Introduction

Thanks to actions by the FOMC to fight inflation by rising rates, fixed income funds, including variable rate and short duration funds, have suffered though at different magnitudes. For CEFs, the past actions and fear of future movements in interest rates, inflation, and municipal revenues have widened the gap between what investors pay for those assets and what those same assets could be liquidated at, the Net Asset Value, referred to as their NAV.

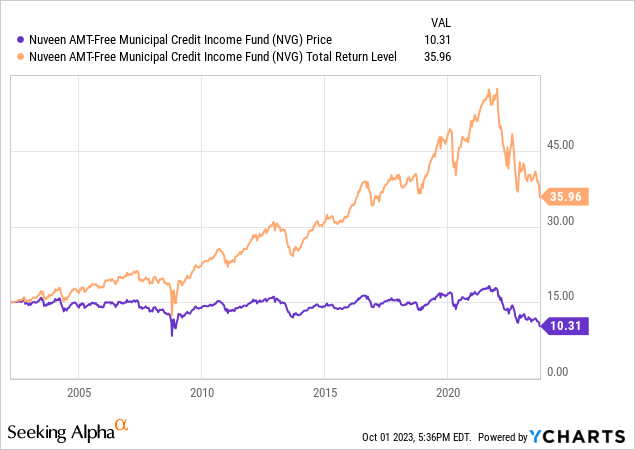

Currently, the Nuveen AMT-Free Municipal Credit Income Fund (NYSE:NVG) is trading at a discount (price<NAV) at levels only seen during the 2008-09 GFC. For investors willing to take potential short-term losses if rates continue climbing, that gap has me giving NVG another Buy rating. Owners sitting on a large loss should consider swapping into another Nuveen fund. At the end of this article, I briefly recap prior ratings and links to those articles which are annual back to 2020.p, plus mentioning the alternative CEF.

Nuveen AMT-Free Municipal Credit Income Fund review

Seeking Alpha describes this CEF as:

Nuveen AMT-Free Municipal Credit Income Fund invests in undervalued municipal securities and other related investments exempt from regular federal income taxes that are rated Baa/BBB or better by S&P, Moody’s, or Fitch. It employs fundamental analysis with bottom-up stock picking approach to create its portfolio. The fund benchmarks the performance of its portfolio against Standard & Poor’s (S&P) Insured Municipal Bond Index. The CEF has changed its name several times, with the initial fund launching in 1999.

Source: seekingalpha.com /NVG

Nuveen provides this description of their CEF:

The Fund’s investment objectives are to provide current income exempt from regular federal income tax and to enhance portfolio value relative to the municipal bond market by investing in tax-exempt municipal bonds that the Fund’s investment adviser believes are underrated or undervalued or that represent municipal market sectors that are undervalued.

The Fund invests in municipal securities that are exempt from federal income taxes. The Fund uses leverage. By investment policy, the Fund may invest up to 55% of its managed assets in municipal securities rated at the time of investment Baa/BBB and below or judged by the manager to be of comparable quality.

Source: nuveen.com NVG

NVG has $2.8b in Net Assets, $4.6b in Managed Assets, and $4.8b in Total Investment Exposure, which accounts for the Net, Managed, and $247m in a Tender Option bond. Tender Option Bonds are special purpose trust investments that create leverage by borrowing primarily from money market funds or other cash-like investors to invest in high quality municipal bonds. Effective leverage is just under 42% and has a cost of 4.47%. Fees include 102bps for the managers, 6 bps in other expenses, 239bps to fund the leverage, for a total of 347bps in total fees. NVG has a yield of 5% based on the latest price.

Data used was the most recent posted on the Nuveen website.

Holdings review

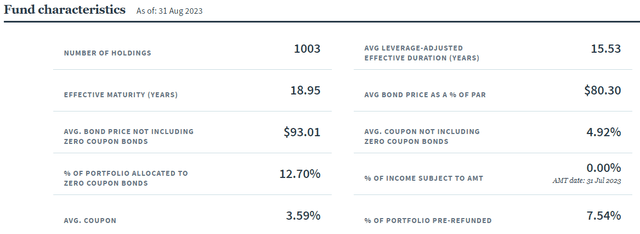

nuveen.com

As expected from the fund’s name, 0% of the distributions are subject to the AMT, a fact important to those in the upper tax brackets. The duration (15.53 yrs) and effective maturity (18.95 yrs) are pretty much standard for a municipal bond fund that does not target shorter values. The average coupon (non-zeros) aligns with the current yield, which I, maybe not others, keep an eye on. The $93 average bond price compares well against two other Nuveen municipal CEFs I recently reviewed, meaning they should not be holding too much in “questionable” debt. With that in mind, the next chart shows the ratings allocation of the portfolio.

