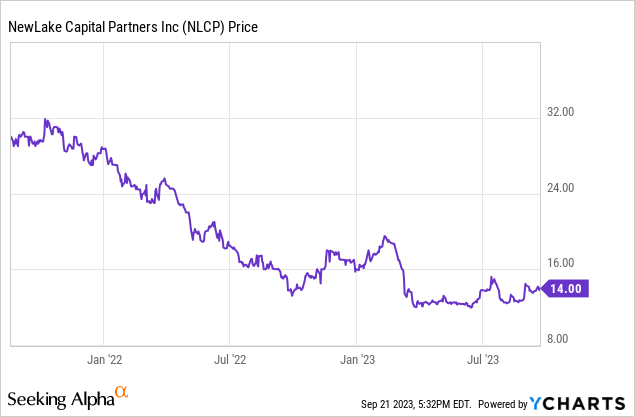

NewLake Capital Partners (OTCQX:NLCP) has had a torrid history since going public in the summer of 2021. It would only be a few months after its public debut that the Fed would embark on its tightest pace of monetary tightening in decades with the Fed funds rate currently sitting at 5.25% to 5.50%. NewLake’s core headwinds since then have been formed from its focus on properties leased to one of the worst-performing sectors in the market over the last two years. Cannabis continues to slump with no clear end to the malaise faced by its constituents as de-scheduling cannabis from a Schedule I drug remains ever beyond the horizon. At risk here is the entire North American cannabis ecosystem with the cost of capital from both debt and equity moving to new heights.

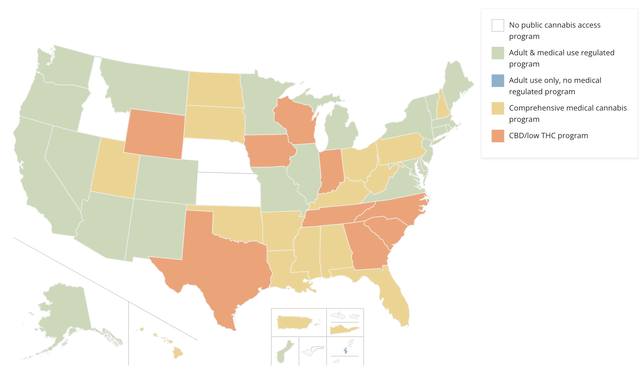

However, cannabis might be reclassified as a Schedule I substance following a Department of Human and Health Services response to a federal review launched by the White House in October 2022. There are strong arguments for this with the drug currently sharing the same classification as other drugs deemed to have no currently accepted medical use and a high potential for abuse. This classification has persisted despite cannabis being legal for recreational use in 23 US states and for medical use in 38 states. There is no guarantee the Drug Enforcement Administration will accept the recommendation and the initial euphoria around the recommendation has been peeled away.

National Conference of State Legislatures

How Safe Is The Dividend

NewLake last declared a quarterly cash dividend of $0.39 per share, in line with its prior payment and for an 11.14% annualized forward yield. The REIT last reported fiscal 2023 second-quarter revenue of $11.4 million, an 8.5% increase over its year-ago period as rental income moved up on the back of acquisitions closed through 2022. NewLake spent around $67 million last year buying four cultivation facilities and one dispensary. It has so far spent only $350,000 in 2023 to buy one parcel of land that is set to host the expansion of an existing Bloom Medical cultivation facility in Missouri.

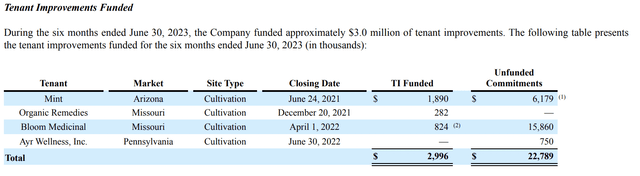

NewLake Capital Partners Fiscal 2023 Second Quarter Form 10-Q

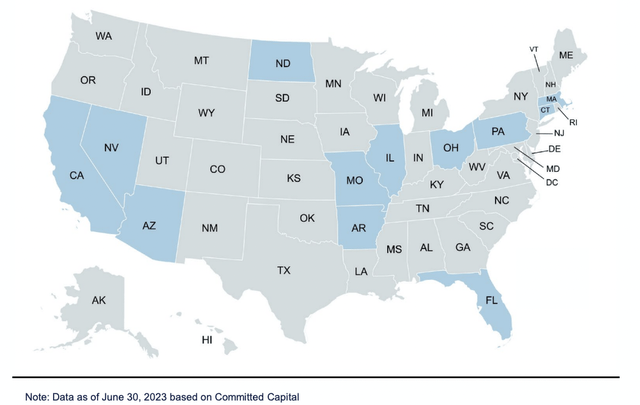

The REIT has around $22.8 million in unfunded tenant improvements which it will earn rent on as of the end of its second quarter, this comes on the back of $45.2 million of tenant improvements carried out through 2022. NewLake’s portfolio consists of 32 properties spread across 12 states and 1.7 million square feet. These properties were also 100% leased under triple-net leases that came with 14.5 years remaining lease term. The strength of NewLake’s portfolio is further emphasized by a 12.2% weighted average rent yield on leases that come with 2.7% annual rent escalations. This portfolio was also backstopped with a low 0.2x debt to EBITDA ratio and broad geographic diversification.

NewLake Capital Partners Fiscal 2023 Second Quarter Presentation

NewLake reported funds from operations (“FFO”) of $9.5 million, with adjusted FFO higher at $9.9 million. Adjusted FFO increased by around 13.3% over its year-ago comp and at $0.46 per share, it covered the dividend by 118%, or an 84.7% payout ratio. Hence, there is no near-term risk of a cut with NewLake also providing adjusted FFO guidance for its full year 2023 of $39.8 to $40.8 million, a growth of at least 4.1% at the midpoint of the range.

Tenants And Risks

NewLake Capital Partners Fiscal 2023 Second Quarter Presentation

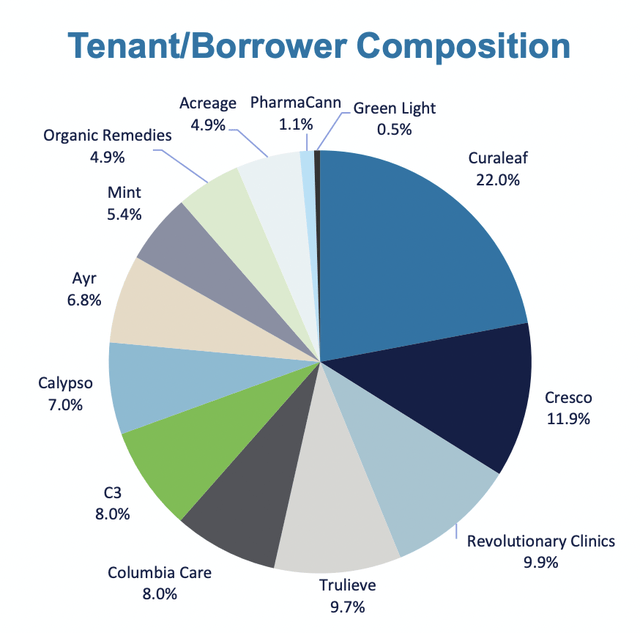

The core headwind faced by NewLake continues to be the lack of liquidity faced by the sector as consistent losses and cash burn continue to stack up. Further, whilst the REIT has a diversified tenant base, Curaleaf (OTCPK:CURLF), Cresco Labs (OTCQX:CRLBF), and Revolutionary Clinic account for 43.8% of its portfolio. The highest risk tenant is likely Columbia Care (OTCQX:CCHWF) which renamed itself to The Cannabist Company on September 19, 2023. The Cannabist, whose merger with Cresco was recently terminated, held cash and equivalents of $40.1 million as of the end of its last reported quarter set against trailing 12-month free cash outflow of $35.1 million. This precarious cash position is reflected across the financial statements of the bulk of cannabis companies as low equity prices and high cost of debt render the extension of cash runways markedly more difficult.

Critically, NewLake holds virtually no debt and has roughly $89 million available under a largely untapped credit facility that provides the REIT with the financial flexibility to potentially meander through the current macro backdrop. The dividend looks safe against the adjusted FFO forecast for the full year and the very conservatively geared balance sheet. I’m not a buyer though as the bearish sentiment could remain. However, with a 7.5x price to forward adjusted FFO multiple, NewLake’s bears might have gone too far and the REIT could stage a recovery at some point in the future if its tenant issues remain limited.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply