2023 Review

So much for a better second half to the year for the Dividend Aristocrats. After a decent start to 2H2023 with the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) ticking up 2.59% in July, things turned sour rather quickly. In August the ETF fell by 2.34%, giving up most of July’s gains. Thus far in September things are looking even worse, through September 27th the ETF is down 6.25%, pushing the year-to-date return down to minus 0.70%.

Not all of the dividend aristocrats are sharing the same fate as the ETF that tracks these elite dividend paying companies. Let’s take a look at which individual aristocrats are driving the return in 2023; 29 dividend aristocrats are beating NOBL through month-end August, and 41 are generating positive total returns this year. These aristocrats are outpacing NOBL after August:

- West Pharma (WST) +73.22%

- Pentair (PNR) +58.09%

- Nucor Corp. (NUE) +31.43%

- Brown & Brown (BRO) +30.77%

- W.W. Grainger (GWW) +29.39%

- A. O. Smith (AOS) +28.39%

- Stanley Black & Decker (SWK) +28.08%

- Ecolab (ECL) +27.09%

- Church & Dwight (CHD) +21.13%

- Linde plc (LIN) +19.55%

- Caterpillar (CAT) +19.16%

- S&P Global (SPGI) +17.57%

- Lowe’s (LOW) +17.42%

- Roper Technologies (ROP) +16.03%

- Walmart (WMT) +16.01%

- Sherwin-Williams (SHW) +15.37%

- Cardinal Health (CAH) +14.95%

- Essex Property Trust (ESS) +14.89%

- PPG Industries (PPG) +14.33%

- Clorox (CLX) +14.07%

- Illinois Tool Works (ITW) +13.49%

- Cintas (CTAS) +12.51%

- Becton, Dickinson (BDX) +10.71%

- Dover Corp. (DOV) +10.68%

- Expeditors International of Washington (EXPD) +9.22%

- McDonald’s (MCD) +8.42%

- International Business Machines (IBM) +8.18%

- Automatic Data Processing (ADP) +7.84%

- Medtronic (MDT) +6.62%

The S&P 500, as measured by SPDR® S&P 500 ETF Trust (SPY), was down 1.63% in August, outperforming NOBL during the month. Month-to-date through September 27th SPY is down 5.40%, again slightly ahead of NOBL. NOBL beat SPY in 2022 with a loss of 6.5% compared to a loss of 21.65%. SPY started 2023 on stronger footing and is beating NOBL by 12.94% year-to-date through September 27th. The dividend aristocrats are not known to consistently beat the S&P 500 index, in fact, the dividend aristocrat index underperformed the S&P 500 index for 6 out of the last 8 full calendar years.

However, if you look further back in history, the dividend aristocrat index is outperforming the S&P 500 index by about 2.18% per year between 1990 and 2022. A significant portion of this long-term outperformance is attributable to the dot com bubble and the financial crisis as well as the immediate years following each market crash. This pattern was broken with the 2020 market crash, perhaps the much shorter duration of the crash and recovery are the reason. The dot com bubble and the financial crisis both extended for multiple years while the 2020 market crash was fully recovered in a matter of months. 2022 also proved to be a strong year for the aristocrats as they earned 15.15% of alpha on the S&P, making up for 3 years of underperformance.

Even though the dividend aristocrats have trailed the S&P for the better part of the last 8 years, long-term investors can rest assured that based on history, over a much longer time period, the dividend aristocrats can hold their own. There are currently 66 companies in the dividend aristocrat index but strong historical returns for the index can be attributed to only a handful of them. As an investor, I am always curious how to identify these drivers of outperformance.

I have decided to remove V.F. Corporation (VFC) from my list of dividend aristocrats. Earlier this year the company cut its dividend and will not qualify for aristocrat status when the index is updated next year. The reason why I removed VFC from my list today is because NOBL has sold its position in VFC as well. Given that I use NOBL as a benchmark for this strategy it is only fair that my universe of dividend aristocrats aligns with the holdings in the ETF.

I want to present 3 strategies that theoretically could identify winning aristocrats and lead to better performance than the dividend aristocrat index. These strategies work best with a buy and hold long-term investing approach as will be evidenced by the results. They are based on quantitative models that do not consider qualitative data; therefore it is prudent that further due diligence is performed on all chosen stocks.

The Most Undervalued Strategy

Strategy number 1 is a focus on valuation and more specifically it targets the potentially most undervalued dividend aristocrats. In theory, this is a long-term strategy since it may take some time to fully see the reward of leveraging a valuation approach. My preferred method for valuation is dividend yield theory, mainly for its simplicity. Unlike other valuation methods, dividend yield theory does not require making assumptions aside from assuming that a given stock will revert back to its long-term trailing dividend yield.

This valuation technique works best for mature businesses with long histories of dividend growth, making the dividend aristocrats an ideal pool of companies to value using this technique.

Selecting the 10 most undervalued dividend aristocrats each month and adopting a buy and hold investing approach can lead to long-term outperformance when/if the targeted stocks return to fair valuation. It may take a few months or even years to see if this strategy actually pays off. I predict that it will underperform NOBL for the first few months while we wait for bargain stocks to return to fair value.

|

Month |

Most Undervalued |

NOBL |

SPY |

|

Aug 21 |

0.49% |

1.87% |

2.98% |

|

Sep 21 |

-2.99% |

-5.69% |

-4.66% |

|

Oct 21 |

3.63% |

5.95% |

7.02% |

|

Nov 21 |

-2.19% |

-1.76% |

-0.80% |

|

Dec 21 |

10.37% |

6.54% |

4.63% |

|

Jan 22 |

1.04% |

-4.08% |

-5.27% |

|

Feb 22 |

-1.94% |

-2.59% |

-2.95% |

|

Mar 22 |

3.40% |

3.86% |

3.76% |

|

Apr 22 |

-2.14% |

-3.42% |

-8.78% |

|

May 22 |

3.11% |

0.31% |

0.23% |

|

Jun 22 |

-7.30% |

-6.73% |

-8.25% |

|

Jul 22 |

5.00% |

6.56% |

4.55% |

|

Aug 22 |

-3.25% |

-2.78% |

-4.08% |

|

Sep 22 |

-11.39% |

-9.15% |

-9.24% |

|

Oct 22 |

10.07% |

10.31% |

8.13% |

|

Nov 22 |

6.99% |

7.12% |

5.56% |

|

Dec 22 |

-5.41% |

-4.12% |

-5.76% |

|

Jan 23 |

4.83% |

3.23% |

6.29% |

|

Feb 23 |

-3.33% |

-2.36% |

-2.51% |

|

Mar 23 |

-0.86% |

0.99% |

3.71% |

|

Apr 23 |

3.06% |

2.12% |

1.60% |

|

May 23 |

-7.87% |

-5.90% |

0.46% |

|

Jun 23 |

7.17% |

8.08% |

6.48% |

|

Jul 23 |

3.27% |

2.59% |

3.27% |

|

Aug 23 |

-3.82% |

-2.34% |

-1.63% |

|

Sep 23 |

-8.52% |

-6.25% |

-5.40% |

|

2021 Partial |

9.05% |

6.54% |

9.06% |

|

2022 |

-3.91% |

-6.50% |

-21.65% |

|

2023 |

-7.12% |

-0.70% |

12.24% |

|

TOTAL |

-2.68% |

-1.08% |

-4.09% |

|

Alpha over NOBL |

-1.60% |

||

|

Alpha over SPY |

1.42% |

The table above shows the monthly and annual returns for the buy-and-hold portfolio of the most undervalued strategy.

The portfolio trailed NOBL in August by 1.48% and SPY by 2.19%. September thus far is looking just as bad. The portfolio is down 8.52% (price return only) through September 27th, while NOBL is down 6.25% and SPY is down 5.40%. Year-to-date the portfolio is grossly underperforming both NOBL and SPY as the strategy has fallen out of favor this year. Since inception the portfolio trails NOBL by 1.60% but remains ahead of SPY by 1.42%.

To be honest I’m not surprised to see this portfolio underperforming currently. The expectation of investing in undervalued aristocrats comes with short-term underperformance as the strategy targets out of favor aristocrats. I still believe that in due time this portfolio will deliver better than average returns and outperform NOBL, while remaining competitive with SPY.

At its peak, this strategy was ahead of both NOBL and SPY by double digit gains. While such outperformance is not something I am expecting the strategy has shown merit when stock valuations revert back to historical means.

The portfolio consists of 39 unique present and former dividend aristocrats. I track this portfolio by investing $1,000 each month equally split among the 10 chosen aristocrats for that month. The positions are never trimmed or sold and all dividends are reinvested back into the issuing stock.

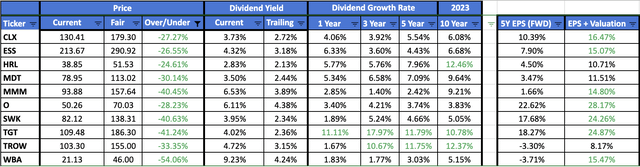

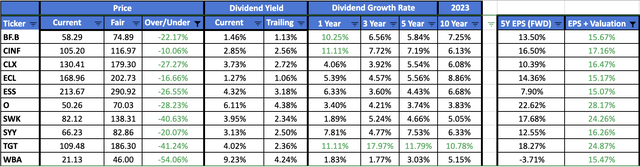

Here are the 10 most undervalued dividend aristocrats chosen for the month of October 2023. The table below shows potential undervaluation (column Over/Under) for each of the 10 chosen aristocrats. The image below is taken from a new spreadsheet I recently created where I am self-computing the 5-year trailing dividend yield. Previously I used Seeking Alpha as a source for the historical yield.

Created by Author

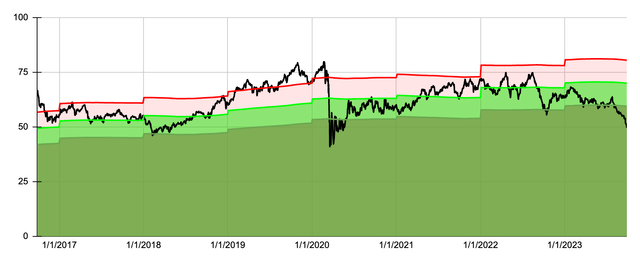

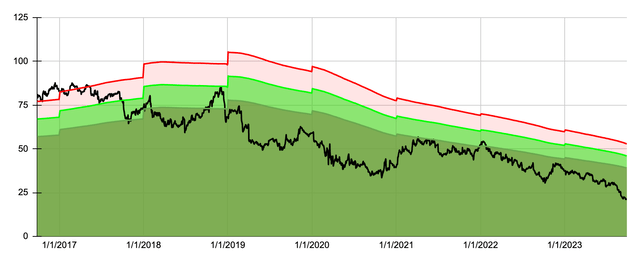

Here is a closer look at Realty Income Group (O).

Realty Income currently looks to be approximately 29% undervalued. In the image below the black line is the actual price since August of 2016. The light green shaded area represents a 0 to 15% undervalued zone. The dark green area represents an undervaluation in excess of 15%. The light red shaded area represents a 0 to 15% overvalued zone.

Created by Author

An estimated daily return test for the period September 2016 through September 2022 yielded positive results in the application of dividend yield theory as a valuation tool. The average return of investing in the stock on all days when the stock appeared to be undervalued was -1.58%. The average return of investing in the stock on all days regardless of valuation was -3.69%. And the average return of investing in the stock on all days when it appeared overvalued was -4.85%. Despite the favorable application of dividend yield theory, the last 7 years have been rather rough for Realty Income. The stock peaked just prior to the 2020 pandemic crash and has not been able to set a new all-time high price since then. While much of the pandemic losses were recovered in subsequent years, since late 2022 the share price has once again tumbled lower. Today, the stock offers a historically high dividend yield of more than 6%, a level not seen since the 2020 pandemic lows.

The Fastest Expected Growth Strategy

Strategy number 2 is a focus on dividend aristocrats that are expected to grow the fastest in the near future. Historically, there has been a correlation between earnings per share growth and share price appreciation. Companies that have grown their earnings faster have also seen higher total returns. One way to gauge how fast earnings for a company will grow is to leverage analyst forecasts. For this strategy, I decided to use a discounted five-year EPS growth forecast combined with a return to fair valuation and the dividend yield to identify the 10 best aristocrats poised for the best total return in the future.

|

Month |

Fastest Growth |

NOBL |

SPY |

|

Aug 21 |

5.12% |

1.87% |

2.98% |

|

Sep 21 |

-4.42% |

-5.69% |

-4.66% |

|

Oct 21 |

5.92% |

5.95% |

7.02% |

|

Nov 21 |

-2.06% |

-1.76% |

-0.80% |

|

Dec 21 |

7.09% |

6.54% |

4.63% |

|

Jan 22 |

-4.42% |

-4.08% |

-5.27% |

|

Feb 22 |

-0.10% |

-2.59% |

-2.95% |

|

Mar 22 |

3.71% |

3.86% |

3.76% |

|

Apr 22 |

-2.19% |

-3.42% |

-8.78% |

|

May 22 |

0.12% |

0.31% |

0.23% |

|

Jun 22 |

-8.94% |

-6.73% |

-8.25% |

|

Jul 22 |

6.09% |

6.56% |

4.55% |

|

Aug 22 |

-2.69% |

-2.78% |

-4.08% |

|

Sep 22 |

-11.37% |

-9.15% |

-9.24% |

|

Oct 22 |

13.68% |

10.31% |

8.13% |

|

Nov 22 |

6.14% |

7.12% |

5.56% |

|

Dec 22 |

-7.53% |

-4.12% |

-5.76% |

|

Jan 23 |

9.41% |

3.23% |

6.29% |

|

Feb 23 |

-3.01% |

-2.36% |

-2.51% |

|

Mar 23 |

-1.79% |

0.99% |

3.71% |

|

Apr 23 |

0.37% |

2.12% |

1.60% |

|

May 23 |

-7.21% |

-5.90% |

0.46% |

|

Jun 23 |

11.17% |

8.08% |

6.48% |

|

Jul 23 |

3.00% |

2.59% |

3.27% |

|

Aug 23 |

-1.86% |

-2.34% |

-1.63% |

|

Sep 23 |

-8.14% |

-6.25% |

-5.40% |

|

2021 Partial |

11.62% |

6.54% |

9.06% |

|

2022 |

-9.86% |

-6.50% |

-21.65% |

|

2023 |

0.19% |

-0.70% |

12.24% |

|

TOTAL |

0.81% |

-1.08% |

-4.09% |

|

Alpha over NOBL |

1.89% |

||

|

Alpha over SPY |

4.90% |

The table above shows the monthly and annual returns for the buy-and-hold portfolio of the fastest expected growth strategy.

The portfolio outpaced NOBL by 0.48% in August but trailed SPY by 0.23%. September thus far is looking a little worse, through September 27th the portfolio is down 8.14% (price return only) while NOBL is down 6.25% and SPY is down 5.40%. Year-to-date the portfolio remains ahead of NOBL by 0.89% but trails SPY by more than 12%. However, since inception, the portfolio maintains a modest level of alpha over both, 1.89% over NOBL and 4.90% over SPY.

The fastest expected growth portfolio is currently the best performing of the 3 strategies. At one point it was trailing the most undervalued strategy by a wide margin but 2023 has seen market trends shift in favor of growth stocks.

The portfolio consists of 34 unique present and former dividend aristocrats. I track this portfolio by investing $1,000 each month equally split amongst the 10 chosen aristocrats for that month. The positions are never trimmed or sold and all dividends are reinvested back into the issuing stock. People’s United was removed from the portfolio in April 2022, as the company was acquired by M&T Bank (MTB); the value of the position was reinvested equally amongst the 10 chosen aristocrats for April.

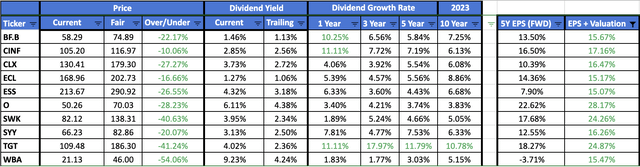

Here are the 10 dividend aristocrats poised for the best total return for the month of October 2023. The table below shows the expected growth rate (column EPS + Valuation) for each of the 10 chosen aristocrats.

Created by Author

Here is a closer look at Brown-Forman Corporation (BF.B). Below is the 7-year dividend yield theory chart.

Created by Author

The average return of investing in the stock on all days when it appeared to be undervalued was 4.89%. The average return of investing in the stock on all days regardless of valuation was -2.05%. And the average return of investing in the stock on all days when it appeared overvalued was -4.08%. Brown-Forman set an all-time high price in late 2020 and has generally trended lower during the last roughly 2.5 years. Dividend yield theory suggested the stock was overvalued for all of 2020, 2021 and a portion of 2022. After the most recent pullback the stock appears to be grossly undervalued.

The stock never paid a very generous dividend yield but today’s yield of 1.5% is one of the best investors have seen in the last 7 years. During the 2020 pandemic crash the yield briefly exceeded 1.5%. Prior to 2020 we observed Brown-Forman exceed a 1.5% yield in 2017. The trailing 5 year average dividend yield has trended lower during the last 7 years from a high of 1.4% in 2017 to its current level of 1.14%.

The Blended Strategy

Strategy 3 is a blend of the first two strategies, with a focus on the fastest expected growth but applied only to undervalued aristocrats. A blend of undervaluation and expected growth could narrow down the best aristocrats between the two strategies. The most undervalued aristocrats may not necessarily be poised for the fastest growth. Additionally targeting only undervalued aristocrats can offer a margin of safety in that securities are purchased for fair or better prices.

|

Month |

Blended |

NOBL |

SPY |

|

Aug 21 |

2.64% |

1.87% |

2.98% |

|

Sep 21 |

-3.42% |

-5.69% |

-4.66% |

|

Oct 21 |

2.70% |

5.95% |

7.02% |

|

Nov 21 |

-2.56% |

-1.76% |

-0.80% |

|

Dec 21 |

10.07% |

6.54% |

4.63% |

|

Jan 22 |

-0.71% |

-4.08% |

-5.27% |

|

Feb 22 |

0.49% |

-2.59% |

-2.95% |

|

Mar 22 |

3.48% |

3.86% |

3.76% |

|

Apr 22 |

-5.04% |

-3.42% |

-8.78% |

|

May 22 |

1.28% |

0.31% |

0.23% |

|

Jun 22 |

-6.23% |

-6.73% |

-8.25% |

|

Jul 22 |

4.56% |

6.56% |

4.55% |

|

Aug 22 |

-3.29% |

-2.78% |

-4.08% |

|

Sep 22 |

-10.88% |

-9.15% |

-9.24% |

|

Oct 22 |

9.97% |

10.31% |

8.13% |

|

Nov 22 |

6.38% |

7.12% |

5.56% |

|

Dec 22 |

-5.32% |

-4.12% |

-5.76% |

|

Jan 23 |

4.15% |

3.23% |

6.29% |

|

Feb 23 |

-3.45% |

-2.36% |

-2.51% |

|

Mar 23 |

-0.31% |

0.99% |

3.71% |

|

Apr 23 |

2.31% |

2.12% |

1.60% |

|

May 23 |

-6.64% |

-5.90% |

0.46% |

|

Jun 23 |

8.48% |

8.08% |

6.48% |

|

Jul 23 |

3.38% |

2.59% |

3.27% |

|

Aug 23 |

-2.63% |

-2.34% |

-1.63% |

|

Sep 23 |

-8.16% |

-6.25% |

-5.40% |

|

2021 Partial |

9.18% |

6.54% |

9.06% |

|

2022 |

-7.04% |

-6.50% |

-21.65% |

|

2023 |

-3.99% |

-0.70% |

12.24% |

|

TOTAL |

-2.55% |

-1.08% |

-4.09% |

|

Alpha over NOBL |

-1.47% |

||

|

Alpha over SPY |

1.55% |

The table above shows the monthly and annual returns for the buy-and-hold portfolio of the blended strategy.

The portfolio trailed NOBL in August by 0.29% and SPY by 1.00%. September thus far is looking slightly worse, the portfolio is down 8.16% through September 27th while NOBL is down 6.25% and SPY is down 5.40%. Year-to-date the portfolio is down 3.99% and underperforming both NOBL and SPY. Since inception, the portfolio trails NOBL by 1.47%, but remains ahead of SPY by 1.55%.

The blended strategy was an attempt to merge the best of the most undervalued and fastest expected growth strategies. However, thus far it has not shown any promise as it has trailed both strategies pretty much since inception.

The portfolio consists of 39 unique present and former dividend aristocrats. I track this portfolio by investing $1,000 each month equally split amongst the 10 chosen aristocrats for that month. The positions are never trimmed or sold and all dividends are reinvested back into the issuing stock. People’s United was removed from the portfolio in April as the company was acquired by M&T Bank; the value of the position was reinvested equally amongst the 10 chosen aristocrats for April.

Here are the 10 dividend aristocrats chosen for the blended strategy for October 2023. The table below shows potential undervaluation (column Over/Under) and the expected growth rate (column EPS + Valuation) for each of the 10 chosen aristocrats.

Created by Author

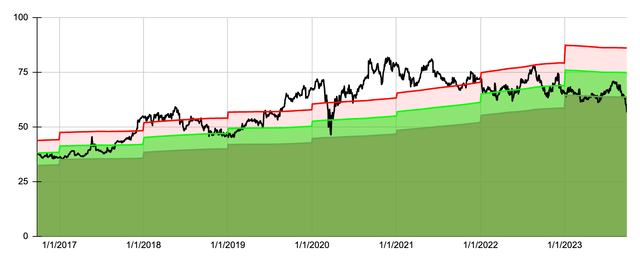

Here is a closer look at Walgreens (WBA). Below is the 7-year dividend yield theory chart.

Created by Author

The above chart is probably exactly what you do not want to see for a stock that you are invested in. Pretty much for the last 7 years Walgreens share price has declined with a few opportunities to swing trade some upside. More recently the same trend continued as we have seen Walgreens dip again in August and September. Whether this is a good entry point, time will tell, but trading for about $21 a share Walgreens deserves a closer look.

The stock still sports a historically high dividend yield today of 9.28%. It’s hard to believe that 7 years ago Walgreens paid a dividend yield slightly above 2%. Even the pandemic low yield in excess of 5% looks insignificant to today’s nearly double digit yield. I would certainly caution a thorough review of the company prior to making any investment decision.

Performance Review

We have already seen how the buy-and-hold strategies are performing in September so now let’s look at how the chosen stocks for the month are doing as well. The 10 chosen aristocrats for the most undervalued strategy are down 10.32%. The fastest expected growth strategy selections and the blended strategy selections for September were the same and both are down 10.75%. The fastest expected growth strategy is off to the best start this year, seeing positive gains in 6 out of the 9 months thus far. The individual selections are also faring much better than the long-term buy-and-hold portfolios, with the year-to-date return being 12.59% through September 27th. However, I still believe that a buy-and-hold approach is the optimal investing path to take with these strategies.

Here is a comparison of the buy-and-hold portfolios and the individual monthly selections for each strategy. As you can see the buy-and-hold portfolios are still performing much better than if we bought and sold the 10 chosen aristocrats each month. A buy-and-hold approach is also a much more tax-friendly investing strategy.

|

Type |

Most Undervalued |

Fastest Growth |

Blended |

NOBL |

|

Individual |

-11.99% |

3.57% |

-4.16% |

-1.08% |

|

Buy-and-Hold |

-2.68% |

0.81% |

-2.55% |

-1.08% |

|

O/U |

9.31% |

-2.76% |

1.61% |

0.00% |

Final Thoughts

I personally believe each of the 3 strategies outlined above can theoretically beat the dividend aristocrat index over a long period of time. These strategies are based on simple principles of valuation and expected returns, and they are easy to understand and implement. Investors should keep in mind that selecting individual stocks carries more risk than investing in an index. The simplest and possibly the safest way to invest in the dividend aristocrats is to purchase shares of NOBL. The fund finished 2021 with a fantastic return, performed much better than the S&P in 2022 and has an annualized rate of return of 10.51% since inception.

2023 is shaping up to be an interesting year for dividend strategies. The S&P 500 had a very poor return in 2022 and seems to be bouncing back this year, driven by strong returns from technology stocks. Dividends aristocrats fared much better in 2022 but got off to a poor start this year. Dividend investing is a marathon, not a sprint and you will find yourself in a slow period from time to time. The best course of action is to stick with your long-term strategy so long as it still fits your long-term objectives.

The dividend aristocrat data in the images of this article came from my live Google spreadsheet that tracks all of the current dividend aristocrats. Because this data is updated continuously throughout the day, you may notice slightly different data for the same company across the images. Also some of my returns may be off by a few basis points from those you’ll see from other sources on the web.

Read the full article here

Leave a Reply