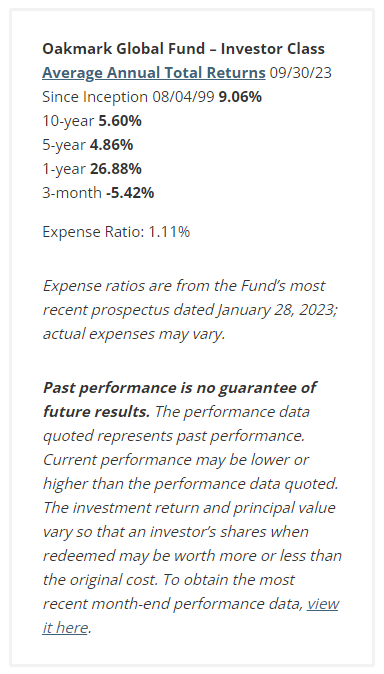

The Oakmark Global Fund (MUTF:OAKGX, the “Fund”) returned 26.88% for the fiscal year ended September 30, 2023, outperforming its benchmark, the MSCI World Index (net), which returned 21.95%. For the most recent quarter, the Fund returned -5.42%, compared to the benchmark’s return of -3.46%. The Fund has returned an average of 9.06% per year since its inception on August 4, 1999, outperforming the MSCI World Index (net)’s annualized gain of 5.46% over the same period.

For the quarter, our highest contributing securities were Charter Communications (CHTR, U.S.), Alphabet (GOOG, GOOGL, U.S.), and ConocoPhillips (COP, U.S.), and our largest detractors were St. James’s Place (OTCPK:STJPF, U.K.), Interpublic Group (IPG, U.S.) and Prudential (PUK, U.K.). From a sector perspective, our strongest contributors were information technology and financials, and our biggest detractors were consumer discretionary and real estate.

Charter Communications (U.S.), a telecommunications and mass media company, was the top contributor to the Fund’s performance for the quarter. Second-quarter broadband subscriptions for Charter Communications grew by 77,000 sequentially, beating consensus expectations of 13,000 and roughly doubling its growth year-over-year. Unit growth outperformed peers, even after adjusting for Charter’s rural initiative, which contributed 26,000 subscriptions. Charter’s mobile net adds were strong at 648,000 and net adds have been over 600,000 each of the last three quarters since Charter launched Spectrum One, which includes one free mobile line for 12 months. Adjusted earnings growth was roughly flat, but we expect it to accelerate over time as the company’s financials are no longer negatively impacted by its investments in marketing personnel and the promo roll-off dynamic begins. While faster unit growth does depress adjusted earnings in the near term, we believe Charter’s strategy will prove valuable to long-term shareholders.

St. James’s Place (U.K.), the largest wealth manager in the U.K., was the Fund’s largest detractor for the quarter. St. James’s Place released weak first half of 2023 results, and management noted that it will reduce fees on certain products ahead of the new consumer duty regulation. St. James’s Place plans to cap annual product management charges at 85 basis points for client bond and pension contributions after a client has been invested for 10 years, which will result in a four basis point impact to the group revenue margin. CEO Andrew Croft also believes this self-directed decision will create goodwill with the regulatory body. Both assets under management and cash earnings were slightly below our expectations, and the relatively low amount of net new money was mainly attributed to weak flows in unit trusts and individual savings accounts. Gross contributions within the unit trusts and individual savings accounts have been concentrated in lower value accounts, and these clients have been most impacted by cost-of-living pressures. Further, clients’ decision to allocate more money to cash products instead of traditional investments has put additional pressure on St. James’s Place as it does not have a cash management product. Lastly, market performance was lower than our estimates due to a strengthening British pound compared to the U.S. dollar. Despite these near-term headwinds, we continue to believe the company offers an attractive long-term investment. Pension reforms in the U.K. have significantly increased the number of defined contribution participants, which benefits St. James’s Place by providing a sustained flow of new clients and assets under management that we believe will continue. We also like that the company’s capital-light operating model generates a higher than average return on capital employed and robust cash conversion, the majority of which gets returned to shareholders.

