Investment Thesis: I take the view that Nestle faces significant obstacles to growth going forward, particularly with price competition in the French market set to increase.

In a previous article back in February, I made the argument that Nestle (OTCPK:NSRGY) would see modest growth in the short to medium-term, as higher costs had increasingly been affecting profitability.

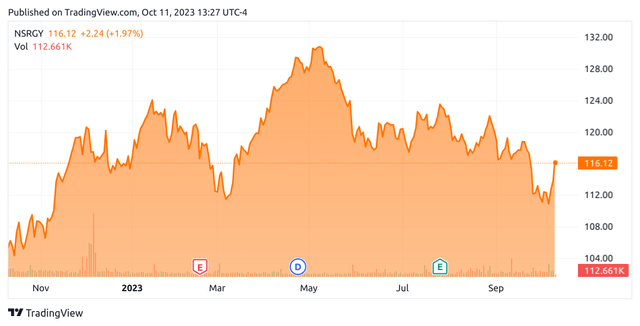

Since then, the stock has descended slightly to a price of $116.12 at the time of writing:

TradingView.com

The purpose of this article is to assess whether Nestle has the ability to see continued growth from here taking recent performance into consideration.

Performance

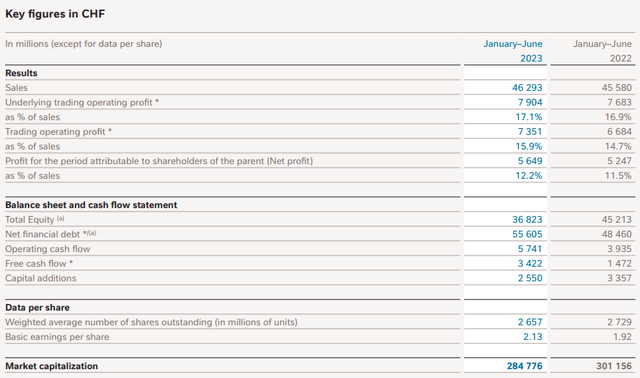

When looking at the company’s half-year earnings results for Nestle, we can see that sales were up by 1.56% on that of the same period last year, while earnings per share was up by 10.93%.

Nestle Half-Year Report: January–June 2023

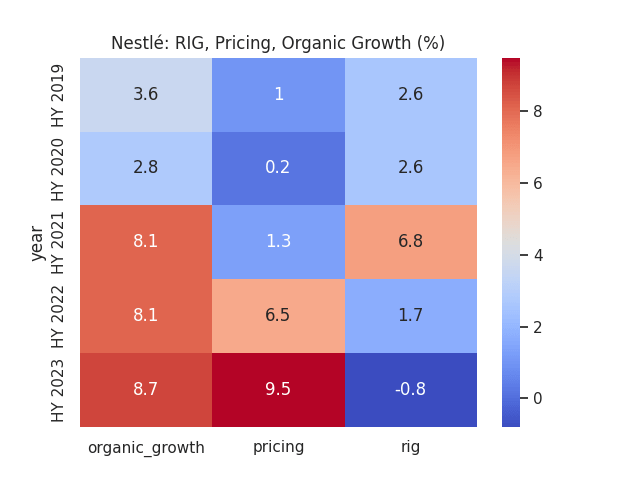

I had previously made the argument that Nestle had been seeing slowing growth on the profitability end – specifically due to a slowdown in real internal growth (that is growth excluding the impact of rising prices).

When looking at organic growth, pricing growth and real internal growth from HY 2019 to HY 2023, we can see that pricing growth is at a 5-year high at 9.5%. With organic growth at 8.7%, we can see that real internal growth was negative at -0.8%, a five-year low.

Figures sourced from historical Nestle half-year reports. Heatmap generated by author using Python’s seaborn library.

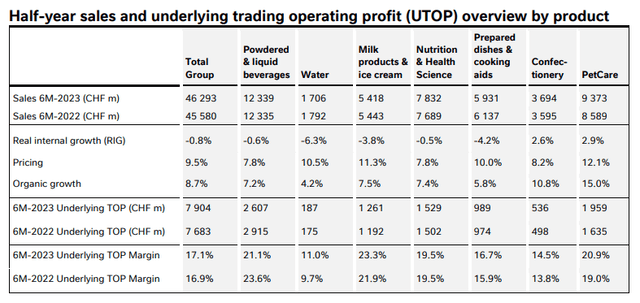

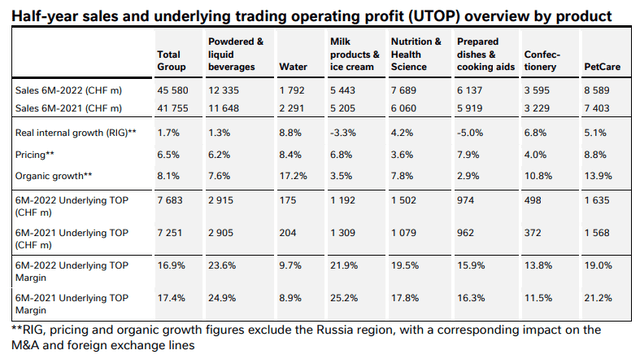

Additionally, when we look at growth trends segregated by product, we can see that real internal growth across each product segment was negative, with the exception of the Confectionery and PetCare segments.

2023 Half-Year Results

Nestle Press Release: 2023 Half-Year Results

Moreover, we can also see that real internal growth was significantly lower than that of HY 2022 across these two segments – which was influenced by higher growth in pricing across the same.

2022 Half-Year Results

Nestle Press Release: 2022 Half-Year Results

With regards to short-term liquidity, we can see that the quick ratio of Nestle (calculated as total current assets less inventories less prepayments all over current liabilities) has decreased slightly over a six-month period and remains significantly below 1 – indicating that Nestle does not have sufficient liquid assets to meet its current liabilities.

| Dec 2022 | Jun 2023 | |

| Total current assets | 35062 | 33316 |

| Inventories | 15019 | 14794 |

| Prepayments | 549 | 910 |

| Current liabilities | 39976 | 40308 |

| Quick ratio | 0.49 | 0.44 |

Source: Figures (in millions of CHF) sourced from 2023 Half-Year Report of the Nestlé Group 2023. Quick ratio calculated by author.

Additionally, we also see that the company’s non-current (or long-term) debt to total assets ratio has also increased slightly over the same period.

| Dec 2022 | Jun 2023 | |

| Non-current financial debt | 43420 | 45814 |

| Total assets | 135182 | 131600 |

| Non-current debt to total assets ratio | 0.32 | 0.35 |

Source: Figures (in millions of CHF) sourced from 2023 Half-Year Report of the Nestlé Group 2023. Non-current debt to total assets ratio calculated by author.

My Perspective

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, it is clear that organic growth has continued to be driven overwhelmingly by pricing – which has been reflected by negative real internal growth.

The fact that growth is being driven by price and not by volume continues to pose a risk to Nestle – as an eventual plateau in price growth coupled with low demand will mean that we may eventually see a sharp drop-off in overall revenue growth.

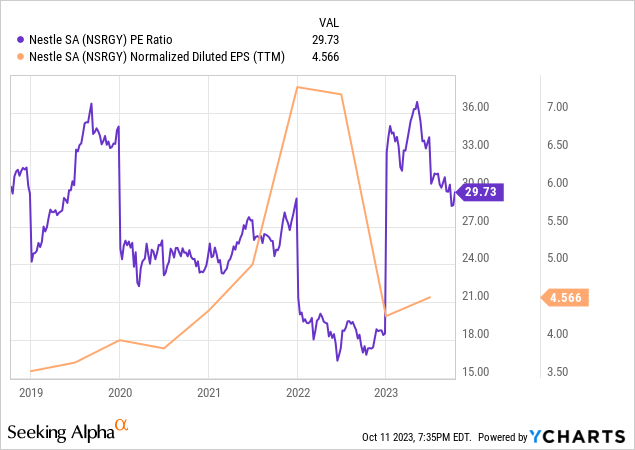

When looking at Nestle’s five-year earnings trajectory, we see that the P/E ratio is trading at the higher end of the range while earnings per share has seen a significant drop from that of last year.

ycharts.com

In this regard, I do not take the view that Nestle is trading at good value at this time.

Risks and Looking Forward

In terms of the potential risks to Nestle going forward, growth that is being driven overwhelmingly by price as opposed to volume remains a risk factor – as this is ultimately not sustainable in the long-term and will eventually lead to a decline in revenue growth if volume cannot rise to accommodate lack of growth in price.

Additionally, Nestle is set to see pricing competition intensify with competitor Danone (OTCQX:DANOY) as government pressures in France seek to secure price cuts across retailers. France is the largest market in Western Europe for Nestle in revenue terms, and France itself remains the European Union’s largest market for groceries by supermarket revenue.

In this regard, Nestle will simply not be able to sustain growth through higher pricing and competition is set to intensify heading into the new year – including with domestic competitors such as Carrefour (OTCPK:CRRFY) – which is placing “shrinkflation” labels on products that are getting smaller without any corresponding price reduction. In this manner, Nestle is unlikely to be able to simply reduce product sizes on a great scale while continuing to sustain price increases.

Conclusion

To conclude, Nestle has been seeing negative real internal growth which has been due to high price growth while organic growth has lagged behind. With price competition set to increase in the French market, I take the view that this will serve as a significant impediment to growth for Nestle going forward. As such, I do not take a bullish view on the company at this time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply