The WisdomTree U.S. Efficient Core Fund (NYSEARCA:NTSX) is an interest asset allocation fund that effectively provides 1.5x leveraged returns to the traditional 60/40 portfolio. For investors that can stomach the higher volatilities, the NTSX ETF does provide higher returns than traditional ‘balanced’ funds.

The key risk to NTSX is if inflation proves to be secular, then interest rates may have to stay ‘higher for longer’, which may prove to be a headwind to 60/40 portfolio allocations. I rate the NTSX ETF a hold.

Fund Overview

The WisdomTree U.S. Efficient Core Fund (“NTSX”) is an asset allocation ETF that aims to provide exposure to U.S. equities combined with an allocation to bond futures for diversification purposes and to lower overall portfolio volatility.

The NTSX ETF invests 90% of net assets in the S&P 500 while 10% is allocated to bond futures to provide 60% notional exposure to a bond ladder composed of 2, 5, 10, and 30 bond futures. The NTSX ETF will rebalance portfolio allocations quarterly or if the asset exposure deviates more than 5% from the default 90%/60% allocation.

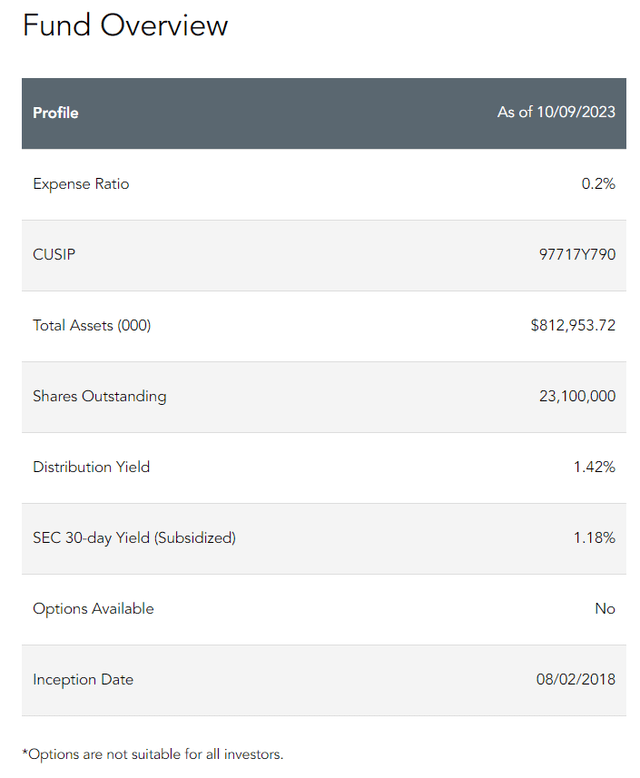

The NTSX ETF has $813 million in assets and charge a 0.2% expense ratio (Figure 1).

Figure 1 – NTSX overview (wisdomtree.com)

New Take On The 60/40

The 60/40 Equity/Bond ‘balanced’ portfolio has been the bedrock of many investors’ portfolios for the past few decades. It provides a mixture of growth, from the 60% equity allocation, and income and safety, from the 40% bond allocation.

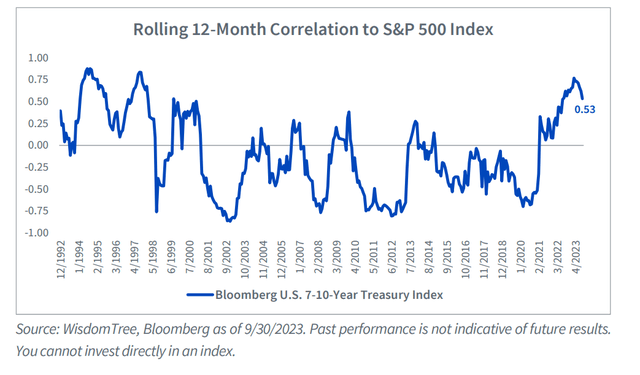

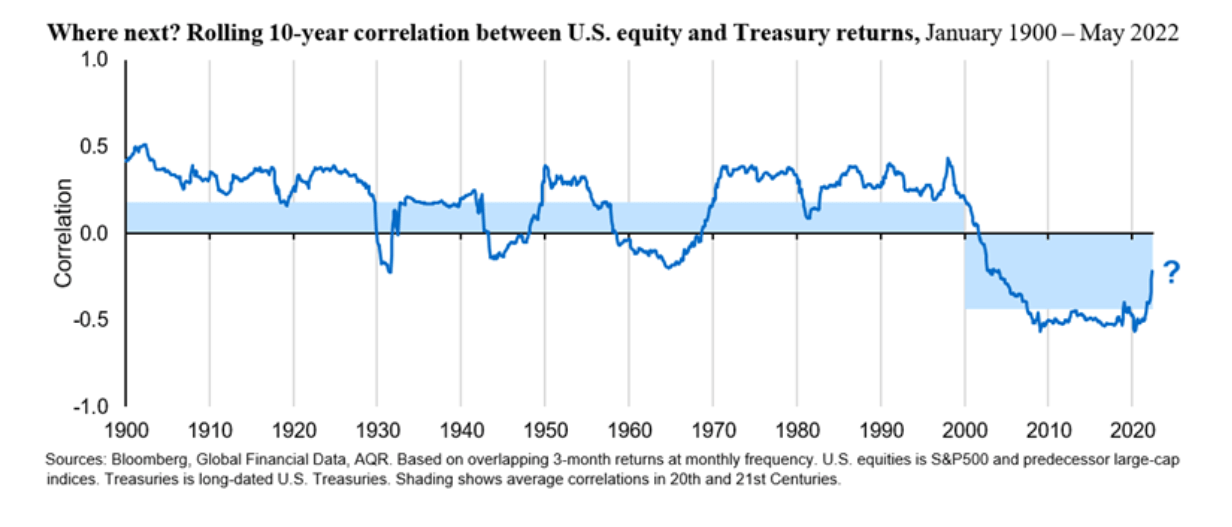

Historically, a negative correlation between bonds and stocks provided the intuition behind the 60/40 portfolio as having bonds in one’s portfolio provided a counterweight to stocks during market corrections, reducing portfolio drawdowns and allowing investors to ‘sleep well’ at night (Figure 2).

Figure 2 – Bonds and stocks have been negatively correlated in the past few decades (wisdomtree.com)

Unfortunately, as interest rates dropped to their lower bound (interest rates cannot go below zero, else why would anyone lend money out) in the aftermath of the Great Financial Crisis in 2008 and the COVID pandemic more recently, the risk of bonds and stocks becoming positively correlated rose. In fact, as we saw in 2022, bonds and stocks can decline at the same time, if the driver of both is a macro shock like inflation requiring the Federal Reserve to raise interest rates.

Nonetheless, WisdomTree believes instead of changing the asset mix, the correct path forward is to lever up the exposures as it believes “larger fixed income exposures would be needed to effectively reduce equity market correlations”. At the same time, the manager believes “some investors may want to maintain high correlations to participate in equity bull markets, despite the threat of higher equity volatility and drawdowns”. These two competing aims created a portfolio paradox where “high return potential coupled with reduced risk seems fundamentally incompatible”.

WisdomTree’s solution is to maximize equity beta by allocating 90% of a portfolio to equities while using the remaining 10% to gain leveraged exposure to fixed income via bond futures.

Hence the 90% Equity / 60% Bonds allocation of the NTSX ETF is basically 1.5x leverage on the historic 60/40 portfolio.

Portfolio Holdings

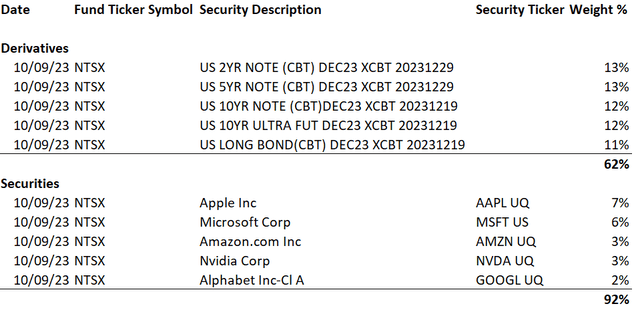

Figure 3 shows the top 10 holdings of the NTSX ETF. As expected, the fixed income allocation accounts for 62% of the fund, spread out among 5 treasury futures. Equities account for 92% of net exposure, which basically replicates the holdings of the S&P 500 Index.

Figure 3 – NTSX portfolio holdings (Author created with holdings file)

Distribution & Yield

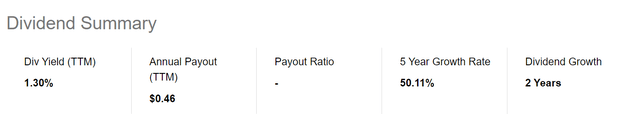

The NTSX ETF pays a nominal 1.3% distribution yield that is similar to the S&P 500 (Figure 4).

Figure 4 – NTSX distribution (Seeking Alpha)

Investors should note that unlike traditional 6/40 portfolios that pay a modest yield from the bond holdings, NTSX’s bond exposure is synthetically created using bond futures hence it does not earn interest income. Instead, any interest income is added to the value of the derivatives, which may prove to be advantageous from a tax perspective as investors pay capital gains taxes instead of income taxes in interest income.

Returns

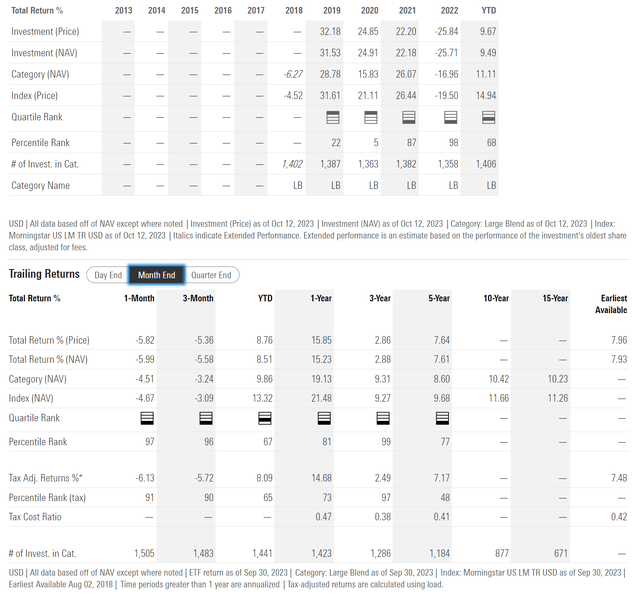

Figure 5 shows the historic returns of the NTSX ETF. The NTSX ETF has performed modestly well in the past few years, delivering strong returns from 2019 to 2021. However, the fund suffered a large decline in 2022. 2023 is shaping up to be another solid year for NTSX.

Figure 5 – NTSX historical returns (morningstar.com)

Overall, the NTSX ETF has delivered 3 and 5 year average annual returns of 2.9% and 7.6% respectively to September 30, 2023.

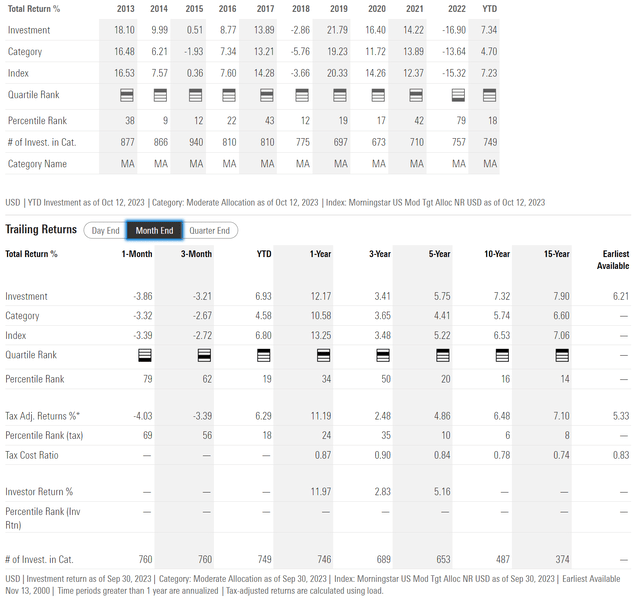

To gauage the performance of the NTSX ETF, I have chosen to compare it against the Vanguard Balanced Index Fund (VBIAX). Historically, the VBIAX fund has returned 3.7% and 4.4% on 3 and 5 year time frames, so the NTSX fund appears to have some merit, especially over longer time frames (Figure 6).

Figure 6 – VBIAX historical returns (morningstar.com)

NTSX vs. VBIAX In Detail

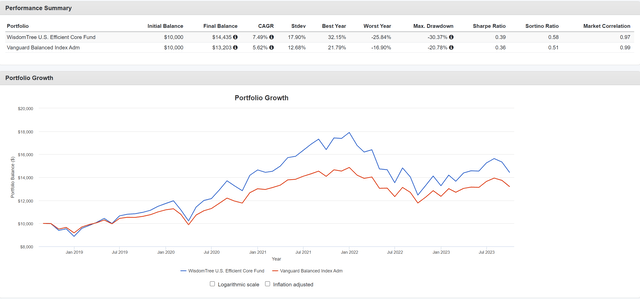

However, before investors crown NTSX as the winner, we should investigate the comparison between NTSX and VBIAX in more details. Figure 7 shows a comparison between NTSX vs. VBIAX created Portfolio Visualizer.

Figure 7 – NTSX vs. VBIAX (Author created using Portfolio Visualizer)

We can see that since inception, the NTSX ETF has delivered a CAGR return of 7.5%, which is superior to VBIAX’s 5.6%. However, it comes at the expense of higher volatility, with Std. Dev of returns of 17.9% vs. 12.7%. Furthermore, the NTSX portfolio had a maximum drawdown of 30.4% compared to 20.8% for VBIAX.

In fact, if we think about it, the NTSX ‘should’ outperform VBIAX, since it is essentially a levered version of the 60/40 portfolio. However, by using bond futures to gain the portfolio leverage instead of borrowing money, the NTSX ETF is more ‘efficient’.

Watch Out For Secular Inflation

The key question in my mind on whether the NTSX ETF is a buy is what macro regime we are in. While Figure 2 above shows that since the 1990s, bonds and stocks have been negatively correlated, suggesting a 60/40 portfolio would intuitively work, other studies have shown that the past 3 decades may be the exception and not the norm.

For example, data from Investment & Pension Europe shows that rolling 10-year correlation between U.S. equities and treasuries have experienced positive correlations for many decades prior to the 2000s (Figure 8).

Figure 8 – Negative correlation between stocks and bonds may be the exception and not the norm (Investment & Pensions, Europe)

Of particular interest is the period in the 1970s and early 1980s which showed a striking similarity with the current macro environment, as an energy shock prompted the Federal Reserve to raise interest rates to combat inflation.

If inflation proves to be secular rather than transitory, then interest rates may stay ‘higher for longer’ and the positive correlation between bonds and equities can persist, which could be detrimental to a 60/40 (or 90/60) portfolio allocation.

Conclusion

For investors who believe in a ‘balanced’ 60/40 portfolio allocation and can stomach higher volatilities, the NTSX is a solid choice as it ‘efficiently’ provides 1.5x leveraged exposure to the 60/40 portfolio using bond futures.

The key risk for investors is if inflation proves to be secular instead of transitory, in which case, interest rates may have to stay high for a long period of time and could prove detrimental to the 60/40 allocation for the coming years. As I am in the secular inflation camp, I rate the NTSX ETF a hold for now.

Read the full article here

Leave a Reply