Yesterday, NN Group NV released its H1 financial release (OTCPK:NNGPF) (OTCPK:NNGRY). Wall Street positively reacted to the quarterly performance, and NN Group was up by 10%. Here at the lab, we have a good grip on the EU insurance business, and this year, we have already reported twice about the Dutch insurance company. Following the US regional banking crisis and Credit Suisse development, we investigated how NN had no exposure to CS’s AT1 corporate bonds and how the company was backed by “Financial Flexibility And A Solid Balance Sheet.” Our buy rating target was supported by NN having 92% of the Government bonds with at least an A credit rating. In addition, the company was above the Solvency II ratio requirements with a solid “capital generation.”

Q2 results with our Buy case evolution

Despite a negative stock price decline year-to-date, we still believe that NN Group is a solid investment call here at the Lab. Looking back to our analysis, we usually cover the main ratio evolution in our insurance update. Here are our critical forward-thinking and key evidence highlights:

- In H1, NN’s operating capital generation reached €997 million and was 14% higher than consensus expectations. The Netherlands’ non-life segment predominantly drove this. In addition, NN’s free cash flow reached €832 million (with a 23% beat) due to a one-off remittance for a reinsurance transaction. Given the H1 results, we are now projecting a 2023 OCG of at least €1.8 billion;

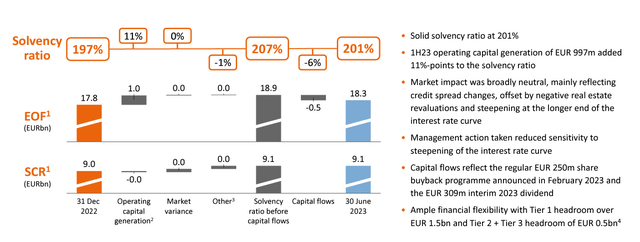

- In line with our projection (to be above the regulatory requirements), the group Solvency II ratio was nine basis points higher than Wall Street. Market impacts favored it due to credit spreads evolution. In numbers, the company ratio increased from 197% to 201% and was partially offset by capital outflows for shareholders’ remuneration (Fig 1). Here at the Lab, we are not making projections on the balance sheet ratio; however, considering the interim dividend payment in September-end (Fig 3) and the residual buyback (estimated at €55 million), we anticipate a five percent drop in the Solvency II ratio, but including the quarterly capital generation of at least €400 million, we believe that NN will be able to achieve a 200% capital ratio entirely in line with regulatory requirements;

- The company increased its OCG guidance of €1.8 billion thanks to a combined 91-93% ratio. This was driven by IFRS 17 evolution (and is very much in line with our EU cross-coverage). To be specific, under the old IRS 4 accounting basis, the combined ratio was in the 93-95% range;

- With this projection on the operating capital generation, given a lower combined ratio evolution, we derived a 2024 EPS of €5.6 per share;

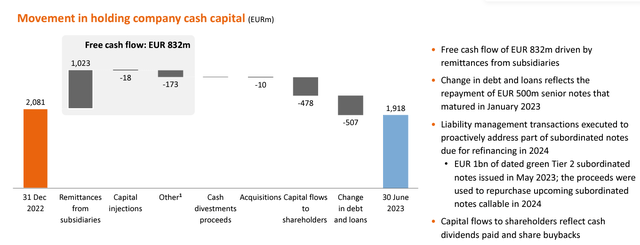

- The Hold cash position was again beaten and reached €1.9 billion (Fig 2);

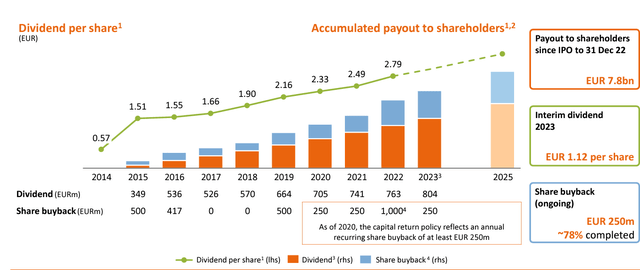

- The company’s interim DPS increased by 12% to €1.12 per share. Our dividend forecast estimates a 2024 total DPS of €3.37 per share with a projected yield (at current market price) of 9.01% (Fig 3). This is based on the fact that NN Group is committed to a progressive capital return policy and has an ongoing buyback for €250 million. Regarding the share repurchase, 78% is already completed.

NN Group Solvency II Ratio evolution

Fig 1

NN Group Cash at Hold evolution

Fig 2

NN Group DPS evolution

Fig 3

Conclusion and Valuation

As anticipated by the CEO, the company remains “well on track to deliver on our ambitious strategic and financial targets for 2025 despite the ongoing macroeconomic challenges.” Given the OCG 2023 target at €1.8 billion, we see achievable the 2025 outlook with the expectation to grow the FF/OCG ratio over the plan. Here at the Lab, we believe that Wall Street is not giving any credit to NN Group development. Interestingly enough, given the H1 results and the solid track record, we anticipate that NN’s share price decline was not matched by a fall in earnings. In addition, the company returned more than €7.8 billion since its IPO date in 2014. This represents almost 80% of its market cap in less than ten years. In line with our second-tier insurance coverage (Aegon and Aviva), we value NN Group with a P/E of 8x (while EU top-tier companies are valued at 10x, i.e., Allianz, AXA, Zurich, and Generali), we derived a target price of €44.8 per share, confirming a buy rating. We should also consider the €1.9 billion in Cash at the Holding level as downside protection. On the risks profile, the company is exposed to reductions in equity market value, adverse claims in P&C and life divisions, and regulatory changes in key markets where it operates. In addition, the company is exposed to credit default risk, given its significant investment portfolio.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply