Written by Nick Ackerman, co-produced by Stanford Chemist.

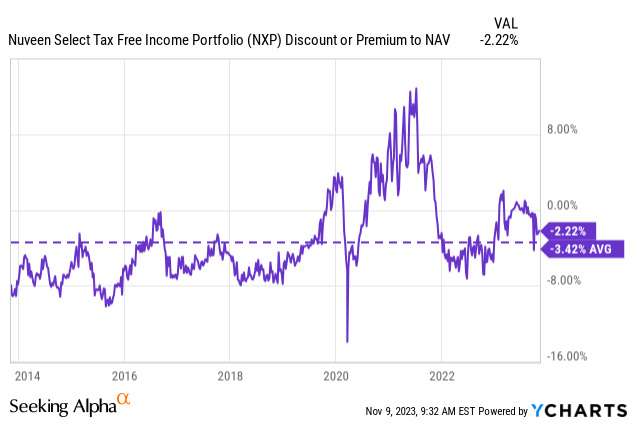

Earlier this year, we took a look at Nuveen Select Tax-Free Income Portfolio (NYSE:NXP) and Nuveen AMT-Free Municipal Value Fund (NYSE:NUW). It’s time to revisit these municipal bond funds to look at distribution coverage and valuations. NXP has slid to trade at a more attractive discount compared to the slight premium it was trading at before. Overall, muni bonds continue to look attractive, both from the tax-free income perspective and from the potential upside when rates come down.

Additionally, both of these funds operate with no or very limited borrowings. That can cap potential upside relative to their leveraged peers, but it’s also a much more conservative approach. It removes the added volatility in case rates have to go even higher, and we’ve already seen the damage that higher rates can wreak on the prices of muni bond funds. Durations are high on these portfolios precisely because they are muni bond focused, and that means generally lower yields and longer maturities.

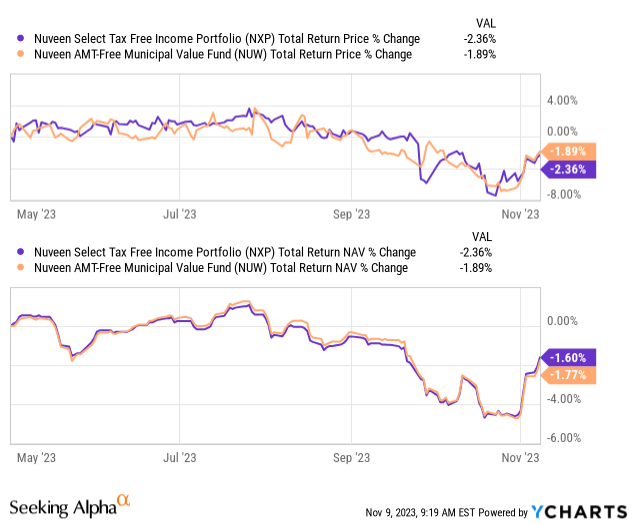

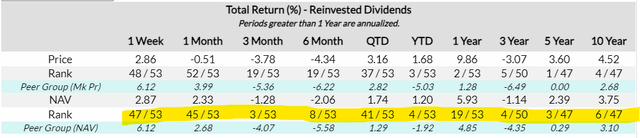

The prior update was posted on May 1, 2023. On a total return basis, for share price and NAV, results have been essentially flat, with total NAV returns being virtually identical.

YCharts

However, that was after dipping quite materially when Treasury Rates once again spiked higher – just as they did last October 2022; this October wasn’t pretty for the funds either.

Since then, there has been a sharp reversal to claw back much of those losses into November. That doesn’t mean that they aren’t worth checking out at this time, as rates could have further to fall when the Fed potentially makes a move early next year.

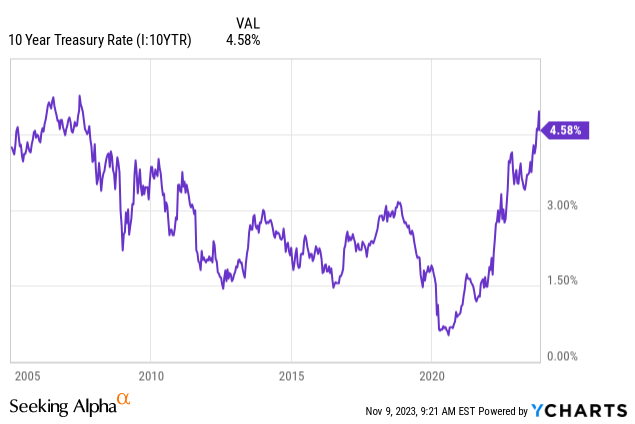

In looking at the 10-Year Treasury Rate, the latest spike pushed rates to the highest level since pre-Global Financial Crisis.

YCharts

If rates continue to fall from here, that could bode well for NXP and NUW for potential upside going forward. However, even if rates stay elevated for several years to come, being positioned in safe, tax-free income plays probably isn’t the worst place someone could be putting capital to work. It makes it really easy to wait and hold for potential higher rates and average down should they continue to be pressured by higher rates.

Nuveen Select Tax-Free Income Portfolio

- 1-Year Z-score: -0.53

- Discount: -2.22%

- Distribution Yield: 4.26%

- Expense Ratio: 0.23%

- Leverage: 0.00%

- Managed Assets: $650.8 million

- Structure: Perpetual

NXP’s investment objective is “current income exempt from regular federal income tax, consistent with preservation of capital.” In attempting to achieve this, the fund will:

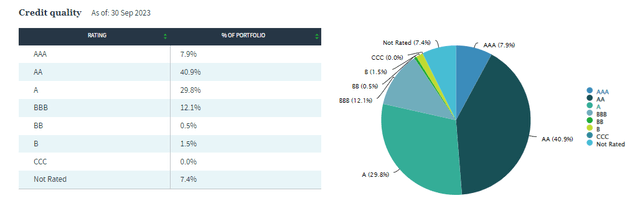

Invest at least 80% of its managed assets in municipal securities rated investment grade at the time of investment, or, if they are unrated, are judged by the manager to be of comparable quality. The Fund may invest up to 20% of its managed assets in municipal securities rated below investment quality or judged by the manager to be of comparable quality, of which up to 10% of its managed assets may be rated below B-/B3 or of comparable quality. The Fund may invest in inverse floating rate municipal securities, also known as tender option bonds. The Fund’s use of tender option bonds to more efficiently implement its investment strategy may create up to 10% effective leverage.

As noted previously, NXP comes in with an incredibly low expense ratio for CEFs, in general. Muni CEF expense ratios on the non or low-leveraged funds are generally lower, but this is still on the lower end of that, too. While the fund can employ up to 10% effective leverage, at this time, they’ve held leverage at 0%, which is where it was earlier this year as well.

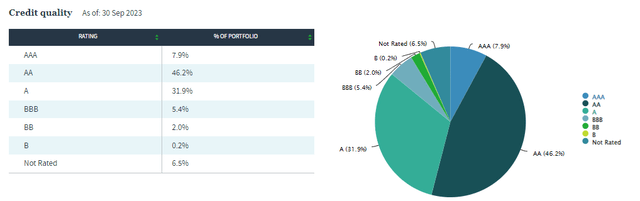

Leveraging up a super safe portfolio, such as what one gets when holding municipal bonds, often isn’t a problem. After all, these portfolios are often positioned with significant exposure to state or local municipalities with an overemphasis on credit quality toward the upper end.

NXP Portfolio Credit Quality (Nuveen)

The problem comes in when you can only earn around 3-5% on these muni bonds while leverage costs have climbed to 4%+ due to short-term borrowings. That’s what puts NXP and NUW in better relative positions compared to their leveraged peers. It’s what saw their distributions be able to climb slightly higher as we entered into a higher-yielding world. However, the higher-yielding world for muni bonds is at a snail’s pace when the average maturity of their portfolio is around 14.5 years.

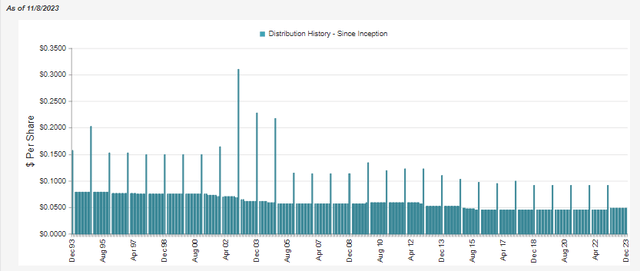

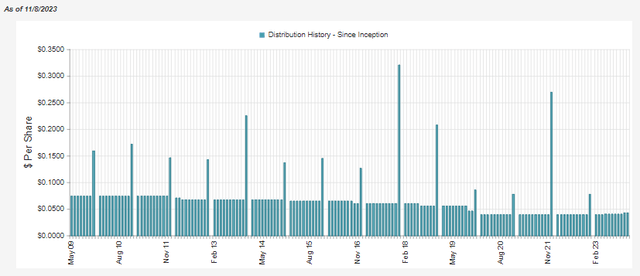

They ended up raising their distribution to start off in 2023. Their distribution coverage comes in at a solid 99.25%.

NXP Distribution History (CEFConnect)

While we’d like to see this at over 100%, there is some potential upside from here as the average bond price of their portfolio (not including zero coupon bonds) comes to $96.52.

For NXP, they don’t have an AMT-free focus like NUW does. NXP puts the latest percentage of income that is subject to AMT at 10.62%. The fund currently has a distribution rate of 4.26%. Based on a 24% Federal tax rate, that would put the taxable equivalent yield at 5.61%.

On an absolute basis, the fund’s discount might not be the most interesting fund to consider in the space. However, it is getting closer to its long-term average. Now, that average is being sort of skewered by the 2021 period, where the fund was trading at a large premium.

YCharts

The justification for this could be that NXP often puts up total returns on an NAV basis that are toward the higher end relative to peers. Not always, and they’ve struggled, it looks like, in the shorter periods of time, but that could warrant a bit of a higher valuation if they can keep up that sort of performance.

NXP NAV Return Ranking (CEFData)

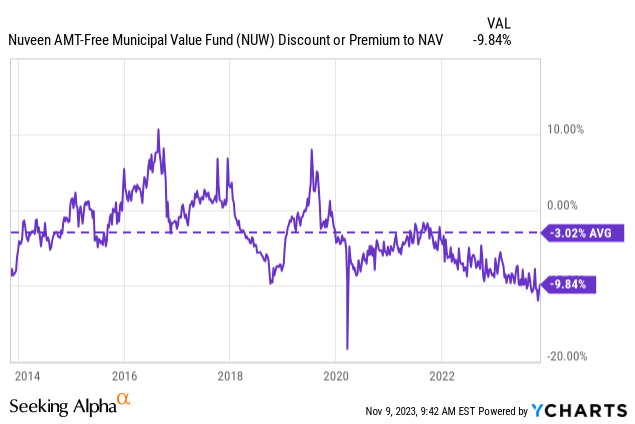

Nuveen AMT-Free Municipal Value Fund

- 1-Year Z-score: -0.81

- Discount: -9.84%

- Distribution Yield: 3.87%

- Expense Ratio: 0.66%

- Leverage: 0.76%

- Managed Assets: $261.5 million

- Structure: Perpetual

NUW’s investment objective is “current income exempt from regular income taxes, and its secondary objective is to enhance portfolio value and total return.” In an attempt to achieve this, the fund will invest in:

Municipal securities that are exempt from federal income taxes, including the alternative minimum tax (AMT). The Fund invests at least 80% of its managed assets in municipal securities rated investment grade at the time of investment, or, if they are unrated, are judged by the manager to be of comparable quality. The Fund may invest up to 20% of its managed assets in municipal securities rated below investment quality or judged by the manager to be of comparable quality, of which up to 10% of its managed assets may be rated below B-/B3 or of comparable quality. The Fund may invest in inverse floating rate municipal securities, also known as tender option bonds. The Fund’s use of tender option bonds to more efficiently implement its investment strategy may create up to 10% effective leverage.

NUW similarly allows up to 10% effective leverage. In this case, it is at less than 1% and virtually non-existent. They listed their annualized leverage costs at 4.18% based on the latest month’s data. Again, this highlights why buying munis that sometimes yield only 3 to 5% doesn’t make sense when leveraging up and considering operating expenses. In this case, the 0.76% is low in terms of an expense ratio, but it is higher than NXP.

Additionally, NUW currently provides investors with a lower distribution rate when compared to NXP, but it also comes AMT-free. They also raised twice this year, with the latest bump starting this month.

NUW Distribution History (CEFConnect)

With that latest bump in the distribution, it did take distribution coverage that was over 100% down to 98.47%. That said, the average bond price (not including zero coupon bonds) for NUW comes to $92.42, lower relative to NXP. The effective maturity of NUW is also higher at 16.56 years, with an effective duration of 8.33 years.

At the 3.87% distribution rate, the taxable equivalent yield for those in the 24% tax bracket comes to 5.09%. The credit quality for NUW is similarly higher quality, though it does carry some higher BBB rated offerings. That could be worth noting as it is one rung above the junk level. That being the case, along with having a bit higher average effective duration, could help explain why NUW’s underlying portfolios are trading at a larger discount to their PAR value.

NUW Portfolio Credit Quality (Nuveen)

Unlike NXP, NUW did not get the premium treatment in 2021. While the discount narrowed during that time, it actually never hit a premium. Instead, the longer-term history for NUW showed that prior to Covid, the fund had been able to achieve trading at a premium on several occasions. In fact, this would be on more occasions than NXP, but it’s even more discounted now as the fund trades near the lowest discount levels since its launch (and excluding the outlier Covid crash lower.)

YCharts

I believe that sets up NUW to be more interesting at this time if we are able to see the discount narrow. In my opinion, it would have a better chance of seeing its discount narrow if we compared it directly to NXP, as that would take NXP going to a premium. Still, the lower distribution yield here is likely a deciding factor for investors. Not all investors necessarily need to look for AMT-free distributions either, so it makes it for a smaller subset of muni bond fund investors looking to climb into NUW.

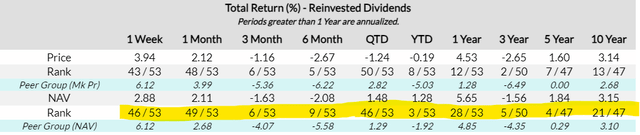

NUW has also been able to put up some solid historical results relative to peers on a 3- and 5-year basis. On a 10-year basis, it only came in about the middle. It too has seemingly suffered in the more short-term period when looking at the last week or month period. Though these are ultra-short periods of time, and when I’m looking to invest, it’s generally for years at a time.

NUW NAV Return Ranking (CEFData)

Conclusion

Investors looking for tax-free income from municipal bonds have several choices to consider these days. NXP and NUW are two diversified ways to play the space. As CEFs, they offer more chances for volatility, but that’s precisely what can make it worthwhile to exploit those discounts/premiums. At this time, NXP has slipped to a slight discount, but NUW remains more attractive if one is looking for a chance at some further upside should the discount narrow.

Of course, there is no guarantee that will happen either, and that is a primary risk. NXP could continue to go to a premium while NUW sinks ever lower into discount territory. Thus wiping out the potential upside that NUW could likely offer relative to its larger muni sister fund.

Read the full article here

Leave a Reply