NETSTREIT Corporation (NYSE:NTST) is a young retail REIT focusing on freestanding, triple net leased buildings. It currently has 531 investment properties in 45 states, with a total of 9.5 million square feet. This is a self-managed managed REIT, and the current CEO was Head of Asset Management at Spirit Realty Capital (SRC). NTST acquires and sometimes develops for its portfolio of single-tenant properties. The company says it targets high credit tenants and that 86.0% of the portfolio is necessities, services or discount retailers. It focuses on tenants where the physical location is important for sales, so this includes home improvements, auto parts, pharmacies, grocers, convenience stores, discount stores, and quick-service restaurants. NETSTREIT believes these kind of tenants are more e-commerce and recession resistant.

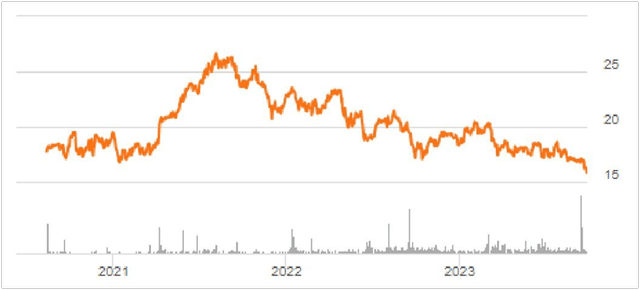

NETSTREIT had its IPO in August of 2020, offering 12,500,000 shares at a debut price of $18.00. A year later, the shares reached their peak of $26.37. The current price of $15.58 is a new low for the company, which has generally traded between $17.00 and $20.00 per share. NETSTREIT has an attractive dividend of 5.18% and recently increased it by 2.5%; but this was only the second increase since 2020. The company currently has a market cap of $1.05 billion, with a Beta of 0.9.

NTST Share Price History (Seeking Alpha Graphs)

An Investment Grade Portfolio, but Some Tenant Risks

NETSTREIT currently has 87 different tenants, across 531 properties, per the 2023 Investor Presentation. The current portfolio is 9.5 million square feet in size and properties are in every state except Alaska, Hawaii, Wyoming, Delaware and Maine. Illinois and Texas have the most properties, generating 8.7% and 8.0% of annualized base rents (ABR) respectively.

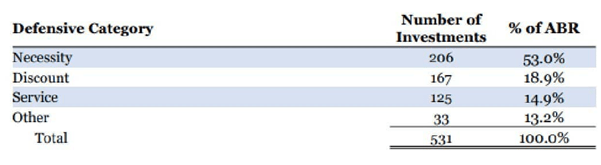

The company targets buildings with a purchase price between $1 million and $10 million, a segment of the market it can operate in “without substantial competition.” It will consider larger properties with a purchase price over $10 million, if they are leased to investment grade tenants like Walmart, Home Depot, or Lowe’s. The current ABR per property is approximately $232,000, and leases typically have initial lease terms of 10 years with two or more options for the tenant to extend for an additional five-years. A breakdown of the portfolio by retail type is below:

NTST Tenant Sectors (2022 Annual Report)

According to its 2022 Annual Report the goal of the company is to be diversified geographically and across industries. For NETSTREIT this means having no more than:

- 5% of its ABR from any single tenant or property, or

- 15% of its ABR from any single retail sector, or

- 15% of its ABR from any single state, or

- 50% of its ABR from its top 10 tenants.

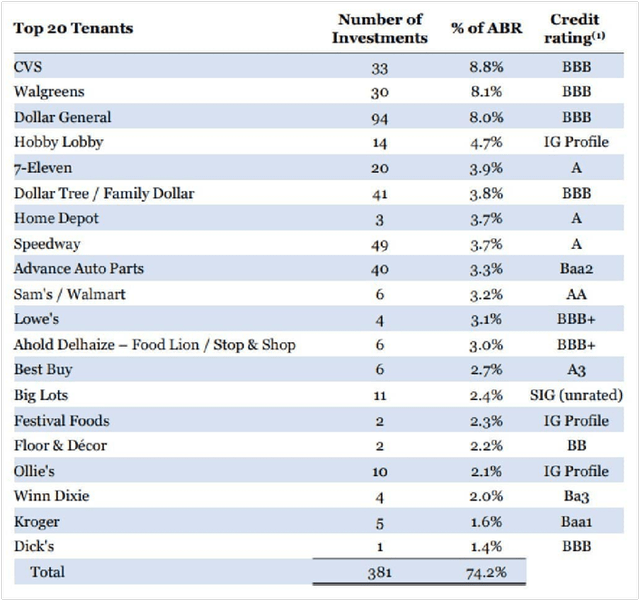

NETSTREIT seeks out tenants that will be e-commerce and recession resistant. It has also tried to construct a portfolio where at least 60.0% of tenants are investment grade, and with a weighted average lease time (WALT) of 10 years or more. Below are the top 20 tenants by ABR with their current Standard & Poor’s or Moody’s credit ratings.

NTST Top 20 Tenants by ABR (NETSTREIT Introduction Page)

The highest rated tenant is Walmart (WMT) with a Standard & Poor’s rating of AA, or high investment grade. Next is Best Buy (BBY) with a Moody’s rating of A3, or medium investment grade. BBB+ is medium investment grade and this applies to Lowe’s (LOW) and Ahold Delhaize (OTCQX:ADRNY). BBB is Standard & Poor’s lower investment grade rating; this applies to Walgreens (WBA), CVS (CVS), Dollar General (DG) and Dollar Tree (DLTR). Floor & Décor (FND), which generates 2.2% of ABR is rated BB or non-investment grade speculative. Non-listed Winn Dixie is rated Ba3 by Moody’s, also non-investment grade speculative. The “SIG” rating for Big Lots (BIG) stands for “sub-investment grade.” Standard & Poor’s no longer rates Big Lots, but the most recent rating was BB+ or non-investment grade speculative.

Out of this group, the tenants that create a little concern are Dollar General, Walgreen’s Boots Alliance, Advance Auto Parts, CVS and of course Big Lots. Together these companies are 30.6% of ABR. Dollar General cut its earnings guidance for 2023. For the second straight quarter, it posted lower earnings. The company reports that its core customers are cutting back on any unnecessary purchases in this inflationary environment. Although CVS is arguably in better financial shape than Walgreen’s, the two plan to close numerous stores located around the country, including 900 CVS locations and at least 150 for Walgreen’s. Competitor Rite Aid is reportedly preparing for bankruptcy. Walgreen’s also cut its 2023 earnings guidance. Advance Auto Parts is having a second year in the red and shares are down 14.0% since its last earnings report. Big Lots posted a loss in the first quarter and is looking at sale-leasebacks of its company owned stores as a way to raise cash. Any of these tenants could become a problem.

Lease Structure and Expirations Are Positives

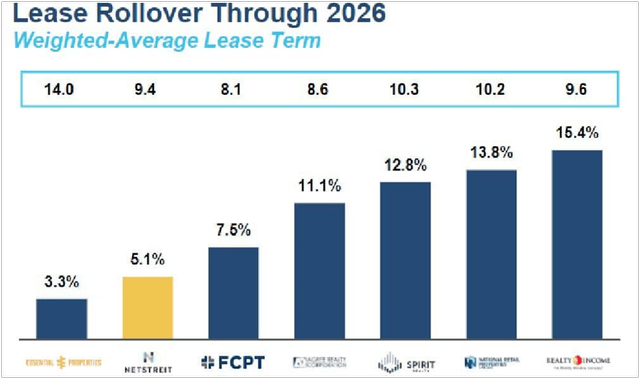

According to NETSTREIT, 100% of its leases are net, in which the tenant pays for all costs associated with the property including taxes, insurance, and common area maintenance (CAM) if any. Occupancy in the portfolio is reported as 100.0% and with no rent in arrears as of the second quarter 2023. Because the company seeks out tenants with long term leases – as stated, 10 years with two 5-year renewals – the weighted remaining lease term is a favorable 9.4 years, as illustrated below and compared to peers:

Weighted Average Lease Term (2023 Investor Presentation)

Frequent Issuance of New Shares

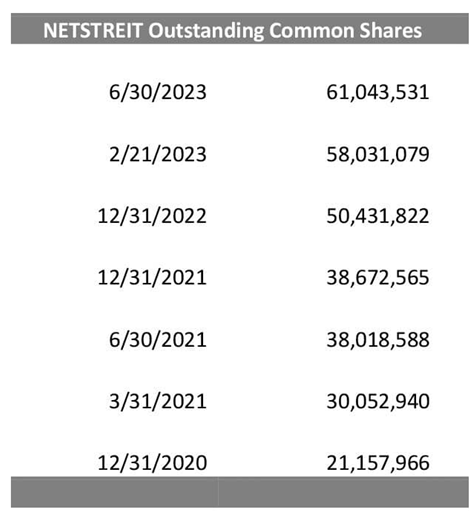

NETSTREIT has frequently used secondary offerings to raise additional capital. I tracked the number of common shares through the annual and quarterly reports and came up with the following table.

Outstanding Common Shares by Date (Quarterly and Annual Reports)

In the three years since the August 2020 IPO, shares outstanding have grown at a compound annual rate of 42.4%. I was able to track the following issuances discussed below.

In 2019, before the IPO, the company sold 8,860,760 shares in December, then another 2,936,835 in February of 2020 to institutional investors. In August 2020, the IPO sold just under 12,500,000 shares. In January 2022, 10,350,000 shares of common stock sold in a public offering of $22.25 per share. In August 2022, another public offering of 10,350,000 shares of common stock was made at $20.20 per share. On December 30, 2022, the company settled 2,973,944 shares of common stock at a price of $20.20 per share. In June 2023, NETSTREIT issued another 1,364,815 shares of common stock at a weighted average price of $17.53 per share, for net proceeds of approximately $23.4 million, net of sales commissions, per the Q2 2023 Report. This is not an exhaustive list, but as you can see the pattern is selling more shares over time and at a progressively lower price. This dilutes share prices and has a lowering effect on earnings per share.

Debt is Moderate and Controlled

NETSTREIT states that it targets a “conservative” net debt to EBITDA leverage ratio of 4.5x to 5.5x. As of the end of the second quarter 2023, it reported this ratio as 3.4X.

As of June 2023, the company had $486.6 million in debt between long-term loans, revolving credit and mortgage notes, or 27.8% of total assets. For year-end 2022, the company had $494.2 million in debt between long-term loans, revolving credit and mortgage notes, for 30.8% of total assets. At year-end 2021, this number was 22.3% of total assets, and in 2020, it was 24.0% of total assets. So the level of overall debt is reasonable, but has been rising slightly through 2023. The company also has a $200 million term loan due in 2028.

Acquisitions of More Net-Leased Properties

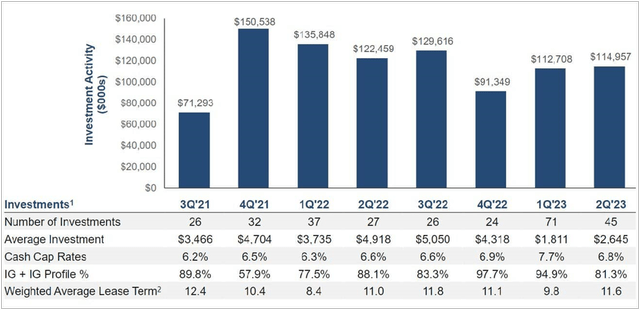

At year end 2020, NETSTREIT had 203 properties with 3.7 million square feet. Currently it has 531 investment properties with a total of 9.5 million square feet. During 2022, the company acquired 105 properties for a total purchase price of $424.8 million, inclusive of $4.2 million of capitalized acquisition costs, for an average price of $4.05 million. During the six months ended June 2023, the Company acquired another 48 properties for a total price of $163.9 million, or an average purchase price of $3.41 million. A table of recent acquisition and development investment activity by quarter is presented below.

Acquisitions by Quarter (2023 Investor Presentation)

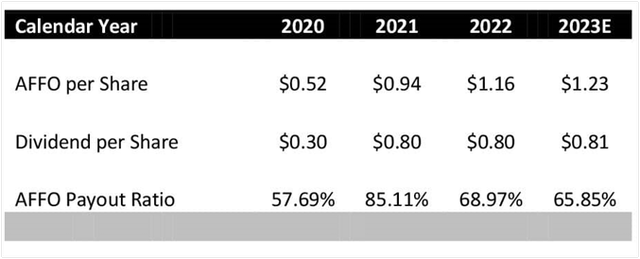

Shares are Slightly Undervalued

I have used two methods to value NETSTREIT shares. The first is using the Price to Adjusted Funds from Operations (AFFO) multiple and the second is using a direct cap rate from investor surveys applied to the AFFO per share. In 2020, NETSTREIT’s reported AFFO was $14,644,000 or $0.52 per share. In 2021, it was $36,229,000 or $0.94 per share, while in 2022 it was $58,517,000 or $1.16 per share. The estimate for 2023 is $73,200,000 and the company recently updated its full year 2023 AFFO per share guidance range to $1.20 to $1.23, from the prior range of $1.17 to $1.23, as explained in its Q2 2023 Press Release. I am going to give NETSTREIT the benefit of the doubt and go with the $1.23 number.

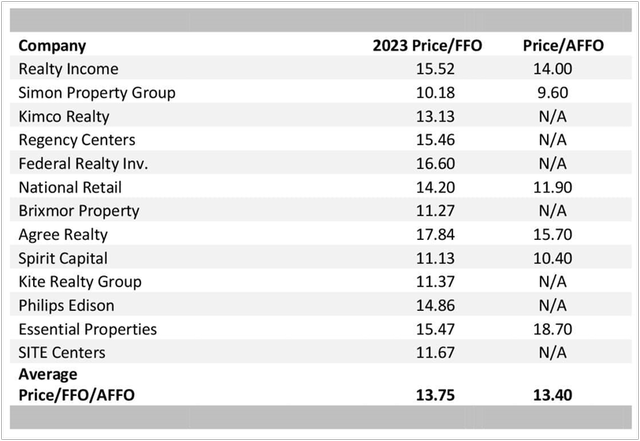

To value the shares, I did a survey of FFO and AFFO multiples for 13 different publicly listed retail REITs of various market caps. If the chart below says N/A, the company did not publish this number. The average for this group was 13.75 for FFO and 13.4 for AFFO, a small difference. The AFFO highs are represented by Realty Income (O), Essential Properties (EPRT) and Agree Realty (ADC). The lows are Simon Property Group (SPG) and Spirit Realty Capital (SRC).

Price/FFO and AFFO Multiples (Author calculated)

Using an AFFO of $1.23 per share and a multiple range of 13.0 to 14.0, the current fair value share price should be between $15.99 and $17.22, or averaging about $16.61. At the current share price of $15.58 the company’s shares are about 6.0% undervalued using the Price to AFFO multiple.

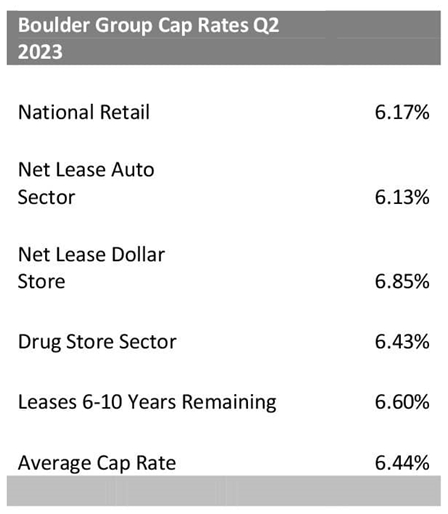

I have also looked at using a cap rate applied to the AFFO number to value the shares. I was able to find cap rate research from The Boulder Group, a national real estate investment firm specializing in single-tenant net lease properties. The relevant investor survey results for the second quarter 2023 are presented below:

Q2 2023 Cap Rate Survey (The Boulder Group)

The national average asking retail cap rate was 6.17% and the average across the different sectors that represents NETSTREIT’s tenants was 6.44%. I felt comfortable using a more conservative cap rate of 7.0% to value the company’s shares as the investor surveys are a lagging indicator. I also expect another Fed rate increase before the end of the year and there are issues that some tenants are facing (Walgreens, CVS, Big Lots, and Advance Auto Parts). So the AFFO of $1.23/.07 = $17.57. Using this method the shares appear to currently be undervalued by 11.0%. Between the two methods I feel comfortable saying shares are between 5.0-10% undervalued at their current price of $15.58.

The Dividend is Attractive, but Had Few Increases

NETSTREIT paid its first dividend in September 2020 in the amount of $0.10 per share. The next quarter it increased the dividend to $0.20 per share, and it held steady at this level for the next two and a half years, through the pandemic and beyond. In August of this year, the dividend was increased to $.205 per quarter, a change of 2.5%, well below the rate of inflation. The current yield, based on a share price of $15.58, is 5.18%. Despite the decent payout ratio of 65.8%, I believe dividend growth is likely to remain low, as the company has frequent new issuances of shares, increasing the overall dividend liability. The current payout ratios for the last four years based on Adjusted Funds from Operations is presented below. For now there does appear to be room for another dividend increase.

AFFO Payout Ratio (Author calculated)

Risks to Outlook

NETSTREIT does have diversification in terms of geography and diversity by tenant type: necessities, discount retailers and services. I see the immediate risks to the company being the possible closures of some CVS and Walgreen’s stores nationally. Right now, however, we don’t know which specific stores will be closed, and it is possible that none may be in this portfolio. The other primary risk is the issuance of more shares, which will dilute the price for current shareholders.

Conclusion

NETSTREIT has a strong portfolio concept of single-tenant net leased properties across the country, concentrated on necessities, services and discount retailers. On first glance the portfolio seems balanced and investment grade, with companies like Walgreens, CVS, Dollar General, Home Depot and 7-Eleven, all household names. But dig a little deeper and some of the tenants are facing problems nationally with planned store closures, or reduced credit ratings or no credit rating at all. So there is some risk to the tenant profile, but for me the bigger issue is the frequent share issuances by NETSTREIT that dilute the value of current shares and, as the number of shares grow, make it more difficult for the company to meaningfully increase the dividend. I am rating the company a hold, despite the currently attractive yield of 5.18%. I just don’t believe there’s enough upside in the long run for the dividend or for the share price.

Read the full article here

Leave a Reply