For the first three quarters of 2023, the stocks that contributed most to returns were Alphabet, Amazon (AMZN, U.S.) and Tenet Healthcare (THC, U.S.). The stocks that detracted most from return were CNH Industrial (CNHI, U.K.), St. James’s Place and Prudential. From a sector perspective, our largest contributors were communication services and information technology, while real estate and consumer staples were the largest detractors.

September 30 ends the Fund’s fiscal year. For that 12-month period, Oracle (ORCL, U.S.) led the positive contributors followed by Alphabet and Allianz (ALIZF, Germany). St. James’s Place, Envista Holdings (NVST, U.S.) and Credit Suisse Group (Switzerland) detracted most from returns. From a sector perspective, financials and industrials were the largest contributors, and real estate was the only detractor.

Oracle (U.S.), a global software company, was the Fund’s top contributor for the fiscal year, with its share price rising primarily after reporting its fiscal fourth-quarter results. More recently, Oracle announced fiscal first-quarter results, which were in line with consensus expectations. The drivers of the core business are performing well, in our view, and management expressed confidence that annual revenue growth will accelerate as planned based on demand trajectory and its strong bookings trends. For the quarter, total revenue increased 8% in constant currency (9% reported), and operating income grew 12% with margins showing improvement. Cloud and support revenue grew 11% in constant currency, powered by Fusion +20% and Netsuite +21%. The “strategic back office cloud” is now up to $6.9 billion in run-rate revenue. Infrastructure cloud and support revenue grew 14% in constant currency, powered by infrastructure cloud services +72% ex-legacy hosting services to $5.6 billion in run-rate revenue. Momentum is continuing to build as Oracle signed several deals for its cloud business greater than $1 billion in total value during the quarter and booked an additional $1.5 billion in the first week of the second quarter. We continue to believe Oracle is an attractive holding and undervalued due to our perception of its intrinsic value.

During the quarter, we initiated new positions in Brunswick (BC) and Cisco Systems (CSCO). We eliminated our positions in Flowserve (FLS) and Parker-Hannifin (PH).

The following is a brief description of our new holdings:Brunswick (U.S.) is the leading manufacturer of marine engines, boats, and related parts and accessories. The company is commonly viewed as a cyclical boat manufacturer. The business has evolved in recent years, however, and now most of its profits come from its outboard engine business as well as its aftermarket parts and accessories segments. These are high-quality businesses in which Brunswick has material competitive advantages and they generate high returns on invested capital. The Mercury outboard business is the crown jewel. Over the past decade, Mercury has taken advantage of its leading scale to fund large investments in R&D and product development. These investments have driven consistent market share gains and enabled Mercury to carve out a dominant position in the fast-growing, high-horsepower part of the outboard market. Meanwhile, Brunswick has grown its parts and accessories business through attractive acquisitions that benefit from its broad-based distribution. The combination has shifted the business mix toward more resilient and faster growing profit streams that we believe are underappreciated today. Investors’ recession fears and erroneous perception that Brunswick is a stale business have provided us with an opportunity to buy this high-quality franchise at a single-digit multiple of our estimate of mid-cycle earnings power. In our view, this is an attractive price for such a strong franchise.

Cisco Systems (U.S.) is the leading networking solutions company. Networking equipment gains importance as businesses modernize their IT infrastructure, and Cisco is well positioned to capture this demand with the broadest portfolio and the most effective go-to-market strategy. Cisco is changing its business from selling mainly transactional hardware to more software and subscriptions. This transition is expected to accelerate growth, improve operating margins and build recurring revenue. Despite these notable business improvements, Cisco still trades near a trough valuation relative to the S&P 500 Index. More recently, Cisco announced its intention to acquire Splunk, a leader in security and observability, adding to its already strong position in the increasingly important security market. At a low-teens multiple of our estimate of normalized earnings, we think Cisco is trading at an attractive discount to our estimate of its intrinsic value.

