Amid tough macroeconomic times, “legacy” businesses are faring much worse as consumers evaluate their spending and cut back wherever possible. Traditional media has been in the headlights for many years now: but that being said, print journalism titan The New York Times Company (NYSE:NYT) has executed well with some encouraging metrics during a tough time.

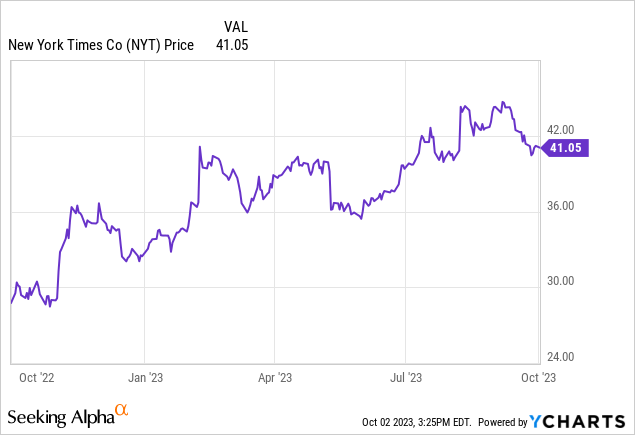

Like most other stocks during the month of September, The New York Times has taken a beating – irrespective of that, the stock remains up more than 20% this year.

I’ve been a longtime bear on The New York Times and recommended selling the stock back in July (when it was trading at similar levels in the low $40s). I had cited a number of concerns ranging from rising newsroom costs to highly promotional tactics to draw in new subscribers.

Since then, however, Q2 results have come out with some positive developments:

- ARPUs (average revenue per user) has ticked up, which is a step in the right direction toward curing the Times’ reliance on promotional activity to drive subscribers

- Increase in digital subscribers despite price increases, which I’d have thought would have produced much more pronounced churn

- Operating margins have held strong and losses at The Athletic have slimmed down

Given all these positive changes, I’m now less concerned that the Times is headed for a near-term imminent crash, and am upgrading the stock to neutral. This all being said, I’d still be wary of the following longer-term risks:

- Will people continue to pay for the news? The internet and a variety of applications are now serving up news for free. Social media applications like Twitter and Instagram now somewhat function as a news-absorption channel for many younger users. Looking ahead to the future, the concept of paying for news may cease to become mainstream.

- Losing focus? The acquisition of The Athletic makes sense. But the addition of Wordle only has a loose connection to the Times’ long-standing history of crossword puzzles. It has become apparent that The New York Times is primarily interested in purchasing companies to keep up digital subscriber growth numbers at any cost, even when large purchases like The Athletic are dilutive to the bottom line. In my view, management is spreading itself too thin in trying to form a conglomerate of different news brands and games.

In short, it will take a lot more for be to become bullish on this stock. I also continue to think The New York Times is valued at an unjustifiable premium: at current share prices near $41, the company trades at a 26x FY24 P/E against Wall Street’s consensus EPS expectations of $1.57 for next year (data from Yahoo Finance). For a company that is barely achieving single-digit top-line growth, I hardly think that’s an appropriate multiple to pay especially in the current interest rate environment where risk-free assets yield 5%.

The bottom line here: The New York Times seems to have avoided a near-term crash and burn, but it still has plenty to prove until it merits a position in your portfolio.

Q2 recap: bundling is saving the day

Let’s now go through some of the recent trends that have made me slightly more sanguine on the Times’ prospects.

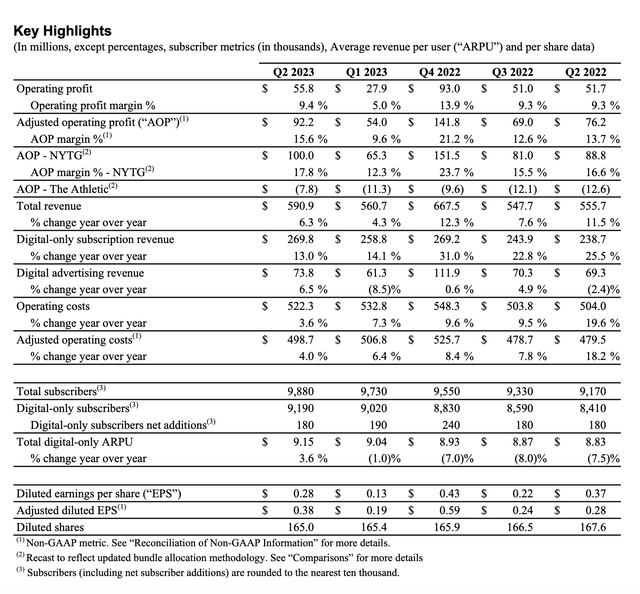

New York Times Q2 results (New York Times Q2 earnings release)

First: revenue growth accelerated slightly to 6.3% y/y to $590.9 million, beating Wall Street’s $581.0 million (+4.5% y/y) expectations. Underlying digital subscription revenue grew 13% y/y to $269.8 million, now just under half of the Times’ total revenue. It’s worth noting that the company’s guidance is calling for digital subscription revenue to accelerate further into Q3, to a range of 14-17% y/y growth.

Secondly: digital ARPU reversed a multi-quarter pattern of decline and improved both sequentially and y/y to $9.15.

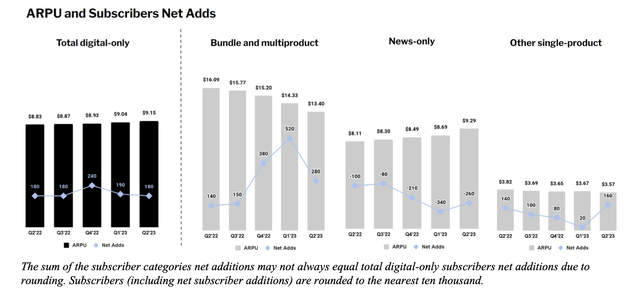

Underneath this ARPU improvement is a combination of two drivers. First: the Times has succeeded tremendously at converting its subscribers toward premium-priced bundle subscriptions. The company added 280k bundle-based subscribers sequentially as shown in the chart below, while news-only subscribers declined by -260k. And of the 180k total net-new digital subscribers that the company added in Q2, more than half of them elected a bundle option.

New York Times ARPU (New York Times Q2 earnings release)

The favorable mix into bundle products was partially offset by a lower ARPU on bundles themselves (likely as the news-only subscribers migrating to multi product are choosing cheaper, lighter bundles), but overall this shift was accretive to total ARPU.

The other trend driving ARPU growth is a large lapsing of customers who were on promotional rates and are now paying full price. In addition to this, the Times successfully executed price increases on news-only (which is reflected in the news-only ARPU) and Games customers. These increases are contributing to ARPU growth, while churn is less than I’d have feared.

Per CEO Meredith Kopit-Levien’s remarks on the Q2 earnings call detailing these pricing trends:

More than a third of our nearly 10 million subscribers are now bundled or multiproduct subscribers, which supports our belief that over the next few years, we can get to 50% or more of our total subscribers on the bundle.

We also grew digital ARPU for the fourth consecutive quarter. And for the first time since our acquisition of the Athletic, we grew digital ARPU year-on-year. That growth is a direct result of our value-based pricing strategy, which combines attractive promotional pricing, multiple subscription options and approve [ph] visibility to step up subscribers to higher prices and more products over time as they come to experience how valuable our products are in their lives.

We saw all of those elements of our pricing strategy on display in the second quarter, and I’ll note particularly that our ongoing deployment of price increases for tenured subscribers to news and games is going well as we continue to enrich both of these fronts. We view the quarter’s subscriber results as a testament to our broad and valuable product portfolio, which continues to attract a large engaged audience despite the ongoing reality of less traffic from the platform and a new cycle less dominated by singular stories that capture unprecedented attention.”

The other favorable driver in Q2 results was profitability, where operating profits increased 8% y/y to $55.7 million and represented a 9.4% operating margin – a 10bps boost y/y and a 440bps increase sequentially versus Q1. We note as well that the operating losses at The Athletic shrunk to -$7.6 million, a best for the segment since the Times acquisition. It helps here that the Athletic is growing revenue at a 55% y/y pace (though at $30.4 million of Q2 revenue, the segment is still a minor <10% contributor to overall results).

Key takeaways

With expectations for accelerating digital revenue growth, tailwinds in ARPU after many quarters of decline, and slimmer losses at The Athletic, many of my more immediate concerns on The New York Times have dimmed. This being said, at a ~26x forward P/E in a high interest rate environment, there’s not much incentive to buy this stock outright.

Stay on the sidelines here and invest elsewhere.

Read the full article here

Leave a Reply