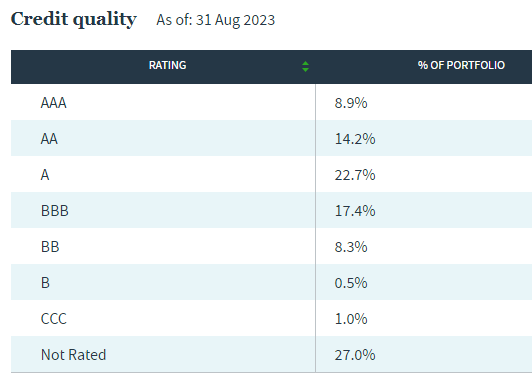

nuveen.com ratings

Defaults rates are what I would consider low until you get to the B (12%) and CCC (16%) ratings. At 27%, the non-rated allocation is average for this fund category and should not be assumed to be low rated bonds. I calculated the weighted average rating on the portfolio is just below “A”.

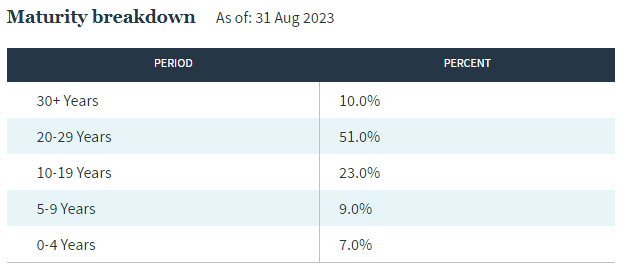

Another important factor that drives performance when rates are moving is the duration, which is highly correlated to the maturity schedule of the portfolio.

nuveen.com maturities

Only .85% of the portfolio matures before 2025, consisting of a pair of Zero-coupon bonds. By that time, interest rates should have peaked, meaning there is little natural asset flows to be used to capture today’s enhanced yields. While 25% of the portfolio is Callable before 2025, that is less likely considering where interest rates are currently.

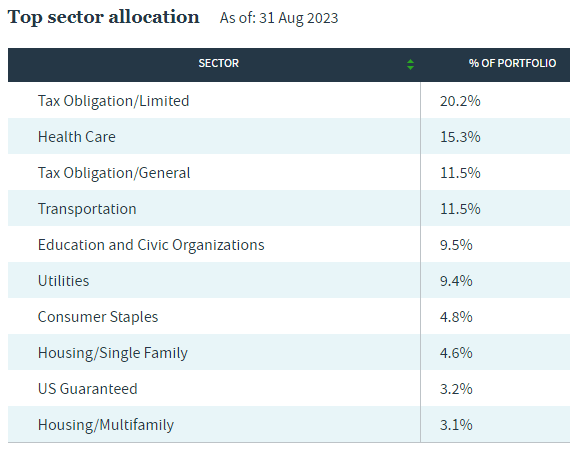

Next is sector and state allocations.

nuveen.com sectors

The top sector bonds are ones issued for projects that generate their own income to pay off the bonds (think toll roads, tobacco bonds, etc), as opposed to the third largest sector that can tap any tax available that isn’t restricted. With the data dataset, keep in mind the allocations are based on where the bonds were issued, which is not just at the state level. This list contains all those with at least a 2.5% exposure.

nuveen.com states

Unlike other Nuveen funds, the Puerto Rico exposure here has zero exposure to the island’s troubled electric company, with most of the bonds trading at $80 and above.

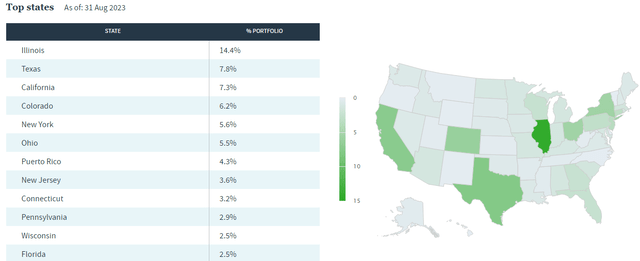

Top holdings

Nuveen.com; compiled by Author

Even with over 1000 positions, the Top 20 still account for 17% of the portfolio. The Energy Harbor is common stock received when the bonds when First Energy was taken over and bondholders received common shares. Five of the largest holders of this common are other Nuveen funds.

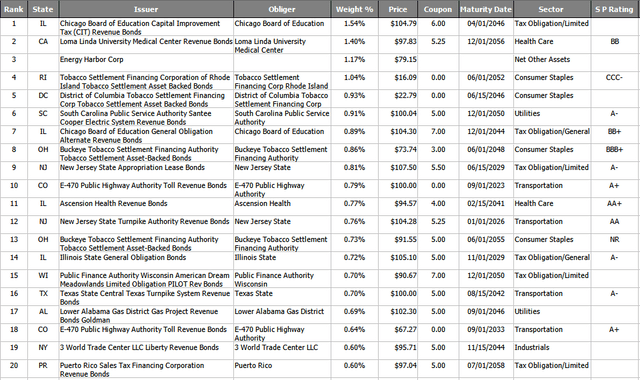

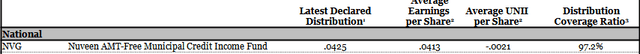

Distribution review

seekingalpha.com DVDs

Since the start of 2022, like many CEFs, this one has cut the payout three times and it is now at the lowest level ever! Unlike some other Nuveen funds, the UNII ratio is still close to 100%.

documents.nuveen.com

It was 103% one year ago so it has also held up well despite the higher cost of using leverage, whose cost is up 70+bps since this time last year.

Price and NAV review

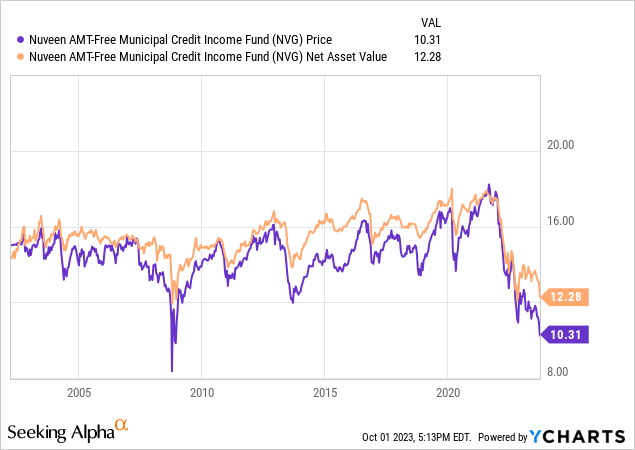

Both the price and NAV are approaching the GFC panic lows, having left the COVID lows this time last year. The next chart shows the gap between the two.

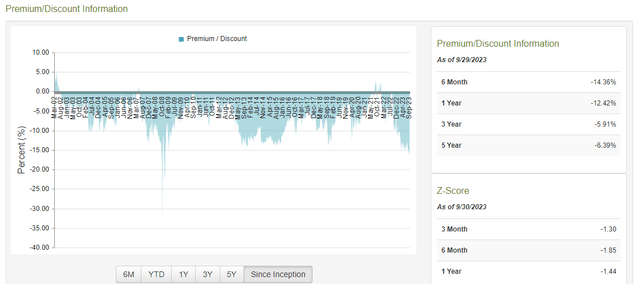

CEFConnect.com

The current discount is 16.2%, only surpassed during the height of the GFC market crash. The Z-scores indicates today would be a good entry point.

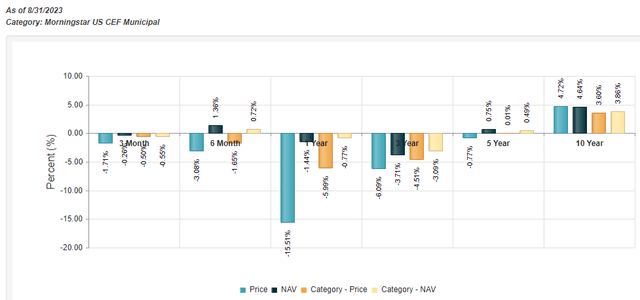

Performance review

While the ten-year data matches well against competing funds, since then NVG has been a laggard for municipal bondholders thanks to its extremely poor results this past year.

CEFConnect.com

Portfolio strategy

I found an article that said Municipal bond CEF have their largest discounts in 18 years, and pointed to two main reasons for this:

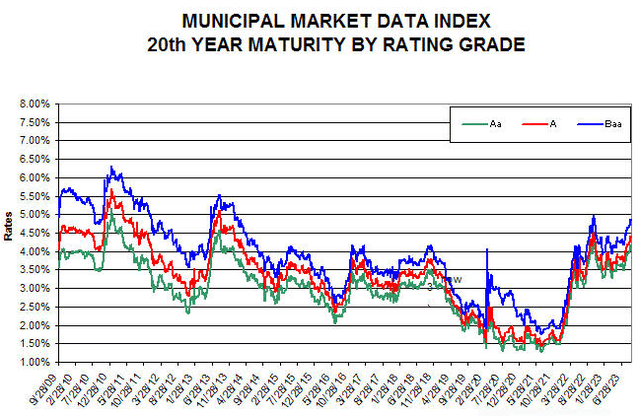

- The funds tend to own longer-term municipal bonds with maturities of 15 to 20 years, which have been hit by the recent selloff in fixed-income markets.

- The use of leverage to enhance the yield has been taken away as leveraging costs are now close to the coupons held by the fund. This has resulted in payout cuts.

With the selloff in the municipal bond market, the average yield is approaching levels last seen in 2014.

munibondadvisor.com

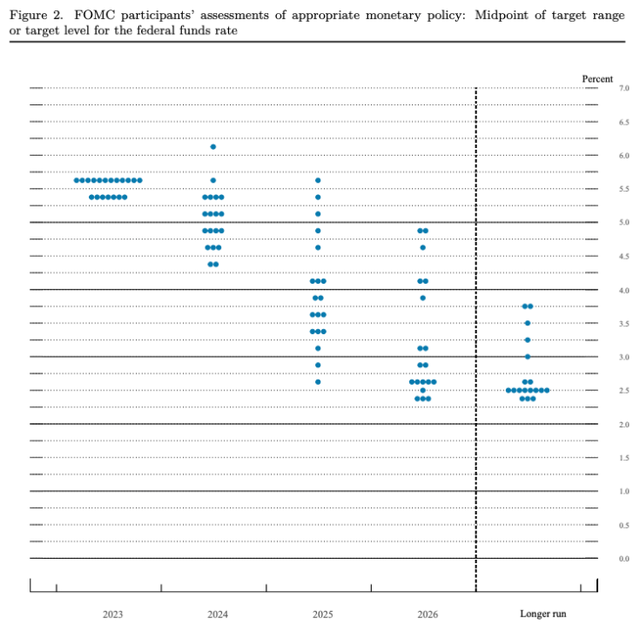

While this should be good going forward, it explains the price and NAV drops that started when the FOMC started pushing up interest rates. So the $64 question is when will the FOMC stop rising and maybe even cut rates? With NVG down over 7% in the past month, investor fear that “higher for longer” might be very accurate. A recent FOMC dot-plot looks like this.

bankrate.com/banking/federal-reserve

Conclusion

If the chart is right, the pain should be about over. For owners with little or no capital losses to claim, I can see holding tight for the following reasons:

- Attractive discount compared to historic levels and other CEFs.

- Good UNII value should minimize more distribution cuts.

- An average “A” rated portfolio provides good compromise between risk exposure and the yield investors earn.

- Belief we are near the top of this rate cycle. If so, the long duration should allow this CEF to outperform shorter duration ones.

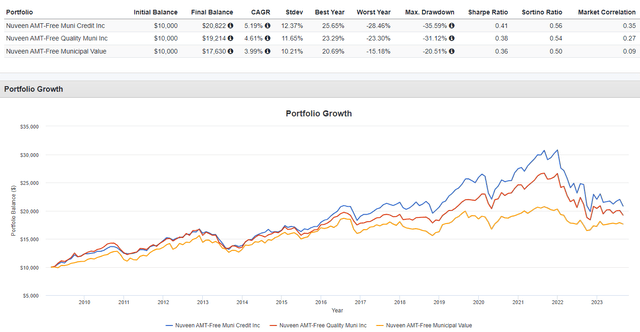

I give it a Sell rating for the others who should consider capturing that loss and reinvesting in one of the other two AMT-Free CEFs that Nuveen offers; those being either the Nuveen AMT-Free Quality Muni (NEA) with its 4.34% yield and 16.5% discount. The second is the Nuveen AMT-Free Municipal Value (NUW), which has a 3.63% yield and a 7.63% discount; both values lower than what NVG or NEA offers. Investors wanting a higher credit quality CEF might prefer NUW. Here is how these three funds’ CAGRs and risk values match up since 2009.

PortfolioVisualizer.com

The past reviews

It turns out I have reviewed the NVG CEF each fall since 2020, each time with a Buy rating. In late 2020, I liked the fact its yield was one of the best of the Nuveen funds (article link). That call worked until early 2022. In late 2021, my Buy rating was based on it being the best performing AMT-Free fund and it match up well with non-AMT-Free funds (article link). That was a bad call with the whiff of inflations that was already in the air. A year ago, the Buy rating was again pushing the AMT-Free theme (article link). While down about 2.5% since then, that Call still might work out.

I include all of those as to being open about the past ratings on NVG that haven’t worked well by themselves even if they were so bad compared to other municipal or even taxable funds. Placing funds in 6-12-month CDs and waiting the FOMC out is a valid option to consider, as would selling NVG now and buying back after 30+ days if sold at a loss.

Read the full article here

Leave a Reply