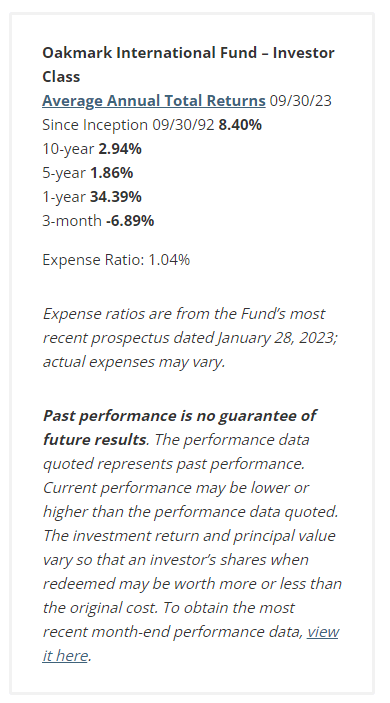

The Oakmark International Fund (MUTF:OAKIX, “the Fund”) increased 34.39% for the fiscal year ended September 30, 2023, outperforming the benchmark, the MSCI World ex U.S. Index (net), which increased 24.00% over the same period. For the most recent quarter, the Fund returned -6.89%, compared to the benchmark’s return of -4.10%. However, the Fund has returned an average of 8.40% per year since its inception in September 1992, outperforming the MSCI World ex U.S. Index (net), which has averaged 5.67% per year over the same period. For additional color on our views of the market environment during the most recent quarter end, please see our market commentary.

Fresenius (FMS, Germany), a global health care group, was the top contributor to the Fund’s performance this quarter. We were impressed by Fresenius’ second-quarter results, particularly in the Kabi and Helios segments. The organic growth for Kabi, which supplies drugs, nutritional products and medical devices, once again comfortably surpassed expectations, even outpacing the 4-7% long-term framework. This outperformance also occurred broadly and across all of Kabi’s units. Kabi’s margins were also encouraging, and it continues to generate significant savings for Fresenius’ restructuring program. Hospital operator Helios also performed well, despite the tough macro environment for hospitals. The solid results from both Helios and Kabi reflect well on Fresenius’ fundamental outlook as well as on its operational transformation, initiated under new CEO Michael Sen to bring stronger performance management to the business. The company’s Vamed segment, however, remained its weak spot due to the previous management team’s decision to expand rapidly into new geographies without proper risk control. Now, Vamed is being restructured, and the new management team expects the second quarter to be the trough. Finally, the stock has benefited from news of portfolio divestitures underway that could crystallize value, simplify the business and help de-lever the balance sheet.

Worldline (OTCPK:WWLNF, France), which creates and operates digital transaction processing platforms, was a top detractor for the quarter and fiscal year. Despite the weak share price performance, the business’s underlying results have been healthy, and we continue to like its longer term prospects. Share price weakness has largely been driven by multiple compressions, which has continued nearly unabated since November 2021 and currently sits at historically low levels. This is despite the company’s continued robust top-line growth (9% organic growth trailing 12 months) and ongoing improvement in margins (90 basis points year-over-year improvement targeted 2023). Valuation has generally been pressured due to higher interest rates, slowing consumer spending concerns, and competitive pressures being experienced in the U.S. payment market that, we believe, are being incorrectly transposed to Europe. European payments are a less competitive market due to a greater variety of payment methods (more than 200 compared to the four dominant payments in the U.S.), disparate country regulatory schemes, and cultural and language barriers. In addition, the European payment market is at an earlier stage of cash-to-card migration, and more market share is still held by share-losing banks. Both factors provide an attractive backdrop for European payments to deliver GDP+ growth for years. Worldline’s underlying execution has generally been in line with our expectations. The cash flow profile of the business is also improving. Worldline has completed over EUR 8 billion in acquisitions since 2019, and the integration and restructuring of those assets have kept cash conversion below normal levels for the past several years. By the end of 2024, the dual running costs of integrating these businesses should fall away, driving both good margin leverage and stronger cash flow. With high-single-digit organic growth, improving operating margins, and strengthening free cash flow conversion, Worldline should compound free cash flow at a mid-teens rate. Given Worldline’s market position and operational characteristics, we believe the company is worth much more than the ~8.5x forward EV/EBITDA at which it currently trades.

