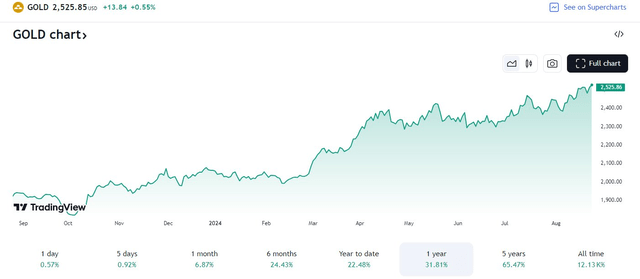

The soft US economic landing appears to have rocky implications for the US Dollar Index (DXY). A decent macro growth backdrop along with a weaker greenback is a bullish recipe for spot gold. Heading into the final week of August, the precious metal traded at more all-time highs, above $2525 per ounce. Certainly, lower real interest rates have been a tailwind, too.

I reiterate a buy rating on Newmont Mining (NYSE:NEM). I am raising my intrinsic value target from $50 last November to $65 based on higher gold prices and better EPS growth trends looking out the next two years. I will note key price points on the chart to watch as we head into year-end.

Shares are up 40% in total return since my 2023 analysis, helped by firmer gold prices and strong execution by NEM’s management team.

Gold Soars to ATHs in August, +32% YoY

TradingView

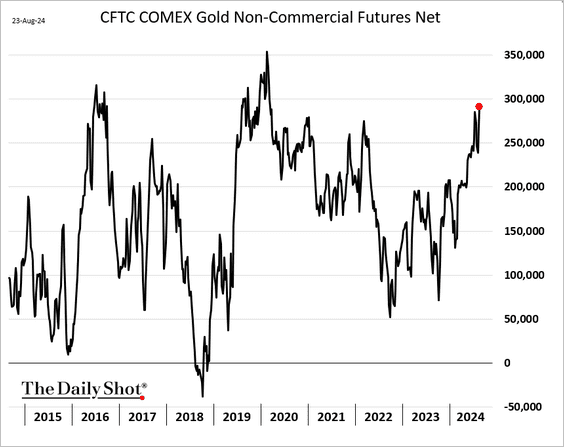

Speculators Boosted Their Net Long Position in Gold Futures Recently

The Daily Shot

Back in July, Newmont reported a solid set of quarterly results. Q2 non-GAAP EPS of $0.72 handily beat the Wall Street consensus estimate of $0.61 while revenue of $4.4 billion, up a massive 64% from the same period a year earlier, was a material $260 million beat. The $60 billion market cap Gold industry company within the Materials sector recorded production of 2.1 million gold equivalent ounces in Q2 while generating an impressive $594 million of free cash flow. Over the past 12 months, free cash flow per share is now $0.64.

From a shareholder-yield perspective, Newmont completed a $250 million stock-repurchase plan and retired $250 million in debt, helping to shore up the balance sheet. To help liquidity, the company announced that it expects to receive $153 million in cash proceeds from the monetization of Batu Hijau and sees $2 billion of gross divestitures from non-core asset sales in the periods to come.

The stock traded lower by 4.2% following the July earnings release, however, but that dip was short-lived, and the stock has recently notched fresh highs going back to April of 2023. Ahead of its Q3 report in October, the options market prices in a 5.3% earnings-related stock price swing when analyzing the at-the-money straddle, expiring soonest after the report. Analysts forecast non-GAAP EPS of $0.76 on revenue of $4.59 billion.

With a reported net income of $857 million and adjusted EBITDA of $2.0 billion for the quarter, profitability trends are healthy, with gold prices notching new highs in Q3. Following the strong results and bullish price action in gold, the stock was upgraded at Scotiabank given macro tailwinds and significant gold buying by central banks, which could perpetuate the precious metal’s bull market.

Key risks include soft gold prices which could come about should real interest rates, a stronger dollar could hurt dollar-denominated hard commodities, higher labor costs and interest rates could result in lower net income for Newmont, while geopolitical and adverse currency moves are other potential risks.

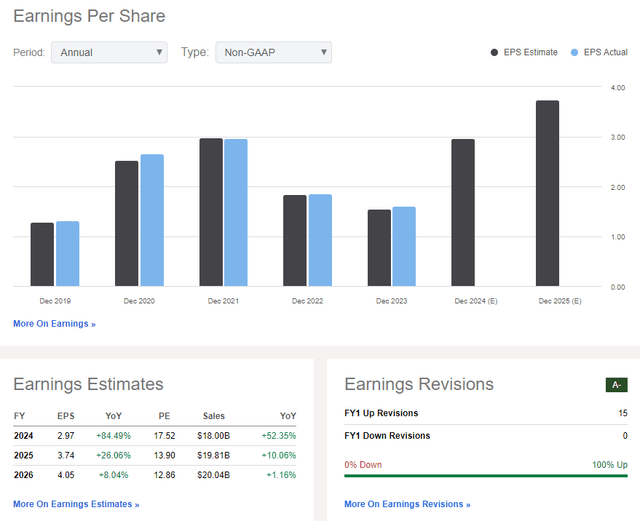

On the earnings outlook, non-GAAP EPS is expected to nearly double this year to $2.97 while out-year per-share earnings growth is seen above 26%. Growth should then stabilize at a low-to-mid single-digit pace by 2026. Sales growth is very high this year and is forecast to slow over the quarters ahead. Dividends remain off their all-time highs notched in 2021 and 2022, but I would not be surprised to see dividend hikes if free cash generation increases in the periods to come.

Newmont: Earnings, Valuation, Sales Forecasts

Seeking Alpha

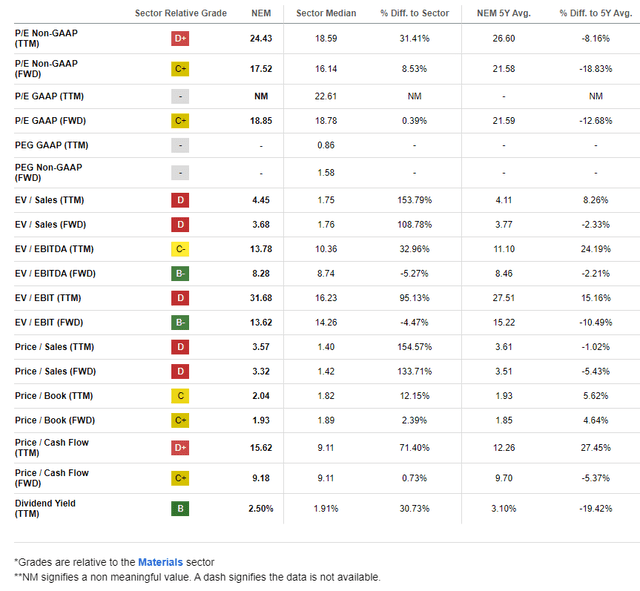

On valuation, if we assume normalized forward operating EPS of $3.40 over the next 12 months and apply a 19 multiple, below its 5-year average P/E given a currently-high earnings cycle which may ease by 2026, then shares should be near $65.

NEM has mixed valuation metrics away from earnings, including a near-average 3.3x price-to-sales ratio, so this is not a screaming buy in my view, but it’s still cheap.

NEM: Attractive On Earnings, But Mixed Elsewhere on Valuation

Seeking Alpha

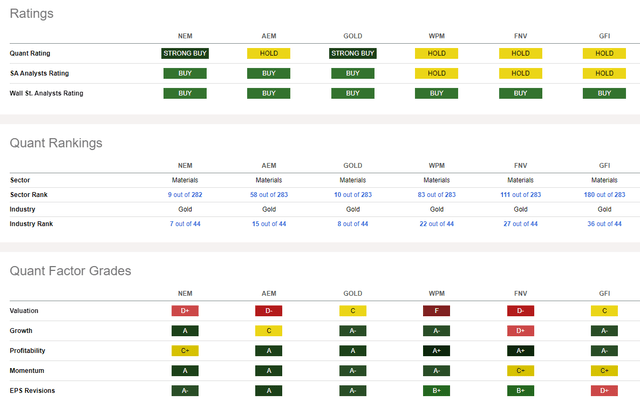

Compared to its peers, Newmont features a soft valuation rating, but the P/E is attractive based on the earnings situation. With a robust growth trajectory, profitability trends are not particularly strong – I’d like to see improved free cash flow, but high profit margins and the executive team’s capital allocation strategies have helped improve the balance sheet.

As a result, the sell-side has turned more sanguine on Newmont. There have been a high of 15 EPS upgrades in the past 90 days, compared with no downgrades. Finally, share-price momentum has been stellar since early Q2, earning the stock an A quant grade on that metric.

Competitor Analysis

Seeking Alpha

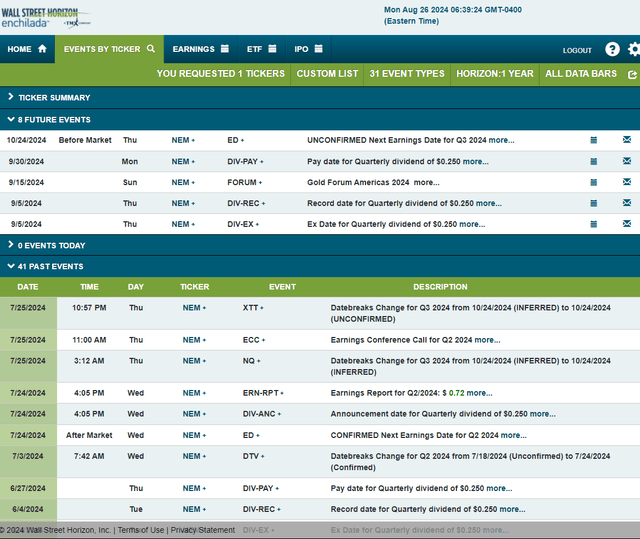

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3, 2024 earnings date of Thursday, October 24 BMO.

Before that, shares trade ex a $0.25 dividend on Thursday, September 5 ahead of the Gold Forum Americas 2024 conference at which Newmont’s management team is expected to present.

Corporate Event Risk Calendar

Wall Street Horizon

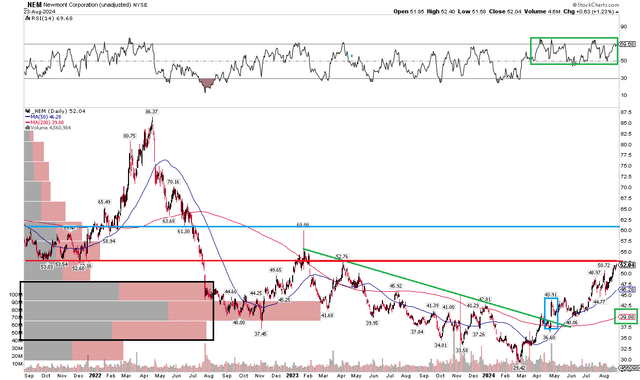

The Technical Take

NEM has achieved its “low $50s” target I outlined in November 2023. Notice in the chart below that shares have been in a robust uptrend since March of this year when they briefly dipped below $30. The past nine months have been impressive and NEM’s long-term 200-day moving average is now positively sloped, currently just under $40. I like the breakout that occurred in late April above a downtrend resistance line that happened to be a breakaway gap and a golden cross as the 50dma rose above the 200dma.

Also, take a look at the RSI momentum oscillator at the top of the graph – it has been ranging in a bullish zone between the high 40s and low 70s, suggesting that the bears have not been able to bring momentum down to oversold levels, which is a positive. The problem is that shares are now at potential resistance, with the next upside level to watch near $61. The good news is that there’s now a high amount of volume by price under the current stock price, suggesting that there should be cushion on a protracted downside move.

Overall, technicals trends are healthy, but we could see a near-term consolidation around this resistance point.

NEM: Bullish Uptrend Following April Breakout, Strong RSI But Near-Term Resistance

Stockcharts.com

The Bottom Line

I have a buy rating on Newmont. With high gold prices and rising earnings expectations, NEM remains decent on valuation, with shares in a technical uptrend.

Read the full article here

Leave a Reply