We eliminated our positions in Flowserve (U.S.) and Parker-Hannifin (U.S.) as their share prices approached our estimates of intrinsic value.

Geographically, we ended the quarter with 48.5% of the portfolio in the U.S., 33.0% in Europe, 14.0% in the U.K. and 4.5% in Asia as a percent of equity. Over the third quarter, Switzerland and China contributed the most to return and the U.K., U.S. and Germany detracted the most. For the fiscal year, the U.S., Germany and Switzerland contributed the most to the Fund’s return, while France and Mexico detracted the most from returns in the period.

We defensively hedge a portion of the Fund’s exposure to currencies that we believe to be overvalued versus the U.S. dollar. However, as of quarter end, the Fund’s currency exposure is unhedged.

We thank you for being our partners in the Oakmark Global Fund. We invite you to send us your comments or questions.

David G. Herro, CFA| Clyde S. McGregor, CFA | Tony Coniaris, CFA |Jason E. Long, CFA | M. Colin Hudson, CFA |John A. Sitarz, CFA, CPA

|

The securities mentioned above comprise the following preliminary percentages of the Oakmark Global Fund’s total net assets as of 09/30/2023: Allianz 2.8%, Alphabet Cl A 4.1%, Amazon.com 1.7%, Brunswick 1.0%, Charter Communications Cl A 3.2%, Cisco Systems 1.7%, CNH Industrial 3.3%, ConocoPhillips 2.4%, Credit Suisse Group 0%, Envista Holdings 2.2%, Flowserve 0%, Interpublic Group 2.6%, Oracle 1.0%, Parker-Hannifin 0%, Prudential 2.6%, St. James’s Place 2.1% and Tenet Healthcare 0%. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual stocks. Access the full list of holdings for the Oakmark Global Fund here. The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. Certain comments herein are based on current expectations and are considered “forward-looking statements.” These forward looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements. The compound return is the rate of return, usually expressed as a percentage that represents the cumulative effect that a series of gains or losses has on an original amount of capital over a period of time. Compound returns are usually expressed in annual terms, meaning that the percentage number that is reported represents the annualized rate at which capital has compounded over time. The percentages of hedge exposure of each foreign currency are calculated by dividing the market value of all same-currency forward contracts by the market value of the underlying equity exposure to that currency. The MSCI World Index (NET) is a free float-adjusted, market capitalization-weighted index that is designed to measure the global equity market performance of developed markets. The index covers approximately 85% of the free float-adjusted market capitalization in each country. This benchmark calculates reinvested dividends net of withholding taxes. This index is unmanaged and investors cannot invest directly in this index. On occasion, Harris may determine, based on its analysis of a particular multi-national issuer, that a country classification different from MSCI best reflects the issuer’s country of investment risk. In these instances, reports with country weights and performance attribution will differ from reports using MSCI classifications. Harris uses its own country classifications in its reporting processes, and these classifications are reflected in the included materials. The Fund’s portfolio tends to be invested in a relatively small number of stocks. As a result, the appreciation or depreciation of any one security held by the Fund will have a greater impact on the Fund’s net asset value than it would if the Fund invested in a larger number of securities. Although that strategy has the potential to generate attractive returns over time, it also increases the Fund’s volatility. Investing in foreign securities presents risks that in some ways may be greater than in U.S. investments. Those risks include: currency fluctuation; different regulation, accounting standards, trading practices and levels of available information; generally higher transaction costs; and political risks. The compound return is the rate of return, usually expressed as a percentage that represents the cumulative effect that a series of gains or losses has on an original amount of capital over a period of time. Compound returns are usually expressed in annual terms, meaning that the percentage number that is reported represents the annualized rate at which capital has compounded over time. The percentages of hedge exposure of each foreign currency are calculated by dividing the market value of all same-currency forward contracts by the market value of the underlying equity exposure to that currency. All information provided is as of 09/30/2023 unless otherwise specified. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply