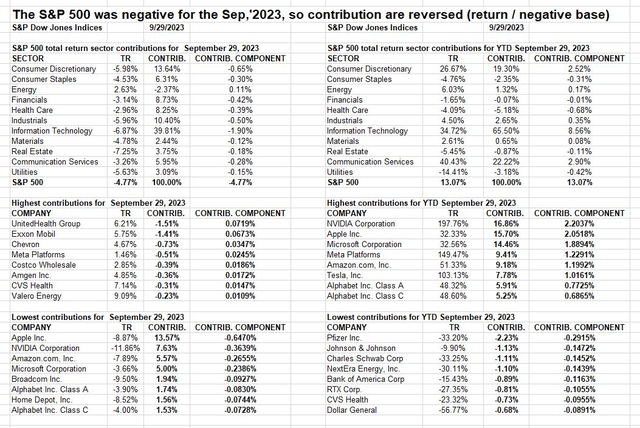

Nvidia (NVDA) has been the biggest contributor to S&P 500 gains so far this year. According to Howard Silverblatt at S&P Global, NVDA’s 198% total return through September tacked on 2.2 percentage points to the SPX, good for 17% of the market’s advance. With two awe-inspiring earnings reports lately (Q1 2024 in May and Q2 in August), the stock has consolidated. That is usually encouraging from a bullish perspective, but further near-term corrective action is a risk.

For that reason, I have a sell rating on the GraniteShares 1.5x Long NVDA Daily ETF (NASDAQ:NVDL). This leveraged ETF is susceptible to increasing volatility and bearish seasonal trends this month. But investors may want to revisit the ETF in late October when seasonality turns more sanguine.

S&P 500 Return Attribution as of Sept. 30, 2023

S&P Global, Howard Silverblatt

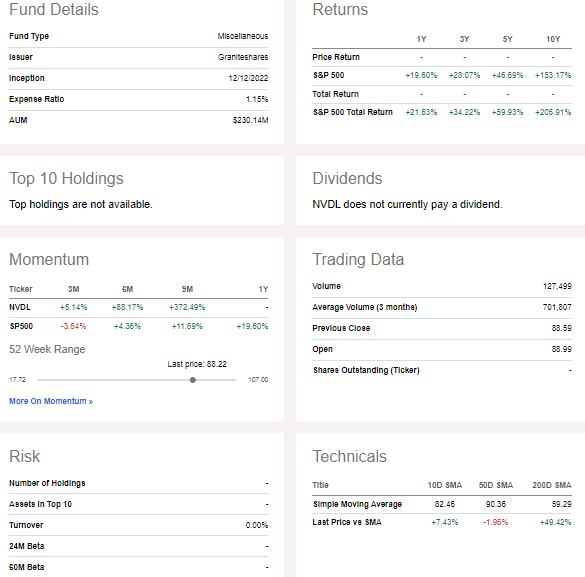

For background and according to the issuer, NVDL seeks daily investment results, before fees and expenses, of 1.5 times (150%) the daily percentage change of the common stock of NVIDIA. The fund should not be expected to provide 1.5 times the cumulative return of NVDA for periods greater than a day.

Unlike traditional ETFs and other leveraged or inverse funds, single-stock leveraged ETFs track the price of an individual company rather than an index, eliminating diversification benefits. Leveraged ETFs are generally riskier than traditional ETFs which do not employ leverage, and as GraniteShares states, “the fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily leveraged (1.5X) investment results, understand the risks associated with the use of leverage and are willing to monitor their portfolios frequently.”

Per the issuer, “for periods longer than a single day, the fund will lose money if the underlying stock’s performance is flat, and it is possible that the fund will lose money even if the underlying stock’s performance increases over a period longer than a single day. An investor could lose the full principal value of his/her investment within a single day.” Further disclosures are provided at the end of the article.

Here is an illustration of how negative compounding returns occur in a leveraged ETF: Suppose an index starts at 100, and the leveraged product also begins at 100. If the index rises by 10% to 110, the 1.5x long product increases to 115. However, if a subsequent 10% drop happens, the index falls to 99 (a 1% loss from the initial value). In contrast, the 1.5x long fund declines to $97.75 (0.85 x 115), reflecting a 2.25% decrease.

NVDL features a high annual expense ratio of 1.15% and has just $230 million in assets under management. Volume was high in August but has trailed off lately. The ETF does not pay a dividend, and the average daily volume is decent at more than 700,000 shares on average over the last three months. GraniteShares notes that the 30-day median bid/ask spread is narrow at 0.00% and shares currently trade at a tight premium of just eight basis points.

NVDL: A 2023 Winner, But Risky When Volatility Rises

Seeking Alpha

With that out of the way, I assert that the S&P 500’s current correction has some legs into later this month. Moreover, while losses have been confined to smaller stocks and sectors away from tech, it is common for corrections to end only when the leaders succumb to selling pressure – a true sense of capitulation is sometimes needed. In those situations, the year-to-date winners are commonly seen as a source of funds as investors raise cash.

This is a plausible scenario I could see unfolding over the coming weeks before a year-end rally shapes up. Thus, being long NVDA over the short run is a risky wager, in my opinion, so selling NVDL considering its bullish focus is the play.

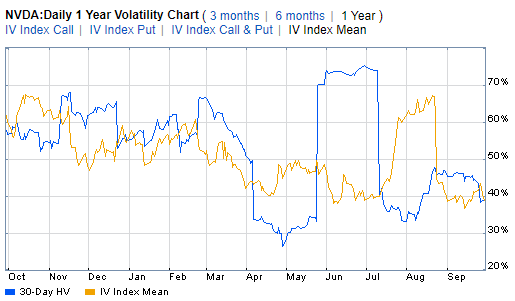

What’s interesting is that even with an uptick in stock and bond market volatility over recent weeks, NVDA’s implied volatility is near 52-week lows. To me, it suggests that there is not much fear priced into the stock, but if bearish trends in the broader market spill over, then we could see much sharper daily moves in NVDA, potentially hurting NVDL’s leveraged-long characteristics.

NVDA Implied Volatility History: Complacency Abounds

Fidelity Investments

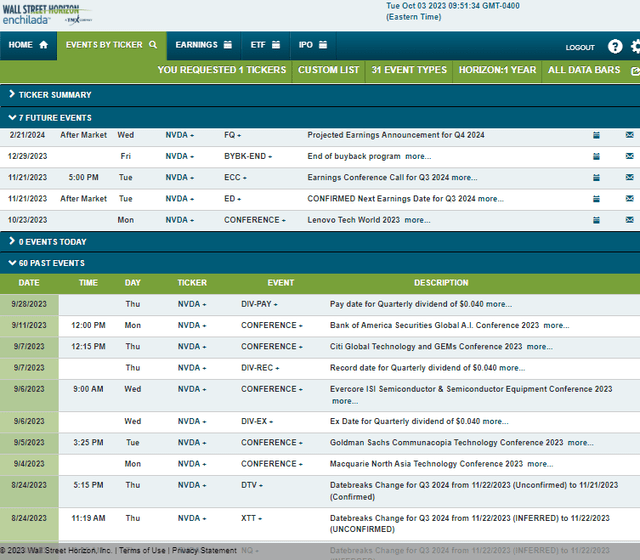

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q3 2024 earnings date of Tuesday, November 21 AMC. Volatility could also come about later this month when the management team presents at the Lenovo Tech World 2023 conference from October 23 to 24.

Corporate Event Risk Calendar

Wall Street Horizon

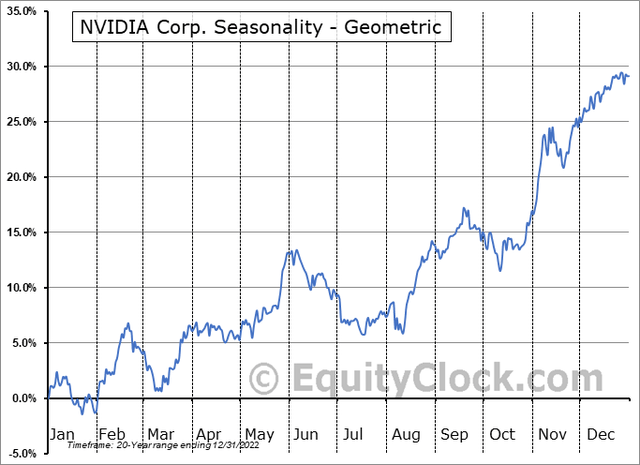

Since NVDL is a leveraged ETF, it is prudent to keep a short-term horizon with your position. Thus, seasonality plays a significant role in the near-term outlook. According to data from Equity Clock, NVDA tends to struggle through late October before often surging into the end of the year. To me, this warrants a cautious stance on NVDL over the coming weeks but have dry powder ready to buy as November approaches.

NVDA: Slightly Bearish October Trends Before A Bullish Nov-Dec Stretch

Equity Clock

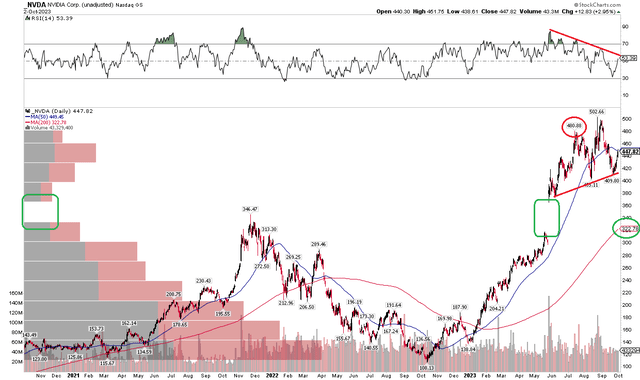

The Technical Take

With lackluster seasonal trends in the near term, are there better prospects on the historical chart? I see risks. Notice in the graph below that shares have nicely held their gap higher following the blowout earnings report last May, but the bulls were unable to get the stock back above its Q2 earnings report reaction highs above $500. I see a key rising support line that comes into play just above the recent low notched last month.

If the stock breaks down under $400, then there could be quite the air pocket down to the $310 to $320 range – near where the rising 200-day moving average comes into play. Also, take a look at the RSI momentum indicator at the top of the chart – it is in a downtrend off the high notched post the Q1 earnings report. So, there are signs that the bears are slowly taking the reins from the bulls. A rally above $480 would likely send the stock rather quickly to retest its all-time highs.

Overall, I see the risk/reward skewed bearish in this case. With soft seasonal trends over the coming weeks, weaker momentum, and a lack of follow-through post-earnings in August, I would hold off on the stock in the short run.

NVDA: Bearish Breakdown Risk to the Rising 200dma Amid Weakening Momentum

Stockcharts.com

The Bottom Line

I have a near-term sell rating on NVDL. The stock appears to be in a consolidation phase following a massive rise, and NVDL’s leverage could work against investors should volatility tick up and if further weakness is seen in October.

Additional disclosures:

1) The Lowdown on Leveraged and Inverse Exchange-Traded Products (FINRA)

2) Leveraged and Inverse ETFs: Specialized Products with Extra Risks for Buy-and-Hold Investors (SEC)

3) FINRA’s Reminder on sales practices for Leveraged and Inverse ETFs (FINRA)

Read the full article here

Leave a Reply