MoonLake Immunotherapeutics (NASDAQ:MLTX), a small Swiss company I covered in April, has done well in the last 5 months after posting positive data from a phase 2 trial of sonelokimab in hidradenitis suppurativa, a skin disorder.

MoonLake is a developer of nanobody medicines for inflammatory diseases. Lead asset sonelokimab is targeting psoriasis, where it has gone through a phase 2 trial, and Hidradenitis Suppurativa (“HS”) as well as Psoriatic Arthritis (PsA), where it just completed phase 2 trials alluded to above.

In my earlier article, after discussing the importance of nanobodies, I noted that the company presented data from a robust phase 2b trial where they boldly used cosentyx as an active comparator, and managed to produce better results than cosentyx (note, however, that although cosentyx was the active comparator, the study was not powered to compare the two drugs, which could simply mean there were uncategorized dosage forms; cosentyx was given at 300mg while sonelokimab’s highest dose was 120mg). The indication was plaque psoriasis. Data showed that sonelokimab 120mg and above was numerically non-inferior to cosentyx, although, the study was not being powered, there is no clarity on whether the difference was statistically significant. Anyhow, the results were impressive, as I noted then.

I also noted that sonelokimab looked like a great asset the company was able to purchase from Merck and that I would be a buyer at dips. MLTX never dipped, and I never bought, but the stock has doubled in the last few months, after it posted positive data from sonelokimab once again, this time in Hidradenitis Suppurativa.

In June, the company posted phase 2 data from the 234-patient MIRA trial, designed to evaluate sonelokimab in adults with moderate-to-severe hidradenitis suppurativa. This was a placebo-compared trial, with adalimumab (Humira) as an active comparator, however, the study was powered to compare sonelokimab with placebo only.

Key highlights:

-

First placebo-controlled randomized trial in HS to report positive topline results using HiSCR75 as the primary endpoint.

-

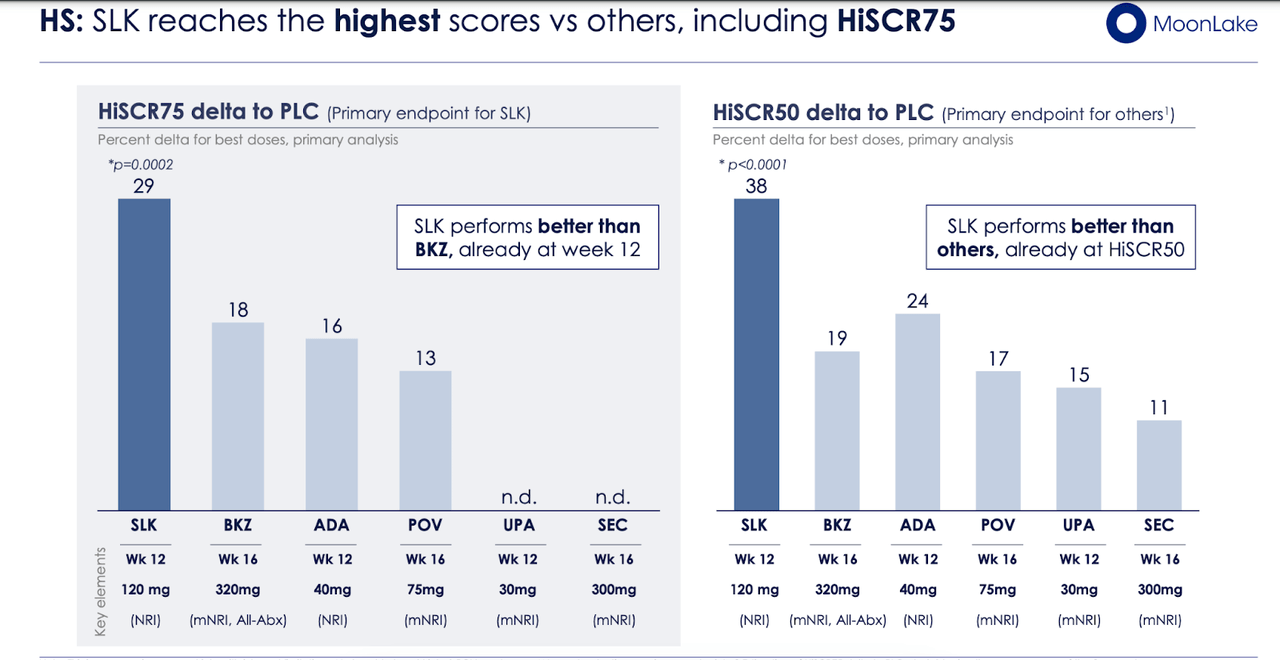

Primary endpoint HiSCR75 met with 29 percentage points (PPT) delta vs. placebo (p=0.0002) at week 12, setting a new bar in HS.

-

HiSCR50 met with 38 ppt delta vs. placebo (p<0.0001), greater delta than observed for any other molecules.

-

Other secondary endpoints also reached statistical significance with clinically meaningful improvements at week 12, including HiSCR90, IHS4, and various patient-reported outcomes.

-

Safety results of sonelokimab are consistent with previously reported studies with no new observed safety signals.

The company noted that HiSCR75, the endpoint used in this trial, was a higher endpoint than HiSCR50 that is normally used in similar trials, and therefore, having met that endpoint with high stat sig, the trial represents a landmark. Both sonelokimab 120mg and 240mg achieved HiSCR75 compared to those on placebo at week 12, and also noteworthy, the primary analysis was based on intent-to-treat non-responder imputation (ITT-NRI), which is a more stringent approach than ITT. The company said:

The results suggest that, as early as week 12, the Nanobody® sonelokimab, relative to placebo, reaches the highest clinical activity among all other therapies tested in similarly stringent pivotal-like trials.

Currently, AbbVie’s Humira is the only drug approved for HS, while UCB’s Bimzelx and Novartis’s Cosentyx are working towards approval. This data gives investors some reason to believe that sonelokimab not only met but could also beat its bigger rivals, although a comparison-powered trial will be required to demonstrate that statistically.

In its presentation, the company presented further data comparing its results with its rivals:

SLK rivals (MLTX website)

In both HiSCR75 and HiSCR50, the drug did numerically better than all its rivals. That gives us hope that in an adequately designed trial, it has a chance of beating these rivals. No wonder the stock has doubled overnight on this data.

Sonelokimab is currently being evaluated in a Phase 2 trial called ‘ARGO’ in patients with active psoriatic arthritis. Data readout is expected in Q4 this year. It could be argued that the other trial data are already priced into the stock, but this one is still out there, giving some hope of another spike if the data is good.

Financials

The market’s high expectation from MLTX was proven by the company’s stock not only not faltering, but actually going hire after it successfully raised a humongous $400mn on the data drop. Last time, I noted how their cash balance was relatively low compared to regular U.S. companies. Currently, with over $500mn in cash, that complaint cannot be made again.

This European company has a lower carbon footprint, so to say, when it comes to spending. It spends much less than many U.S. counterparts of similar proportions. Thus, research and development expenses for the quarter ended June 30, 2023, were $8.7 million, while general and administrative expenses were $4.5 million. With such expense control even at this late stage in development, the company has enough cash to last them for a number of years.

Bottom Line

Now comes the big question: is there further upside? In response, analysts will like to throw numbers at you – the markets SLK is targeting, what revenues competitors are raking in, the comparative trial data – these things being the key talking points. While I cannot disagree that these speculations have some basis, the stock market doesn’t always work that way. Until they have hard revenue, these comparisons are mere speculations, and speculation thrives in hope and hype.

Right now, MoonLake Immunotherapeutics is thoroughly upbeat and worked up, so if they can present positive data from ARGOS 3 months later, I would be surprised if there’s not another spike. After all, this was a stock that went up even after raising funds worth nearly half their baseline market cap at the time of the offering.

Read the full article here

Leave a Reply