Summary

Readers may find my previous coverage via this link. My previous rating for Nuvei Corp. (NASDAQ:NVEI) was a buy, as I believed the share price decline was a buying opportunity as I continued to expect high growth rates in the mid-terms. I am revising my rating from a buy to a hold rating as my bull case is dismissed in the near term. Management’s revision of guidance was a major negative surprise, which I think will continue to pressure the stock price in the near term. The burden of proof is now on management to show that growth can accelerate back to 20+% and its margin can recover to pre-PAYA acquisition levels. Like many other investors, I am going to stay away from the stock until NVEI shows tangible progress.

Financials

In 2Q23, NVEI’s net revenue of $307 million was in line with expectations, and the company’s gross margin of 82.4% was higher than the consensus estimate of 78.8%. In line with the consensus estimate of $109 million, adjusted EBITDA came in at $110 million, implying 36% EBITDA margin. However, adjusted EPS of $0.39 was 14% lower than expected.

Comments

Recommending to size up investment stakes in NVEI turned out to be a big mistake. I am now downgrading shares of NVEI to hold following 2Q23 results given reduced visibility into the business, the significant reduction in 2H23 outlook, and the reduction in the company’s long-term guidance.

The management’s updated outlook for 3Q23 indicates an expected volume range of $47.5 billion to $49.5 billion, with revenue projected between $300 million and $308 million. At the midpoint of these figures, the estimated take rate would be 63 basis points (bps). Additionally, they anticipate an adjusted EBITDA ranging from $105 million to $110 million, resulting in an EBITDA margin of approximately 35.4%. This reflects a negative 60 bps decrease compared to 2Q23.

For the full year 2023, management now predicts a lower volume range of $193 billion to $197 billion, down from the previous range of $196 billion to $202 billion. Similarly, the previously forecasted revenue range of $1.225 billion to $1.264 billion has been adjusted to $1.17 billion to $1.195 billion. Additionally, the projected revenue growth rate, excluding digital assets and crypto, has been narrowed to a range of 16% to 20%, down from the previous range of 23% to 28%. These revisions are primarily due to customer tendencies to postpone go-live dates into the following year, along with a more conservative approach reflecting challenging year-over-year comps in 2H23 related to the absence of the World Cup that contributed to strong growth in 2H22.

Now, my opinion is that the lowered guidance for FY23 is not all that bad as a standalone. It is pretty much expected that 2H23 is going to be a tougher one, as 2H22 was a really strong half. Also, the delay in implementation could be somewhat attributed to the weakness in the current macroeconomic environment. But the last nail in the coffin was management’s revision of its medium-term growth targets.

Management has drastically reduced their revenue growth projections from over 20% to 15% to 20%. After acquiring PAYA, which has a slower organic growth rate than NVEI’s core business, management decided to lower the company’s medium-term guidance range. While the market already knows that Paya is growing in the mid-teens, it is surprising that management is now attributing the growth slowdown to PAYA. It begs the question, “Why now?” Why hasn’t management brought this up before? Recall that previously I mentioned that the bear case for NVEI was that management guided revenue of $1.225 billion to $1.264 billion, which implies an acceleration in growth towards 2H23.

2H23 acceleration in growth will break historical trends, and the direction of how the macro environment will move in 2H23 is something that could swing NVEI results. In short, there is elevated risk for NVEI not being able to hit 2H23/FY23 expectations. Source: 2Q23 earnings

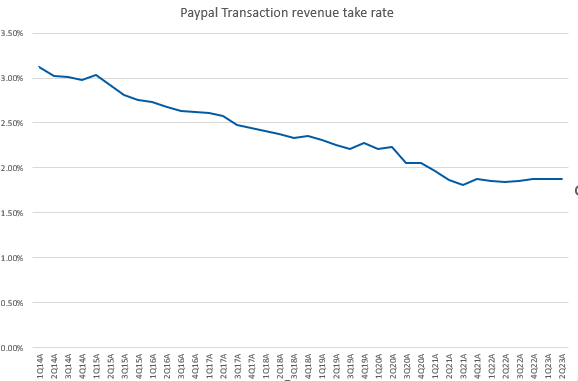

As a result, the stock price crashed after management announced a significant reduction in their expectations. This is a big challenge to me leaning towards the bull case. My prior recommendation to buy the stock was based on the company increasing its revenue by 20%. While I believe NVEI has the potential to post growth within its targeted range over time, I believe this to be highly contingent on NVEI realizing synergies from its PAYA acquisition and growing in its e-commerce segment; unfortunately, management has lowered its near-term growth expectations. In light of the increasing levels of competition in the e-commerce sector and the resulting compression of take rates among the industry’s major service providers like PayPal, I am doubtful growth will recover to 20+% in the near-term.

Based on author’s own math

I anticipate that the stock’s “unwanted” status will persist so long as investors continue to mistrust management’s outlooks. Regaining the confidence of investors will take time, but I believe NVEI can do so once it demonstrates it can revive its growth and improve its margin profile. Giving management the benefit of doubt, again, it seems like they are on the right track, according to the Goldman Sachs conference. At the conference, PAYA’s management highlighted the company’s partnerships with independent software vendors [ISV], noting that these businesses are increasingly trying to reduce the number of suppliers they work with. Considering the widespread reach of NVEI, I consider this a promising development. Furthermore, management stressed the company’s recent success in attracting net new ISV partners, citing two ISVs with over $1 billion in processing volume at the time of signing.

So, it appears that the “growth” aspect of the recovery is on the right track. But I expect the first “milestone” for NVEI to be a return of EBITDA margin to levels seen prior to the purchase of PAYA. This is very likely to occur, which will be beneficial in restoring faith in NVEI. It’s important to keep in mind that NVEI’s recent years of expansion into new markets have required a sizable initial financial outlay. I anticipate that now that these licenses have been obtained, management will shift its attention to pursuing the growth opportunity, which should in turn improve margins.

Overall, my downgrade to a hold rating is due to the fact that my bullish view is now dismissed in the near term. The market is unlikely to react positively to any of management’s positive guidance unless it is printed in the results.

Conclusion

I am downgrading my rating on NVEI from buy to hold as my previously bullish outlook for the company has been dispelled in the near term. The surprise revision in management’s guidance has cast uncertainty on the business, resulting in reduced visibility and a significant downgrade in the outlook for 2H23 and the company’s long-term growth trajectory. While the lowered FY23 guidance is somewhat expected due to challenging comps and delayed implementations in the current macroeconomic environment, it’s the revision of medium-term growth targets that has been the tipping point. Management’s reduction of revenue growth projections from over 20% to 15%-20% raises questions, particularly regarding the attribution of the slowdown to the PAYA acquisition.

Although NVEI may regain investor confidence by demonstrating growth recovery and margin improvement, the market is likely to remain skeptical until tangible results materialize. My “hold” rating reflects the need for NVEI to prove its ability to meet revised expectations before considering a more positive outlook.

Read the full article here

Leave a Reply