 500 Index (SP500) and related broad market equity benchmarks.

source: finviz

The Fed Likely Won’t Hike Again

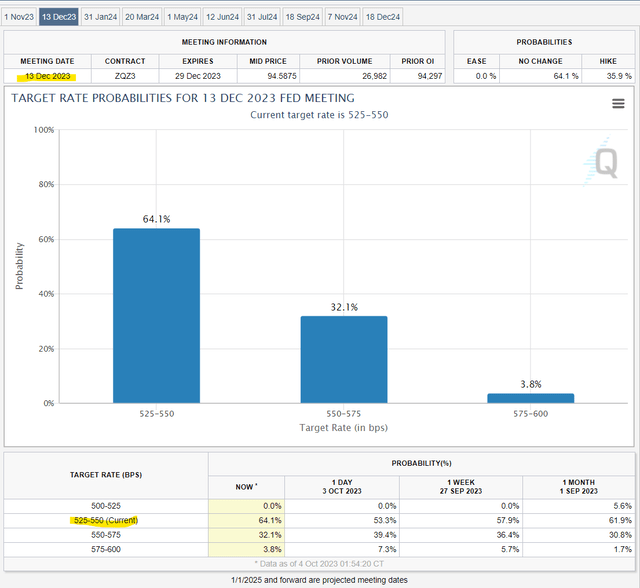

The first point here is that it’s becoming less and less likely the Fed will need to hike rates again this year. This is confirmed by the CME FedWatch tool tracking the market-implied probability at 64% that the Fed Funds rate will now end the year flat from the current level of 5.5%. On the other hand, the odds for another rate hike in 2023 have dropped to 36% compared to 47% just yesterday.

Considering it was the run in energy prices that ruffled the hawkish feathers suggesting to some that inflation was set to accelerate, the correction in oil turns that view upside down. Our confidence that the Fed won’t hike again has been strengthened.

source: CME FedWatch

A Favorable Backdrop for Disinflation

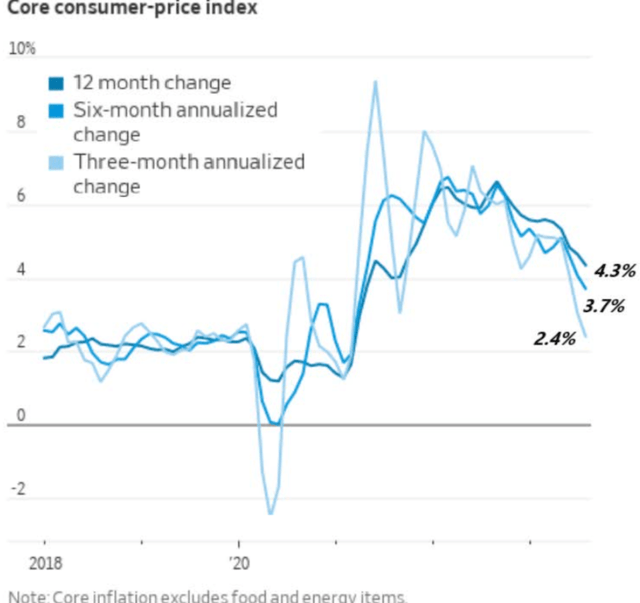

Looking ahead to the September CPI report set to be released on October 12, the market can focus more on the core measures that exclude volatile energy prices. On this point, the trends have been much more favorable and confirm the disinflationary process is well underway.

The annual core CPI hit 4.3% in the last August update with the more dynamic three-month annualized measure at a very mundane 2.4%. What we have here is evidence that the Fed’s strategy is working and further rate hikes are unnecessary for the headline rate to converge towards the target 2.0% down the line.

source: Wall Street Journal

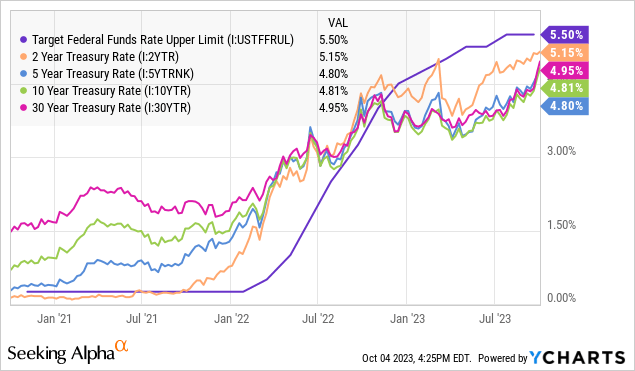

Bond Yields Can Pull Back

With a building consensus that inflationary pressures are easing, the next step is to see a downside to interest rates and bond yields. There are many ways to interpret the yield curve. It’s fair to say that a large part of the recent spike in rates reflects a concern that inflation was set to remain elevated and the Fed would need to at least hold rates for longer.

If we can agree that the price of oil is going to remain relatively contained around the current level for the foreseeable future, long-term rates can be limited to the upside.

Comments by Chairman Powell at the September Fed meeting opened the door but did not commit to another hike, urging a sense of caution. We know the Fed is data-dependent, and the takeaway here is that with the latest drop in oil prices, the data that matters looks pretty good on the inflation front.

The bullish case for bonds considers a scenario where the CPI trends lower faster than expected, opening the door for the Fed to cut earlier rather than later into 2024.

Importantly, this could occur even as economic conditions remain resilient in a “soft landing” environment because inflation expectations anchored to the target level would justify such a move and not because the economy is collapsing.

What About Stocks?

By removing that headwind of surging oil prices which was one factor contributing to the crash in the bond market (spike in yields) and climbing inflation expectations, the setup for stocks gets a new tailwind of sentiment.

Investors can start looking forward to the upcoming earnings season which gets underway later this month with all indications that companies captured a solid operating environment in Q3.

We see room for the S&P 500 to climb right back to its recent highs of around $4600 as a year-end price target. The environment of resilient economic conditions as interest rates stabilize while corporate earnings climb supports a bullish view. We also expect the reset of inflation expectations lower based on the latest energy price correction to drive some short covering in both the stock and bond market as a near-term catalyst.

To conclude by covering some of the risks, the potential that the price of oil regains strength quickly, climbing above $100 a barrel can drive some renewed inflationary concerns with some upside in bond yields. During the Q3 earnings season, weaker-than-expected EPS or poor management guidance would likely lead to a new round of volatility.

source: finviz

Read the full article here

Leave a Reply