Intesa Sanpaolo (OTCPK:ISNPY, Italy), the largest bank in Italy, was the Fund’s top contributor for the fiscal year. Intesa has generated substantial net profit increases in recent periods thanks to a significant rise in net interest income (NII). This was consistent with our view that Intesa would dramatically benefit from rising rates. This first became evident following the nine-month results released in November 2022. The company’s NII leverage to rising interest rates has remained robust. Its NII increased by nearly 69% year over year in the first half of 2023 and by 10% sequentially in the second quarter. The rate sensitivity led Intesa to increase its 2022 guidance to greater than EUR 4 billion of net income and to guide for well above EUR 5.5 billion in 2023. Following an even more impressive NII than expected, guidance was raised to greater than EUR 7 billion of net income this year. Importantly, Intesa’s asset quality has also remained rather benign at just 25 basis points in the first half of the year, and non-performing loan formation has continued to decline, reflecting the low-risk business model and strong underwriting of management. Intesa has also been able to keep operating costs well-controlled, thanks to efficiency measures that have largely offset inflationary impacts. Intesa’s shareholders are directly benefitting from the company’s higher earnings. With one of the highest dividend payout ratios in Europe (70%), Intesa has also been returning capital to shareholders via buybacks while maintaining a robust balance sheet. Intesa remains a strong banking franchise run by an excellent management team, in our view. We believe it remains an attractive holding.

We initiated a new position in Bunzl (OTCPK:BZLFF, U.K.) during the quarter. Bunzl is a leading distributor of not-for-resale items (packaging, cleaning supplies, etc.) to the food service, grocery, safety and retail end markets. Customers benefit from Bunzl’s bulk purchasing terms and by the ability to outsource the warehouse and distribution requirements of necessary, but non-core, products. Given the essential nature of these items, Bunzl’s top-line trends tend to be highly stable. Organically, Bunzl’s business is relatively low growth (in line with GDP), but the business can generate significant value by acquiring smaller distribution businesses to expand its customer base, product offerings and geographies served (after taking into account M&A top line has grown at a high single digit rate over the past decade). We believe Bunzl will likely create significant value via future M&A activity, a potential that the market currently undervalues. As shareholders twice before, we are familiar with the management team and the business model, and we see the recent share price decline as an opportunity to establish a position in a high-quality, defensive compounder at an attractive valuation.

During the quarter, we sold Orica (OTCPK:OCLDF, Australia) and Restaurant Brands International (QSR, Canada) to fund other positions we believe offer more attractive opportunities on a risk-to-reward basis.

Geographically, we ended the quarter with approximately 88.0% of our holdings in Europe and the U.K., 6.9% in Asia, 3.5% in Japan, and 1.6% in North America (Canada and the U.S.).

David G. Herro, CFA | Eric Liu, CFA | Michael L. Manelli, CFA

|

The securities mentioned above comprise the following preliminary percentages of the Oakmark International Fund’s total net assets as of 09/30/2023: Bunzl 0.1%, Fresenius 2.4%, Fresenius Medical Care 2.1%, Intesa Sanpaolo 2.7%, Orica 0% and Worldline 1.8%. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual stocks. Access the full list of holdings for the Oakmark International Fund as of the most recent quarter-end. The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. Certain comments herein are based on current expectations and are considered “forward-looking statements.” These forward looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements. The EV/EBITDA ratio is a comparison of Enterprise Value and Earnings Before the deduction of payments for Interest, Taxes, Depreciation and Amortization which is a measure of operating income. Non-performing loans are bank loans that are subject to late repayment or are unlikely to be repaid by the borrower. The MSCI World ex U.S. Index (NET) is a free float-adjusted, market capitalization-weighted index that is designed to measure international developed market equity performance, excluding the U.S. The index covers approximately 85% of the free float-adjusted market capitalization in each country. This benchmark calculates reinvested dividends net of withholding taxes. This index is unmanaged and investors cannot invest directly in this index. On occasion, Harris may determine, based on its analysis of a particular multi-national issuer, that a country classification different from MSCI best reflects the issuer’s country of investment risk. In these instances, reports with country weights and performance attribution will differ from reports using MSCI classifications. Harris uses its own country classifications in its reporting processes, and these classifications are reflected in the included materials. The Fund’s portfolio tends to be invested in a relatively small number of stocks. As a result, the appreciation or depreciation of any one security held by the Fund will have a greater impact on the Fund’s net asset value than it would if the Fund invested in a larger number of securities. Although that strategy has the potential to generate attractive returns over time, it also increases the Fund’s volatility. Investing in foreign securities presents risks that in some ways may be greater than U.S. investments. Those risks include: currency fluctuation; different regulation, accounting standards, trading practices and levels of available information; generally higher transaction costs; and political risks. All information provided is as of 09/30/2023 unless otherwise specified. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply