Novanta Inc. (NASDAQ:NOVT) manufactures and sells a variety of components and parts to OEMs in industrial and medical end markets. The company separates its business units into three segments: Photonics, Vision, and Precision Motion.

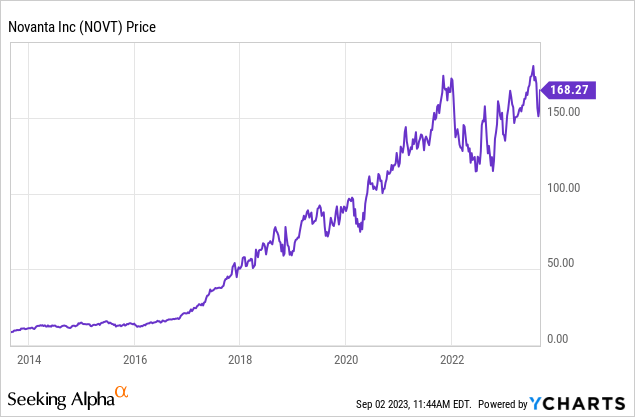

Novanta’s stock is up over 1,000% since 2016 when it changed its name from GSI Group. This name change signaled a transformation in its business model that had taken shape in the years prior. During this transformation, Novanta sold its semiconductor business and focused more on its other products with photonics and medical applications. Given Novanta’s improved business performance and the subsequent rise in its stock, this transformation was clearly the right call.

As a generalist, I don’t claim to be well acquainted with most of the products it sells as they are quite technical and are involved in a variety of different applications. However I can see how Novanta’s transformation and shift in focus to these products has changed the financial results of the business and investors’ perception of the business. In short, Novanta has been able to grow its top line with acquisitions while also improving its returns on invested capital. These two factors have not only led to higher earnings but have led to investors being more willing to pay a high multiple of earnings for the stock.

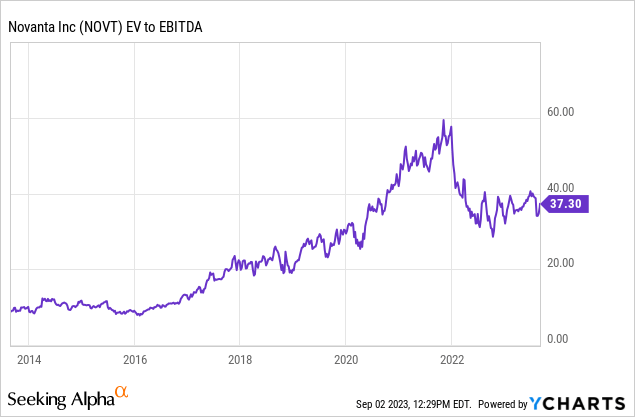

This enthusiasm from investors and subsequent multiple expansion makes the stock look very expensive based on its earnings multiple. I would agree that it is expensive, but I don’t think it’s as expensive as it looks as GAAP earnings don’t necessarily reflect the true economics of the business.

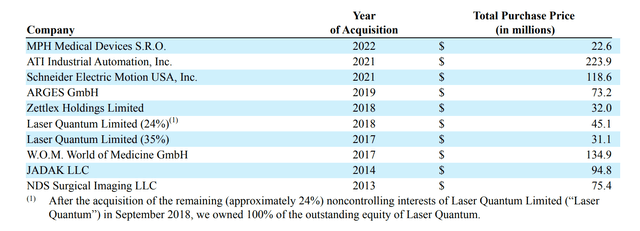

Novanta is a serial acquirer as they have and will continue to use acquisitions to fuel revenue and earnings growth. This status as a serial acquirer makes it more appropriate to value the business based on free cash flow or EBITDA rather than GAAP earnings as GAAP earnings will include large expenses attributable to the amortization of intangible assets. As long as the acquisitions are maintaining their value, this expense doesn’t reflect the true earnings that owners receive.

Novanta Acquisitions (2022 Annual Report)

While investors shouldn’t focus on the fact the Novanta trades at over 70x trailing GAAP earnings, the stock is still expensive at 35x trailing EBITDA. Novanta may eventually prove to deserve this valuation but it’s not a bet that I am willing to make as its returns on invested capital are below what I think a company at this valuation should earn. I believe that investors are willing to look past this because of Novanta’s growth and operations in markets with secular tailwinds, but any hiccups could be painful for investors due to the potential for multiple compression.

A comparison to Constellation Software, Inc. (CSU:CA) can help clarify my thoughts on Novanta and its valuation. Constellation is another serial acquirer, but it focuses strictly on vertical market software (VMS) businesses. Constellation also always looks expensive, but its valuation is justified due to its consistently high returns on acquisitions, its long runway for growth, and management team that is in a league of its own.

The market seems to think that Novanta can have Constellation type growth as the stock is currently trading at a similar multiple, but I don’t think the risk/reward of making that bet is currently favorable. With this in mind, I am initiating coverage with a sell rating while recognizing that the reasons for Novanta’s premium valuation are valid.

Business Overview

I would encourage investors to get an idea of Novanta’s products and end markets by reading the brief descriptions that the company provides in its annual reports.

In brief, photonics based applications are used in industrial, metrology, medical and life science industries. Again, I don’t claim to be an expert on photonics or its applications but it’s important to understand that this technology has uses in large and growing end markets. While some of these end markets are quite cyclical, investment in this technology will benefit from secular tailwinds due to its applications in DNA sequencing and medical procedures.

The vision segment designs and manufactures a variety of specialized products for medical uses. As the name of the segment suggests, many of the products under the vision umbrella have to do recording and video technologies in medical applications such as surgeries and imaging.

The precision motion segment manufactures and sells products for robotics and machines that require precision motors and general precision machine components.

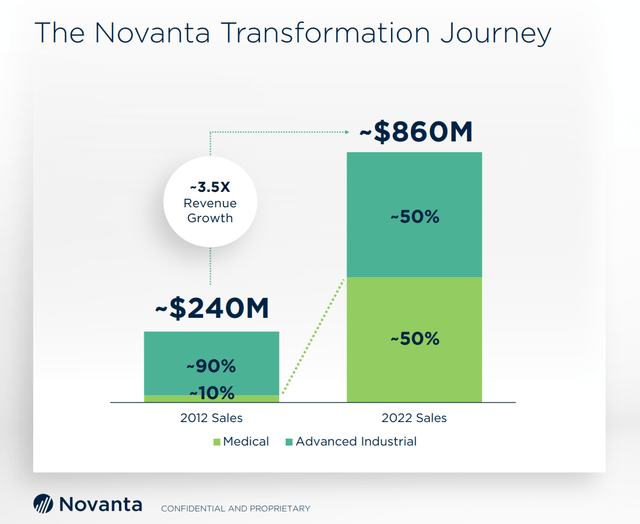

As I mentioned above, the company’s name was changed from GSI Group to Novanta in 2016 to signal its shift in business strategy to focus more on growth markets, especially the medical end market. Investments in medical technologies are less cyclical and have more tailwinds than do investments in industrial markets so this shift makes sense for smoother long term growth. Novanta has specifically focused on components for minimally invasive and robotic surgery applications. Revenue attributed to medical markets has grown from 10% of total revenue in 2012 to 50% of total revenue in 2022.

Novanta’s Revenue by Market (Novanta Investor Presentation June 2023)

Additionally, Novanta touts its “Novanta Growth System” as a reason for its recent success. Novanta defines this as “a set of tools and processes for deploying our strategy into developing innovative products and building commercial and operations excellence”.

This vague definition makes it a relatively nebulous concept to company outsiders, but investors like when companies have systems with proven results. This is a big reason why investors are willing to pay a high multiple for Constellation Software. In Constellation’s shareholder letters, Constellation’s CEO, Mark Leonard, speaks to the strict discipline in their M&A process and, given the company’s adherence to it, investors are betting that Constellation’s success will continue.

Novanta’s growth system is likely having a similar effect on investors.

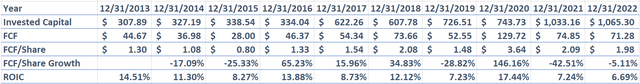

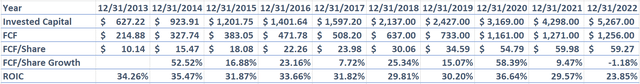

Past Financials and Current Valuation

While Novanta’s stock may receive a bit of a premium due to its culture, its valuation must be backed by its financial results and reasonable beliefs of its future financial results.

From 2016 through 2022, Novanta’s EBITDA grew from $56 million to $160 million for a 16% CAGR. Despite this growth, returns on invested capital averaged 10.5%, which is low given the growth in its multiple from 10x EBITDA to 35x EBITDA.

Novanta’s ROIC (Created by Author)

EBITDA growth with minimal dilution is generally accompanied by good returns on invested capital but Novanta’s ROIC has been volatile. This volatility can be attributed to acquisitions that lead to large increases in intangible assets and the company’s invested capital, the denominator in the ROIC equation. Intangible assets must be included in the calculation of ROIC because they stem from acquisitions which are a core part of Novanta’s growth strategy. Additionally, Novanta’s relatively high capital intensity contributes to the volatility in the company’s ROIC.

On the other hand, Constellation has grown EBITDA at a 26% CAGR since 2013 and its return on invested capital has averaged an astonishing 31% in that time. 2013 is around when the market really began to notice Constellation as its multiple expanded from 10x EBITDA to 40x EBITDA. It has traded in the 30x to 40x range ever since.

Constellation Software’s ROIC (Created by Author)

This is obviously a high multiple but Constellation deserves it. There is a high chance that they will continue to generate high returns on acquisitions and investors believe that there is still a long runway of growth ahead as they continue to acquire small VMS businesses at attractive valuations. Of course, accretive growth is a concern as the company gets larger but investors trust that Constellation’s strict adherence to its M&A principles will lead to similar financial results in the future.

At 35x trailing EBITDA, the market is giving Novanta a similar premium to Constellation despite the slower growth and lower returns on invested capital. I believe the main reasons for this are Novanta’s operations in higher growth markets with tailwinds versus Constellation’s operations in VMS businesses which often involves niche and low growth industries, investors’ perceptions that the company has a very long runway for growth, and investor’s trust of Novanta’s acquisition and growth system. The danger for investors is if even one of these beliefs is shaken, the multiple compression could lead to a large decline in the stock.

HireQuest, Inc. (HQI) is another serial acquirer that I have followed for some time. It have written an article about it but I believe investors give its stock a premium multiple due to its history of high returns on its acquisitions, its long runway for growth, and its CEO and management team that are proven capital allocators.

Despite this premium, its stock declined 25% after its most recent quarterly results were released. This happened because earnings dropped due to a decline in organic growth and higher than expected expenses relating to a large acquisition. This led to the stock’s multiple contracting by 25%, from 20x to 15x EBITDA, as investors seemed to have lost some confidence that the management team would be able to continue making acquisitions at high rates of return.

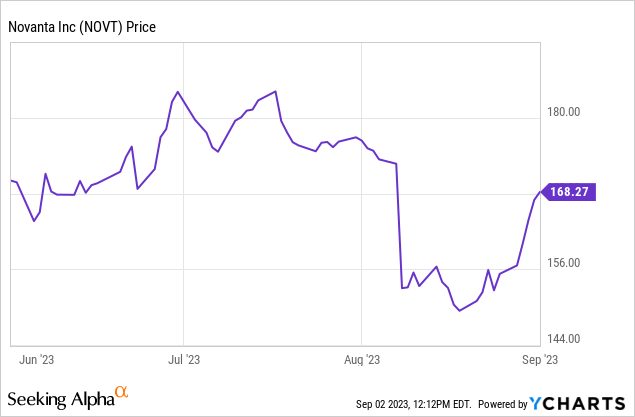

I believe something similar may happen to Novanta. If Novanta’s returns on invested capital don’t begin to rise to pre-pandemic levels in an upcoming quarter, I would not be surprised to see a similarly large decline in the stock’s multiple. This happened to a small degree after Q2 results were released on August 8th, but the stock has bounced back. This drop makes me believe that investors are a bit more apprehensive of Novanta’s prospects and could react more aggressively if ROIC does not improve soon.

A 25% decline in Novanta’s EBITDA multiple would lead to a 26x multiple. At the midpoint of guidance, 2023 EBITDA would be $200 million and with a 28x multiple, $311 million of net debt, and 35.9 million diluted shares outstanding, Novanta’s stock would trade at $136 per share. This would represent a 20% decline in the stock and I would reconsider my rating if it got closer to this price.

Final Thoughts

Novanta is trading at a premium EBITDA multiple for a reason. Investors see a long growth runway and believe that Novanta’s management team is capable of delivering solid growth via acquisitions with decent returns on invested capital. This is similar to the Constellation Software story. Constellation has demonstrated that they will grow EBITDA with high returns for a long period of time due to management’s strict adherence to smart M&A policies.

Despite deserving to trade at a premium, Novanta’s current multiple is pricing the company for Constellation type growth. This valuation may prove to be the correct one eventually but it is a bet that I am not willing to make. I believe the multiple could contract up to 25% if ROIC does not inflect upwards at some point over the next 12 months. This 25% reduction would lead to a 26x multiple which, along with $311 million of net debt, and 35.9 million diluted shares outstanding, leads to my $136 price target.

This type of multiple compression occurred with HireQuest when Q2 2023 earnings were released. HireQuest also has a similar story due to its long runway for growth via acquisitions with high returns on invested capital. However expenses from its most recent acquisition have lingered for longer than investors expected, which caused ROIC to drop. This led to a decline in the market’s confidence for HireQuest’s long term prospects, which caused the 25% drop in the stock’s EBITDA multiple. I would not be surprised if something similar happened to Novanta.

Read the full article here

Leave a Reply